The Fed Models the Weather Although It Can’t Even Stress Test Treasuries

The Fed has conducted a “pilot climate scenario analysis exercise”. Let's take a peek inside this laughable event.

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Click the share button above to email/forward this article to your friends and colleagues. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

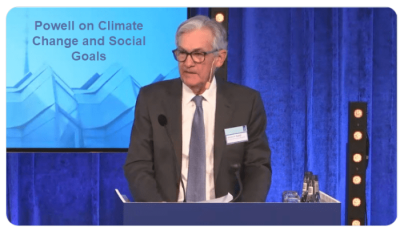

On January 10, Fed Chairman said the Fed ‘will not be a climate policymaker’.

Under guise that it’s just a stress test model and not a policy setting model, the Fed announced details on its Pilot Climate Scenario Risk Analysis Program on January 17.

As described in the instruction document released today, the six largest U.S. banks will analyze the impact of scenarios for both physical and transition risks related to climate change on specific assets in their portfolios. To support the exercise’s goals of deepening understanding of climate risk-management practices and building capacity to identify, measure, monitor, and manage climate-related financial risks, the Board will gather qualitative and quantitative information over the course of the pilot, including details on governance and risk management practices, measurement methodologies, risk metrics, data challenges, and lessons learned.

“The Fed has narrow, but important, responsibilities regarding climate-related financial risks – to ensure that banks understand and manage their material risks, including the financial risks from climate change,” Vice Chair for Supervision Michael S. Barr said. “The exercise we are launching today will advance the ability of supervisors and banks to analyze and manage emerging climate-related financial risks.”

Climate Results Are In

Please consider the WSJ report The Fed’s Climate Studies Are Full of Hot Air by David Barker.

This year the Fed is forcing big banks to produce complex reports on their climate vulnerability in a “pilot project” that is sure to expand and might lead to lending restrictions. A query of the Fed’s listing of recent publications returns hundreds of research papers, press releases and policy statements related to climate change.

With all this effort, one might hope the Fed would produce high-quality research on climate change. But I took a close look at two Fed studies on the subject and found shockingly poor analysis. These studies on the effect of temperature on U.S. and world economic growth are cited without a hint of skepticism and widely lavished with media attention.

Recently I published a critique of a study from the Federal Reserve Board claiming that a year of above-normal temperatures in countries around the world makes economic contraction more likely. The original study used sophisticated statistical techniques but failed to report that its primary finding was statistically insignificant. My request to the study’s author for computer code to reproduce the paper’s results went unanswered.

I managed to write the code from scratch and exactly replicate the results, allowing me to run additional tests that the author didn’t report. The author’s primary result—that temperature has a bigger effect in bad than in good economic times—turned out to be statistically insignificant. Additional analysis showed that there is no reliable effect of temperature on growth at all.

There are two main reasons why the Fed study appeared at first to show a statistically significant effect of temperatures on economic growth. First, each country in the sample had equal weight in the analysis. China had the same weight as St. Vincent though China’s population is 13,000 times as large. Equal weighting means that some small countries with unusual histories of economic growth greatly influenced the results.

The paper’s results disappeared when countries like Rwanda and Equatorial Guinea—which had economic catastrophes and bonanzas unrelated to climate change—were omitted. Omitting similar countries representing less than 1% of world gross domestic product was enough to eliminate the paper’s result.

The only thing to learn from the Fed’s research is that climate propaganda is spreading fast, and when it comes to climate, academic economists are no more deserving of trust than are other supposed scientists and experts. The Fed’s time would be better spent on more urgent matters, like improving its botched regulation of the banking system.

The author, David Barker, has taught economics and finance at the University of Chicago and the University of Iowa and worked as an economist at the Federal Reserve Bank of New York. He has a doctorate in economics from the University of Chicago.

Hoot of the Day

The Fed cannot even model US Treasuries. Its stress-free test would have failed to identify the imploded Silicon Valley Bank as a problem.

Yet, for political reasons, the Fed is now attempting to stress test the weather.

To get the desired results, the Fed study gave St. Vincent, Rwanda, and Equatorial Guinea the same weight as China and the United States.

I suggest the Fed should throw this nonsense in the garbage and stress test commercial real estate, interest rates, accelerated QT, and things that it has clearly neglected.

Commercial Real Estate Implosion

Commercial real estate is one area in particular that the Fed ought to be watching.

For discussion, please see The Next Bank Crisis Is Coming Right Up, Commercial Real Estate Implosion.

There is a plausible theory that too many people are watching CRE for that to be a “black swan”.

By plausible, I mean the theory could easily be right. However, plenty of people were watching and calling for a residential real estate implosion in 2008 and they were correct.

And it wasn’t a true black swan anyway as it was easily predictable. I wrote about it for months on end. So did many others including Calculated Risk, Implode-O-Meter, Barry Ritholtz and many others.

It’s a mistake to try and judge what people think by looking at Twitter. In contrast to housing in 2008, very few people are watching CRE and those who are are not a fervent about it.

Nonetheless, let’s consider a best case scenario that there will be some big losses but no bank failures. In that scenario, the small and regional banks are capital impaired and stop making loans.

That’s a credit deflation scenario, not exactly a robust environment for GDP or equities.

One of my readers accurately commented, that “Modeling the impact of bad climate policy would be more useful.”

Of course that presumes the Fed has any idea just how bad, and inflationary, our climate policy is.

*

Note to readers: Please click the share button above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Featured image is from Mish Talk