“The Hidden System of Finance”, National Security Waivers and The Security and Exchange Commission (SEC)

"FASAB Standard 56" and the Authority of the Director of National Intelligence to Waive SEC Financial Reporting

The purpose of this report is to offer a clear explanation of how two financial reporting exemptions has de facto created a hidden system of finance that runs parallel to the official financial system that facilitates and governs interactions between the federal government and the private sector. Below, I present a discussion of national security waivers that exempt some businesses from standard financial reporting requirements laid out by the Security and Exchange Commission (SEC). I also summarize the recent adoption of Federal Accounting Standards Board (FASAB) Standard 56, which gives those with high level national security clearances the authority to modify government financial statements. I then discuss the implications of these to reporting exemptions for both the federal government and the financial system.

Private Sector Financial Reporting Exemptions

On May 23,2006, BusinessWeek published the article “Intelligence Czar Can Waive SEC Rules (Kopeki, 2006). In the article Kopeki writes that at least since the Carter era the President had the ability to waive standard business accounting and securities-disclosure obligations required by the SEC. However, an entry in the Federal Register revealed that in 2006 President Bush delegated the authority to waive financial reporting to the Director of National Intelligence. At the time the article was written, the primary concern appeared to be in concealing top-secret defense projects and investments. However, to our knowledge there is nothing in the law to restricts its use of financial reporting exemptions to the defense industry. Perhaps the most important factor in maintaining a strong military is to ensure the strength and reputation of financial system and the dollar as the primary reserve currency of the world. It is possible that this authority could be used to conceal certain financial institutions from fully reporting if such waivers were deemed to be in the interest of national security. Note also that the timing of the transfer of this authority to the Director of National Intelligence just preceded the financial crisis; reporting exemptions may well have been granted during the crisis in order to conceal sensitive actions by the Federal Reserve and other key financial entities.

Federal Government Financial Reporting Exemptions

In October 2018, the government implemented a critical recommendation by the Federal Accounting Standard Advisory Board (FASAB) (FASAB, 2018). The recommendation, which is called FASAB Standard 56, was motivated by the first ever external audit of the Department of Defense (DOD) that began in January 2018. The stated concern was that if the DOD were to fully report as per existing financial reporting regulations and laws, sensitive information could be revealed and thus pose a threat to national security. As discussed in detail in Skidmore and Fitts (2019), the new policy allowed government authorities to create a modified set of financial statements for the public, and an actual set of actual financial statements that that is accessible only to those with the required national security clearances. 2 Astoundingly, the FASAB Standard 56 had no parameters or constraints limiting the degree to which financial statements could be modified:

- The financial statements of all federal entities could potentially be modified to conceal sensitive information;

- The financial statements of all federal entities could have modifications inserted that do not affect net results of operation or position;

- Allows a component reporting entity to be excluded from one reporting entity and consolidated into another reporting entity in a way that changes net results of operation and/or net worth; and

- There is no limit on the amount by which financial reporting can be modified.

