The Great Global Debt Depression: It’s All Greek To Me

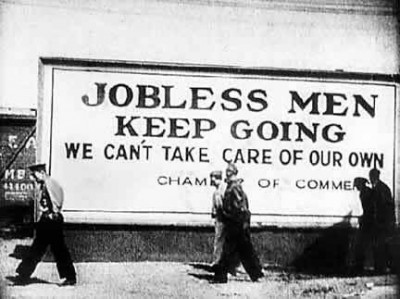

In late June of 2011, the Greek government passed another round of austerity measures, ostensibly aimed at getting Greece “back on track” to economic progress, but in reality, implementing a systematic program of ‘social genocide’ in the name of servicing an endless and illegitimate debt to foreign banks. Right on cue, protests and riots broke out in Athens against the draconian measures, and the state moved in to do what states do best: oppress the people with riot police, tear gas and bashing batons, leaving roughly 300 people injured.

Is Greece simply a case of a country full of lazy people who spent beyond their means and are now paying for their own decadence? Or, is there something much larger at stake – and at play – here? Greece is, in fact, a microcosm of the global economy: mired in excessive debt, economically ruined, increasingly politically repressive and socially explosive. This report takes a look at the case of the Greek debt crisis specifically, and places it within a wider global context. The conclusion is clear: what happens in Greece will happen here.

This report examines the Greek crisis, as well as the larger global economic crisis, including the origins of the housing bubble, the bailouts, the banks, and the major actors and institutions which will come to dominate the stage over the next decade in what will play out as ‘The Great Global Debt Depression.’

An Olympian Debt

With the global economic crisis rampaging throughout the world in 2008, Greece experienced major protests and riots at government reactions to the crisis. The unpopularity of the government led to an election in which a Socialist government came to power in October of 2009 under the premise of promising an injection of 3 billion euros in order to revive the Greek economy.[1] When the government came to power, they inherited a debt that was double that which the previous government had disclosed. This prompted Greece’s entry into a major debt crisis, as the debt was roughly 127% of Greece’s GDP in 2009, and thus, the costs of borrowing rose exponentially.

In April of 2010, Greece had to seek a bailout by the EU and the IMF in order to pay the interest on its debt. However, by taking such a bailout from the EU and IMF, Greece ultimately incurred a larger long-term debt, as the money from these institutions simply added to the overall debt, and thus, actually increased eventual interest payments on that debt. Thus, we see the true nature of debt: a financial form of slavery. Debt is designed in such a way that, like a fly caught in a spider’s web, the more it struggles, the more entangled it gets; the more it struggles to break free, the more it arouses the attention of the spider, which quickly moves in to strike its prey – paralyzed – with its venom, so that it may wrap the fly in its silk and eat it alive. Debt is the silk, the people are the fly, and the spider is the large financial institutions – from the banks to the IMF. The nature of debt is that one is never meant to be able to escape it. Hence, the “solution” for Greece’s debt problem – according to those who decide policy – is for Greece to acquire more debt. Of course, this new debt is used to pay the interest on the old debt (note: it is not used to pay OFF the old debt, just the interest on it). However, the effect this has is that it increases the over-all debt of the nation, which leads to higher interest payments and thus a greater cost of borrowing. This, ultimately, leads to a need to continue borrowing in order to pay off the higher interest payments, and thus, the cycle continues. For all the “bail outs” and aims at addressing Greece’s debt, this prescription inevitably results in greater debt levels than those which induced the debt crisis in the first place.

So why is this the prescription?

Not only does this prescription incur more debt to pay interest on old debt, but the process of borrowing and “consolidating” debt has devastating social and political consequences. For example, in the case of Greece, in order to receive loans from the IMF and EU, Greece was forced to impose “fiscal austerity measures.” This blatantly ambiguous economic nomenclature of “fiscal austerity” is in fact more accurately described in real human terms as “social genocide.” Why is this so?

‘Fiscal Austerity’ means that the state – in this case, Greece – must engage in “fiscal consolidation.” In economic parlance, this implies that the state must cut spending and increase taxes in order to “service” its debt by reducing its annual deficit. Thus, the ‘conditions’ for receiving a loan demand “fiscal austerity” measures being implemented by the debtor nation. This is supposedly a way for the lender to ensure that their loans are met with appropriate measures to deal with the debt. The objective, purportedly, is to reduce expenditure (spending) and increase revenue (income), allowing for more money to pay off the debt. However, as with most economic concepts, the reality is far different than the theoretical implications of “fiscal austerity.”

In fact, ‘fiscal austerity’ is a state-implemented program of social destruction, or ‘social genocide’. Such austerity measures include cutting social spending, which means no more health care, education, social services, welfare, pensions, etc. This directly implies a massive wave of layoffs from the public sector, as those who worked in health care, education, social services, etc., have their jobs eliminated. This, naturally, creates a massive growth in poverty rates, with the jobless and homeless rates climbing dramatically. Simultaneously, of course, taxes are raised drastically, so that in a social situation in which the middle and lower classes are increasingly impoverished, they are then over-taxed. This creates a further drain of wealth, and consumption levels go down, further driving production levels downward, and (local) private businesses cannot compete with foreign multinational conglomerates, and so businesses close and more lay-offs take place. After all, without a market for consumption, there is no demand for production. In a country such as Greece, where the percentage of people in the employ of the state is roughly 25%, these measures are particularly devastating.

Naturally, in such situations, the masses of people – those who are doomed to suffer most – are left greatly impoverished and the middle classes essentially vanish, and are absorbed into the lower class. As social services vanish when they are needed most, life expectancy rates decrease. With few jobs and massive unemployment, many are left to choose between buying food or medicine, if those are even options. Crime rates naturally increase in such situations, as desperate conditions breed desperate actions. This creates, especially among the educated youth who graduate into a jobless market, a ‘poverty of expectations,’ having grown up with particular expectations of what they would have in terms of opportunities, which then vanish quite suddenly. This results in enormous social stress, and often, social unrest: protests, riots, rebellion, and even revolution in extreme circumstances. These are exactly the conditions that led to the uprising in Egypt.

The reflexive action of states, therefore, is to move in to repress – most often quite violently – protests and demonstrations. The aim here is to break the will of the people. Thus, the more violent and brutal the repression, the more likely it is that the people may succumb to the state and consent – even if passively – to their social conditions. However, as the state becomes more repressive, this often breeds a more reactive and radical resistance. When the state oppresses 500 people one day, 5,000 may show up the next. This requires, from the view of the state, an exponentially increased rate of oppression. The risk in this strategy is that the state may overstep itself and the people may become massively mobilized and intensely radicalized and overthrow – or at least overcome – the power of the state. In such situations, the political leadership is often either urged by a foreign power to leave (such as in the case of Egypt’s Mubarak), or flees of their own will (such as in Argentina), in order to prevent a true revolution from taking place. So, while the strategy holds enormous risk, it is often employed because it also contains possible reward: that the state may succeed in destroying the will of the people to resist, and they may subside to the will of the state and thereby consent to their new conditions of social genocide.

Social genocide is a slow, drawn-out and incremental process. Its effects are felt by poor children first, as they are those who need health care and social services more than any other, and are left hungry and unable to go to school or work. They are the ‘forgotten’ of society, and they suffer deeply as such. The reverberations, however, echo throughout the whole of society. The rich get richer and the poor get poorer, while the middle class is absorbed into poverty.

The rich get richer because through economic crises, they consolidate their businesses and receive tax breaks and incentives from the state (as well as often direct infusions of cash investments – bailouts – from the state), purportedly to increase private capital and production. This aspect of “fiscal austerity” is undertaken in the wider context of what is referred to as “Structural Adjustment.”

