De-Dollarization in Africa: South Sudan to Drop US Dollar for Local Currency

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name (desktop version)

To receive Global Research’s Daily Newsletter (selected articles), click here.

Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

Back in 2010, the South Sudanese Government was warned by students who majored in economics that using the US dollar for local transactions would pose an economic risk to the country, and they were right. The Sudan Tribune report described the students concerns about the government’s dollarization of South Sudan’s economy, “Southern Sudanese students studying economics at higher learning institutions in collaboration with local economists from semi-autonomous government of South Sudan (GoSS) have joined academics and finance scholars to warn against heavy reliance on US dollar in local transactions, saying the trend was exposing the region to great economic risks.” Students from Juba University called on GoSS to intervene “before the situation got out of hand” Lual Deng Kuol, a student of economics and social studies continued “I don’t understand why the government is allowing dollarization of the economy” he said “noting that excessive use of the dollar was exerting unnecessary pressure on the local currency.”

Kiir Wol Baak, who is a member of the region’s business community said that the government and its central bank failed to regulate the use of dollars. It is true that when a country gives up its option to print its own money, the ability to influence the economy, administer a monetary policy or impose an exchange rate diminishes. Kiir Wol Baak said that “The problem is that there is no control by the government and people will keep demanding dollars, unnecessarily, this is not good at all for our weak economy.” According to the Sudan Tribune’s own words in what will be the aftermath once the process of dollarization has succeeded:

Experts define dollarization as an extreme situation of an economic instability in which a foreign currency, often the US dollar replaces a country’s currency in performing basic functions of money. With each seller of a product or service demanding the dollar or the shilling at an exchange rate of one’s own choice, it translates into every deals and trading in money, which legally is the reserve of commercial banks and bureau of change.

Kiir cautioned that if this trend of everybody yearning for the dollar is left to prevail, it’s likely to end up with adverse consequences for the regional economy. He urged those “obsessed” with the dollar to strive for exports of goods and services

Fast forward to 2023, and the South Sudan government is now in a difficult situation economically because of their past decisions to dollarize the economy. The East African recently published ‘South Sudan abandons US dollar for local currency’ says that “South Sudan’s government has suspended the use of the US dollar and instead directed all transactions be executed in the local currency, the South Sudanese pound (SSP), in a move feared to stifle economic activity in the war-ravaged economy.” Due to hyperinflation, the weakness in the local currency, and a civil war that ended in 2020 has destabilized South Sudan’s economy. The aftermath of the civil war which lasted for seven years killed over 380,000 people and over 1.5 million people have fled the war-torn country and collapsed South Sudan’s oil production capabilities at the same time has brought more hardship to the Sudanese people. According to the East African, “the Bank of South Sudan has banned the use of the greenback and directed that all commercial contracts be signed in the local currency.” The South Sudanese Information Minister, Michael Makuei Lueth told CGTN (China’s State run English-Language News agency) “That is a clear directive from the Central Bank that all the transactions in South Sudan must be done in our currency. So, all commercial contracts must be signed in our local currency.”

Sanctions on Zimbabwe’s Economy Led to De-Dollarization

South Sudan is following what other African Nations are doing, and that is rejecting the US dollar as an economic weapon which has failed the continent in many ways. TFI Global published an article in 2022 titled ‘Zimbabwe fast-tracks de-dollarization of its mineral sector’ explained why the sudden move:

Zimbabwe gold coins: Zimbabwe has implemented rules which allow the government to collect mining royalties partly in the form of minerals. President Emmerson Mnangagwa stated that the state is going to begin collecting half of the royalties of gold, diamond, and platinum mining in minerals to develop Zimbabwe’s reserves. The rest of the royalty would be received in cash. A government notice stated, “Royalties remitted to the Zimbabwe Revenue Authority in respect of gold and those minerals specified shall be paid on the basis of 50% in kind.” The notice further added that the royalties’ cash component would constitute 40% Zimbabwean dollars and 10% foreign currency. So, you see what did Zimbabwe just do with the American Dollar? It simply rejected it!

In 2001, the US and its European lapdogs have sanctioned Zimbabwe for its land reform program to confiscate land from minority white farmers so that they can redistribute land to landless Zimbabweans. If a government can seize land and give it to others is wrong on every level, but its an internal issue among the Zimbabweans. The US and EU imposed sanctions has caused Zimbabwe to lose more than $100 billion in investments, grants, loans from the IMF and the World Bank, and the African Development Bank (An important note to consider: the IMF or World bank are not altruistic institutions). The point is that Zimbabwe’s economy has been destroyed because of the sanctions. TFI Global explains how sanctions have caused hardships on individuals and businesses:

Now, the US and Europe have imposed sanctions on Zimbabwe for decades, which have had drastic repercussions on the economy as they restricted its access to the international financial market.

For example, the owner of Imperial Refrigeration, a Zimbabwean company, needed to import equipment for which he had to pay in US dollars. However, an American law called Zimbabwe Democracy and Economic Recovery Act (ZIDERA), prohibits international lenders from working with Zimbabwe. So, the Zimbabwean businessman couldn’t import the desired equipment. This is how the US is killing the Zimbabwean economy day by day

Two wrongs surely don’t make it right. Western sanctions on Zimbabwe had a devastating impact on the economy despite the government’s actions on land reform measures that were unfair to white farmers. However, Western sanctions have devastated the economy for everyone, both black and white.

According to TFI Global, Zimbabwe’s economy has been in a difficult situation because of its dealings with Western nations, particularly the US, “Zimbabwe has realized that relying on the West will further complicate its economic problems, hence it is employing constructive ideas and taking decisions which will end the dominance of the US in its economy” and that “Zimbabwe has set an example for all African nations looking forward to ending the US dominance in their domestic affairs.”

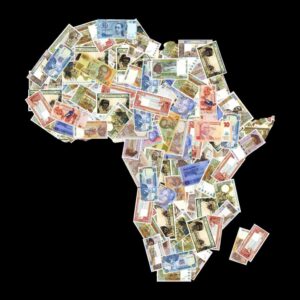

South Sudan’s de-dollarization process is just the beginning. African countries will follow what South Sudan, Zimbabwe and others have done, and that is de-dollarizing their respective economies. Libya’s President, Muammar Gaddafi who was murdered by US-backed forces on October 20th, 2011, was the first African leader in modern times to propose a gold-backed African Dinar to bypass US dollars for all of Africa, and now others are following suit. In other words, the days of the US dollar’s ‘exorbitant privilege in Africa is coming to an end.

*

Note to readers: Please click the share buttons above or below. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Timothy Alexander Guzman writes on his own blog site, Silent Crow News, where this article was originally published. He is a regular contributor to Global Research.

Featured image is from SCN