“A Textbook Case of Genocide Unfolding in Front of our Eyes.” The Military Industrial Complex and the “Corporate Enablers” of Israel’s War on Gaza

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Click the share button above to email/forward this article to your friends and colleagues. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

At the time of this publication, over 6,500 people have been killed in Israel’s bombardment of Gaza, including more than 2,700 children, with many thousands more people injured or missing. Israel has told 1.1 million people to flee northern Gaza, which many fear is a pretext for ethnic cleansing. Thousands of buildings and homes have been obliterated. Palestinians in Gaza are being choked of water, fuel and other supplies by the Israeli government. With a ground invasion by Israeli forces imminent, and fears of a wider war, there may be no end in sight to the bombardment for Palestinians.

Voices across the world are sounding the alarm over the barbarous and catastrophic scope of the assault. One expert has called the situation “a textbook case of genocide unfolding in front of our eyes.”

A UN official stated that the transfer of Palestianians in Gaza would be “the largest instance of ethnic cleansing in the history of this tormented land.”

Amnesty International has documented “damning evidence of war crimes,” stating that Israel’s “cataclysmic assault on the occupied Gaza Strip” has seen “indiscriminate attacks” that have “caused mass civilian casualties and must be investigated as war crimes.”

All of this is being abetted by top U.S. defense corporations who profit from selling weapons to the Israeli government that have been used relentlessly against Palestinian civilians. In his October 20 speech calling for billions in weapons shipments to Israel and Ukraine, President Biden invoked “patriotic American workers” who are “building the arsenal of democracy and serving the cause of freedom,” but it’s the defense company CEOs who rake in tens of millions a year, and Wall Street shareholders, who are the real beneficiaries of warmongering. Just a few days ago, RTX (formerly Raytheon) executives raved about billions in weapon sales, set only to increase with the current wars, noting that “[a]cross the entire Raytheon portfolio, you’re going to see the benefit of this restocking.”

Moreover, the current onslaught is also enabled by billionaires who donate huge sums to rightwing pro-Israel Super PACs pushing for continued violence — and the elected officials who eagerly accept their donations.

This primer maps out some of the major defense companies propping up and profiting from, and some of the billionaire donors enabling, the ongoing war against Palestinians in Gaza.