This term refers to the loans from the World Bank and IMF that began in the late 1970s and early 1980s in their lending to ‘Third World’ nations in the midst of the 1980s debt crisis. Referred to as “Structural Adjustment Programs,” (SAPs) any nation wanting a loan from the World Bank or IMF needed to sign a SAP, which set out a long list of ‘conditionalities’ for the loan. These conditions included, principally, “fiscal austerity measures” – cutting social spending and raising taxes – but also a variety of other measures: liberalization of markets (eliminating any trade barriers, subsidies, tariffs, etc.), supposedly to encourage foreign investment which it was theorized would increase revenue to pay off the debt and revive the economy; privatization (privatizing all state-owned industries), in order to cut state spending and encourage foreign direct investment (FDI), which again – in theory – would create revenue and reduce debt; currency devaluation (which would make foreign dollars buy more for less), again, under the aegis of encouraging investment by making it cheaper for foreign companies to buy assets within the country.

However, the effects that these ‘structural adjustment programs’ had were devastating. Liberalizing markets would eliminate subsidies and protections which were desperately needed in order for these ‘developing’ nations to compete with the industrialized powers of America and Europe (who, in a twisted irony, heavily subsidize their agriculture in order to make it cheaper to foreign markets). For example, a small country in Africa which was dependent upon a particular agricultural export had heavily subsidized this commodity, (which keeps the price low and thus increases its demand as an exported commodity), then was ordered by the IMF and World Bank to eliminate the subsidy. The effect was that foreign agricultural imports, say from the United States or Europe, were cheaper not only in the international market, but also in the nation’s domestic market. Thus, grains imported from America would be cheaper than those grown in neighbouring fields. The effect this had in an increasingly-impoverished nation was that they would become dependent upon foreign imports for food and agriculture (as well as other commodities), while the domestic industries would suffer and be bought out by foreign multinational corporations, thus increasing poverty, as many of these nations were heavily dependent upon their agricultural sectors as they were often still largely rural societies in some respects. This would accelerate urbanization and urban poverty, as people leave the countryside and head to the cities looking for work, where there was none.

Privatization, for its part, would eliminate state-owned industries, which in many developing nations of the post-World War II era, were the major employers of the population. Thus, massive unemployment would result. As foreign multinational corporations – largely American or European – would come in and buy up the domestic industries, they would often cooperate with the dominant domestic corporations and banks – or create domestic subsidiaries of their own – and consolidate the markets and industries. Thus, the effect would be to strengthen a domestic elite and entrench an oligarchy in the nation. The rich would get richer, profiting off of their cooperation and integration with the international economic system, and they would then come to rely ever-more on the state for protection from the masses.

The devaluation of currencies would, while making commodities and investments cheaper for foreign multinationals and banks, simultaneously make it so that for the domestic population, it would require more money to buy less products than before. This is called inflation, and is particularly brutal in the case of buying food and fuel. For a population whose wages are frozen (as a requirement of ‘fiscal austerity’), their income (for those that have an income) does not adjust to the rate of inflation, hence, they make the same dollar amount even though the dollar is worth much less than before. The result is that their income purchases much less than it used to, increasing poverty.

This is ‘Structural Adjustment.’ This is ‘fiscal austerity.’ This is social genocide.

Debt and Derivatives

Greece has a total debt of roughly 330 billion euros (or U.S. $473 billion).[2] So how did this debt get out of control? As it turned out, major U.S. banks, specifically J.P. Morgan Chase and Goldman Sachs, “helped the Greek government to mask the true extent of its deficit with the help of a derivatives deal that legally circumvented the EU Maastricht deficit rules.” The deficit rules in place would slap major fines on euro member states that exceeded the limit for the budget deficit of 3% of GDP (gross domestic product), and that the total government debt must not exceed 60% of GDP. Greece hid its debt through “creative accounting,” and in some cases, even left out huge military expenditures. While the Greek government pursued its “creative accounting” methods, it got more help from Wall Street starting in 2002, in which “various investment banks offered complex financial products with which governments could push part of their liabilities into the future.” Put simply, with the help of Goldman Sachs and JP Morgan Chase, Greece was able to hide its debt in the future by transferring it into derivatives. A large deal was signed with Goldman Sachs in 2002 involving derivatives, specifically, cross-currency swaps, “in which government debt issued in dollars and yen was swapped for euro debt for a certain period — to be exchanged back into the original currencies at a later date.” The banks helped Greece devise a cross-currency swap scheme in which they used fictional exchange rates, allowing Greece to swap currencies and debt for an additional credit of $1 billion. Disguised as a ‘swap,’ this credit did not show up in the government’s debt statistics. As one German derivatives dealer has stated, “The Maastricht rules can be circumvented quite legally through swaps.”[3]

In the same way that homeowners take out a second mortgage to pay off their credit card debt, Goldman Sachs and JP Morgan Chase and other U.S. banks helped push government debt far into the future through the derivatives market. This was done in Greece, Italy, and likely several other euro-zone countries as well. In several dozen deals in Europe, “banks provided cash upfront in return for government payments in the future, with those liabilities then left off the books.” Because the deals are not listed as loans, they are not listed as debt (liabilities), and so the true debt of Greece and other euro-zone countries was and likely to a large degree remains hidden. Greece effectively mortgaged its airports and highways to the major banks in order to get cash up-front and keep the loans off the books, classifying them as transactions.[4]

Further, while Goldman Sachs was helping Greece hide its debt from the official statistics, it was also hedging its bets through buying insurance on Greek debt as well as using other derivatives trades to protect itself against a potential Greek default on its debt. So while Goldman Sachs engaged in long-term trades with Greek debt (meaning Greece would owe Goldman Sachs a great deal down the line), the firm simultaneously was betting against Greek debt in the short-term, profiting from the Greek debt crisis that it helped create.[5]

This is not an unusual tactic for the company to engage in. As a two-year Senate investigation into Goldman Sachs revealed in April of 2011, “Goldman Sachs Group Inc. profited from the financial crisis by betting billions against the subprime mortgage market, then deceived investors and Congress about the firm’s conduct.”[6] In 2007, as the housing crisis was gaining momentum, Goldman Sachs executives sent emails to each other explaining that they were making “some serious money” by betting against the housing market, a giant bubble which they and other Wall Street firms had helped create. So while the bank had a large exposure (risk) in the housing market, by holding significant derivatives in trading mortgages (mortgage-backed securities, collateralized debt obligations, credit default swaps, etc.), the same bank also used the derivatives market to bet against the housing market as it crashed – a type of self-fulfilling prophecy – which further drove the market down (as speculation does), and thus, Goldman Sachs profited from the crisis it created and made worse.[7]

The derivatives market is a very important feature not only in the housing bubble and bust of 2008, but also in the current Greek crisis, and will remain an important facet of the unfolding global debt crisis. The current global derivatives market was developed in the 1990s. Derivatives are referred to as “complex financial instruments” in which they are traded between two parties and their value is derived (hence: “deriv-ative”) from some other entity, be it a commodity, stock, debt, currency or mortgage, to name a few. There are several types of derivatives. One example is a ‘put option,’ which is betting that a particular stock, commodity or other asset will fall in price over the short term; that way, those who purchase put options will profit from the fall in prices of the asset bet on.

Who Built the Bubble?

One of the most common derivatives is a credit default swap (CDS). These ‘financial instruments’ were developed by JP Morgan Chase in 1994 as a sort of insurance policy. The aim, as JP Morgan at the time had tens of billions of dollars on the books as loans to corporations and foreign governments, was to trade the debt to a third party (who would take on the risk), and would then receive payments from the bank; thus, JP Morgan would be able to remove the risk from its books, freeing up its reserves to make more loans. JP Morgan was the first bank to make it big on credit default swaps, opening the first credit default swaps desk in New York in 1997, “a division that would eventually earn the name ‘the Morgan Mafia’ for the number of former members who went on to senior positions at global banks and hedge funds.” The credit default swaps played a large part in the housing boom:

As the Federal Reserve cut interest rates and Americans started buying homes in record numbers, mortgage-backed securities became the hot new investment. Mortgages were pooled together, and sliced and diced into bonds that were bought by just about every financial institution imaginable: investment banks, commercial banks, hedge funds, pension funds. For many of those mortgage-backed securities, credit default swaps were taken out to protect against default.[8]

Of course, there were a great many players in the financial crisis: bankers, economists, politicians, regulators, etc. The confusion of the situation has allowed all those who are culpable to point the finger at one another and place blame on each other. For example, Jamie Dimon, CEO of JPMorganChase, referred to the government-chartered mortgage lending companies, Fannie Mae and Freddie Mac, as “the biggest disasters of all time,” blaming them for encouraging the banks to make the bad loans in the first place.[9] Of course, he had an ulterior motive in removing blame from himself and the other banks.

