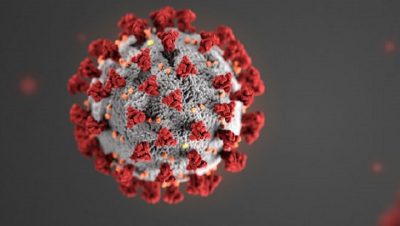

Corona Pandemic: The Perfect Scapegoat for the Financial and ‘Everything Bubble’ Market Crash: The Great Depression 2.0

Corona virus with its mysterious origin is the perfect cover up for the financial crash and the fall of Dollar as the world reserve currency. At the core of it, it is about United States’ last kick to stay as the world top power.

***

In the next few days and even months you will start hearing from mainstream corporate news, pseudo-experts (pseudo-economist, analyst, consultant), politicians, governments, world organisations and world leaders that the Corona virus or Covid-19 pandemic has caused recession and massive unemployment.

This is not an entirely false statement, because the lockdown imposed by governments has caused business and companies to shut down for unknown period which mean lost business and it is bad for the economy. But half truth is a lie. Before the occurrence of the Corona virus whose first outbreak was in November 2019 in Wuhan, China, our economic and financial systems are already heading for a crash.

IMF Managing Director Kristalina Georgieva predicts a global downturn at least as bad as the 2008 financial crisis because of Corona virus. She also suggests more easing in monetary policy (QE) and that poor and developing countries to borrow more predatory loan from the IMF?

Since the financial crisis 2008 which is also known as the Great Recession we haven’t really addressed the issue and instead worsening the situation by giving bailouts to banks and corporations. The Federal Reserve and other countries’ central banks have since implemented an endless QE (Quantitative Easing). The problem with QE is that it is simply printing money out of thin air, it is not money that is backed by value such as gold, making it a FIAT or paper money.

First in the chart below, we see how the Fed has been increasing its assets (aka printing money) especially since 2009 but stopped growing its balance sheet in 2014:

![]()

When the Fed stopped its printing in 2014, we can see from the chart below that the ECB stepped right in and carried things on until last year. Apparently not only war that has the term “proxy war”, there is also “proxy printing” between Central Banks.

A Little History of Our Monetary System

US Dollar as Global Reserve Currency is not backed by gold since 1971 when President Nixon ended the Bretton Woods system. The Bretton Woods Agreement in July 1944 set up a new global monetary standard replacing the gold standard with USD as the global currency and 1 USD is pegged to 1/35 of an ounce of gold. Other countries’ currencies are pegged to the US dollar. This Bretton Woods agreement gives USA the global dominance in world economy and gave birth to the World Bank and IMF, both are U.S.-backed organisations that would monitor the new system.

When some countries began to doubt that there were more than 35 USD per ounce of gold, the world rejected US dollar, as a result later on in 1973 USD was tied to oil commodity, which led to the birth of Petrodollar.

Not only that USD is not backed by gold, with the oil industry decline and oil price down to the lowest level in four years, the world reserve currency is in threat of collapsing as the global currency. As long as US dollar remains the world’s most demanded currency, USA can continue printing its FIAT money to fund its network of global military bases, Wall Street bailouts and other bailouts (corporations, the riches), its military industrial complex (read its weapon and arm industry) and tax cuts for the rich.

Then there is also the fractional reserve in banking that only creates more bubble as bank is required to only have 1/10 of the total money it lends. For example, if bank A has a million dollar, it can lend 10 millions to bank B, which can lend 100 millions to a country, since bank B owns 10 millions. This is the fraudulent practice of our monetary system. Not only the bank will get all its money back, bank also charges interest on this ‘fake money’ loan.

The ‘Everything Bubble’ Market

The Fed’s Quantitative Easing Monetary Policy cause an excess amount of money circulating in the market that is used to speculate in the financial market from speculation in the derivative financial instruments and share/stock buybacks.

This graph below shows that there is a linear correlation between the increase in the Fed’s Balance Sheet and the increase in S&P 500 index. Thus supporting the argument above.

For x % growth in stock market, The Fed Balance Sheet also grows x %. This means that the rise in stock market doesn’t reflect its fundamental values, but just a hype because of too much money flowing in the market because of the Fed’s QE (Quantitative Easing).

The graph shows that the increase in S&P 500 Index doesn’t reflect the real profit margins, confirming the bubble in the stock market. Source: Real Investment Advice

To summarize, the stock market is ‘inflated’ and the US economy has been stagnant at 2% growth annually since 2000 but at the contrary US’ debt has increased significantly as shown by the graph below.

Source: RIA (Real Investment Advice)

The other bubble in financial market is the Fed’s bailouts from money printing to the repo market, the banks, the hedge funds, etc. As the Fed’s Balance Sheet and total US’ Debt increase enormously from its projected path hadn’t it suffered the 2008 financial crisis, USA is at risk of default or bankruptcy as the US’ debt now sits at 23 Trillion dollars. The huge burden of debt and its interest payment caused by the ‘economic financial bubble’ created by the Fed by its ‘printing money’ policy to bailout the elites led to a serious potential decline of USA as the top economic power and putting the US dollar as world reserve currency at risk.

Source: Zero Hedge

How Covid-19 Pandemic Fits Into All of This : ‘Kill Two Birds with One Stone’

As the financial collapse is inevitable as the Federal Reserve can’t keep printing money and creates more bubbles that at some point definitely will pop, the Covid-19 pandemic provides the global elites with the perfect scapegoat where it will be blamed (and it already started) for all the economic and financial crisis, for the massif layoffs, and the economic depression. The timing could not be more perfect, the ‘Black Swan’ event needed to cover up all the fraudulent schemes in how our world operates. In the meantime it also provides the distraction needed to blind the masses so they can’t realise and understand what is going on and what has been done to them all this time, of the fraud and plundering done by the banks, corporations and our global elites as the people are busy handling the pandemic and are afraid for their lives.

Corona virus pandemic will also be used to further the global elites’ agenda while plundering of the middle and poor class and more massif amount of transfer of wealth is ongoing. Because for the global elites it is “Never let a good crisis go to waste”.

Not only that the virus pandemic provides the right excuse, scapegoat and cover up for the economic and financial crash which is going to be worse than the 2008 “Great Recession”, it also attacked severely China and Iran, two countries USA perceives as enemies. It also caused huge number of deaths in Italy, the only and the first country in EU to sign China’s Belt and Road Initiative. With the mysterious origin of the corona virus is Covid-19 pandemic “Killing Several Birds with One Stone” strategy?

It seems the Cold War is not over yet. From the no winner of the US-China Trade War, it seems to step up to a Biological War if the corona virus is deliberately unleashed to attack a country or certain countries. But like any other bio warfare, it can spread and resulted in collateral damage as the virus is now spread to almost all over the world and more than half the world population is now under confinement.

While most of the world is figthing the virus pandemic, the battle for world hegemony continues as the global superpower will do everything it can to stay at the top and attack any country it considers as threat or enemy. At the core of it all, it is about United States maintaining its hegemony as the world top power and maintaining its currency as the world reserve currency.

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

This article was originally published on Indonesia Merdeka.

Sianny Rooney is an essayist, inquisitive world citizen and an entrepreneur.

Featured image is from Health.mil