Weapons Manufacturers

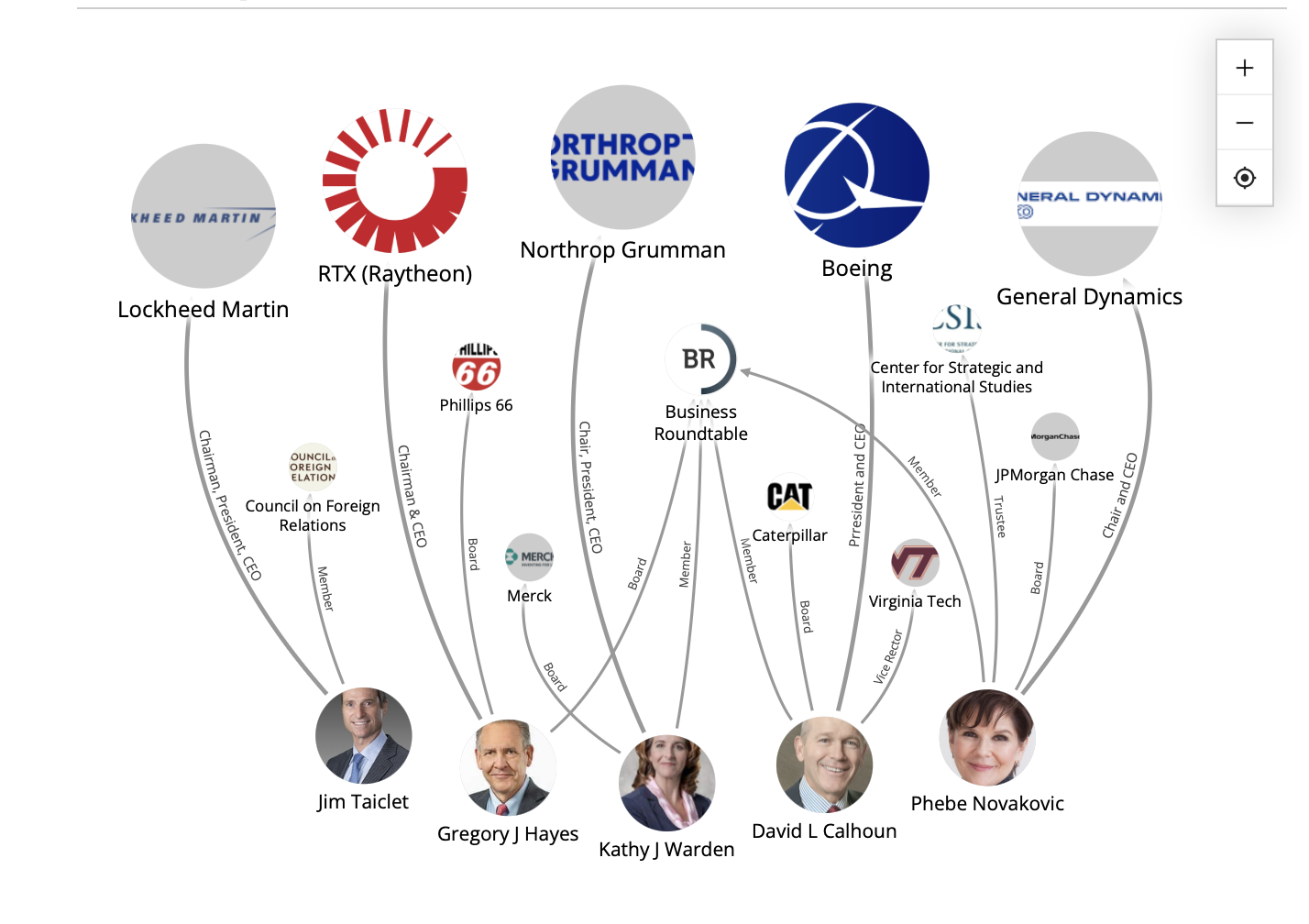

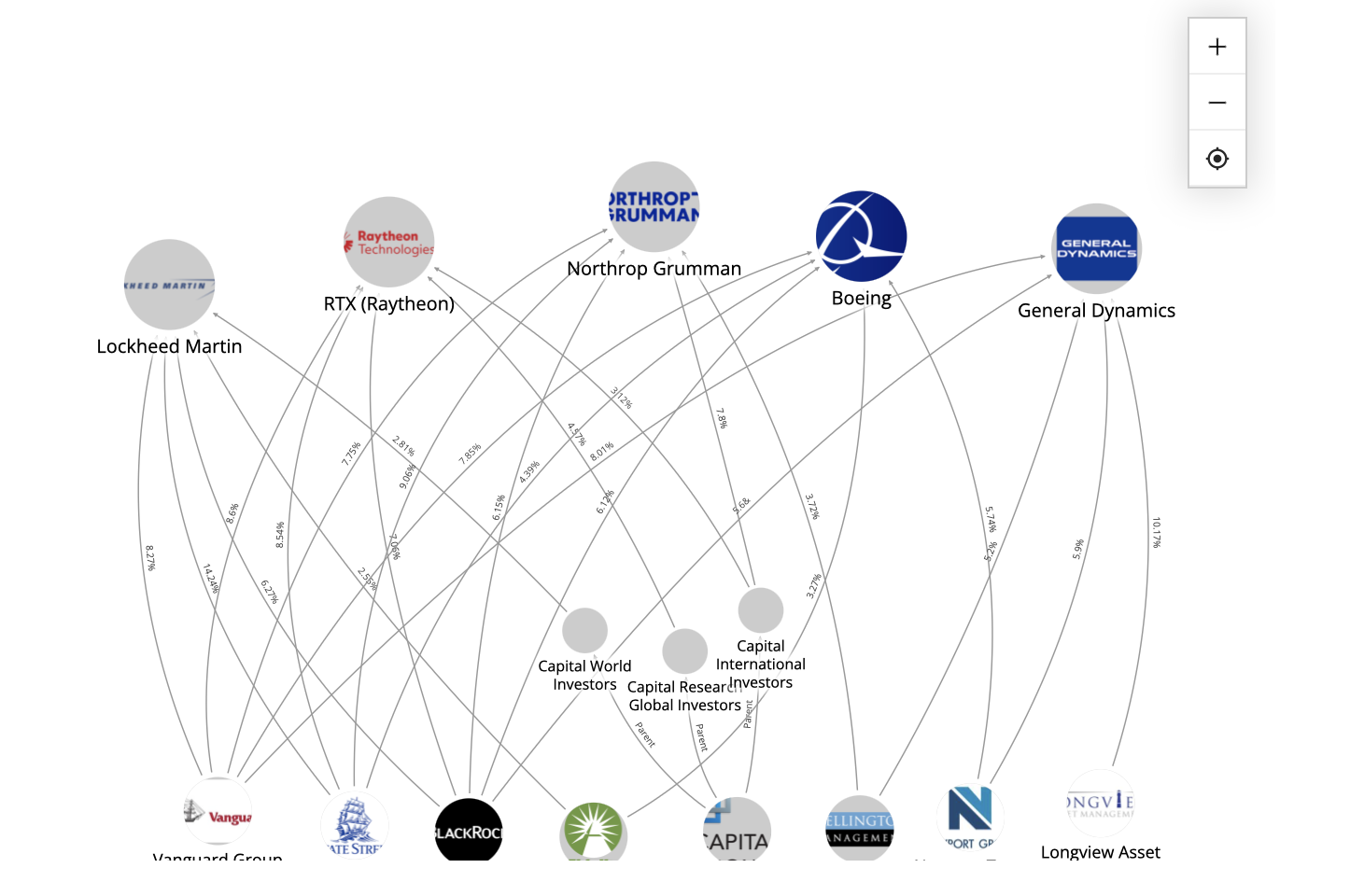

Five of the top six global defense corporations are based in the U.S. They are Lockheed Martin, RTX (formerly Raytheon), Northrop Grumman, Boeing and General Dynamics. All five have long sold weapons to Israel that are used against Palestinians, and they have been mentioned in the news recently as being tied to weapons sales or potential weapons sales around the current assault on Gaza. Most of their stock prices shot up with the onset of the current war.

These five companies took in an astounding $196 billion in military-related revenue in 2022. Their five CEOs rake in huge amounts of compensation. From 2020 to 2022, these five CEOs together have taken in around $318 million in total compensation — salary, stock awards, and other forms of payment. Moreover, the CEOs own massive amounts of corporate stock, meaning they profit handsomely when stock prices go up. These CEOs are powerful figures, often also serving as company chairs and presidents, and having influential ties to the wider corporate and political world.

Weapons CEOs

Click here for the interactive graph.