There is, however, some truth to his contention, but the situation is more complex. Fannie Mae was created in 1938 after the Great Depression to provide local banks with federal money in order to finance home mortgages with an aim to increase home ownership. In 1968, Fannie Mae was transformed into a publicly held corporation, and in 1970, the government created Freddie Mac to compete with Fannie Mae in providing home mortgages. In 1992, President George H.W. Bush signed the Housing and Community Development Act of 1992, which included amendments to the charters of Fannie Mae and Freddie Mac, stating that they “have an affirmative obligation to facilitate the financing of affordable housing for low- and moderate-income families.”[10]

In 1992, the U.S. Department of Housing and Urban Development (HUD) subsequently became the ‘regulator’ of Fannie Mae and Freddie Mac. In 1995, Bill Clinton’s HUD “agreed to let Fannie and Freddie get affordable-housing credit for buying subprime securities that included loans to low-income borrowers.”[11] In 1996, HUD “gave Fannie and Freddie an explicit target — 42% of their mortgage financing had to go to borrowers with income below the median in their area.”[12] In a 1999 article in the New York Times, it was reported that, “the Fannie Mae Corporation is easing the credit requirements on loans that it will purchase from banks and other lenders.” The action, reported the Times, “will encourage those banks to extend home mortgages to individuals whose credit is generally not good enough to qualify for conventional loans.” It began in 1999 as a pilot program involving 24 banks in 15 markets (including New York), and had hoped to make it nationwide by Spring 2000. The article went on:

Fannie Mae, the nation’s biggest underwriter of home mortgages, has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people and felt pressure from stock holders to maintain its phenomenal growth in profits.

In addition, banks, thrift institutions and mortgage companies have been pressing Fannie Mae to help them make more loans to so-called subprime borrowers. These borrowers whose incomes, credit ratings and savings are not good enough to qualify for conventional loans, can only get loans from finance companies that charge much higher interest rates — anywhere from three to four percentage points higher than conventional loans.[13]

The loans going to low-income households increased the rate given to African Americans, as in the conventional loan market, black borrowers accounted for 5% of loans, whereas in the subprime market, they accounted for 18% of loans. The article itself warned that Fannie Mae “may run into trouble in an economic downturn, prompting a government rescue.”[14] In 2000, as housing prices increased, the U.S. Department of Housing and Urban Development (HUD), under Bill Clinton, continued to encourage loans to low-income borrowers.

Just in time, the Federal Reserve (the central bank of the United States) dramatically lowered interest rates and kept them artificially low in order to encourage the lending by mortgage lenders and banks, and to encourage borrowing by low-income individuals and families, essentially lulling them into a false sense of security. This ‘easy money’ flowing from the Federal Reserve’s low interest rates and printing press (as the Fed is responsible for the amount of money pumped into the U.S. economy), oiled the wheels of the mortgage lenders and the banks that were making bad loans to high-risk individuals. In the 1990s, the Federal Reserve under Chairman Alan Greenspan had created the dot-com bubble, which burst (as all bubbles do), and subsequently, in order to avoid a deep recession, Greenspan and the Federal Reserve actively inflated the housing bubble. So, with the dot-com bubble bursting in 2000 (brought to you by Alan Greenspan and the Federal Reserve), Greenspan’s Fed then cut interest rates to historic lows and began pumping out money in order to prevent a downward spiral of the economy, which would later prove to be inevitable. This also encouraged rabid speculation in the derivatives market, in particular by hedge funds, managing money from banks, who engaged in high-risk trades taking advantage of the uniquely low interest rates in order to purchase derivatives which provide more long-term gains, further fuelling a massive speculative bubble.[15]

Transcripts from a 2004 meeting of Federal Reserve officials revealed a debate about whether there was an inflating housing bubble, at which Greenspan stated that dissent should be kept secret so that the debate does not reach a wider audience (i.e., the ‘public’). As he stated, “We run the risk, by laying out the pros and cons of a particular argument, of inducing people to join in on the debate, and in this regard it is possible to lose control of a process that only we fully understand.”[16] In 2005, the Fed officials were openly acknowledging the existence of a bubble, but continued with their policies all the same.[17] In 2005, Alan Greenspan left the Fed to be replaced by Ben Bernanke, who that year told Congress that there was no housing bubble, and that the increases in hosuing prices “largely reflect strong economic fundamentals.”[18]

The bubble was fuelled in a number of ways. The Federal Reserve kept the interest rates at historic lows, which encouraged both lending and borrowing. The Fed also pumped large amounts of money into the economy for the purpose of lending and borrowing. The government-sponsored mortgage companies of Freddie Mac and Fannie Mae encouraged the banks to make bad loans to high-risk individuals (and provided significant funds to do so). The banks, all too happy to make bad loans to high-risk borrowers, then used the derivatives market they created to profit off of those loans (and further inflate the bubble), through trading primarily Credit Default Swaps (CDS). As the Fed’s long-term interest rates were kept artificially low, the banks speculated through the derivatives market that the housing market would continue to grow apace, and massive amounts of speculative money flowed into the housing bubble, which itself further increased confidence of banks and mortgage companies to lend, as well as individuals to borrow. Of course, the reality was that the individuals were high-risk for a reason: because they couldn’t afford to pay. Thus, it was an inevitable result that this massive and ever-increasing bubble built on nothing but bank-created and government-sponsored ‘faith’ was destined to burst.

Of course, when the bubble burst, the major banks were in a unique position to profit immensely from the collapse through speculation, and then, of course, repossess everyone’s homes. In order for financial speculation to be such a menace in the global economy as it is today, the Clinton administration took the bold steps necessary to eradicate the barriers to such destructive financial practices and facilitate the rapid and unregulated growth of the derivatives market. This was termed the “financialization” of the U.S. economy, and de facto, much of the global economy.

The Glass-Steagall Act was put in place by FDR in 1933 in order to establish a barrier between investment banks and commercial banks and to prevent them from engaging in rabid speculative practices (a major factor which created the Great Depression). However, in 1987, the Federal Reserve Board voted to ease many regulations under the act, after hearing “proposals from Citicorp, J.P. Morgan and Bankers Trust advocating the loosening of Glass-Steagall restrictions to allow banks to handle several underwriting businesses, including commercial paper, municipal revenue bonds, and mortgage-backed securities.” Alan Greenspan, in 1987, “formerly a director of J.P. Morgan and a proponent of banking deregulation – [became] chairman of the Federal Reserve Board.” In 1989, “the Fed Board approve[d] an application by J.P. Morgan, Chase Manhattan, Bankers Trust, and Citicorp to expand the Glass-Steagall loophole to include dealing in debt and equity securities in addition to municipal securities and commercial paper.” In 1990, “J.P. Morgan [became] the first bank to receive permission from the Federal Reserve to underwrite securities.”[19]

In 1998, the House of Representatives passed “legislation by a vote of 214 to 213 that allow[ed] for the merging of banks, securities firms, and insurance companies into huge financial conglomerates.” And in 1999, “After 12 attempts in 25 years, Congress finally repeal[ed] Glass-Steagall, rewarding financial companies for more than 20 years and $300 million worth of lobbying efforts.”[20]

[In] the late 1990s, with the stock market surging to unimaginable heights, large banks [were] merging with and swallowing up smaller banks, and a huge increase in banks having transnational branches, Wall Street and its many friends in congress wanted to eliminate the regulations that had been intended to protect investors and stabilize the financial system. Hence the Gramm-Leach-Bliley Act of 1999 repealed key parts of Glass-Steagall and the Bank Holding Act and allowed commercial and investment banks to merge, to offer home mortgage loans, sell securities and stocks, and offer insurance.[21]

