The Shock Wave of Bankruptcies: Dumping NYC Office Leases: Global Vacancies Hit Record High

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Click the share button above to email/forward this article to your friends and colleagues. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

The shockwaves from WeWork’s bankruptcy last week continue to reverberate around the commercial real estate market, leaving office landlords around the world trembling with fear at the prospect of losing one of their largest tenants.

Bankrupt WeWork to Immediately Dump 40 NYC Office Leases: BBG

The proverbial straw that broke the CREmel's back.

— zerohedge (@zerohedge) November 7, 2023

Especially in prime markets such as New York City, San Francisco, London and Paris, WeWork played an outsized role in the office rental market, occupying large swaths of premium office space.

According to Bloomberg,

“Dormant locations in New York dominate a list of nearly 70 leases the coworking giant intends to terminate, court papers show. The roughly 40 contracts at issue include space near Union Square and in Fulton Center, a retail and transit facility in downtown Manhattan.”

As Statista’s Felix Richter reports, WeWork’s demise come at the worst possible time for landlords, who are already struggling to find tenants, as many companies are reducing their office footprint to reduce costs and adapt to the post-pandemic world of hybrid work.

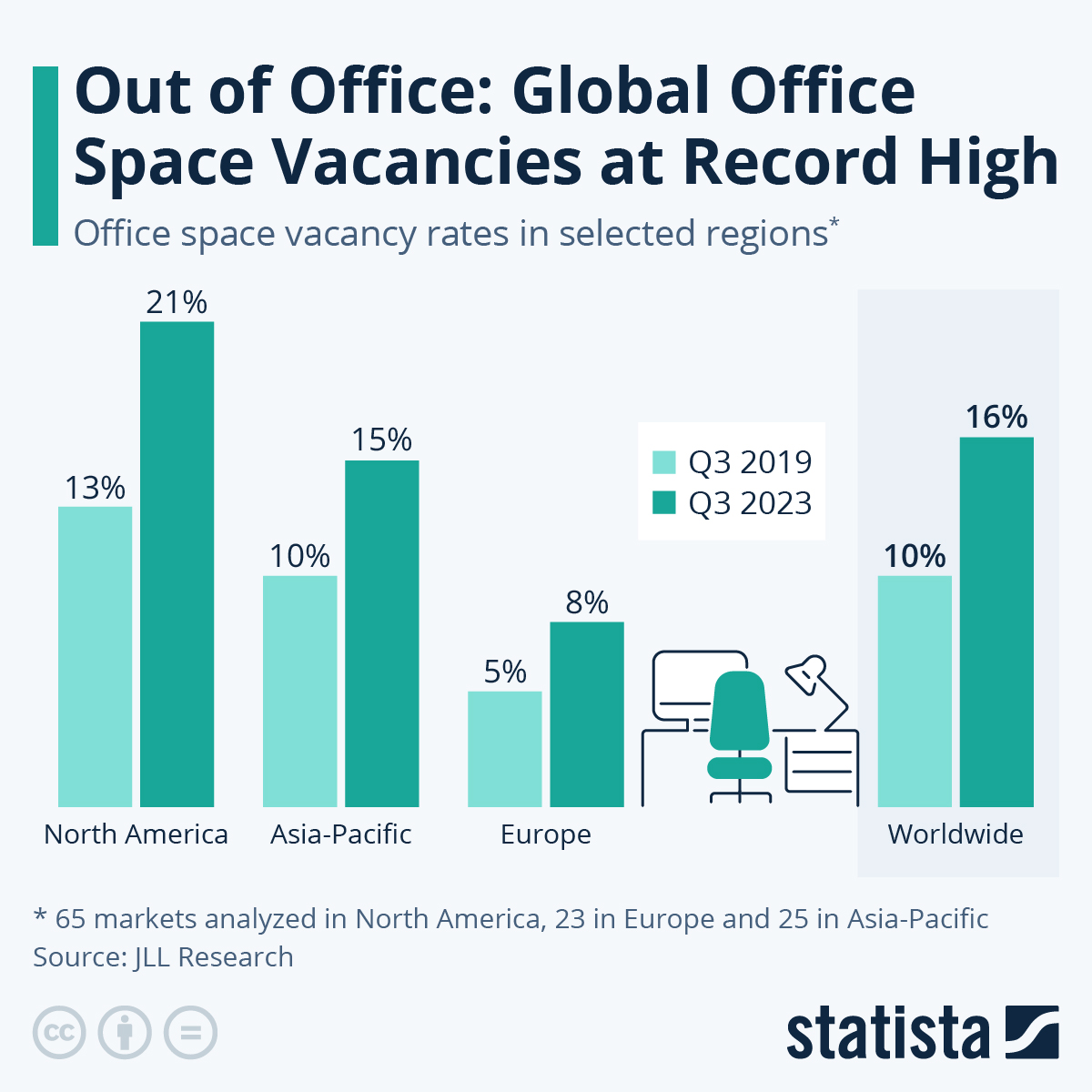

According to real estate specialist Jones Lang LaSalle (JLL), office vacancy rates are higher than ever, reaching 21 percent in the U.S. and Canada in Q3 2023 and 16 percent globally, i.e. in the 100+ markets analyzed by JLL Research. In both cases, that’s an increase of 60 percent compared to pre-pandemic vacancy rates, which stood at 13 and 10 percent in North America and globally in Q3 2019, respectively.

You will find more infographics at Statista.

At the end of June, WeWork operated 906,000 workstations in 777 locations across 39 countries, with total (current and long-term) lease obligations amounting to $14.2 billion.

While it’s unclear what will happen to these locations post-bankruptcy, landlords look certain to lose out on a large chunk of their agreed-upon leases and to end up with even more excess supply of prime office space.

As of June 2022, the company rented nearly 20 million square feet of office space across the US. And what’s happening in NYC is coming to a city near you.

Weeks ago, Scott Rechler, Chairman and CEO of RXR Realty, warned the CRE crisis was just getting starting…

*

Note to readers: Please click the share button above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Featured image is from the author