Why Austerity?

We’ve all heard ‘government spending must be cut back to live within our means’.

We’ve heard it for decades; we’ve endured sell offs of national assets and budget cutbacks. But for what purpose? Was it necessary? Is it necessary? And if not necessary, why do governments do it? Politicians say we don’t have the money to do as we once did, but that just doesn’t sound right. How can we not afford some things in this more advanced age that we could afford a generation ago?

I give politicians this much credit; they are correct. We do need more money to pay our interest bill! This is one item that has grown out of control, the amount of money we pay to the banks. As our debt has grown so have our loans. The interest due must come from somewhere. Let’s ask first, why has the debt grown?

This question is covered in some depth in my book An Insiders Memoir, you can read what I wrote here but its essentially what follows.

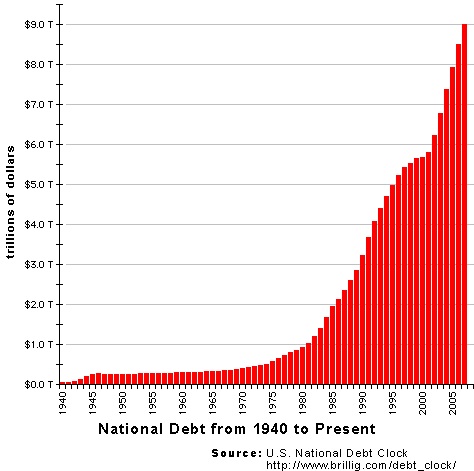

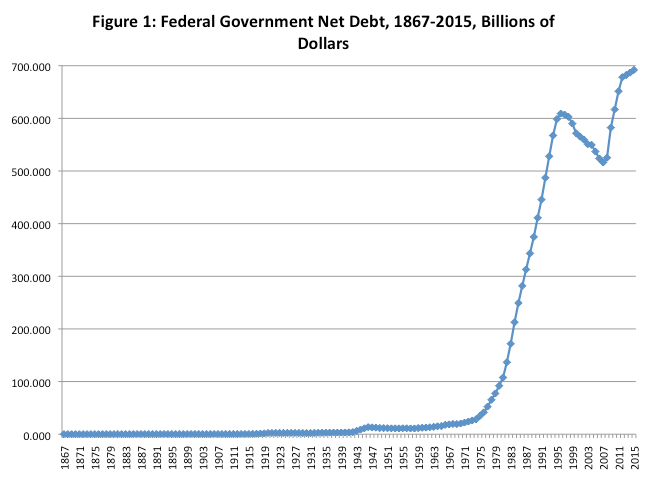

If you look at national debt in the US and Canada from about 1940 through to today, the charts for the two countries are similar; both are shown below, the US above, Canada below. Note that debt is all but flat through the second world war, building the St. Lawrence Seaway, the Korean War, the Vietnam War, and taking man to the moon (1969). Then in the mid seventy’s debt starts to soar, in both countries! What happened?

What happened was that both countries at the same time stopped using their federal bank to finance projects and started borrowing from the private banks. The effect was that now there were interest payments to the banks. Before, if there was interest charged, it came back to the people.

Only one chart is necessary to show what happened, two charts makes it clear that it had to be coordinated. I have tried to find out how that change came about but failed. There is little doubt that it was designed to happen below the radar.

To understand how this came about, we need to go back a few years to the Bretton Woods Agreements which were international monetary agreements agreed to in 1944. Those ended when the United States arbitrarily went off the gold standard in 1971. The Basel Committee on Banking Supervision was established in 1974 and was located within the Bank for International Settlements (the ‘Bankers Bank’) in Basel Switzerland. At essentially the same time Canadian and American federal borrowing practices changed!

Today, when members of government look at their budgets, they see that the government is short of money, but they move into clichés rather than trying to figure out why.

Their clichés may be sincere, but they are more often wrong. For example, they say a nation is like a family. But families don’t pay unemployment insurance in which payments go up as tax income goes down. Nor do families get to print money nor do they need to stimulate the economy. As a consequence of the steadily increasing debt, we have been subject, in election after election, to hand wringing and finger pointing. Lots of anguish and no action – no matter who wins the election. National debt exists and much like John Kenneth Galbraith wrote about Money; debt too is hard to explain as to Whence it came and Where it went.

We can learn about ways to deal with debt by looking at how it was handled differently during the economic collapse of 2008 in Iceland and Greece. 2008 was the major global economic collapse in which north America bailed out the ‘too big to fail’ banks!

All three of Iceland’s commercial banks failed. The country was bankrupt. In the end they rejected IMF proposals, they jailed bankers, sold one of the banks and gave the money to the people. Instead of being defeated by debt, the country has come back and the people were treated fairly.

By contrast, the Greeks suffered, as their ex Minister of Finance explained in the title of his book, And The Poor Must Suffer What They Must. When Greece went broke the International Monetary Fund came in. At first, the Greeks rejected their proposals but, in the end, capitulated. The nation that could not pay for its loans, was lent more money. That is as stupid as it sounds. But the IMF in so doing, kept the banks solvent as they sunk the Greek people deeper into debt. No amount of austerity, and they were forced to swallow lots, ever helped them.

And here in 2018 Ontario elected a conservative government that has been making austerity cutbacks to everything that serves the people; cuts to childcare, education, public health, the environment. The cutbacks are unnecessary and are making the province poorer.

When I started researching my book, finding good material on economics was difficult. Today it’s different. There are dozens of books explaining why austerity was never a good idea and increasingly there are books about the nearing end of capitalism. If you want a reading list, I would be pleased to suggest one. You can click here to request it.

Austerity does not work and has never worked to help the people.

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.