The top shareholders in these five defense companies largely consist of big asset managers, or big banks with asset management wings, that include BlackRock, Vanguard, State Street, Fidelity, Capital Group, Wellington, JPMorgan Chase, Morgan Stanley, Newport Trust Company, Longview Asset Management, Massachusetts Financial Services Company, Geode Capital, and Bank of America.

Lockheed Martin

Lockheed Martin is the world’s top defense company by revenue. In 2022, it took in $66 billion in revenue, of which 96%, or $63.3 billion, was in defense revenue.

Lockheed Martin has supplied weapons to Israel for decades to use against Palestinians. According to the watchdog site Investigate, Lockheed’s weapons have been used in attacks that “include war crimes that Israel has committed during several major military offensives against the Gaza Strip.” According to the Financial Review, Israel is currently seeking Hellfire missiles, which are made by Lockheed Martin.

Lockheed Martin’s stock price soared with Israel’s war on Gaza.

Lockheed Martin’s CEO Jim Taiclet took in over $66 million in total compensation from 2020 to 2022. As of February 24, 2023, he owned 56,054 total common shares and stock units with the company. As of the closing of the U.S. stock market on October 23, 2023, Lockheed’s share price was $446.16, meaning his stock holdings could be worth $25 million. Taiclet is a board member of the Council on Foreign Relations, perhaps the most influential U.S. foreign policy establishment think tank.