Implications of Financial Reporting Exemptions

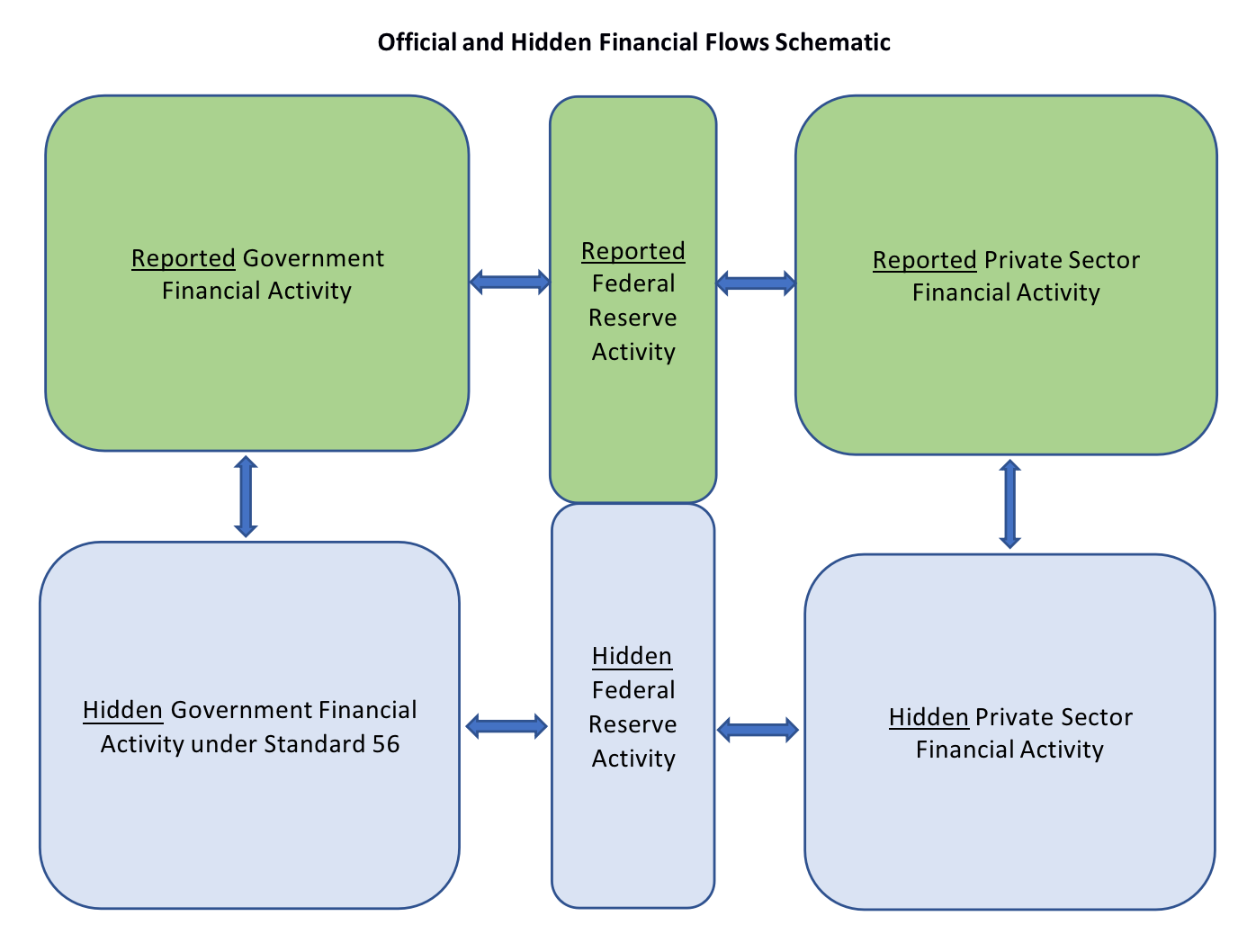

The figure below offers a simple illustration of the official financial system and the hidden (or shadow) system. At the nexus of the federal government and the private sector is the Federal Reserve Bank (FRB). The FRB serves as the fiscal agent for the federal government, and thus facilitates all transactions for the government including inflows via the purchase of government securities (by either the private sector or the FRB itself through electronically created funds recorded as liabilities on the FRB balance sheet). However, much FRB is opaque: We cannot fully observe all transactions and activities the FRB engages in and/or facilitates.3

The top portion in green of the figure illustrates the flow of officially reported financial transactions facilitated by the FRB. The arrowed blue lines represent the flow of funds in/out of government through the FRB and to/from the private sector. The private sector includes all firms such as defense contractors, financial institutions and a variety on private contracting entities that provide services to the government. The green portion of the figure represents what many believe to be the full set of government-related activities within the economy.

With the private sector reporting exemptions authorized by the Director of National Intelligence, consider the bottom righthand portion of the figure in light blue noted as “Hidden Private Sector Financial Reporting”. While we know that private entities are exempt reporting, how many firms are exempt and how much is unknown by those who do not have the needed high-level national security clearances. Prior to the adoption of FASAB Standard 56 in 2018, some of this unreported activity was reflected in government financial reporting via “unsupported journal voucher adjustments”, where unsupported transactions are documented in existing government documents. As described in Skidmore and Fitts (2017), unsupported transactions for the DOD and the Department of Housing and Urban Development (HUD) tallied to $21 trillion between 1998-2015. After the implementation of FASAB Standard 56, the government officially added the “Hidden Government Financial Reporting” component as illustrated in the bottom left portion of the figure. Those with high-level national security clearances have authority to move both revenues and expenditures from the officially reported side of the figure to the hidden ledger. This same set of government officials can also conceal financial reporting for the FRB and any private entity. The integration of the two laws has enabled an entire system of hidden finance in the sense the revenues and expenditures are not recorded in any official financial statements in either the public or private sectors.

