U.S. Oil and Gas Companies Set to Make Tens of Billions More from Wartime Oil Prices in 2022

All Global Research articles can be read in 51 languages by activating the “Translate Website” drop down menu on the top banner of our home page (Desktop version).

To receive Global Research’s Daily Newsletter (selected articles), click here.

Visit and follow us on Instagram, Twitter and Facebook. Feel free to repost and share widely Global Research articles.

***

With oil prices rising to near-record levels due to Russia’s ongoing war in Ukraine, companies producing oil and gas in the United States are in line to make tens of billions in additional profits. Using Rystad Energy’s UCube database — a database that tracks the industry’s production economics at the well level — we can get an insight into how much money the industry is set to earn simply as a result of this massive price spike. Under conservative estimates, we find the U.S. upstream oil and gas industry will collect a windfall of $37 to $126 billion in 2022 alone.[1]

Before the most recent phase of Russia’s war against Ukraine began, the forecast oil price for 2022 used in Rystad Energy’s upstream database was $70 per barrel, in line with the U.S. Energy Information Administration’s December 2021 assessment.[2] On March 9th, Rystad updated its 2022 oil price to $88 per barrel. But oil prices could remain elevated if Russia’s supply is severely curtailed, represented by the $120 case. Some analysts believe that prices could even hit $200 per barrel this summer.[3] We ran two scenarios comparing the pre-war price of $70 per barrel with the updated base case of $88 per barrel and a high case of $120 per barrel. These scenarios also include similarly higher gas prices in their analysis of companies’ cash flow.

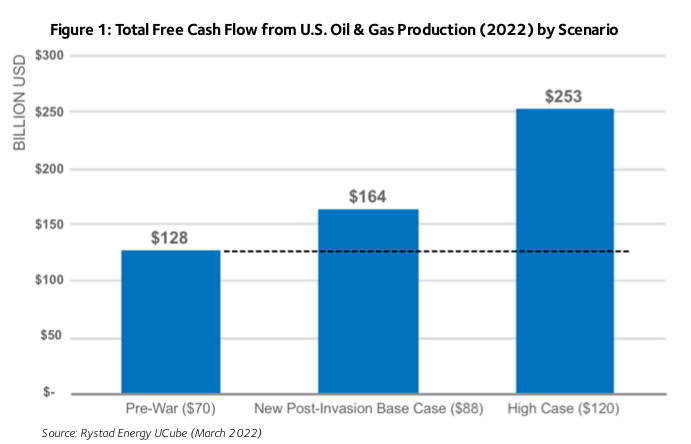

We found that the U.S. upstream industry is in line to earn an additional $37 billion if the current base case ($88) holds. If prices spike this summer and the 2022 average is closer to $120, earnings could soar by $126 billion compared to the pre-war case. Total projected free cash flow for 2022 would nearly double from $128 billion in the $70 scenario, to a potential $253 billion in the $120 scenario.

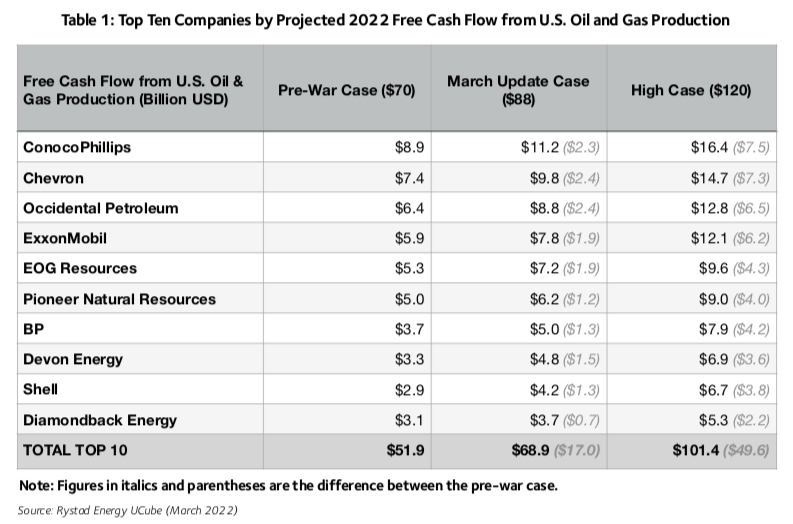

We also looked at the top ten earners. ConocoPhillips, Chevron and Occidental lead the pack with the potential to earn an additional $6.5 billion to $7.5 billion each if prices average $120. Together the top ten could earn additional profits just shy of $50 billion.

Oil executives have recently signaled that high oil prices may not lead to a rapid increase in domestic production.[4] U.S. production is still quite high historically but is recovering from the Covid-19 downturn in oil demand,[5] and U.S. drillers do not have the ability to immediately spin up new production. What’s more, pressure from Wall Street to impose “capital discipline” could lead these companies to pocket the gains from these high prices and return them to investors via dividends and buybacks.[6]

Much of this excess free cash flow that is boosting oil corporation balance sheets is flowing from the pocketbooks of U.S. consumers. It is only right for Congress to pass a windfall profits tax and return some of these profits to consumers, as Sen. Sheldon Whitehouse and Rep. Ro Khanna recently proposed.[7] Despite misleading talk of “energy independence” from some politicians, the U.S. can’t drill its way to lower gasoline prices. Thanks to the lifting of the crude oil export ban in 2015, U.S. drillers are fully integrated with the global market; when crude prices increase globally, they also increase in the U.S. Booming U.S. exports of liquefied natural gas (LNG) also tend to drive up domestic gas prices.[8]

If Congress had taken decisive action on climate change at any time in the last three decades the U.S. economy would be more insulated against oil shocks, and would be enjoying the benefits of a renewable-powered economy that is healthier, more affordable, and more just. The answer to high gasoline prices is not to triple-down on a failed system.

*

Note to readers: Please click the share buttons above or below. Follow us on Instagram, Twitter and Facebook. Feel free to repost and share widely Global Research articles.

Notes

1 See Methodology below for methods and definitions.

2 U.S. Energy Information Administration. December 2022. Short-Term Energy Outlook. https://www.eia.gov/outlooks/steo/archives/Dec21.pdf

3 Reuters, Goldman hikes crude price forecast, Barclays and Rystad warn of $200 oil. March 8, 2022. https://www.reuters.com/markets/europe/ goldman-raises-oil-price-forecasts-russia-supply-shock-2022-03-08/

4 Paraskova, T. 2022. High Oil Prices Aren’t Enough To Tempt Shale Producers. Oil Price, March 1. https://oilprice.com/Energy/Oil-Prices/High-Oil-Prices- Arent-Enough-To-Tempt-Shale-Producers.html

5 U.S. Energy Information Administration. Crude Oil Production. https://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_m.htm

6 Stevens, P. 2022. Oil producers in a ‘dire situation’ and unable to ramp up output, says Oxy CEO. CNBC, March 8. https://www.cnbc.com/ 2022/03/08/oil-producers-in-a-dire-situation-and-unable-to-ramp-output-says-oxy-ceo.html

7 Sheldon Whitehouse Press Release, March 10, 2022. https://www.whitehouse.senate.gov/news/release/with-gasoline-prices-sky-high-whitehouse- leads-democrats-in-introducing-curb-on-big-oil-companies-engaged-in-profiteering-to-provide-relief-at-the-pump

8 Nalley, Stephen, Acting Administrator of U.S. Energy Information Administration, Statement before the U.S. Senate Energy and Natural Resources Committee, November 16, 2021. https://www.energy.senate.gov/services/files/9E0CF3E9-FD05-4010-BDF5-30E2D04D3ECC