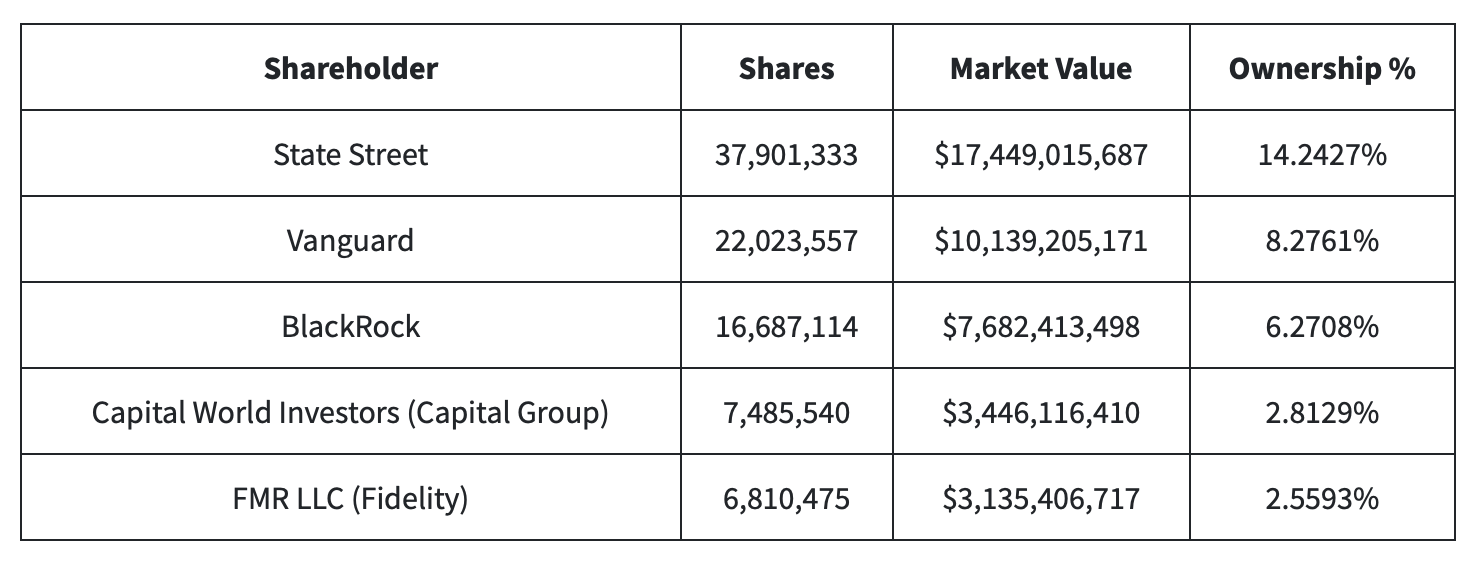

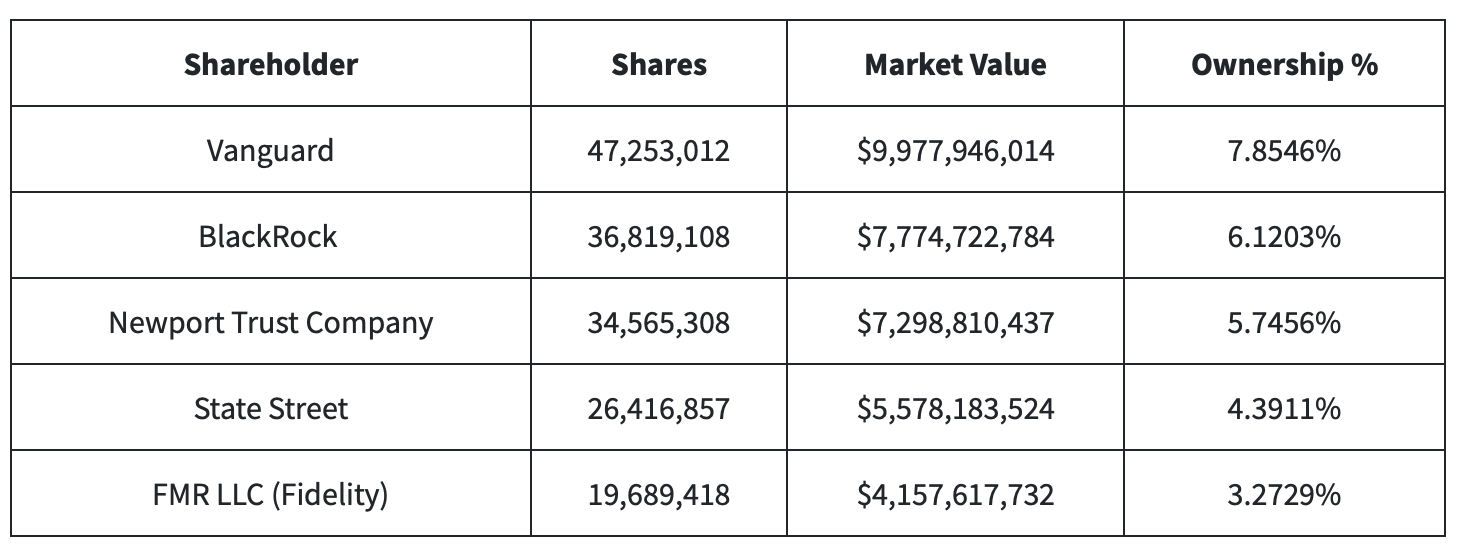

According the business data website Whalewisdom, Lockheeds’s top five shareholders are:

All told, these five asset managers together own more than a 34% stake in Lockheed Martin. The next top five shareholders are Charles Schwab, Morgan Stanley, Geode Capital, Bank of America, and Capital Research Global Investors.

Lockheed Martin’s Lead Independent Director is Daniel F. Akerson, a former Vice Chairman of private equity giant Carlyle Group and former CEO of General Motors. Lockheed’s board also includes a slew of revolving door and influential figures, such as former Obama Secretary of Homeland Security and current Paul Weiss law firm partner, Jeh Johnson, as well as Vicki A. Hollub, the President and CEO of oil giant Occidental Petroleum.

RTX (Raytheon)

RTX (formally Raytheon Technologies) is the second-top defense company in the world by revenue. In 2022, it took in $67.1 billion in revenue, of which 59%, or $39.6 billion, was in defense revenue.

According to the watchdog site Investigate, Raytheon has consistently and extensively supplied Israel with weapons used in Gaza over the past two decades. For example, “[i]n its frequent military offensives against Gaza,” says Investigate, “the Israeli military uses Raytheon’s 5,000-pound GBU-28 “bunker buster” and laser-guided Paveway bombs, as well as AGM-65 Maverick air-to-ground missiles, AIM-9X missiles, AIM-120 Sidewinder missiles, and TWO long-range missiles.”

