|

All Global Research articles can be read in 51 languages by activating the “Translate Website” drop down menu on the top banner of our home page (Desktop version).

To receive Global Research’s Daily Newsletter (selected articles), click here.

Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

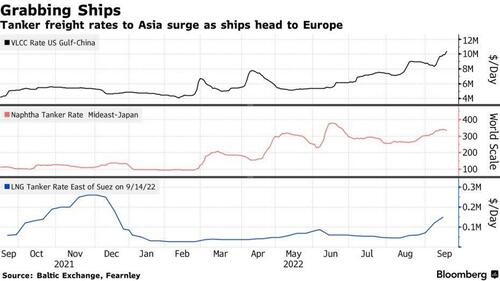

The unilateral sanctions that Western countries unleashed on Russia have caused energy supply disruptions and energy hyperinflation across the world. Europe is rejiggering its energy supply chain away from Russia as it sources energy products elsewhere. EU countries are scrambling for tankers to import energy products from abroad, which has led to a surge in global tanker shipping rates.

Since slapping Russia with sanctions, the West has realized that global supply chains are fragile. Even before the Ukraine war, supply chains struggled due to uneven Covid economic recovery, trade war conflicts, and increasing geopolitical risks.

As such, the decision to rejigger Europe’s entire energy supply chain away from Russia amid all the chaos in the world has created a shortage of vessels to carry essential fuels to energy-stricken regions this winter.

Bloomberg reported that Europe is importing liquefied natural gas, diesel, and crude from far away regions that keep tankers in transit for extended periods and delay return to service for other critical shipping lanes. Shipping experts warn this is sparking the latest surge in global tanker freight rates.

LNG freight rates are at elevated levels for this time of year and threaten to surpass last year’s winter peak. The cost of shipping a US oil cargo to China is at the highest since 2020, while transporting a cargo of naphtha petrochemical feedstock from the Middle East to Japan costs more than twice as much as it did in March, according to data from the Baltic Exchange.

The ship shortage threatens to impact Asian economies that import oil and gas from the US, as they may find it difficult to get spare cargoes at short notice if the weather turns extremely cold this winter, said traders and shipowners. Even petrochemical feedstock shipments are becoming more expensive to transport, further burdening buyers grappling with sluggish demand for chemicals as the pace of manufacturing slows.

Concerns are growing that the limited availability of LNG vessels this winter may cause cargo disruptions.

Shipowners are demanding LNG carriers back to the Freeport facility in Texas ahead of restarting operations in November after a fire shuttered the plant in early June.

“What we’ve seen in shipping this year has been remarkable as a result of the war in Ukraine,” said Peter Sand, chief analyst at Xeneta, a freight market analytics platform.

Western sanctions on Russia is the culprit behind energy chaos worldwide and soaring tanker rates, and risks increase of limited ship availability to hire this winter. What a mess this has become.

*

Note to readers: Please click the share buttons above or below. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Featured image is from Oilprice.com

|