The Lockdown: Engineered Economic Depression, The Globalization of Poverty

The following text is Chapter IV of Michel Chossudovsky E-Book.

To access the full document consisting of 10 chapters click below.

***

At the time of writing, there are essentially four distinct phases in the engineered destabilization of the global economy.

- The First phase was launched in late January, when the Trump administration announced (Jan 31, 2020) that it will deny entry to foreign nationals “who have traveled in China in the last 14 days”. This immediately triggered a crisis in air transportation. China-US trade as well as the tourism industry were affected.

- The second phase was initiated on February 20th 2020, following WHO Director General’s Dr. Tedros warning that a pandemic was imminent, which served to trigger the beginning of the 2020 Corona Financial crash.

- The third Phase was launched with the March 11, 2020 lockdown and closing down of 190 national economies, with devastating social consequences and

- A Fourth phase was initiated in October-November coinciding with the so-called “Second Wave”.

- A “Third Wave” was launched in early 2021.

Video

click the lower right corner to access full-screen

.

The Disruption of US-China Trade

Trump’s decision on January 31, 2020 was taken immediately following the announcement by the WHO Director General of a Public Health Emergency of International Concern (PHEIC) (January 30, 2020). In many regards, this was an act of “economic warfare” against China.

And then, following Trump’s January 31st 2020 decision to curtail air travel and transportation to China, a campaign was launched in Western countries against China as well against ethnic Chinese. The Economist reported that “The coronavirus spreads racism against and among ethnic Chinese”

“Britain’s Chinese community faces racism over coronavirus outbreak”

According to the South China Morning Post (Hong Kong):

“Chinese communities overseas are increasingly facing racist abuse and discrimination amid the coronavirus outbreak. Some ethnic Chinese people living in the UK say they experienced growing hostility because of the deadly virus that originated in China.”

And this phenomenon happened all over the U.S.

China Town, San Francisco

US-China Trade. America’s Dependence on “Made in China”

The unspoken truth is that America is an import led economy (resulting from offshoring) with a weak manufacturing base, heavily dependent on imports from the PRC. Despite America’s financial dominance and the powers of the dollar, there are serious failures in the structure of America’s “Real Economy” which have been exacerbated by the corona crisis.

US imports from China have declined significantly as a result of the “pandemic”, the impacts on US retail trade are potentially devastating. This process of disruption affecting production, supply lines, international transport started in early February, following Trump’s declaration on January 31st 2020

Political and geopolitical factors played a key role including the anti-Chinese campaign launched in February 2020 as well threats by the Trump administration, claiming that China was responsible for “spreading the virus”.

The impacts on bilateral US-China trade were devastating: US commodity imports from China declined by 28.3% (average over first three months of 2020 in relation to first 3 months of 2019).

Following the March 11 lockdown and closure of the global economy, the decline of US imports from China in March 2020 were of the order of 36.5% (in relation to March 2019). The decline in China’s exports to the US recorded in April and May were of the order 7.9% to 8.5% in relation to April-May 2019.

Moreover, according to figures quoted by the the Financial Times (largely attributable to the deep-seated financial crisis which started in February 2020), the value of (announced) Chinese direct investment projects into the US had fallen by about 90%: $200 million in the first quarter of 2020, down from an average of $2 Billion per quarter in 2019.

“Chinese direct investment into the US stood at $5bn, a slight drop from $5.4bn in 2018 and well off a recent peak of $45bn in 2016, when Chinese companies were much more free to acquire US counterparts”

While the US economy had entered into a deep-seated crisis (starting in February 2020 with the financial crash), China’s economy had recovered: China’s overall exports Worldwide (dollars) in April rose by 3.5% (in relation to April 2019).

What has transpired is a major redirection of China’s exports to the European Union (EU) and the rest of the World, which inevitably affects “Made in China” retail trade throughout the US.

The geopolitical implications are far-reaching, while the real economy in the US is in a shambles, China has now become the EU’s largest trading partner.

