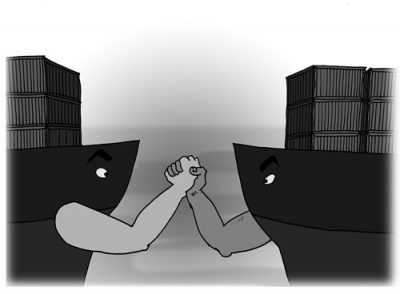

Trump’s Trade War Measures Hit the Financial Markets

Financial markets around the world fell on Friday as a result of the shock wave from US President Trump’s surprise announcement Thursday that he intended to impose a 10 percent tariff from September 1 on a further $300 billion worth of Chinese goods.

The announcement has added to concerns that the escalation of the US trade war against China will exacerbate the downward trend in global economic growth. The result was a rush to security in the financial markets, lifting the price of government bonds and sending bond yields down.

This movement was most pronounced in Germany, where the yield on 30-year government bonds went into negative territory for the first time in history. For a brief period, yields across the entire market were below zero.

There was a continued sell-off on US markets, with the S&P 500 stock index recording a fall for the week of 3.1 percent. The yield on the benchmark 10-year US Treasury bond continued at below 2 percent.

Since the launching of the trade war more than a year ago, Trump has continued to escalate US attacks while negotiations with the Chinese have assumed an on-again, off-again character. This latest measure, however, coming after Trump and Chinese President Xi Jinping agreed to a truce at the end of June and the resumption of talks, could mean a complete breakdown.

Further discussions were scheduled for next month in Washington following talks between the two sides in Shanghai this week. But there are growing doubts as to whether they will proceed.

Figures released by the Commerce Department Friday show the significant impact of the conflict so far. US imports from China fell 12 percent in the first six months of 2019 compared to a year earlier, while US exports to China dropped by 18 percent. The total bilateral trade in the first quarter of the year fell below the levels with Canada and Mexico—the first time that has happened in more than a decade.

Responding to Trump’s latest move, China’s commerce ministry said it would “have to take necessary countermeasures” if the tariffs went ahead. It added that Trump’s announcement “seriously violates” the agreement reached between the US president and Xi.

No decision has been made on whether China will attend the September talks, but the issue is clearly under active consideration. Asked about whether the current plan would go ahead, a foreign ministry spokeswoman, Hua Chunying, said,

“We believe the ball is currently in the United States’ court. At this time the United States must demonstrate sincerity.”

In its analysis of the latest turn in the trade war, the South China Morning Post said China was facing a make-or-break decision over the next month: either to walk away from the negotiations or make major concessions to the US side.

The chief economist for Citigroup Capital Markets Asia, Li-Gang Liu, cast doubt on whether the September talks would go ahead.

“When negotiations collapsed in May, [Vice-Premier] Liu He still flew to Washington to talk. It’s hard to imagine that China would do it again if Trump is determined to raise tariffs,” he told the newspaper.

Speaking yesterday, Trump gave every indication he is determined to go ahead.

“China has to do a lot of things to turn it around,” he said. “Frankly, if they don’t do it I could always increase it very substantially.”

The latest escalation against China, coming just one day after the holding of talks described by the US side as “constructive,” takes place amid indications of a broader shift in the economic agenda of the White House in the direction of currency warfare.

This was indicated by Trump’s response to the decision of the US Federal Reserve to cut interest rates by 0.25 percentage points on Wednesday. Trump had railed against the Fed for not cutting rates, claiming that Wall Street’s Dow Industrials stock index would be 10,000 points higher but for the Fed’s policies.

However, there now appears to be a shift of emphasis.

“What the market wanted to hear from [Fed Chair] Jay Powell and the Federal Reserve was that this was the beginning of a lengthy and aggressive rate-cutting cycle which would keep pace with China, the European Union and other countries around the world,” Trump said after the Fed’s latest decision.

Trump was referring to the moves towards easier monetary policies internationally—especially by the European Central Bank, which is expected to move significantly because of lower euro zone growth. Such policies tend to push up the value of the dollar. The effect of the increased valuation is to make it more difficult for the US to compete in global export markets while lessening the impact of US-imposed tariff measures.

A further sign of a turn in the direction of White House policy was provided in an interview on the business channel CNBC with Judy Shelton, a Trump nominee to fill one of two vacant positions on the board of the Federal Reserve.

Shelton said central banks in Europe. China and Japan were all devaluing their currencies through their monetary policies and the US should do the same. The official policy of the US is that it favours a strong dollar and the position of all governments and central banks is that monetary policy must not be used to target the currency. But, as with the use of tariffs, the prohibition on this form of economic warfare is being undermined.

“I don’t think that we should make it harder for our own manufacturers to compete domestically against imports from other countries where they have resorted to cheating really, through currency devaluation, to make it look like they’re offering the same thing at a better price,” she said.

In a warning of where international economic relations are heading, Shelton likened the present situation to the “beggar thy neighbour” policies of the 1930s. The outcome of that economic conflict was the eruption of the Second World War in 1939.

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.