America on the Verge of the Debt Trap

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Click the share button above to email/forward this article to your friends and colleagues. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

The US is balancing on a debt trap.

When debt was low, interest rates didn’t burden the government budget.

When interest rates were low, a high level of debt didn’t burden the government budget either.

Come 2023, not only are both the debt and interest rates high, they are both exploding.

This is the typical situation of the frog sitting drowsily while the water in the pot slowly heats up. At the beginning the frog – the US government of both parties – just felt a nice warmth from their deficits. As the Wall Street Journal reports today 5 October 2023, the debt situation has been moving very unfavorably for the US government over time, but until now, that has happened “below the radar” of both economists, politicians, and even the oligarchs at Wall Street.

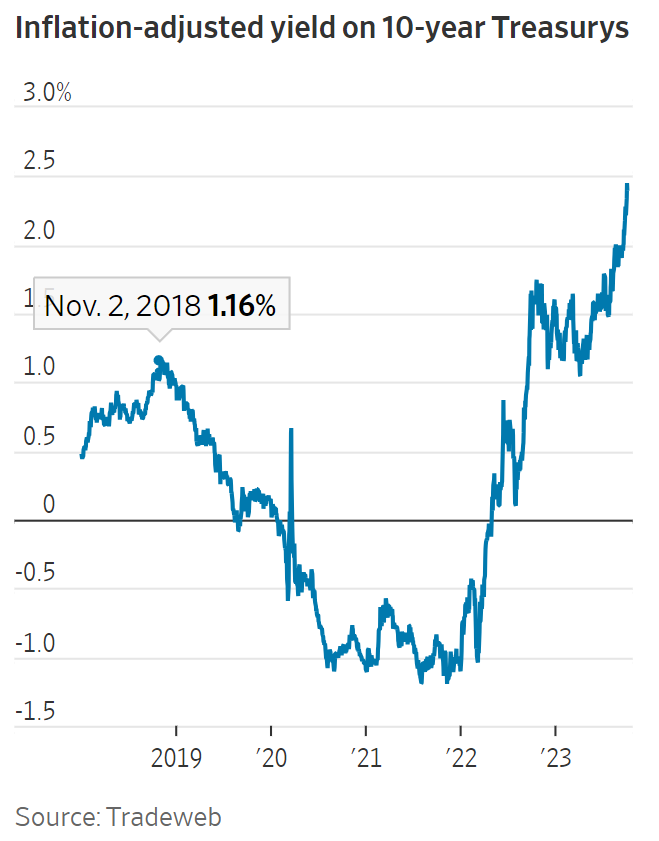

But that is ending now, as at least the oligarchs on Wall Street are starting to wake up and their response is a sharp increase in the rate of interests on US debt, see figure below.

US payments on debt is acutely threatening to snowball out of control.

Higher rates of interest on a big debt means very big payments of interests.

Big payments of interests mean even higher debt, even higher rates of interest, and an accelerating development in the US debt. The US government is on the verge of destroying all foundation for not only its own budgetary existence, but for the whole US capital market, the US financial system, and the US dollar as well.

The resulting crisis can come nearly anytime – it will make the 2009 crisis look like Paradise – and there will be no remedy except pain, pain, pain.

Right now, Rep. Matt Gaetz, Rep. Nancy Mace, et. al. are vilified as they have been prepared to blow up the sleepy US frog by letting the US government come to a complete standstill. Even the Wall Street Journal spends no less than two to three op-eds to attack Matt Gaetz & co.

But debt addiction is not easy to cure – sometimes forcing a cold turkey is needed. So maybe, I just say maybe, it’s time to thank them.

Interesting of all old “villains” is Steve Bannon because he speaks very much for the populist Republicans who just nuked the House of Representatives. Bannon defines himself as a populist, and even in an old and long interview, Bannon accepts populists on the left. Bannon is very eloquent. Bannon in his own web-channel www.warroom.org not only supports Rep. Matt Gaetz and Rep. Nancy Mace, but Bannon also spends a lot of time explaining (I find in a good way) why the debt problem matters, and is acute.

What I want to point out here about Bannon, and I note that Bannon speaks for a lot of Republican populists, is that Bannon acknowledges that budget cuts alone will not be able to rectify the out-of-control US budget deficit. Bannon, an arch Republican, therefore argues, that tax increases are needed. And not only does Bannon argue that tax increases are needed. Bannon also argues to tax the ultra-rich and argues that it is only just and fair to tax them because the ultra-rich US oligarch class has not only helped to create the fiscal malaise, but has profiteered from it all the way.

What we just saw with the ouster of the Speaker of the House is just the beginning of an enormous political and financial battle affecting not only all of the USA, but all of the world.

*

Note to readers: Please click the share button above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Karsten Riise is a Master of Science (Econ) from Copenhagen Business School and has a university degree in Spanish Culture and Languages from Copenhagen University. He is the former Senior Vice President and Chief Financial Officer (CFO) of Mercedes-Benz in Denmark and Sweden.

He is a regular contributor to Global Research.

Featured image source