The February 2020 Corona Financial Crash

Speculative trade and financial fraud played a key role. On Thursday the 20th of February afternoon in Geneva, (CET Time) the WHO Director General. Dr Tedros Adhanom Ghebreyesus held a press conference. I am “concerned”, he said, “that the chance to contain the coronavirus outbreak” is “closing” …

“I believe the window of opportunity is still there, but that the window is narrowing.”

These “shock and awe” statements contributed to triggering panic, despite the fact that the number of confirmed cases outside China was exceedingly low: 1076 cases outside China, for a population of 6.4 billion. (Excluding the Diamond Princess, there were 452 so-called “confirmed cases” Worldwide)

The statement by Dr. Tedros (based on flawed concepts and statistics), set the stage for the February financial collapse triggered by inside information, foreknowledge, derivative trade, short-selling and a galore of hedge fund operations.

COVID-19 was narrowly identified as the catalyst of the financial crash.

Who was behind this catalyst?

Who was behind the fear campaign which contributed to triggering chaos and uncertainty on financial markets?

The small number of confirmed cases outside China (1076) did not in any way confirm the spread of a Worldwide epidemic. But this did not prevent the markets from plummeting.

The markets had been manipulated. Whoever had foreknowledge (inside information) of the WHO Director General’s February 20th, 2020 statement would have reaped significant monetary gains.

Was there a conflict of interest (as defined by the WHO)? The WHO receives funds from the Gates Foundation. Bill Gates has “60% of his assets invested in equities [including stocks and index funds]”, according to a September 2019 CNBC report.

Was there a conflict of interest (as defined by the WHO)? The WHO receives funds from the Gates Foundation. Bill Gates has “60% of his assets invested in equities [including stocks and index funds]”, according to a September 2019 CNBC report.

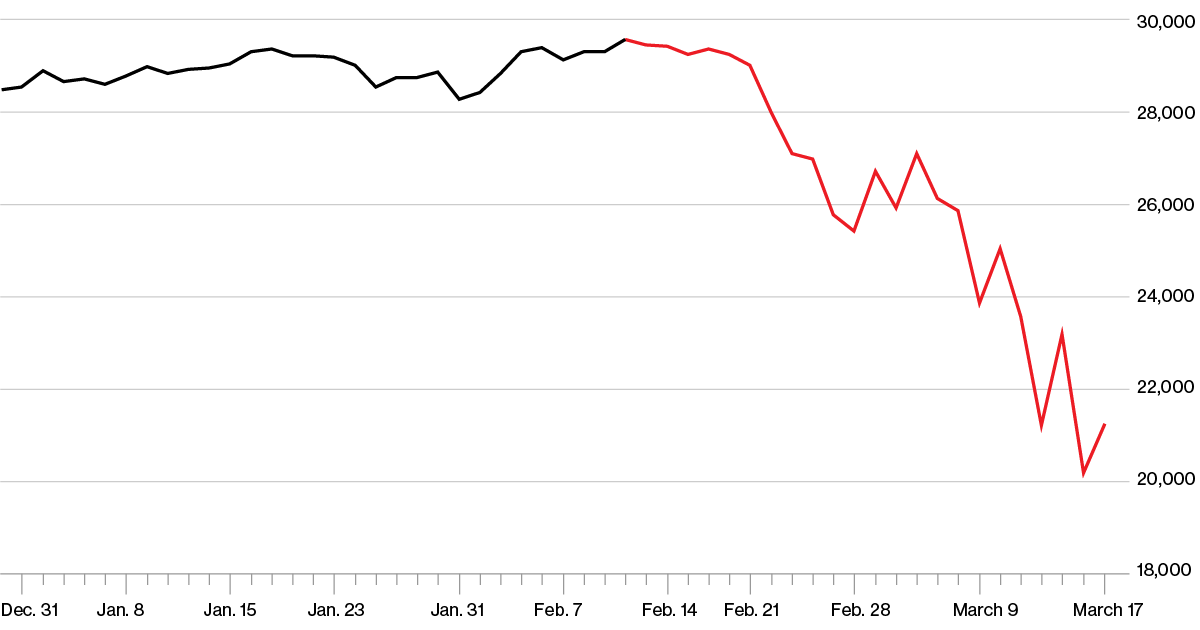

The stock market crash initiated on February 20th referred to as the 2020 Coronavirus Crash (February 20-April 7, 2020), was categorized as:

“the fastest fall in global stock markets in financial history, and the most devastating crash since the Wall Street Crash of 1929.”

