|

One purpose of the show staged by Washington’s political establishment every four years, called “election campaign”, is to demonstrate to the world that the American people democratically decide on the future course of their country.

Nothing could be further from the truth.

The decision being made on Tuesday November 8, will only supply the answers to the following three questions:

- Who will be Wall Street’s CEP (chief executive politician) occupying the Oval Office until 2020 in the service of major banks, hedge funds and other financial organizations?

- Who will be in charge of diverting the American people’s attention away from their real problems by engaging in all sorts of sham battles? And last but not least:

- Who will be responsible for ideologically preparing Americans for further wars through targeted manipulation?

The political differences between the candidates only reflect the different points of view presently prevalent in the financial industry. In dealing with Russia and China, for example, Hillary Clinton plans to continue a policy of confrontation and preparation for war, while Donald Trump has obviously decided to follow the course laid out by Zbigniew Brzezinski (right) in his April 2016 paper ‘A New Realignment’. The political differences between the candidates only reflect the different points of view presently prevalent in the financial industry. In dealing with Russia and China, for example, Hillary Clinton plans to continue a policy of confrontation and preparation for war, while Donald Trump has obviously decided to follow the course laid out by Zbigniew Brzezinski (right) in his April 2016 paper ‘A New Realignment’.

In it, Brzezinski insists that the US should definitely hold on to its status as the world’s leading power, but acknowledges the fact that it has lost part of its economic strength and can only maintain its role as the world’s hegemon by avoiding a major military conflict with Russia or China.

This strategy by no means signals a turn towards a more peaceful policy. Quite the opposite, a realignment with Russia and China would allow the US to concentrate all their military power on another conflict, which currently has a high priority for Wall Street: The war in Syria.

Contrary to what is being reported in the mainstream media, the US government is not undertaking any measures to end this war. Actually, Washington is doing everything in its power to deepen and widen the conflict, not only because of Syria’s strategically important position (which ignited the conflict), but also for another reason that has become of vital interest to the US financial industry during the past two years.

A Huge Problem for Wall Street: The Oil Price

For several years now the US has attempted to become a global market leader in the oil business and gain independence from oil and gas imports by furthering its shale industry. In the beginning stages, the method of fracking was hardly competitive with classical techniques of oil extraction. However, as technical progress made this mode of production more and more profitable, several hundred large investors developed interest in the business and provided loans of hundreds of billions of dollars to the shale industry.

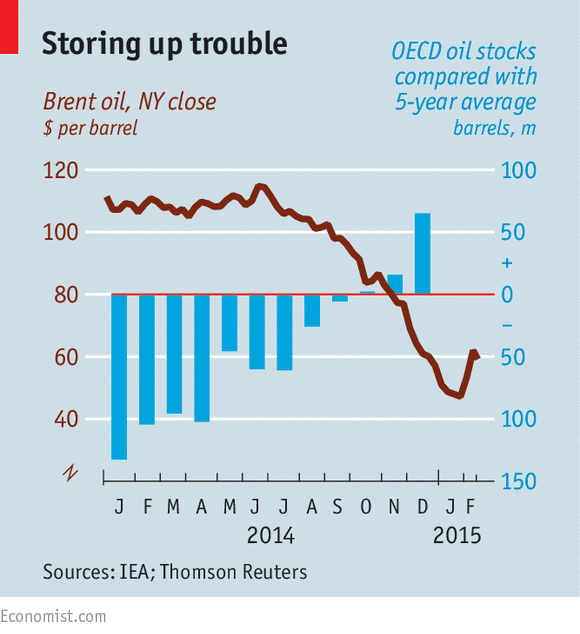

By now it is clear that most of this investment was based on a massive miscalculation. The oil price has fallen by more than 50 % over the past two years. Although production costs in fracking have been significantly reduced, the price, which has been floating around $ 45.00 for months now, is not nearly enough to generate the profits needed for the shale industry’s survival.

Between January 2015 and July 2016, 90 oil and gas producers have already gone bankrupt and left behind more than $ 66 billion in debt. Since these loans were most certainly reinsured through credit default swaps, they must have left considerable holes in the balance sheets of major US banks.

When the rest of the loans come due at the end of this fall, creditors will be facing enormous problems, as the world economy remains stagnant with no improvement in sight. Above that, the present price of oil is itself the product of massive manipulation: Producers have hired fleets of tankers that are filled to breaking point and storages are almost bursting at the seams. Contrary to media reports there is no chance that production will be significantly cut in the near future, due to the fierce competition between the producing states, some of whom are themselves on the verge of bankruptcy.

The Financial Industry is already preparing for War

By the end of the year the US financial system could thus be threatened by a crisis approximately the size of the Dotcom bubble. However, sixteen years later and eight years after being artificially propped up after the fall of Lehman Brothers, the financial system is more instable than ever. The Fed has pumped trillions of dollars into the system and its interest rate is close to zero. Risk exposure in the derivative markets is at record levels, and excessive speculation has led to huge bubbles in the bond, stock and real estate markets. In an environment like this the problems of the shale industry could very well become the spark threatening to blow up the financial system.

Thus Wall Street finds itself in a position in which an increase of the price of oil is more urgent than ever. However, being unable to jack it up by furthering demand, reducing production or stepping up manipulation, there is only one option left and that is the escalation of the war in Syria and the destruction of a large number of oil wells in the Middle East.

There are indications that a decision has already been made behind the scenes. For one thing, the oil price is above all determined by future contracts. That price being higher than the market would actually suggest, points to big investors expecting a rise in demand. If one takes a look at US shale junk bonds, one will see that there has not only been a rise in demand, but almost a run on these bonds over the summer. For example, PDC Energy whose creditworthiness is four levels beneath ‘creditworthy’, were offered $ 1,5 billion for bonds worth $ 400 million. Also, premiums on credit default swaps for junk bonds have fallen by 30 % since February. Strategists at the Bank of America Meryll Lynch called the summer of 2016 “one of the best as far as high-yield foreign-funded loans were concerned.”

Both Hillary Clinton and Donald Trump know what the financial industry expects from the next President of the United States. That’s why there are three issues in the ongoing election campaign that the two of them entirely agree upon: The ‘war on terror’, the ‘struggle against radical Islamists’ and the ’destruction of Isis’. All three slogans are nothing but a pretext for putting a fuse to the oil keg, which is the Middle East.

Neither Trump nor Clinton will ever mention the fact that America’s allegedly biggest enemy recruits big parts of its membership from organizations like Al Qaida, Al Nusra and the Free Syrian Army that, for some time, have been supported and supplied with money and weapons by the US.

None of the two will ever mention that no radicalization of Muslims would have occurred had the US and their allies not destroyed whole countries like Afghanistan, Iraq, Libya, and Syria and brutally terrorized their population. And neither Trump nor Clinton will ever mention that the coming escalation of the war and the human catastrophe it brings with it will be caused for one single purpose only: To once more satisfy the insatiable greed of Wall Street.

Instead, both candidates will use the last three weeks of their campaign to unanimously spread the lie that the United States’ security depends on the ‘War against Terror’ and thus demonstrate to the world that both of them are exactly what their predecessors in the Oval Office were: humble and willing servants of Wall Street.

Ernst Wolff is a freelance journalist and the author of the book ‘Pillaging the World. The History and Politics of the IMF’, published by Tectum-Verlag, Germany.

|