On October 17, the New York Times reported that the Biden administration was “already moving to send additional ammunition and Iron Dome interceptor missiles” made by Raytheon. Like many other weapons companies, Raytheon’s stock also jumped with the war on Gaza.

RTX’s CEO Gregory J. Hayes took in over $63 million in total compensation from 2020 to 2022. As of February 8, 2023, he beneficially owned 801,339 total shares of RTX stock. Hayes sits on the boards of both the Business Roundtable and fossil fuel giant Phillips 66.

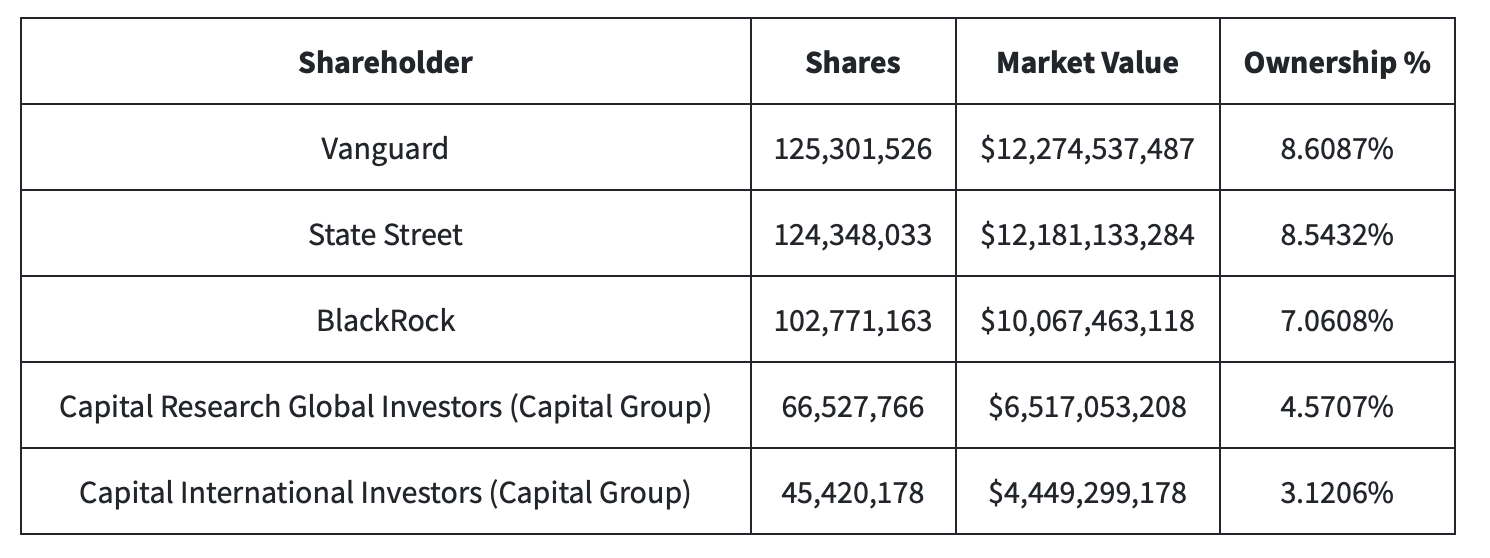

According the business data website Whalewisdom, RTX’s top five shareholders are:

All told, these five asset managers together own a nearly 32% stake in RTX. The next top five shareholders are Wellington, JPMorgan Chase, Dodge & Cox, Morgan Stanley, and Geode Capital.

RTX’s board contains revolving door figures such as former Deputy Secretary of Defense Robert O. Work, and former Vice Chairman of the Joint Chiefs of Staff, James A. Winnefeld Jr.

Northrop Grumman

Northrop Grumman is the world’s third biggest defense company in the world by revenue. In 2022, it took in$36.6 billion in revenue, of which 89%, or $32.4 billion, was in defense revenue.

According to the watchdog site Investigate, Northrop Grumman “supplies the Israeli military with a wide variety of weapons, including various missile systems. The company’s technologies are also integrated into Israel’s main weapon systems, including its fighter jets, missile ships, and trainer aircraft.” The company has provided Israel weapons for decades and, says Investigate, “these weapons have repeatedly been used against Palestinian civilians, resulting in numerous casualties as well as mass destruction of homes and civilian infrastructure, including hospitals, schools, and water and electric systems.”

With Israel’s current war on Gaza, Northrop Grumman’s stock price boomed.