The cause of the financial crash was (according to “analysts”) V. The Virus, namely, the “massive spread” of the epidemic outside China. But that was an outright lie: there were only 1076 cases Worldwide for a population of 6.4 billion outside China. (see Chapter III). Media disinformation played a key role in spearheading the fear campaign

Insider Trading and Financial Fraud

The possibility of financial fraud and “inside trading” (which is illegal) was casually dispelled by financial analysts and media reports.

Without the human hand, there is no causal relationship between a microscopic virus and the complex gamut of financial variables.

The “killer virus” fear campaign coupled with Dr. Tedros’ timely “warnings” of the need to implement a Worldwide pandemic indelibly served the interests of Wall Street’s institutional speculators and hedge funds. The financial crash led to a major shift in the distribution of money wealth. (See analysis in Chapter V)

In the week following the February 20-21 WHO announcement, the Dow Jones collapsed by 12% (CNBC, February 28, 2020). According to analysts, the plunge of the DJIA was the result of the Worldwide spread of the virus. A nonsensical statement in contradiction with the (small) number of WHO Covid positive estimates (1076 outside China), most of which were based on the faulty PCR test.

Dow Jones Industrial Average December 2019 – March 2020

Also on February 24th, Trump requested a $1.25 billion emergency aid.

According to the BBC, Worldwide stock markets saw sharp falls “because of concerns about the economic impact of the virus”, suggesting that the Virus was “the invisible “hand” responsible for the decline of financial markets.

COVID-19 was narrowly identified as the catalyst of the financial crash.

Who was behind the fear campaign which contributed to triggering chaos and uncertainty on financial markets coupled with bankruptcies and a massive redistribution of money wealth?

March 11, 2020: The Covid-19 Pandemic, Lockdown, Closing Down of 190 National Economies

On March 11, 2020: the WHO officially declared a Worldwide pandemic at a time when there were 118,000 confirmed cases and 4291 deaths Worldwide (including China). (March 11, 2020, according to press conference). What do these “statistics” tell you?

The number of confirmed cases outside of China (6.4 billion population) was of the order of 44279 and 1440 deaths (figures recorded for March 11 by the WHO, (on March 12). (There is a contradiction in the number of deaths outside China recorded by the WHO. In Tedros’ WHO press conference: 4291 outside China). (See Chapter III).

Immediately following the March 11, 2020 WHO announcement, the fear campaign went into high gear. As in the case of the February 20-21 crash, the March 11 statement by the WHO Director General had set the stage.

Stock markets crashed worldwide. On the following morning, the Dow (DJIA) plummeted by 9.99% (A decline of 2,352.60 to close at 21,200.62) Black Thursday, March 12, 2020 was “the Dow’s worst day” since 1987. Financial fraud was the trigger. A massive transfer of financial wealth had taken place in favor of America’s billionaires. (see chapter V)

“Stay at Home” confinement instructions were transmitted to 193 member states of the United Nations. Politicians are the instruments of powerful financial interests. Was this far-reaching decision justified as a means to combating the Virus?

The decision was based on a flawed lockdown model designed by Imperial College London.

Unprecedented in history, applied almost simultaneously in a large number countries, entire sectors of the World economy were destabilized. Small and medium sized enterprises were driven into bankruptcy. Unemployment and poverty are rampant.

In several developing countries, famines have erupted out (see analysis below). The social impacts of these measures are devastating. The health impacts (mortality, morbidity) of these measures including the destabilization of the system of national health care (in numerous countries) far surpass those attributed to Covid-19.

Economic Warfare

The instructions came from above, from Wall Street, the World Economic Forum, the billionaire foundations. This diabolical project is casually described by the corporate media as a “humanitarian” public health endeavor. The “international community” has a “Responsibility to Protect” (R2P). An unelected “public-private partnership” under the auspices of the World Economic Forum (WEF), has come to the rescue of Planet Earth’s 7.8 billion people. The closure of the global economy is presented as a means to “killing the virus”.