The principal adherents for the repeal of Glass-Steagle were Alan Greenspan, as well as Treasury Secretary Robert Rubin (who had been with Goldman Sachs for 26 years prior to entering the Treasury), and Deputy Treasury Secretary Larry Summers (who was previously the Chief Economist of the World Bank). After largely orchestrating the removal of Glass-Steagle, Rubin went on to become an executive at Citigroup and is currently the Co-Chairman of the Council on Foreign Relations; while Summers went on to become President of Harvard University and later, served as Director of the White House National Economic Council for the first couple years of the Obama administration. Larry Summers had sparked controversy when he was Chief Economist of the World Bank, and in 1991, signed a memo in which he endorsed toxic waste dumping in poor African countries, stating, “A given amount of health-impairing pollution should be done in the country with the lowest cost, which will be the country with the lowest wages,” and further, “I think the economic logic behind dumping a load of toxic waste in the lowest-wage country is impeccable and we should face up to that.”[22] The “impeccable logic” Summers referred to was the notion that in countries with the lowest life expectancy, dumping toxic waste is intelligent, because statistically speaking, the population of the country is more likely to die before the long-term health impacts of the toxic waste take effect. Put more bluntly: the poor should be the first to die.

The most prestigious (and arguably most powerful) financial institution in the world is the Bank for International Settlements (BIS). One might say it’s the most powerful institution you never heard of, since it is rarely discussed, even more rarely studied, and barely understood at all. It is, essentially, a global central bank for the world’s central banks, and de facto acts as an independent global banking supervisory body, establishing agreements for the practices of central banks and private banks. In 2004, the BIS established the Basel II accords to manage capital risk by banks. Basel II was “intended to keep banks safe by requiring them to match the size of their capital cushion to the riskiness of their loans and securities. The higher the odds of default, the less they can lend.” However, as the regulations were being implemented in 2008 in the midst of the financial crisis, it lessened the ability of banks to lend, and thus, deepened the financial crisis itself.[23] The BIS, formed in 1930 in the wake of the Great Depression, was created in order to “remedy the decline of London as the world’s financial center by providing a mechanism by which a world with three chief financial centers in London, New York, and Paris could still operate as one.” As historian Carroll Quigley wrote:

[T]he powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basle, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations.[24]

In 2007, the BIS released its annual report warning that the world was on the verge of another Great Depression, as “years of loose monetary policy has fuelled a dangerous credit bubble, leaving the global economy more vulnerable to another 1930s-style slump than generally understood.” Among the worrying signs cited by the BIS were “mass issuance of new-fangled credit instruments, soaring levels of household debt, extreme appetite for risk shown by investors, and entrenched imbalances in the world currency system.” The BIS hinted at the U.S. Federal Reserve when it warned that, “central banks were starting to doubt the wisdom of letting asset bubbles build up on the assumption that they could safely be ‘cleaned up’ afterwards.”[25]

In 2008, the outgoing Chief Economist of the BIS, William White, authored the annual report of the BIS in which he again warned that, “The current market turmoil is without precedent in the postwar period. With a significant risk of recession in the US, compounded by sharply rising inflation in many countries, fears are building that the global economy might be at some kind of tipping point.” In 2007, warned the BIS, global banks had $37 trillion of loans, equaling roughly 70% of global GDP, and that countries were already so indebted that monetization (printing money) could simply sow the seeds of a future crisis.[26]

Bailout the Bankers, Punish the People

In the fall of 2008, the Bush administration sought to implement a bailout package for the economy, designed to save the US banking system. The leaders of the nation went into rabid fear mongering. Advertising the bailout as a $700 billion program, the fine print revealed a more accurate description, saying that $700 billion could be lent out “at any one time.” As Chris Martenson wrote:

This means that $700 billion is NOT the cost of this dangerous legislation, it is only the amount that can be outstanding at any one time. After, say, $100 billion of bad mortgages are disposed of, another $100 billion can be bought. In short, these four little words assure that there is NO LIMIT to the potential size of this bailout. This means that $700 billion is a rolling amount, not a ceiling.

So what happens when you have vague language and an unlimited budget? Fraud and self-dealing. Mark my words, this is the largest looting operation ever in the history of the US, and it’s all spelled out right in this delightfully brief document that is about to be rammed through a scared Congress and made into law.[27]

Further, as the bailout agreement stipulated, it essentially hands the Federal Reserve and the U.S. Treasury total control over the nation’s finances in what has been termed a “financial coup d’état” as all actions and decisions by the Fed and the Treasury Secretary may be done in secret and are not able to be reviewed by Congress or any other administrative or legal agency.[28] Passed in the last months of the Bush administration, the Obama administration further implemented the bailout (and added a stimulus package on top of it).

The banks got a massive bailout of untold trillions, and they were simultaneously consolidating the industry and merging with one another. In 2008, with the collapse of Bear Stearns, JP Morgan Chase bought the failed bank with funds in an agreement organized by the Federal Reserve Bank of New York, whose President at the time was Timothy Geithner (who would go on to become Obama’s Treasury Secretary, managing the major bailout program). As JPMorganChase was the ultimate benefactor of the Bear Stearns purchase by the NYFed, it is perhaps no small coincidence that Jamie Dimon, CEO of JPMorganChase, was on the board of the New York Fed, a privately-owned bank, of which JPMorganChase is itself a major shareholder. JPMorganChase later absorbed Washington Mutual, one of the nation’s largest banks prior to the crisis; Bank of America bought Merrill Lynch; Wells Fargo bought Wachovia; and a host of other mergers and acquisitions took place. Thus, the “too big to fail” banks became much bigger and more dangerous than ever before.

Among the many recipients of bailout funds (officially referred to as the Troubled Asset Relief Program – TARP), were Fannie Mae, AIG (insurance), Freddie Mac, General Motors, Bank of America, Citigroup, JPMorgan Chase, Wells Fargo, Goldman Sachs, Morgan Stanley, and hundreds of others.[29] As the Federal Reserve dished out trillions of dollars in bailouts to banks, many European banks even became recipients of American taxpayer-funded bailouts, including Barclays, UBS, the Royal Bank of Scotland, and Société Générale, among many others.[30] The Federal Reserve bailout of American insurance giant AIG was actually a stealth bailout of foreign banks, as the money went through AIG to the major European banks that had significant risks with AIG, including Société Générale of France, UBS of Belgium, Barclays of the U.K., and Deutsche Bank of Germany.[31] In total, the multi-billion dollar bailout of AIG in 2008 benefited roughly 87 banks and financial institutions, 43 of which were foreign, primarily located in France and Germany, but also in the U.K., Canada, the Netherlands, Denmark, and Switzerland, and on the domestic side much of the funds went to Goldman Sachs, JPMorgan Chase, and Bank of America.[32]

Neil Barofsky, who was until recently, the special inspector general for the TARP bailout program – the individual responsible for attempting to engage in oversight of a secret bailout program – wrote an article for the New York Times upon his resignation from the position in March of 2011, in which he stated that he “strongly disagrees” that the program was successful, saying that:

billions of dollars in taxpayer money allowed institutions that were on the brink of collapse not only to survive but even to flourish. These banks now enjoy record profits and the seemingly permanent competitive advantage that accompanies being deemed “too big to fail.”[33]

In June of 2009, as governments around the world were implementing stimulus packages and bailouts to save the banks and ‘rescue’ their economies, the Bank for International Settlements (BIS) issued a new round of warnings about the state of the global economy. Among them, the BIS warned that, “governments and central banks must not let up in their efforts to revive the global banking system, even if public opinion turns against them,” and that the BIS felt that there had only been “limited progress” in reviving the banking system. The BIS continued:

Instead of implementing policies designed to clean up banks’ balance sheets, some rescue plans have pushed banks to maintain their lending practices of the past, or even increase domestic credit where it’s not warranted… The lack of progress threatens to prolong the crisis and delay the recovery because a dysfunctional financial system reduces the ability of monetary and fiscal actions to stimulate the economy… without a solid banking system underpinning financial markets, stimulus measures won’t be able to gain traction, and may only lead to a temporary pickup in growth.[34]

Further, the BIS warned, “A fleeting recovery could well make matters worse,” as “further government support for banks is absolutely necessary, but will become unpopular if the public sees a recovery in hand. And authorities may get distracted with sustaining credit, asset prices and demand rather than focusing on fixing bank balance sheets.” The BIS concluded that all the various measures to revive the global economy leave an “open question” as to whether or not they will be successful, and specifically, “as governments bulk up their deficits to spend their way out of the crisis, they need to be careful that their lack of restraint doesn’t come back to bite them.” As the annual report warned, “Getting public finances in order will therefore be the main task of policy makers for years to come.”[35]

The BIS further warned that, “there’s a risk central banks will raise interest rates and withdraw emergency liquidity too late, triggering inflation,” as history shows policy-makers “have a tendency to be late, tightening financial conditions slowly for fear of doing it prematurely or too severely.” As Bloomberg reported:

Central banks around the globe have lowered borrowing costs to record lows and injected billions of dollars into the financial system to counter the worst recession since World War II. While some policy makers have stressed the need to withdraw the emergency measures as soon as the economy improves, the Federal Reserve, Bank of England, and European Central Bank are still in the process of implementing asset-purchase programs designed to unblock credit markets and revive growth.

“The big and justifiable worry is that, before it can be reversed, the dramatic easing in monetary policy will translate into growth in the broader monetary and credit aggregates,” the BIS said. That will “lead to inflation that feeds inflation expectations or it may fuel yet another asset-price bubble, sowing the seeds of the next financial boom-bust cycle.”[36]

The BIS report stated that the unprecedented policies of central banks “may be insufficient to put the economy on the path to recovery,” stressing that there was a “significant risk” that the monetary and fiscal stimulus of governments will only lead to “a temporary pickup in growth, followed by a protracted stagnation.”[37]

William White, the former Chief Economist of the BIS, warned in September of 2009 that, “the world has not tackled the problems at the heart of the economic downturn and is likely to slip back into recession,” and he “also warned that government actions to help the economy in the short run may be sowing the seeds for future crises.” White, who accurately predicted the global financial crisis in 2008, stated that we are “almost certainly” going into a double-dip recession and “would not be in the slightest bit surprised” if we were to go into a protracted stagnation. He added: “The only thing that would really surprise me is a rapid and sustainable recovery from the position we’re in.” White, a Canadian economist who ran the economic department at the BIS from 1995 until 2008, had “warned of dangerous imbalances in the global financial system as far back as 2003 and – breaking a great taboo in central banking circles at the time – he dared to challenge Alan Greenspan, then chairman of the Federal Reserve, over his policy of persistent cheap money.” As the Financial Times reported in 2009:

Worldwide, central banks have pumped thousands of billions [i.e., trillions] of dollars of new money into the financial system over the past two years in an effort to prevent a depression. Meanwhile, governments have gone to similar extremes, taking on vast sums of debt to prop up industries from banking to car making.

These measures may already be inflating a bubble in asset prices, from equities to commodities, [White] said, and there was a small risk that inflation would get out of control over the medium term if central banks miss-time their “exist strategies”.

Meanwhile, the underlying problems in the global economy, such as unsustainable trade imbalances between the US, Europe and Asia, had not been resolved, he said.[38]

William White further warned that, “we now have a set of banks that are even bigger – and more dangerous – than ever before.” Simon Johnson, former Chief Economist of the IMF, also warned that the finance industry had effectively captured the US government and that “recovery will fail unless we break the financial oligarchy that is blocking essential reform.”[39]

In 2009, the BIS warned that the market for derivatives still poses “major systemic risks” to the financial system, standing at a total value of $426 trillion (more than the worth of the entire global economy combined) and that, “the use of derivatives by hedge funds and the like can create large, hidden exposures.”[40] In 2010, one independent observer estimated the derivatives market was at roughly $700 trillion.[41] The Bank for International Settlements estimated the market value at $600 trillion in December 2010.[42] In June of 2011, the BIS warned that, “the world’s top 14 derivatives dealers may need extra cash to handle a surge in transaction clearing, especially in choppy markets,” as “world leaders have agreed that chunks of the $600 trillion off-exchange derivatives market must be standardized and cleared by the end of 2012 to broaden transparency and curb risk.” The major institutions that the BIS identified as in need of more funds to handle their derivatives exposure are Bank of America-Merrill Lynch, Barclays Capital, BNP Paribas, Citi, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, JP Morgan Chase, Morgan Stanley, RBS, Société Générale, UBS, and Wells Fargo Bank.[43]

In January of 2011, Barofsky, while still Special Inspector General of the TARP bailout program, issued a report which warned that future bailouts of major banks could be “a necessity,” and that, “the government still had not developed objective criteria to measure the amount of systemic risk posed by giant financial companies.”[44] In an interview with NPR, Barofsky stated:

The problem is that the notion of too big to fail – these large financial institutions that were just too big to allow them to go under – since the 2008 bailouts, they’ve only gotten bigger and bigger, more concentrated, larger in size. And what’s really discouraging is that if you look at how the market treats them, it treats them as if they’re going to get a government bailout, which destroys market discipline and really puts us in a very dangerous place.[45]

In June of 2011, Barofsky stated in an interview with Dan Rather that the next crisis may cost $5 trillion, and told Rather, “You should be scared, I’m scared,” and that a coming crisis is inevitable.[46]

Even though the bailouts have already cost the U.S. taxpayers several trillion dollars (which they will pay for through the decimation of their living standards), the IMF in October of 2010 warned that within the coming 24 months (up to Fall 2012), global banks face a $4 trillion refinancing crisis, and that, “governments will have to inject fresh equity into banks – particularly in Spain, Germany and the US – as well as prop up their funding structures by extending emergency support.” The IMF Global Financial Stability Report stated that, “the global financial system is still in a period of significant uncertainty and remains the Achilles’ heel of the economic recovery.” This is especially significant considering that the debts that banks needed to write off between 2007 and 2010 sat at $2.2 trillion, and that benchmark hadn’t even been achieved. Thus, with nearly double that amount needing to be written off in an even shorter time span, it would seem inevitable that the banks will need a massive bailout as “nearly $4 trillion of bank debt will need to be rolled over in the next 24 months.” Further, warned the IMF, “Planned exit strategies from unconventional monetary and financial support may need to be delayed until the situation is more robust, especially in Europe… With the situation still fragile, some of the public support that has been given to banks in recent years will have to be continued.”[47]

In other words, “exit strategies,” meaning harsh draconian austerity measures may need to be delayed in order to give enough time to undertake bailouts of major banks. After all, engineering trillion dollar bailouts of large financial institutions which created a massive global crisis is hard to do at the same time as punishing an entire population through destruction of their living standards and general impoverishment in order to pay off the debt already incurred by governments (which through bailouts essentially ‘buy’ the bad debts of the banks, and hand the taxpayers the bill).