Official and Hidden Financial Flows Schematic

What We Know and Do not Know

According to the latest official figures, the $2.2 trillion Cares Act (U.S. Treasury, 2020) pushed the official deficit to $3.2 trillion in fiscal year 2019. As of November 2020, the official total debt held internally and externally exceeds $27 trillion (United States Debt Clock, 2020). Importantly, between September 2019 and October 2020, the FRB’s balance sheet increased by $3.3 trillion (Federal Reserve, 2020); nearly all new federal government debt issuance was fully monetized by the FRB. The debt trajectory is anticipated to soar in the coming years.

However, with the opaque financial reporting rules described in this report, it is possible that the FRB’s balance sheet is much higher than official reports indicate. Unfortunately, without full transparency there is no way to know the degree to which the FRB may have funded a variety of secret activities through unreported debt monetization. Along these lines, critical financial institutions may also be exempt from reporting any covert funding activity. Normally, issuers of securities need to “make and keep books, records, and accounts, which, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the issuer” and maintain internal accounting according to generally accepted accounting principles (GAAP) (15 USC 78m(b)). Failing to do so can result in criminal liability (15 USC 78m(b)). A waiver from the Director of National Intelligence can remove some of those requirements, allowing private entities to deviate from GAAP and even alter their books if the waiver allows.4

Even within the official financial records much activity can be and is hidden. For example, Webb (2020) carefully documents how through Operation Warp Speed $6 billion in vaccine contracts have been funneled through a government contractor with ties the Central Intelligence Agency (CIA) and the Defense Advance Research Program (DARPA). While Webb’s article is critical reading for a variety of reasons, of greatest relevance here is that financial reporting is embedded in and thus hidden by the private contractor. These types of “public-private” partnerships are increasingly being used to shield activities and financial reportion from public scrutiny. Importantly, the activities of the private contractor are exempt from Freedom of Information Act requests. As another example, consider the BlackRock investment firm, which authored the bailout strategy for the next crisis in which central banks would make direct loans to trading houses on Wall Street as well as facilitate direct purchases of primary and secondary corporate bonds and bond exchange traded funds. What is called the “going direct” plan also includes making direct transfers to individuals in digital wallets. BlackRock was then given a no-bid contract to manage the FRB’s corporate bond buying programs. (Martens and Martens, 2020)

While I have shared several examples of finances/activities that are not fully transparent, reporters and researchers have been able to glean valuable information about opaque programs that are critical to the future of everyone. However, there is much we do not know:

- How many companies are exempt from standard SEC financial reporting?

- Which companies are exempt from standard SEC financial reporting?

- How much in revenues, expenditures and other financial information is exempt from standard SEC financial reporting?

- What kinds of projects are funded via the hidden system of finance?

- How many federal government entities/agencies have modified financial statements?

- Which federal government entities/agencies have modified financial statements?

- How much in revenues, expenditures and funded activities are hidden from the public by FASAB Standard 56?

- What kinds of projects are funded through the hidden system of finance?

- Is there an unreported expansion of the FRB’s balance sheet (unreported debt monetization)?

- Is there an unreported expansion of balance sheets at Treasury and FHA/Ginnie with bonds, debentures and mortgage securities that are issued without being recorded on official balance sheets?

- Is there hidden market participation and leverage provided through the Exchange Stabilization Fund?5

While investigative reporters and researchers have compiled considerable information that offers some insight into these questions, the opacity of the financial system prevents one from knowing with certainty the scale of the hidden system of finance. Given all these considerations, one remaining question comes to mind: With the scale of non-transparency documented in this report, should the United States be called a representative democracy?

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

Sources

Federal Accounting Standards Advisory Board (2018). “Statement of Federal Financial Accounting Standards 56.” Accessed on 10/30/2020: https://fas.org/sgp/news/2018/07/fasab-review.pdf

Federal Reserve Bank of the United States (2020). “Credit and Liquidity Program and Balance Sheet.” Accessed on 11/3/2020: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

Ferri, M. and Lurie, J. (2019a). “FASAB Statement 56: Understanding New Government Financial Accounting Loopholes.” Accessed on 11/3/2020: https://constitution.solari.com/fasab-statement-56-understanding-new-government-financial-accounting-loopholes/

Ferri, M. and Lurie, J. (2019b). “The Black Budget: The Crossroads of (Un)Constitutional Appropriations and Reporting.” Accessed on 11/3/2020: https://constitution.solari.com/the-black-budget-the-crossroads-of-unconstitutional-appropriations-and-reporting/

Ferri, M. and Lurie, J. 2019c). “National Security Exemptions and SEC Rule 10b-5.” Accessed on 11/3/2020: https://constitution.solari.com/national-security-exemptions-and-sec-rule-10b-5/