Sounds absurd. Closing down the real economy of Planet Earth is not the “solution” but rather the “cause” of a process of Worldwide destabilization and impoverishment, which in turn will inevitably have an impact on patterns of morbidity and mortality. In this regard, what must be addressed is the causal relationship between economic variables (i.e purchasing power) and the state of health of the population.

The national economy combined with political, social and cultural institutions is the basis for the “reproduction of real life”: income, employment, production, trade, infrastructure, social services.

Destabilizing the economy of Planet Earth cannot constitute a “solution” to combating the virus. But that is the imposed “solution” which they want us to believe in. And that is what they are doing.

The Lockdown and the Process of Engineered Bankruptcy

There is an important relationship between the “Real Economy” and “Big Money”, namely the financial establishment.

What is ongoing is a process of concentration of wealth, whereby the financial establishment, (i.e. the multibillion dollar creditors) are slated to appropriate the real assets of both bankrupt companies as well as State assets.

The “Real Economy” constitutes “the economic landscape” of real economic activity: productive assets, agriculture, industry, goods and services, trade, investment, employment as well social and cultural infrastructure including schools, hospitals, universities, museums, etc. The real economy at the global and national levels is being targeted by the lockdown and closure of economic activity.

The lockdown instructions transmitted to national governments have been conducive to the destabilization of “the national economic landscape”, which consists of an entire economic and social structure. The “stay at home” lockdown prevents people from going to work. From one day to the next, it creates mass unemployment (Worldwide). In turn, the lockdown is coupled with the closure of entire sectors of the national economy.

The lockdown immediately contributes to the disengagement of human resources (labor) which brings productive activity to a standstill. On the one hand the channels of supply and distribution are frozen, which eventually leads to potential shortages in the availability of commodities.

In turn, several hundred million workers Worldwide lose their jobs and their earnings. While national governments have set up various “social safety nets” for the unemployed, the payment of wages and salaries by the employer is disrupted which in turn leads to a dramatic collapse of purchasing power.

It’s a payments crisis. Wages and salaries are not paid. Impoverished households are unable to purchase food, pay their rent or monthly mortgage. Personal and household debts (including credit card debts) go fly high. It’s a cumulative process.

The globalization of poverty leads to a decline in consumer demand which then backlashes on the productive system, leading to a further string of bankruptcies. Inevitably, the structure of international commodity trade is also affected.

Global Indebtedness

The Global Money financial institutions are the “creditors” of the real economy which is in crisis. The closure of the global economy has triggered a process of global indebtedness. Unprecedented in World history, a multi-trillion bonanza of dollar denominated debts is hitting simultaneously the national economies of 193 countries.

The creditors will also seek to acquire ownership and/or control of “public wealth” including the social and economic assets of the State through a massive indebtedness project under the surveillance of creditor institutions including the IMF, the World Bank, the regional development banks, etc.

Under the so-called “New Normal” Great Reset put forth by the World Economic Forum (WEF), the creditors (including the billionaires) are intent upon buying out important sectors of the real economy as well as taking over bankrupt entities (See Chapter IX)

Crisis of the Global Economy. The Evidence

In the sections below we review the dramatic impacts of the closure of the global economy focussing on bankruptcies, global poverty, unemployment, the outbreak of famines as well as education.

Most of the figures quoted below are from UN, government and related sources, which tend to underestimate the seriousness of this ongoing global crisis, which is literally destroying people’s lives.

Indebtedness in all sectors of economic activity Worldwide is the driving force.

What is presented below is but the tip of the iceberg. Much of the data corresponds to the first 6-8 months of 2020. The devastating impacts of the Second Wave lockdown which are ongoing are yet to be assessed:

Bankruptcies

The wave of bankruptcies triggered by the closure of the World economy affects both Small and Medium Sized Enterprises (SME) as well as large Corporations. The evidence suggests that small and medium sized enterprises are literally being wiped out.

