US Economic Recovery or Misleading Job Payroll Statistics? Something Strange Is Going On With Nonfarm Payrolls

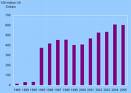

Let’s start with the basics: why is there a majority consensus that the Fed will hike rates after it removes its “patient” language tomorrow? One simple reason: non-farm payrolls. As reported earlier in the month, following the report of March’s expectations smashing 295,000 jobs added, there have now been a 13 consecutive months of 200K+ payroll months…

… something which together with the 5.5% unemployment rate, is for the Fed is a clear indication that the slack in the labor is about to disappear and wages are set to surge.

Sadly, as we showed before, wages are not only not rising, but for 80% of the population they are once again sliding.

Falling wages aside (a critical topic as it singlehandedly refutes the Fed’s bedrock thesis of no slack in a labor force in which there are 93 million Americans who no longer participate in the job market) going back to the original topic of which economic factors are prompting the Fed to assume there is an economic recovery, without exaggeration, all alone.

Is there nothing else that can validate the Fed’s rate hike hypothesis? Well… no.

Below is a selection of the economic data points that have missed expectations in just the past month.

MISSES

- Personal Spending

- Construction Spending

- ISM New York

- Factory Orders

- Ward’s Domestic Vehicle Sales

- ADP Employment

- Challenger Job Cuts

- Initial Jobless Claims

- Nonfarm Productivity

- Trade Balance

- Unemployment Rate

- Labor Market Conditions Index

- NFIB Small Business Optimism

- Wholesale Inventories

- Wholesale Sales

- IBD Economic Optimism

- Mortgage Apps

- Retail Sales

- Bloomberg Consumer Comfort

- Business Inventories

- UMich Consumer Sentiment

- Empire Manufacturing

- NAHB Homebuilder Confidence

- Housing Starts

- Building Permits

- PPI

- Industrial Production

- Capacity Utilization

- Manufacturing Production

- Dallas Fed

- Chicago Fed NAI

- Existing Home Sales

- Consumer Confidence

- Richmond Fed

- Personal Consumption

- ISM Milwaukee

- Chicago PMI

- Pending Home Sales

- Personal Income

- Personal Spending

- Construction Spending

- ISM Manufacturing

- Atlanta Fed GDPNow

So a pattern emerges: we have an economy in which jobs and only jobs are acting as if there is a strong recovery, while everything else is sliding, disappointing economists, and in fact hinting at another contraction (whatever you do, don’t look at the Fed’s internal model of Q1 GDP).

To be sure, economists these days are better known as weathermen, and so they are quick to blame every economic disappointment on the weather. Because, you see, they were unaware it was snowing outside when they provided their forecasts about the future, a future which should be impacted by the snowfall that day, and which they promptly scapegoat as the reason for their cluelessness. Yet one wonders: why didn’t the harsh snow (in the winter) pound February jobs as well? Recall last year’s payroll disappointments were immediately blamed on the weather which was just as “harsh” as this year. Why the difference?

And yet, today this rising “anomaly” between Nonfarm Payolls “data” and everything else, hit a crescendo, and some – such as Jim Bianco – have had it with the lies anomalies, which prompted him to ask the following:

Why Are Construction Jobs and Housing Starts Telling Different Stories? Is The Problem Non-Farm Payrolls

Bloomberg.com – Housing Starts Plunge by the Most in Four Years

Housing starts slumped in February by the most in four years as bad winter weather in parts of the U.S. prevented builders from initiating new projects. Work began on 897,000 houses at an annualized rate, down 17 percent from January and the fewest in a year, the Commerce Department reported Tuesday in Washington. The median estimate of 80 economists surveyed by Bloomberg called for 1.04 million. “It was just the weather, basically,” said Richard Moody, chief economist at Regions Financial Corp. in Birmingham, Alabama. Still, “my view of the recovery in single-family housing is that it’s coming more gradually than others think.”

Comment

The red line above shows seasonally adjusted housing starts for February plunged by one of the largest amounts in the post-crisis period.

The chart below shows a subset of the February non-farm payroll report, residential construction jobs. Seasonally adjusted these jobs increased by 17,200 in February, the most in two years (Feb 2013 was greater) and the second most in four years.

The vast majority of residential construction jobs are due to new housing starts. Existing housing does not create a lot of construction jobs. So while economists are blaming the weather for the plunge in housing starts, residential construction jobs were fairly robust in February. This makes no sense.

Could remodeling have accounted for this discrepancy? Was there a big rush to redo kitchens in February? In Home Depot’s February 24 investor conference call, they made no mention of an unusual or a big increase in remodeling. Remodeling is so important to Home Depot that they partnered with Harvard University to create an economic series to help track sales (noted in the conference call).

If remodeling was not responsible for this discrepancy, we are left with a theme we have brought up on multiple occasions over the past few weeks. Payrolls data continues to paint a rosy picture of the economy while the rest of the economic data is doing quite the opposite.

Economists seem to start with the premise that the non-farm payroll data is correct and everything else needs to be dismissed by weather and other factors. Maybe we should ask why the non-farm payrolls number is different from everything else.

* * *

Here is another way of seeing the above “anomaly”:

So, instead of asking why everything else is showing an abnormal – and rapid – slowdown in the US economy (and blaming everything on snow) is it about time that everyone – the Fed included – finally asks: just what is going on with the “data” that is reported every month by the Bureau of Labor Statistics?