Ferri, M. and Lurie, J. 2019d). “Classification for Investors 101.” Accessed on 11/3/2020: https://constitution.solari.com/classification-for-investors-101/

Kopecki, D. (2006). “Intelligence Czar Can Waive SEC Rules.” BusinessWeek. Accessed on 10/30/2020: https://archive.org/details/GeorgeHwBushExemptsSelectCorporationsFromSecFinancialReporting_45

Martens, P. and Martens, R, (2020). “The Dark Secrets in the Fed’s Last Wall Street Bailout Are Getting a Devious Makeover in Today’s Bailout.” CounterPunch. Accessed on 11/3/2020: https://www.counterpunch.org/2020/04/02/the-dark-secrets-in-the-feds-last-wall-street-bailout-are-getting-a-devious-makeover-in-todays-bailout/

Powell, C. (2001). “Lawsuit Survive Hearing on Dismissal Motions.” Accessed on 11/3/2010: http://gata.org/node/4211

Skidmore, M. and Fitts, C. (2017). “Summary Report on ‘Unsupported Journal Voucher Adjustments’ in the Financial Statements of the Office of the Inspector General for the Department of Defense and the Department of Housing and Urban Development.” Accessed on 10/30/2020: https://missingmoney.solari.com/wp-content/uploads/2018/08/Unsupported_Adjustments_Report_Final_4.pdf

Skidmore, M. and Fitts, C. (2017). “Should We Care about Secrecy in Financial Reporting.” Accessed on 10/30/2020: https://hudmissingmoney.solari.com/should-we-care-about-secrecy-in-financial-reporting/

Taibbi, M. (2019). “Has the Government Legalized Secret Defense Spending?” Rolling Stone. Accessed 11/3/2020: https://www.rollingstone.com/politics/politics-features/secret-government-spending-779959/

United States Code (2020). “15 U.S. Code § 78m(b)(3)(A)”. Accessed on 11/3/2020: https://www.law.cornell.edu/uscode/text/15/78m

United States Debt Clock. (2020). Accessed on 11/3/2020: https://usdebtclock.org/

United States Department of Treasury (2020). “The Cares Act Works for All Americans.” Accessed 11/3/2020: https://home.treasury.gov/policy-issues/cares

Webb, W. (2020). “Operation Warp Speed is Using a CIA-Linked Contractor to Keep Covid-19 Contracts Secret.” Accessed on 11/3/2020: https://www.thelastamericanvagabond.com/operation-warp-speed-is-using-a-cia-linked-contractor-to-keep-covid-19-vaccine-contracts-secret/

Notes

[1 Department of Agricultural, Food, and Resource Economics/Department of Economics, Michigan State University, 91 Morrill Hall of Agriculture, East Lansing, MI 48824-1039; [email protected]; 517-353-9172.]

[2 See Taibbi (2019) and Ferri and Lurie (2019a) for detailed discussions of the implications of FASAB Standard 56 for transparency in federal government financial reporting.]

[3 See for example the work of Felkerson (2011) who through painstaking evaluation determined that the FRB gave or loaned out $29 trillion during the 2007-09 financial crisis. He was only able to learn of these activities after it had been done, not during the crisis. See also an excellent article by Martens and Martens (2020) on the opacity of FRB bailouts to key financial institutions during the COVID-19 crisis.]

[4 See Ferri and Lurie (2019b) for a detailed discussion of the laws relating to the black budget and financial reporting. See also Ferri and Lurie (2019c) for an in-depth discussion of waivers from SEC financial reporting requirements, and Ferri and Lurie (2019d) for a discussion of the implications of opaque government reporting for investors.]

[5 The United States Treasury website (https://home.treasury.gov/policy-issues/international/exchange-stabilization-fund) explicitly states that it has the authority to intervene in financial markets, including gold, foreign exchange, and other instruments of credit and securities, to achieve its objective of maintaining an orderly system of exchange rates. In a brief prepared by the Gold Anti-Trust Committee Inc., Powell (2001) discusses a court hearing in which Plaintiff Howe argued a case against representatives from Bank of International Settlements, Goldman Sachs, Deutsche Bank, J.P. Morgan/Chase, Citigroup, the United States Treasury Department, the Federal Reserve Board, and the New York Federal Reserve Bank that there was explicit intervention in the gold market by the United States Treasury. Yet it is difficult or even impossible to ascertain from official Exchange Stabilization Fund documents the degree of such interventions. ]

Featured image is from The Missing Money