According to a survey by the International Trade Centre, quoted by the OECD, pertaining to SMEs in 132 countries:

two-thirds of micro and small firms report that the crisis strongly affected their business operations, and one-fifth indicate the risk of shutting down permanently within three months. Based on several surveys in a variety of countries, McKinsey (2020) indicates that between 25% and 36% of small businesses could close down permanently from the disruption in the first four months of the pandemic. (OECD Report, emphasis added)

According to Bloomberg: “Over half of Europe’s small and medium-sized businesses say they face bankruptcy in the next year if revenues don’t pick up, underscoring the breadth of damage wrought by the Covid-19 crisis.

One in five companies in Italy and France anticipate filing for insolvency within six months, according to a McKinsey & Co. survey in August of more than 2,200 SMEs in Europe’s five largest economies.

The surveys tend to underestimate the magnitude of this unfolding catastrophe. The numbers are much larger than what is being reported.

In the US, the bankruptcy process is ongoing. According to a group of academics in a letter to Congress:

“we anticipate that a significant fraction of viable small businesses will be forced to liquidate, causing high and irreversible economic losses,. “Workers will lose jobs even in otherwise viable businesses. …

“A run of defaults looks almost inevitable. At the end of the first quarter of this year, U.S. companies had amassed nearly $10.5 trillion in debt — by far the most since the Federal Reserve Bank of St. Louis began tracking the figure at the end of World War II. “An explosion in corporate debt,” Mr. Altman said” (NYT, June, 16, 2020).

With regard to small businesses in the US:

almost 90% of small businesses experienced a strong (51%) or moderate (38%) negative impact from the pandemic; 45% of businesses experienced disruptions in supply chains; 25% of businesses has less than 1-2 months cash reserves.“ (OECD)

The results of a survey of over 5 800 small businesses in the United States:

… shows that 43% of responding businesses are already temporarily closed. On average, businesses reduced their employees by 40%. Three-quarters of respondents indicate they have two months or less in cash in reserve. … (OECD)

“half of all US small business owners in the entire country believe that they may soon be forced to close down for good. Not even during the Great Depression of the 1930s did we see anything like this”

Global Unemployment

A massive Worldwide contraction in employment is ongoing. In an August report, the International Labour Organization (ILO) confirms that:

Among the most vulnerable are the 1.6 billion informal economy workers, representing half of the global workforce, who are working in sectors experiencing major job losses or have seen their incomes seriously affected by lockdowns.

The COVID‐19 crisis is disproportionately affecting 1.25 billion workers in at-risk jobs, particularly in the hardest-hit sectors such as retail trade, accommodation and food services, and manufacturing (ILO, 2020b). Most of these workers are self-employed, in low-income jobs in the informal sector… Young people, for example, are experiencing multiple shocks including disruption to education and training, employment and income, in addition to greater difficulties in finding jobs.

The ILO does not in any way explain the political causes of mass unemployment, resulting from actions taken by national governments, allegedly with a view to resolving the Covid pandemic. Moreover, the ILO tends to underestimate both the levels as well as the dramatic increase in unemployment.

Governments are under the control of global creditors. What is contemplated for the post-Covid era is the implementation of massive austerity measures including the cancellation of workers’ benefits and social safety nets.

Unemployment in the U.S.

In the US, “more than 30 million people, over 15% of the workforce, have applied for unemployment benefits… ” (CSM, May 6, 2020).

In the US, “more than 30 million people, over 15% of the workforce, have applied for unemployment benefits… ” (CSM, May 6, 2020).

Announced in early December: “”More than 10 million Americans are projected to lose their unemployment benefits the day after Christmas unless Congress acts to extend key pandemic-related programs – a prospect that as of now looks uncertain at best.” (US News and World Report)

The cliff edge looms as coronavirus cases surge around the country and applications for unemployment benefits rise with states and localities reimposing virus-related restrictions. The lapse is also set to occur as protections for renters, student loan borrowers and homeowners expire – a potential devastating confluence of events for both individuals, whose savings have been ravaged by the pandemic, and the economy at large, which is gradually clawing its way back from the coronavirus-induced recession.

According to Census Bureau estimates, 30 to 40 million Americans face possible eviction in 2021 for lack of income to pay rent or service mortgages.