Northrop Grumman CEO Kathy J. Warden took in over $61 million in total compensation from 2020 to 2022. As of March 15, 2023, she owned 161,231 shares of company stock, currently worth around $78 million. Warden also sits on the board of pharmaceutical giant Merck, and she is a member of the Business Roundtable

According the business data website Whalewisdom, Northrop Grumman’s top five shareholders are:

All told, these five asset managers together own a nearly 35% stake in Northrop Grumman. The next top five shareholders are FMR LLC (Fidelity), Bank of America, Massachusetts Financial Services Company, JPMorgan Chase, and Morgan Stanley.

Northrop Grumman’s Lead Independent Director is Madeleine A. Kleiner, who is also on the board of fastfood chain Jack in the Box. Northrup compensated her with $361,122 in 2022. Kleiner is also on the board of the Ladies Professional Golf Association. Other Northrup board members include David Abney, former Chairman and CEO of UPS; Arvind Krishna, Chairman and CEO of IBM; and Thomas M. Schoewe, a former top executive for Walmart, and a former director of private equity giant KKR, and a current director of General Motors.

Boeing

Boeing is the world’s fifth biggest defense company in the world by revenue. In 2022, it took in $66.6 billion in revenue, of which 46%, or $30.8 billion, was in defense revenue.

On October 17, 2023, the New York Times reported that “[n]ew shipments of small, 250-pound guided bombs made by Boeing are… being sent to Israel, as are additional gear that converts older, crude bombs into precision-guided “smart” munitions.” The Financial Review reports that “joint direct attack munitions (JDAMs)… and small diameter bombs (SDBs)” produced by Boeing are being sought by Israel. The watchdog site Investigate has documented Boeing extensive weapons shipments to Israel that have been used against Palestinians over the years.

Boeing CEO David Calhoun took in over $64 million in total compensation from 2020 to 2022. He currently holds 193,247 shares of Boeing stock, worth nearly $35 million. Calhoun is a former executive of the private equity giant Blackstone Group. He sits on the board of directors of Caterpillar and is a member of the Business Roundtable. Calhoun is also the Vice Rector of the Board of Trustees of Virginia Tech.

According the business data website Whalewisdom, Boeing’s top five shareholders are:

All told, these five asset managers together own more than a 27% stake in Boeing. The next top five shareholders are Capital World Investors, Loomis Sayles, Capital Research Global Investors, Geode Capital, and Morgan Stanley.

Boeing’s board chair is Lawrence W. Kellner. In his role, Boeing compensated him with $616,000 in 2022. Kellner is also on the board of ExxonMobil. Boeing’s board also includes, among others, Lynn J. Good, the chairman and CEO of utilities giant Duke Energy; Sabrina Soussan, the chairman and CEO of water privatization giant Suez; and Ronald A. Williams, the former chairman and CEO of healthcare giant Aetna.

General Dynamics is the world’s sixth biggest defense company in the world by revenue. In 2022, it took in$39.4 billion in revenue, of which 77%, or $30.4 billion, was in defense revenue.

General Dynamics

The Financial Review reports that, currently, “Israel will also need 120mm-calibre tank rounds, made by General Dynamics.” The watchdog site Investigate documents General Dynamics extensive business with Israel. For example, it notes that “General Dynamics’ MK-84 2,000-pound bombs have been used extensively by the Israeli Air Force during its frequent assaults on Gaza, including in 2021 and in multiple suspected war crimes in 2014.”

General Dynamics stock shot up with Israel’s attacks on Gaza

General Dynamics CEO Phebe N. Novakovic took in over $64 million in total compensation from 2020 to 2022. As of March 8, 2023, she held 1,616,279 shares of total common stock and equivalents. Novakovic sits on the board of banking giant JPMorgan Chase. She is a member of the Business Roundtable and a trustee of the foreign policy think tank Center for Strategic and International Studies.

