Israel’s Credit Rating Lowered by Morgan Stanley, Moody’s Warns of ‘Significant Risk’

Citibank and Morgan Stanley warned of instability in Israel in light of the approval of the reasonableness standard law.

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Click the share button above to email/forward this article to your friends and colleagues. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

Israel’s sovereign credit rating on Tuesday was lowered by credit rating agency Morgan Stanley, and Moody’s warned of a “significant risk” that political and social tensions will lead to “negative consequences for Israel’s economy and security situation,” following the Knesset’s vote to pass the first law of its controversial judicial reform on Monday.

Morgan Stanley updated Israel’s sovereign credit to a “dislike stance,” noting that the government has reaffirmed the trajectory of its economy in a direction that is likely to scare off investors.

“We see increased uncertainty about the economic outlook in the coming months and risks becoming skewed to our adverse scenario,” the agency said. “Markets are now likely to extrapolate the future policy path and we move Israel sovereign credit to a ‘dislike stance.’”

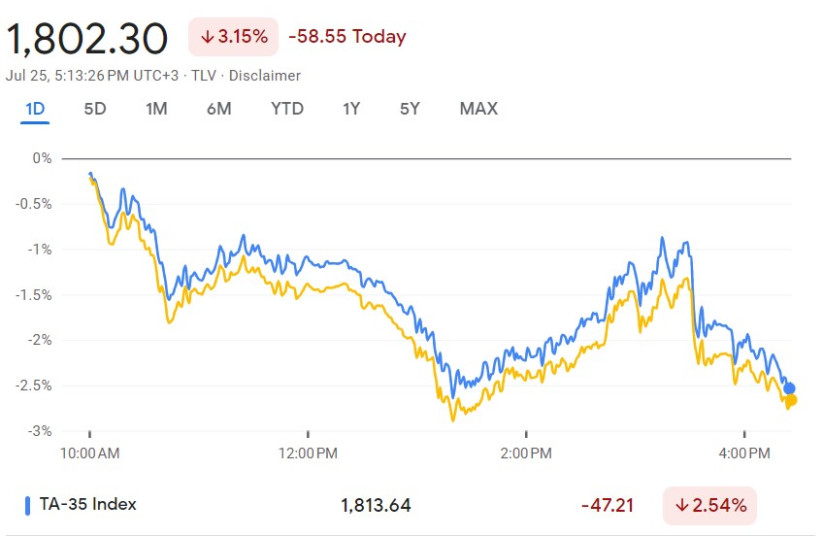

They added that recent events indicate “ongoing uncertainty” in Israel and that the shekel is likely to continue depreciating alongside the Tel Aviv Stock Market, which has lost nearly 10% since November of last year.

Screenshot of stock market activity the day after the first law of the judicial reform passed. July 25, 2023 (credit: screenshot)

Shoveling More Problems Onto the Pile

Moody’s warned that there is “a significant risk that political and social tensions over the [judicial reform] will continue, with negative consequences for Israel’s economy and security situation.”

The credit rating agency warned that it believes that “the wide-ranging nature of the government’s proposals could materially weaken the judiciary’s independence and disrupt effective checks and balances between the various branches of government, which are important aspects of strong institutions.”

The agency added that “the executive and legislative institutions have become less predictable and more willing to create significant risks to economic and social stability.”

Click here to read the full article on The Jerusalem Post.

*

Note to readers: Please click the share button above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Featured image: View of screens showing falling stocks at the Tel Aviv Stock Exchange, in the center of Tel Aviv, December 23, 2018. (Photo credit: MIRIAM ALSTER/FLASH90)