Without federal aid or an extended rent moratorium, a calamity of biblical proportions may unfold in the coming months. Stephen Lendman

Unemployment in the European Union (EU)

“Unemployment across the whole of the European Union is expected to rise to nine percent in 2020, in the wake of the Coronavirus pandemic and subsequent lockdowns enforced by national governments”.

According to official EU figures:

Greece, Spain and Portugal … have once again seen large rises in youth unemployment since the start of the pandemic. Greece saw a surge from 31.7 percent in March to 39.3 percent in June, while Spain and Portugal had similar increases, from 33.9 percent to 41.7 percent and 20.6 percent to 27.4 percent, respectively.

Unemployment in Latin America

In Latin America, the average unemployment rate was estimated at 8.1 per cent at the end of 2019. The ILO states that it could rise by a modest 4 to 5 percentage points to 41 million unemployed.

In absolute numbers, these rates imply that the number of people who are looking for jobs but are not hired rose from 26 million before the pandemic to 41 million in 2020, as announced by ILO experts.

These estimates of the ILO and the World Bank are misleading. According to the Inter American Development Bank (IDB), the increase in unemployment for the Latin American region is of the order of 24 million, with jobs losses in Colombia of the order of 3.6 million, Brazil, 7.0 million and Mexico 7.0 million.

Even these figures tend to underestimate the dramatic increase in unemployment. And the situation is likely to evolve in course of the Second Wave lockdown which has triggered a renewed wave of bankruptcies.

According to a Survey conducted by the Instituto Nacional de Estadística y Geografía (INEGI) the increase in unemployment in Mexico was of the order of 12.5 million in April, i.e. in the month following the March 11, 2020 lockdown and closure of the national economy.