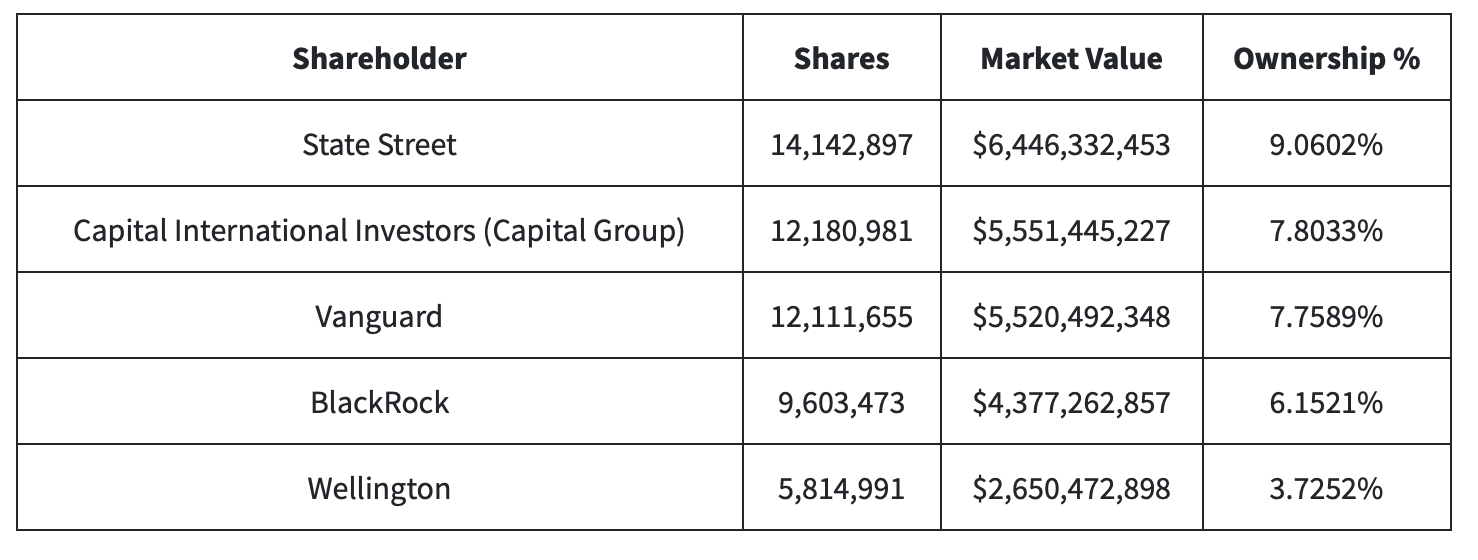

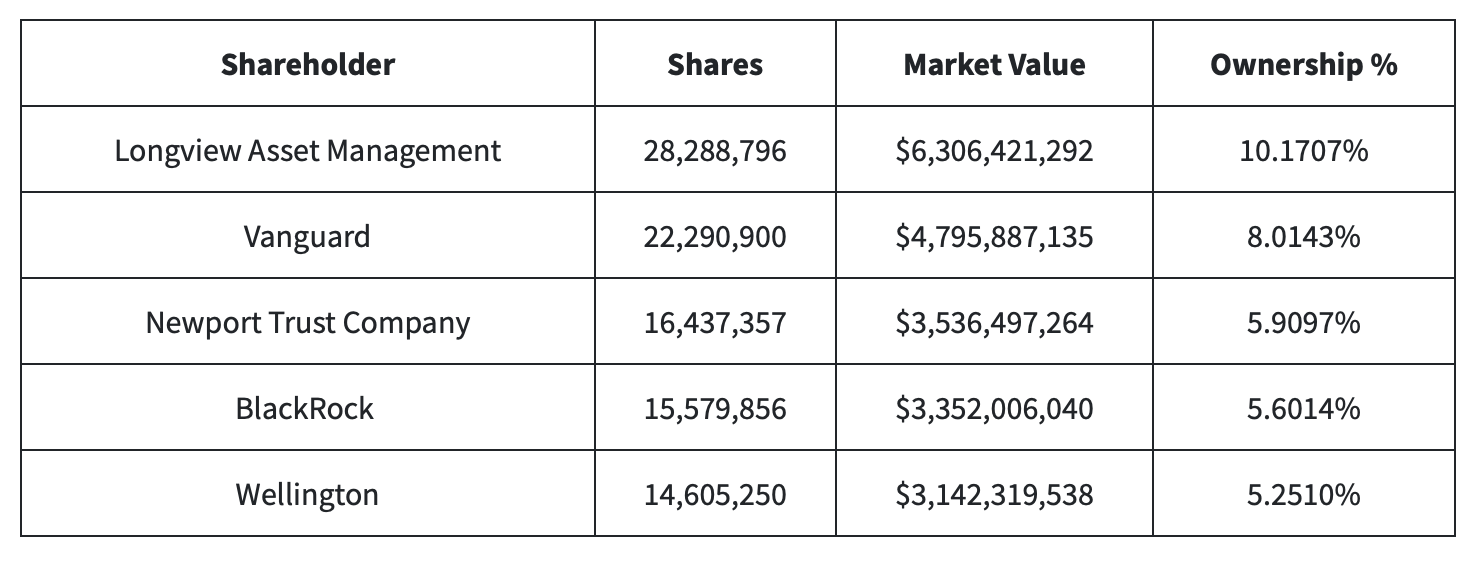

According the business data website Whalewisdom, General Dynamic’s top five shareholders are:

All told, these five asset managers together own a nearly 35% stake in General Dynamic. The next top five shareholders are State Street, Capital Research Global Investors, Bank of America, Massachusetts Financial Services Company, and JPMorgan Chase.