So while many say that the banks need another bailout, one must question whether the first bailout was necessary, as it simply allowed the banks to get bigger, take more risks, and essentially get a government guarantee of future bailouts (not to mention, the massive fraud and illegalities that took place through the bailout mechanism). However, several top economists and financial experts have pointed out that the “too big to fail” banks are actually the largest threat to the economy, and that they are more accurately “too big to exist,” explaining that recovery cannot take place unless they are broken up. Nobel Prize winning economist and former Chief Economist of the World Bank, Joseph Stiglitz, along with former Chief Economist of the IMF, Simon Johnson, both warned Congress that propping up the banks is preventing recovery from taking place. Even the President of the Federal Reserve Bank of Kansas stated that, “policymakers must allow troubled firms to fail rather than propping them up.”[48]

The true aim of the bailouts was to prevent the major banks of the world (all of which are insolvent – unable to pay debts) from collapsing under the weight of their own hubris, and to effectively employ the largest transfer of wealth in human history from major nations (taxpayers) to the bankers and their shareholders. The true cost of the bailouts, a far cry from the IMF’s statement of a couple trillion dollars, was in the tens of trillions. The Federal Reserve itself bailed out the financial industry for over $9 trillion, with $2 trillion going to Merrill-Lynch (which was subsequently acquired by Bank of America), $2 trillion going to Morgan Stanley, $2 trillion going to Citigroup, and less than $1 trillion each for Bear Stearns (which was acquired by JPMorgan Chase), Bank of America, and Goldman Sachs. These details were released by the Federal Reserve and cover 21,000 separate transactions between December 2007 and July of 2010.[49]

The Federal Reserve also undertook a massive bailout of foreign central banks. During the financial crisis, the Fed established a lending program of shipping US dollars overseas through the European Central Bank, the Bank of England, and the Swiss National Bank (among others), and “the central banks, in turn, lent the dollars out to banks in their home countries in need of dollar funding.”[50] The overall bailouts, including those not undertaken by the Fed specifically, but government-implemented, reach roughly $19 trillion, with $17.5 trillion of that going to Wall Street.[51] No surprise there, considering that Neil Barofsky had warned in July of 2009 that the bailout could cost taxpayers as much as $23.7 trillion dollars.[52]

The Federal Reserve Represents the Banks

In February of 2010, the Federal Reserve announced that it would be investigating the role of U.S. banks in Greece’s debt crisis.[53] However, the Washington Post article which reported on the Fed’s ‘investigation’ failed to mention the ‘slight’ conflicts of interest, which essentially have the fox guarding the hen house. What am I referring to? The Federal Reserve System is a quasi-governmental entity, with a national Board of Governors based in Washington, D.C., with the Chairman appointed by the President. Alan Greenspan, one of the longest-serving Federal Reserve Chairmen in its history, was asked in a 2007 interview, “What is the proper relationship – what should be the proper relationship between a Chairman of the Fed and the President of the United States?” Greenspan replied:

Well, first of all, the Federal Reserve is an independent agency, and that means basically that there is no other agency of government which can over-rule actions that we take. So long as that is in place and there is no evidence that the administration, or the Congress, or anybody else is requesting that we do things other than what we think is the appropriate thing, then what the relationships are don’t frankly matter.[54]

Not only is the Federal Reserve unaccountable to the American government, and thereby, the American people, but it is directly accountable to and in fact, owned by the major American and global banks. Thus, the notion that it would ‘investigate’ the illicit activities of banks like Goldman Sachs and J.P. Morgan Chase is laughable at best, and is more likely to resemble a criminal cover-up as opposed to an ‘independent investigation.’

The Federal Reserve System is made up of 12 regional Federal Reserve banks, which are themselves private banks, owned by shareholders, which are made up of the principle banks in their region, who ‘select’ a president to represent them and their interests. The most powerful of these banks, unsurprisingly, is the Federal Reserve Bank of New York, which represents the powerful banks of Wall Street. The current Treasury Secretary, Timothy Geithner, was previously President of the Federal Reserve Bank of New York, where he organized the specific bailouts of AIG and JP Morgan’s purchase of Bear Stearns. The current president of the New York Fed is William Dudley, who previously was a partner and managing director at Goldman Sachs, and is also currently a member of the board if directors of the Bank for International Settlements (BIS). The current chairman of the board of the New York Fed is Lee Bollinger, President of Columbia University, who is also on the board of directors of the Washington Post Company. Until recently, Jeffrey R. Immelt was on the board of directors of the New York Fed, while serving as CEO of General Electric. However, he was more recently appointed by President Obama to head his Economic Recovery Advisory Board, replacing former Federal Reserve Chairman Paul Volcker. Another current member of the board of directors of the New York Fed include Jamie Dimon, Chairman and CEO of JP Morgan Chase.

Not only are the major banks represented at the Fed, but so too are the major corporations, as evidenced by the recent board membership of the CEO of General Electric (which incidentally received significant funds from the bailouts organized by the Fed). However, the Fed also has a number of advisory groups, such as the Community Affairs Advisory Council, which was formed in 2009 and, according to the New York Fed’s website, “meets three times a year at the New York Fed to share ground-level intelligence on conditions in low- and moderate-income (LMI) communities.” The members include individuals from senior positions at Bank of America and Goldman Sachs.[55]

The Economic Advisory Panel is “a group of distinguished economists from academia and the private sector [who] meet twice a year with the New York Fed president to discuss the current state of the economy and to present their views on monetary policy.” Among the institutions represented through individual membership are: Harvard University, Morgan Stanley, Deutsche Bank, Columbia University, American International group (AIG), New York University, Carnegie Mellon University, University of Chicago, and the Peter G. Peterson Institute for International Economics.[56]

Perhaps one of the most important advisory groups is the International Advisory Committee, “established in 1987 under the sponsorship of the Federal Reserve Bank of New York to review and discuss major issues of public policy concern with respect to principal national and international capital markets.” The members include: Lloyd C. Blankfein, Chairman and CEO of Goldman Sachs; William J. Brodsky, Chairman and CEO of the Chicago Board Options Exchange (derivatives); Stephen K. Green, Chairman of HSBC; Marie-Josée Kravis, Senior Fellow and Member of the Board of Trustees of the Hudson Institute (and longtime Bilderberg member); Sallie L. Krawcheck, President of Global Wealth and Investment Management at Bank of America; Michel J.D. Pebereau, Chairman of the Board of BNP Paribas; and Kurt F. Viermetz, retired Vice Chairman of J.P. Morgan.[57]

Another group, the Fedwire Securities Customer Advisory Group, consists of individuals from senior positions at JP Morgan Chase, Citibank, The Bank of New York Mellon, Fannie Mae, Northern Trust, State Street Bank and Trust Company, Freddie Mac, Federal Home Loan Banks, the Depository Trust & Clearing Corporation, and the Assistant Commissioner of the U.S. Department of the Treasury.[58] It is then made painfully clear whose interests the Federal Reserve – and specifically the Federal Reserve Bank of New York – serve. An article from Bloomberg in January of 2010 analyzed the information that was revealed in a Senate hearing regarding the secret bailout of AIG by the New York Fed, which “described a secretive group deploying billions of dollars to favored banks, operating with little oversight by the public or elected officials.” As the author of the article wrote, “It’s as though the New York Fed was a black-ops outfit for the nation’s central bank.”[59]

Who Benefits from the Greek Bailout?

Greece has a total debt of roughly 330 billion euros (or U.S. $473 billion).[60] In the lead-up to the Greek bailout orchestrated by the IMF and European Union in 2010, the Bank for International Settlements (BIS) released information regarding who exactly was in need of a bailout. With the bailout largely organized by France and Germany (as the dominant EU powers), who would be providing the majority of funds for the bailout itself (subsequently charged to their taxpayers), the BIS revealed that German and French banks carry a combined exposure of $119 billion to Greek borrowers specifically, and more than $900 billion to Greece, Spain, Portugal and Ireland combined. The French and German banks account for roughly half of all European banks’ exposure to those euro-zone countries, meaning that the combined exposure of European banks to those four nations is over $1.8 trillion, nearly half of which is with Spain alone. Thus, in the eyes of the elites and the institutions which serve them (such as the EU and IMF), a bailout is necessary because if Greece were to default on its debt, “investors may question whether French and German banks could withstand the potential losses, sparking a panic that could reverberate throughout the financial system.”[61]