The Outbreak of Famines

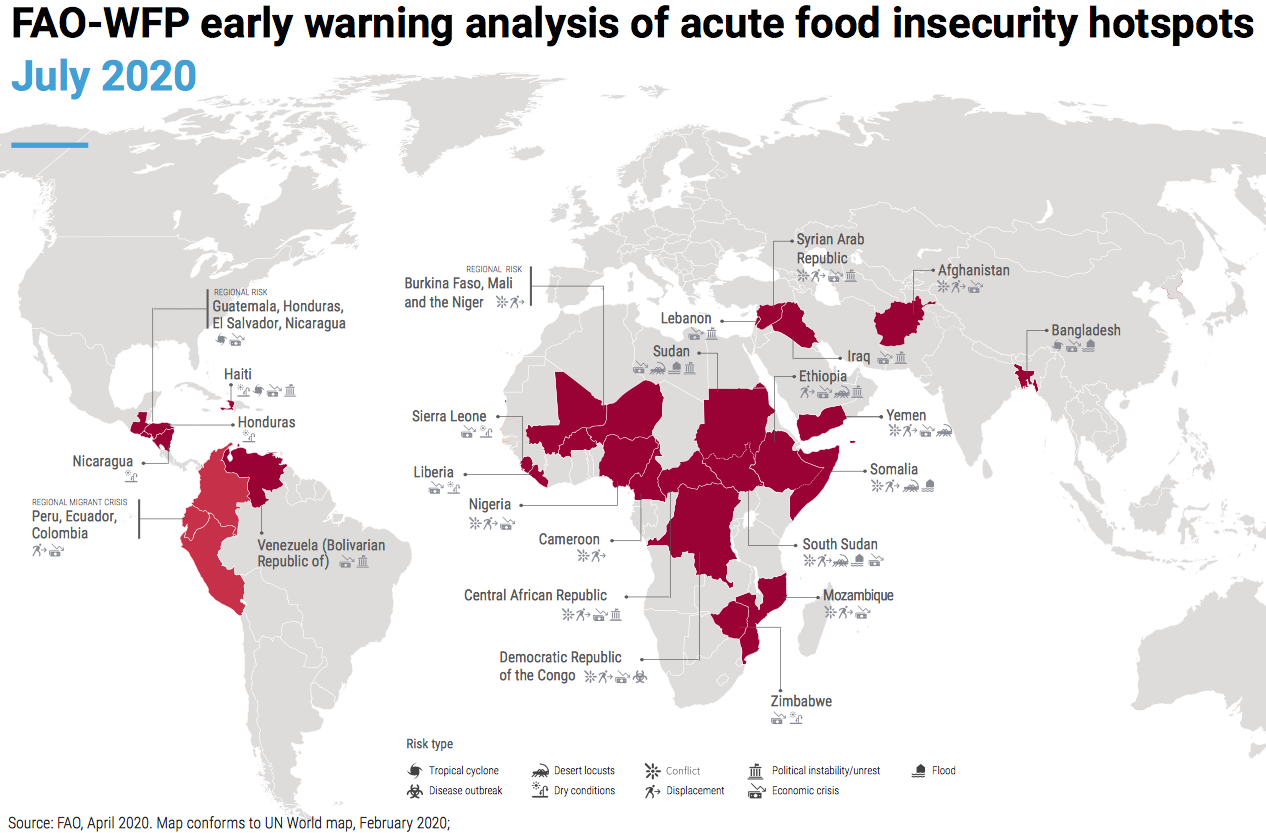

Famines have erupted in at least 25 developing countries according to UN sources. According to the FAO July 17, 2020

The UN’s Food and Agriculture Organization (FAO) and World Food Programme (WFP) identifies 27 countries that are on the frontline of impending COVID-19-driven food crises, as the pandemic’s knock-on effects aggravate pre-existing drivers of hunger.

No world region is immune, from Afghanistan and Bangladesh in Asia, to Haiti, Venezuela and Central America, to Iraq, Lebanon, Sudan and Syria in the Middle East to Burkina Faso, Cameroon, Liberia Mali, Niger, Nigeria, Mozambique, Sierra Leone and Zimbabwe in Africa.

The joint analysis by FAO and WFP warns these “hotspot countries” are at high risk of – and in some cases are already seeing – significant food security deteriorations in the coming months, including rising numbers of people pushed into acute hunger.

.

The COVID-19 pandemic has potentially far-reaching and multifaceted indirect impacts on societies and economies, which could last long after the health emergency is over. These could aggravate existing instabilities or crises, or lead to new ones with repercussions on food security, nutrition and livelihoods.

With over two billion people, or 62 percent of all those working worldwide, employed in the informal economy according to ILO data, millions of people face a growing risk of hunger. Earnings for informal workers are estimated to decline by 82 percent, with Africa and Latin America to face the largest decline (ILO 2020). (FAO, p. 6)

Famine and Despair in India

The social and economic impacts of the March 11 Lockdown in India are devastating triggering a wave of famine and despair. “Millions of people who have lost income now face increased poverty and hunger, in a country where even before the pandemic 50 percent of all children suffered from malnourishment”

In late November, the largest general strike in the country’s history was carried out against the Modi government with more than 200 million workers and farmers. According to the Mumbai University and College Teachers’ Union:

This strike is against the devastating health and economic crisis unleashed by COVID-19 and the lockdown on the working people of the country. This has been further aggravated by a series of anti-people legislations on agriculture and the labour code enacted by the central government. Along with these measures, the National Education Policy (NEP) imposed on the nation during the pandemic will further cause irreparable harm to the equity of and access to education.

According to Left Voice:

“The pandemic has spread from major cities such as Delhi, Mumbai, and other urban centers to rural areas where public health care is scarce or non-existent. The Modi government has handled the pandemic by prioritizing the profits of big business and protecting the fortunes of billionaires over protecting the lives and livelihoods of workers.”

Food Insecurity in the U.S.

Nutrition and food insecurity is not limited to developing countries. In the US, according to Stephen Lendman:

“Around one in four US households experienced food insecurity this year — over 27% of households with children.

A Northwestern University Institute for Policy Research study estimates the number of food insecure households with children at nearly 30%. Black families are twice as food insecure as their white counterparts. Latino households are also disproportionately affected.”

