“Mr. President, Tap the Brakes”: 3,900 Auto Dealers Warn EV Demand Crumbling

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Click the share button above to email/forward this article to your friends and colleagues. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

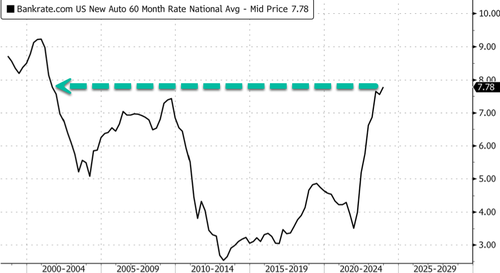

Data from Bankrate indicates that interest rates for new auto loans with a 60-month term have reached their highest point since the Dot Com bust era. Additionally, the soaring prices of new electric vehicles pose a significant affordability challenge for the average working-class American. Beyond affordability issues, consumer interest in EVs is also waning. This sentiment is echoed by 3,900 auto dealers who have written to President Biden, urging his administration to reconsider the pace of EV mandates, citing a severe decline in demand for these vehicles.

“Currently, there are many excellent battery electric vehicles available for consumers to purchase. These vehicles are ideal for many people, and we believe their appeal will grow over time. The reality, however, is that electric vehicle demand today is not keeping up with the large influx of BEVs arriving at our dealerships prompted by the current regulations. BEVs are stacking up on our lots,” the dealers said.

They said 2022 was a year of “hope and hype about EVs” but has morphed into a bust cycle as “supply of unsold BEVs is surging, as they are not selling nearly as fast as they are arriving at our dealerships — even with deep price cuts, manufacturer incentives, and generous government incentives.”

They warned:

“Already, electric vehicles are stacking up on our lots which is our best indicator of customer demand in the marketplace.”

According to Bankrate data, this may be because new auto loans with 60-month terms have soared from around 3.5% to 7.78% in a very short period – we call this an interest rate shock. Current rates are at levels not seen since the second half of 2001.

The dealers said most customers are not ready for EVs, citing unaffordability issues. No fiscally conservative American trying to survive the failure of Bidenomics wants a +$1,000 EV car payment.

They explained most customers don’t have “garages for home charging or easy access to public charging stations” and were concerned about “loss of driving range in cold or hot weather.”

With that being said, the dealers asked Biden:

Mr. President, it is time to tap the brakes on the unrealistic government electric vehicle mandate. Allow time for the battery technology to advance. Allow time to make BEVs more affordable. Allow time to develop domestic sources for the minerals to make batteries. Allow time for the charging infrastructure to be built and prove reliable. And most of all, allow time for the American consumer to get comfortable with the technology and make the choice to buy an electric vehicle.

None of this should be surprising to readers. We have well-documented the EV bust this year, pointing out in late summer that dealers struggled to sell EVs with inventories piling up.

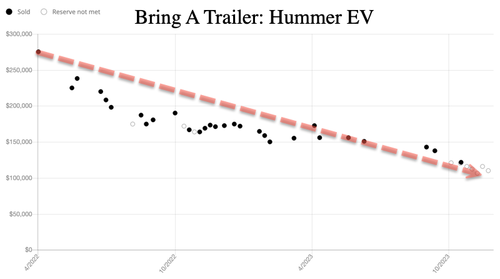

We even showed the ‘rise and fall’ of the EV hype in one chart, Bring A Trailer listings for the GMC Hummer EV.

The letter to the president also comes as the clean energy industry is plunging into turmoil, with shares of solar, wind, and hydrogen stocks crashing this year.

President Biden’s green revolution stands no chance in a high interest rate environment.

And we wonder if the EV price war sparked by Elon Musk earlier this year with major automakers means Tesla is soaking up market share – or if they, too, are experiencing demand troubles.

*

Note to readers: Please click the share button above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Featured image is from Spiked