In late February of 2010, Greece replaced the head of the Greek debt management agency with Petros Christodoulou. His job was “to procure favorable loans in the financial markets so that Athens can at least pay off its old debts with new debt.” His career went along an interesting path, to say the least, as he studied finance in Athens and Columbia University in New York, and went on to hold senior executive positions at several financial institutions, such as Credit Suisse, Goldman Sachs, JP Morgan, and just prior to heading the Public Debt Management Agency (PDMA), he was treasurer at the National Bank of Greece.[62] Before his 12-year stint at the National Bank of Greece, the largest commercial bank in Greece, he headed the derivatives desk at JP Morgan.[63]

In March of 2010, Greece passed a draconian austerity package in order to qualify for a bailout from the IMF and EU, as they had demanded. In April, Greece officially applied for an emergency loan, and in May of 2010, the EU and the IMF agreed to a $146 billion loan after Greece unveiled a new round of austerity measures (spending cuts and tax hikes). While Greece had already imposed austerity measures in March to even be considered for receivership of a loan, the EU and IMF demanded that they impose new and harsher austerity measures as a condition of the loan (just as the IMF and World Bank forced the ‘Third World’ nations to impose ‘Structural Adjustment Programs’ as a condition of loans). As the Los Angeles Times wrote at the time:

In Greece, workers have been mounting furious protests against the prospect of drastic government cuts. Officials are bracing for a general strike Wednesday over the new austerity plan, which includes higher fuel, tobacco, alcohol and sales taxes, cuts in military spending and the elimination of two months’ annual bonus pay for civil servants. Axing the bonus is a particularly fraught move in a country where as many as one in four workers is employed by the state.[64]

The EU was set to provide 80 billion euros of the 110 billion euro total, and the IMF was to provide the remaining 30 billion euros.[65] Greece was broke, credit ratings agencies (CRAs) were downgrading Greece’s credit worthiness (making it harder and more expensive for Greece to borrow), banks were speculating against Greece’s ability to repay its debt in the derivatives market, and the EU and IMF were forcing the country to increase taxes and cut spending, impoverishing and punishing its population for the bad debts of bankers and politicians. However, in one area, spending continued.

While France and Germany were urging Greece to cut its spending on social services and public sector employees (who account for 25% of the workforce), they were bullying Greece behind the scenes to confirm billions of euros in arms deals from France and Germany, including submarines, a fleet of warships, helicopters and war planes. One Euro-MP alleged that Angela Merkel and Nicolas Sarkozy blackmailed the Greek Prime Minister by making the Franco-German contributions to the bailout dependent upon the arms deals going through, which was signed by the previous Greek Prime Minister. Sarkozy apparently told the Greek Prime Minister Papandreou, “We’re going to raise the money to help you, but you are going to have to continue to pay the arms contracts that we have with you.” The arms deals run into the billions, with 2.5 billion euros simply for French frigates.[66] Greece is in fact the largest purchaser of arms (as a percentage of GDP) in the European Union, and was planning to make more purchases:

Greece has said it needs 40 fighter jets, and both Germany and France are vying for the contract: Germany wants Greece to buy Eurofighter planes — made by a consortium of German, Italian, Spanish and British companies — while France is eager to sell Athens its Rafale fighter aircraft, produced by Dassault.

Germany is Greece’s largest supplier of arms, according to a report published by the Stockholm International Peace Research Institute in March, with Athens receiving 35 percent of the weapons it bought last year from there. Germany sent 13 percent of its arms exports to Greece, making Greece the second largest recipient behind Turkey, SIPRI said.[67]

Thus, France and Germany insist upon French and German arms manufacturers making money at the expense of the standard of living of the Greek people. Financially extorting Greece to purchase weapons and military equipment while demanding the country make spending cuts in all other areas (while increasing the taxes on the population) reveals the true hypocrisy of the whole endeavour, and the nature of who is really being ‘bailed out.’

As Greece was risking default in April of 2010, the derivatives market saw a surge in the trading of Credit Default Swaps (CDS) on Greece, Portugal, and Spain, which increased the expectations of a default, and acts as a self-fulfilling prophecy in making the debt more severe and access to funding more difficult.[68] Thus, the very banks that are owed the debt payments by Greece bet against Greece’s ability to repay its debt (to them), and thus make it more difficult and urgent for Greece to receive funds. In late April of 2010, Standard & Poor’s (a major credit ratings agency – CRA) downgraded Greece’s credit rating to “junk status,” and cut the rating of Portugal as well, plunging both those nations into deeper crisis.[69] Thus, just at a time when the countries were in greater need of funds than before, the credit ratings agencies made it harder for them to borrow by making them less attractive to lenders and investors. Investors wait for the ratings given by CRAs before they make investment decisions or provide credit, and thus they “wield enormous clout in the financial markets.” There are only three major CRAs, Standard & Poor’s (S&P), Moody’s, and Fitch. In relation to the S&P downgrading on Greece’s rating, the Guardian reported:

S&P has effectively said it views Greece as a much riskier place to invest, which increases the interest rate investors will charge the Greek government to borrow money on the open market. But S&P is also implying that the risk of Greece defaulting on its loans has increased, a frightening prospect for bondholders and European politicians.[70]

CRAs also have major conflicts of interest, since they are companies in their own right, and receive funding and share leadership with individuals and corporations who they are responsible for applying credit-worthiness to. For example, Standard and Poor’s leadership includes individuals who have previously worked for JP Morgan, Morgan Stanley, Deutsche Bank, the Bank of New York, and a host of other corporations.[71] Further, S&P is owned by The McGraw-Hill Companies. The executives of McGraw-Hill include individuals past or presently associated with: PepsiCo, General Electric, McKinsey & Co., among others.[72] The Board of Directors includes: Pedro Aspe, Co-Chairman of Evercore Partners, former Mexican Finance Minister and director of the Carnegie Corporation; Sir Winfried Bischoff, the Chairman of Lloyds Banking Group, former Chairman of Citigroup, former Chairman of Schroders; Douglas N. Daft, former Chairman and CEO of the Coca-Cola Company, a director of Wal-Mart, and is also a member of the European Advisory Council for N.M. Rothschild & Sons Limited; William D. Green, Chairman of Accenture; Hilda Ochoa-Brillembourg, President and Chief Executive Officer of Strategic Investment Group, formerly at the World Bank, a director of General Mills and the Atlantic Council, and is an Advisory Board member of the Rockefeller Center for Latin American Studies at Harvard University; Sir Michael Rake, Chairman of British Telecom, and is on the board of Barclays; Edward B. Rust, Jr., Chairman and CEO of State Farm Insurance Companies; among many others.[73]

Moody’s is another of the major Credit Ratings Agencies. Its board of directors includes individuals past or presently affiliated with: Citigroup, the Federal Reserve Bank of Dallas, the Federal Reserve Bank of New York, Barclays, Freddie Mac, ING Group, the Dutch National Bank, and Pfizer, among many others.[74] The Executive team at Moody’s includes individuals past or presently affiliated with: Citigroup, Bank of America, Dow Jones & Company, U.S. Trust Company, Bankers Trust Company, American Express, and Lehman Brothers, among many others.[75]

Fitch Ratings, the last of the big three CRAs, is owned by the Fitch Group, which is itself a subsidiary of a French company, Fimalac. The Chairman and CEO is Marc Ladreit de Lacharrière, who is a member of the Consultative Committee of the Bank of France, and is also on the boards of Renault, L’Oréal, Groupe Casino, Gilbert Coullier Productions, Cassina, and Canal Plus. The board of directors includes Véronique Morali, who is also a member of the board of Coca-Cola, and is a member of the management board of La Compagnie Financière Edmond de Rothschild, a private bank belonging to the Rothschild family. The board includes individuals past or presently affiliated with: Barclays, Lazard Frères & Co, JP Morgan, Bank of France, and HSBC, among many others.[76]

So clearly, with the immense number of bankers present on the boards of the CRAs, they know whose interest they serve. The fact that they are responsible not only for rating banks and other corporations (of which the conflict of interest is obvious), but that they rate the credit-worthiness of nations is also evident of a conflict, as these are nations who owe the banks large sums of money. Thus, lowering their ratings makes them more desperate for loans (and makes the loans more expensive), since the nation is a less attractive investment, loans will be given with higher interest rates, which means more future revenues for the banks and other lenders. As the credit ratings are downgraded, the urgency to pay interest on debt is more severe, as the nation risks losing more investments and capital when it needs it most. To get a better credit rating, it must pay its debt obligations to the foreign banks. Thus, through Credit Ratings Agencies, the banks are able to help strengthen a system of financial extortion, made all the more severe through the use of derivatives speculation which often follows (or even precedes) the downgraded ratings.

