Stock Market Tremors and the Financial Bubble Economy. The Failures of Monetary Policy

All three major US stock indexes fell Friday, capping the largest weekly decline in US stock markets in nearly two months. The catalyst for Friday’s sell-off was a very weak series of sales figures and projections from three corporations tied to consumer spending: Amazon, the largest online retailer; Wal-Mart, the largest brick-and-mortar retailer; and Visa, the credit and debit card transaction company.

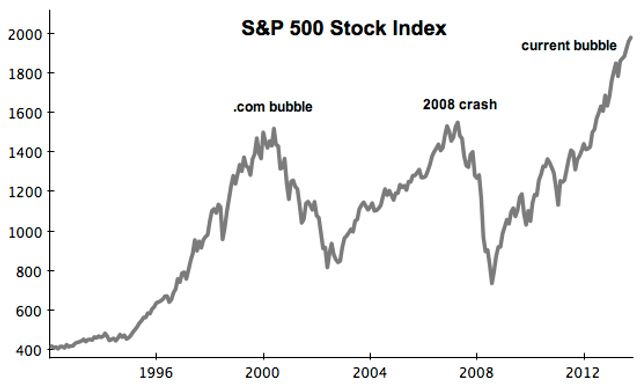

More broadly, the stock market tremors reflect growing concern within the ruling class that share values, which have doubled, and in some cases tripled, since their 2009 lows, are on the verge of another historic collapse.

The open secret of the US economy is that the extraordinary rise in the stock markets is entirely disconnected from the process of production. While the economic growth was only 1.8 percent last year, below the average of the previous three years, the S&P 500 stock shot up more than 20 percent. In the first quarter of this year, as the economy contracted at a rate of nearly three percent, all three US stock indexes continued to rise.

The stock market rally is based on two interconnected elements: the systematic transfer of wealth from the working class to the financial elite, and the provision of an essentially unlimited flow of cash into the financial system by the Federal Reserve.

The stock market bubble has facilitated mergers and acquisitions designed to inflate corporate stock prices by mass layoffs and cost cutting, further choking off economic growth. Such mergers and acquisitions are up by some 50 percent over the past year. A case in point was Microsoft’s announcement this month of 18,000 worldwide layoffs in the aftermath of its $7 billion acquisition of Nokia’s mobile division.

Corporate profits as a share of US GDP were higher last year than any year on records going back to the late 1940s. A measure of the speculative fever that has once again gripped corporate America: companies are using these profits not for investment, but rather to swell executive pay, raise dividends, and buy back their own stocks. Stock buybacks reached their second-highest level on record in the first quarter of this year, behind only the second quarter of 2007, just before the financial meltdown.

The fact that the stock market rally is clearly unstable has generated murmurs of concern from some quarters. Earlier this month, Fitch Ratings Agency warned of an “increasing anxiety among investors that valuations reflect too much money chasing too few income-producing assets.” The rating agency added, “Investors feel they have little choice but to invest in whatever comes to market, despite the continuing fall in yields and coupons.”

One commentator warned this month in the New York Times of an “Everything Bubble” in which “there are very few unambiguously cheap assets.” These warnings echoed concerns raised by the Bank of International Settlements, which concluded late last month that “it is hard to avoid the sense of a puzzling disconnect between the markets’ buoyancy and underlying economic developments.”

The most categorical warning comes from John P. Hussman, a former University of Michigan professor and current investment fund manager who published a memo this week entitled, “Yes, This Is An Equity Bubble.” He concluded, “Make no mistake – this is an equity bubble, and a highly advanced one. On the most historically reliable measures, it is easily beyond 1972 and 1987, beyond 1929 and 2007, and is now within about 15% of the 2000 extreme.” He concludes, “The Federal Reserve can certainly postpone the collapse of this bubble, but only by making the eventual outcome that much worse.”

Soaring corporate profits and stock values have accompanied an enormous decline in social conditions for the vast majority of the US population. According to one recent study, the inflation-adjusted net worth of a typical US household has declined by 36 percent between 2003 and 2014. Median household income in the US plummeted by 8.3 percent between 2007 and 2012, and the number of people using food stamps has increased by 70 percent since 2008.

The enormous social retrogression of American society is summed up in one statistic: one in four children in the United States live below the official poverty line, while one in five are at risk of going hungry.

The 2008 collapse nearly brought down the entire world financial system and sparked a global recession, with no recovery. The Fed has lowered interest rates to essentially zero, where they have stayed for nearly six years, allowing banks access to cash for free. Through a variety of asset purchasing programs, the Fed has tripled the size of its balance sheet since 2008. This policy has been mimicked internationally, coupled with ever more brutal austerity measures directed at the working class.

This game cannot go on forever. Ultimately, the valuations of financial assets must come crashing down. The consequences of the coming crash will be even more dramatic than those of the 2008 financial meltdown.

The US ruling elite has reached a historical dead end. It staggers from crisis to crisis, trying to put out fires with gasoline. This pragmatic, shortsighted and parasitic approach to the crisis of the US economy is expressive of the basic physiognomy of the financial elite. This is a social layer that has amassed its wealth not through productive activity, but through the looting of society: raiding pension funds, slashing wages, shutting down industrial facilities and laying off workers.

This internal socioeconomic crisis of American capitalism is a significant factor in US foreign policy, the extraordinary recklessness with which the ruling class and its representatives in the political and media establishment stoke conflict all over the world.

Facing an economic and political disaster at home, the US ruling elite seeks through war a desperate means to shore up its position in the global economy and deflect social anger at home into wars and interventions abroad. Each stage of the economic crisis has been accompanied by an every greater paroxysm of imperialist violence.

The policy of the American ruling class is, in a profound sense, insane. However, it is a socially conditioned insanity, an insanity that expresses a bankrupt economic system and a social order on the eve of revolution.