Education: The Impacts on Our Children

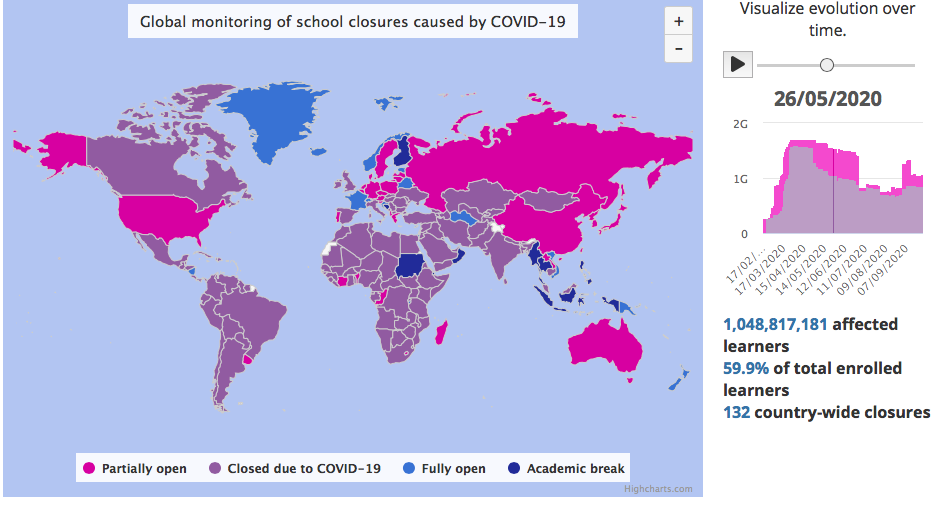

The very foundations of civil society are threatened. UNICEF estimates that 1.6 billion children and adolescents are affected by the closure of schools Worldwide.

“As the COVID-19 pandemic has spread across the globe, a majority of countries have announced the temporary closure of schools, impacting more than 91 per cent of students worldwide… Never before have so many children been out of school at the same time…

Colleges and universities are also paralysed. Students are denied the right to education. While UNESCO confirms that more than one billion learners are affected, it offers no concrete solution or critique. The official narrative imposed by the so-called “public / private partnership” which is imposed on national governments has been adopted at face value.

School closures have been implemented in 132 countries. See diagram below (UNESCO, May 2020).

click map to access UNESCO report.

The Macro-Economic Implications: Supply, Demand and The Fiscal Crisis of the State

The above review of the economic and social impacts points to a complex process. Large sectors of the World population have been precipitated into poverty and despair.

I will attempt to conclude this chapter with some simple concepts which describe the nature of this Worldwide crisis.

The Lockdown has triggered a process of Worldwide economic destabilization which directly affects both “Supply” and “Demand” relations. It’s the most serious economic crisis in World history affecting simultaneously more than a 150 countries.

“Supply” pertains to the production of goods and services, namely the activities of the “Real Economy”.

“Demand” pertains to the ability of consumers given their purchasing power to acquire goods and services.

Both supply and demand relations are in jeopardy.

Worldwide, large sectors of industry, agriculture and urban services stand idle. The lockdown initiated in March 2020 has triggered bankruptcies and unemployment, which in turn have been conducive to a process of disengagement of human resources (labor) and productive assets from the economic landscape.

The freeze of air-travel, the contraction in international trade in the course of the last year has also contributed to a massive decline in production and investment.

As documented in this chapter, the consequences are twofold:

On the supply side, a massive contraction in the production and availability of goods and services (commodities) is unfolding. Entire sectors of the global economy are “not producing”: scarcities of certain commodities and services have emerged.

On the demand side, mass unemployment and poverty triggered by the lockdown has contributed to an unprecedented collapse in purchasing power (of families and households Worldwide), which in turn has led to the collapse in the demand for goods and services. People do not have money to buy food.

The collapse in purchasing power resulting from mass unemployment has in turn led to a mounting personal debt crisis.

The Fiscal Crisis of the State

Public sector activities (funded by the State) including health, education, culture, sports and the arts are also in jeopardy.

Since the onset of the corona crisis, the public debt in country after country has gone fly high.

Why? The answer is obvious.

Bankrupt companies no longer pay taxes.

Unemployed workers (without earnings) no longer pay taxes.

Tax dollars are no longer coming into the coffers of the State.

The increase in global unemployment and poverty coupled with bankruptcies have led to an unprecedented fiscal crisis.

The creditors of the state are “Big Money”. Ultimately they call the shots. What is unfolding is the “privatization of the State” including the “Welfare State”.