So while Greece received the bailout in order to pay interest to the banks (primarily French and German) which own the Greek debt, the country simply took on more debt (in the form of the bailout loan) for which they will have to pay future interest fees. Of course, this would also imply future bailouts and thus, continued and expanded austerity measures. This is not simply a Greek crisis, this is indeed a European and in fact, a global debt crisis in the making.

The Great Global Debt Depression

In March of 2010, prior to Greece receiving its first bailout, the Bank for International Settlements (BIS) warned that, “sovereign debt is already starting to cross the danger threshold in the United States, Japan, Britain, and most of Western Europe, threatening to set off a bond crisis at the heart of the global economy.” In a special report on ‘sovereign debt’ written by the new chief economist of the BIS, Stephen Cecchetti, the BIS warned that, “The aftermath of the financial crisis is poised to bring a simmering fiscal problem in industrial economies to the boiling point,” and further: “Drastic austerity measures will be needed to head off a compound interest spiral, if it is not already too late for some.” In reference to the way in which Credit Ratings Agencies and banks have turned against Greece in ‘the market’, the report warned:

The question is when markets will start putting pressure on governments, not if. When will investors start demanding a much higher compensation [interest rate] for holding increasingly large amounts of public debt? In some countries, unstable debt dynamics — in which higher debt levels lead to higher interest rates, which then lead to even higher debt levels — are already clearly on the horizon.[77]

Further, the report stated that official debt figures in Western nations are incredibly misleading, as they fail to take into account future liabilities largely arising from increased pensions and health care costs, as “rapidly ageing populations present a number of countries with the prospect of enormous future costs that are not wholly recognised in current budget projections. The size of these future obligations is anybody’s guess.”[78]

In all the countries surveyed, the debt levels were assessed as a percentage of GDP. For example, Greece, which was at the time of the report’s publication, at risk of a default on its debt, had government debt at 123% of GDP. In contrast, other nations which currently are doing better (or seemingly so), in terms of market treatment, had much higher debt levels in 2010: Italy had a government debt of 127% of GDP and Japan had a monumental debt of 197% of GDP. Meanwhile, for all the lecturing France and Germany have done to Greece over its debt problem, France had a debt level of 92% of its GDP, and Germany at 82%, with the levels expected to rise to 99% and 85% in 2011, respectively. The U.K. had a debt level of 83% in 2010, expected to rise to 94% in 2011; and the United States had a debt level of 92% in 2010, expected to rise to 100% in 2011. Other nations included in the tally were: Austria with 78% in 2010, 82% in 2011; Ireland at 81% in 2010 and 93% in 2011; the Netherlands at 77% in 2010 and 82% in 2011; Portugal at 91% in 2010 and 97% in 2011; and Spain at 68% in 2010 and 74% in 2011.[79]

Further, the BIS paper warned that debt levels are likely to continue to dramatically increase, as, “in many countries, employment and growth are unlikely to return to their pre-crisis levels in the foreseeable future. As a result, unemployment and other benefits will need to be paid for several years, and high levels of public investment might also have to be maintained.”[80] The report goes on:

Seeing that the status quo is untenable, countries are embarking on fiscal consolidation plans [austerity measures]. In the United States, the aim is to bring the total federal budget deficit down from 11% to 4% of GDP by 2015. In the United Kingdom, the consolidation plan envisages reducing budget deficits by 1.3 percentage points of GDP each year from 2010 to 2013.[81]

However, the paper went on, the austerity measures and “consolidations along the lines currently being discussed will not be sufficient to ensure that debt levels remain within reasonable bounds over the next several decades.” Thus, the BIS suggested that, “An alternative to traditional spending cuts and revenue increases is to change the promises that are as yet unmet. Here, that means embarking on the politically treacherous task of cutting future age-related liabilities.”[82] In short, the BIS was recommending to end pensions and other forms of social services significantly or altogether; hence, referring to the task as “politically treacherous.” The BIS recommended “an aggressive adjustment path” in order to “bring debt levels down to their 2007 levels.”[83] The challenges for central banks, the BIS warned, was that it could spur long-term increases in inflation expectations, and that the uncertainty of “fiscal consolidation” (see: fiscal austerity measures) make it difficult to determine when to raise interest rates appropriately. Inflation acts as a ‘hidden tax’, forcing people to pay more for less, particularly in the costs of food and fuel. Raising interest rates at such a time “would not work, as an increase in interest rates would lead to higher interest payments on public debt, leading to higher debt,” and thus, potentially higher inflation.[84]

In April of 2010, the OECD (Organisation for Economic Co-operation and Development) warned that the Greek crisis was spreading “like Ebola,” and that the crisis was “threatening the stability of the financial system.”[85] In early 2010, the World Economic Forum (WEF) warned that there was a “significant chance” of a second major financial crisis, “and similar odds of a full-scale sovereign fiscal crisis.” The report identified the U.K. and U.S. as having “among the highest debt burdens.”[86]

Nouriel Roubini, a top American economist who accurately predicted the financial crisis of 2008, wrote in 2010 that, “unless advanced economies begin to put their fiscal houses in order, investors and rating agencies will likely turn from friends to foes.” Due to the financial crisis, the stimulus spending, and the massive bailouts to the financial sector, major economies had taken on massive debt burdens, and, warned Roubini, faced a major sovereign debt crisis, not relegated to the euro-zone periphery of Greece, Portugal, Spain, and Ireland, but even the core countries of France and Germany, and all the way to Japan and the United States, and that the “U.S. and Japan might be among the last to face investor aversion.” Thus, concluded Roubini, developed nations “will therefore need to begin fiscal consolidation as soon as 2011-12 by generating primary surpluses, which can be accomplished through a combination of gradual tax hikes and spending cuts.”[87]

In February of 2010, Niall Ferguson, economic historian, Bilderberg member, and official biographer of the Rothschild family, wrote an article for the Financial Times in which he warned that a “Greek crisis” was “coming to America.” Ferguson wrote that far from remaining in the peripheral eurozone nations, the current crisis “is a fiscal crisis of the western world. Its ramifications are far more profound than most investors currently appreciate.” Ferguson wrote that the crisis will spread throughout the world, and that the notion of the U.S. as a “safe haven” for investors is a fantasy, even though the “day of reckoning” is still far away.[88]

In December of 2010, Citigroup’s chief economist warned that, “We could have several sovereign states and banks going under,” and that both Portugal and Spain will need bailouts.[89] In late 2010, Mark Schofield, head of interest rate strategy at Citigroup, “said that a debt overhaul with similarities to the ‘Brady Bond’ solution to the 1980s crisis in Latin America was being extensively discussed in the markets.”[90] This would of course imply a similar response to that which took place during the 1980s debt crisis, in which Western nations and institutions reorganized the debts of ‘Third World’ nations that defaulted on their massive debts, and thus they were economically enslaved to the Western world thereafter.

In January of 2011, the IMF instructed major economies around the world, including Brazil, Japan, and the United States, “to implement deficit cutting plans or risk a repeat of the sovereign debt crisis that has engulfed Greece and Ireland.” At the same time, the Credit Ratings Agency Standard and Poor’s cut Japan’s long-term sovereign debt rating for the first time since 2002. As the Guardian reported:

The IMF said Japan, America, Brazil and many other indebted countries should agree targets for bringing borrowing under control. In an updated analysis on global debt and deficits, it said the pace of deficit reduction across the advanced economies was likely to slow this year, mainly because the US and Japan are preparing to increase their borrowing.[91]