General Dynamics’ Lead Independent Director is Laura J. Schumacher, who is also a director of CrowdStrike Holdings, a cyber security company. General Dynamics compensated Schumacher with $330,336 in 2022. General Dynamics board also includes Jim Mattis, former Secretary of Defense for Donald Trump and a commander during the invasion and occupation of Iraq who investigative news sources have suggested could be tied to war crimes in Iraq.

Top 5 Shareholders of Top 5 Defense Companies

Click here for the interactive graph.

Funders of Right Wing, Pro-Israel Super PACs

In the early weeks of Israel’s war on Gaza, lobbying groups including The American Israel Public Affairs Committee (AIPAC) and Democratic Majority for Israel have been active in Washington, calling on lawmakers to send money and weapons to Israel. AIPAC was pushing for a funding package even before President Biden introduced his proposal to lawmakers. Democratic Majority for Israel, which was launched by AIPAC operatives in 2019 to shore up support for Israel within the Democratic Party, has been holding briefings for members of Congress, including one that featured former Israeli Prime Minister Naftali Bennett as a guest speaker.

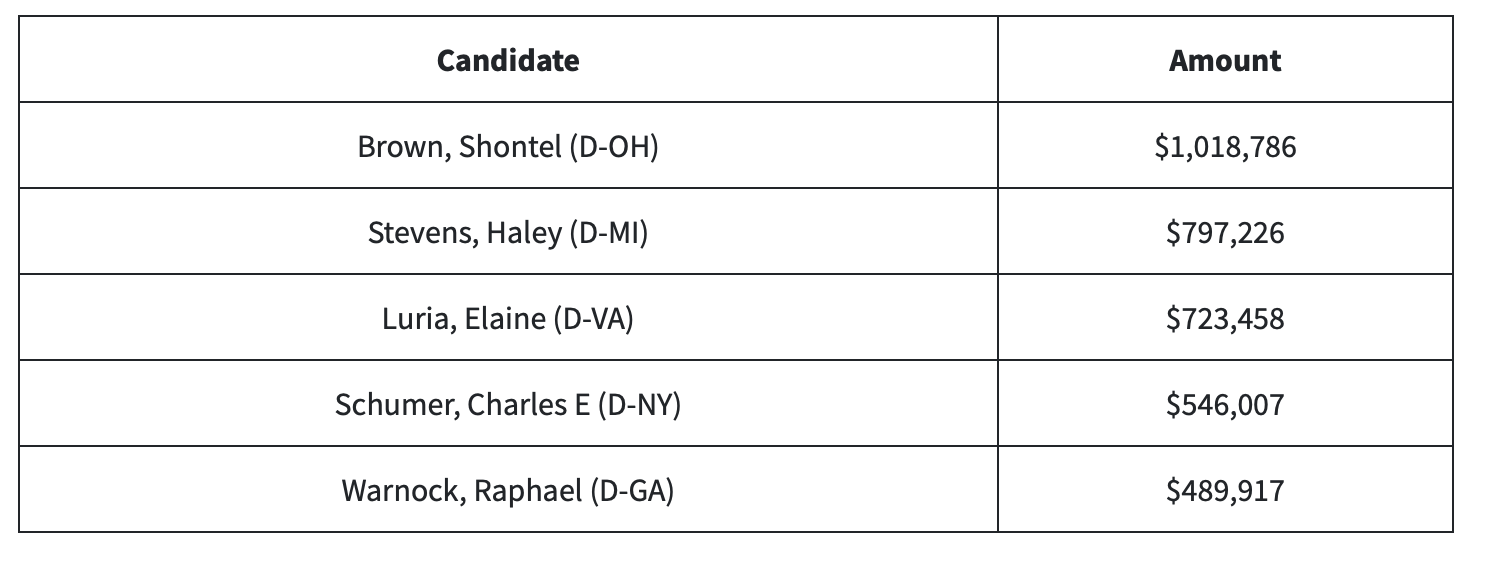

In 2022, AIPAC was far and away the biggest spender among pro-Israel organizations in the U.S. According to OpenSecrets, AIPAC gave $12 million to candidates and parties during the 2021-2022 election cycle. $7.9 million went to Democrats and $4.7 million went to Republicans. AIPAC’s Super PAC, United Democracy Project, also spent $26 million in a massive push to influence the 2022 Democratic primaries by spending against progressive Democratic candidates that AIPAC considered to be not supportive enough of Israel. The group spent an additional $2 million in lobbying last year.

The chart below shows the top five Congressional recipients of Pro-Israel campaign contributions in the 2022 election cycle, according to OpenSecrets.

To read the complete “Eyes on the Ties” article click here

*

Note to readers: Please click the share button above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Featured image: Smoke rises following an Israeli airstrike in Gaza City, October 9, 2023. (Source: CGTN)