|

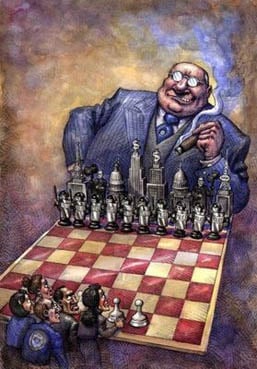

There has been a bit of brushing under the carpet of late. While headlines are filled with banter, a lawsuit against five major banks, labeled the Cartel, was finalized and for the most part, the news scrubbed.

UBS, Citigroup, JP Morgan, Barclays and The Royal Bank of Scotland are required to ante up $5.7 billion in fines for currency manipulation. And while this slap was a significant one, it was still a mere slap. No one was charged with criminal activity, no one individual was called out despite a comment made by one trader at Barclays, “If you ain’t cheatin’, you ain’t trying.”. Which pretty much sums up the ethic. A further penalty interred by the Feds was a promise that they wouldn’t do it again…, as well as a promise to cease all criminal activity. WOW!

I bet Bernie Madoff is fuming!

In addition to the Federal fine, The Federal Reserve Bank has imposed its own fine in the amount of $1.6 billion. Given the Federal Reserve Bank is a private banking system, I found this a bit odd given they were not a named party in the lawsuit. In fact they only joined the investigation later in the game, but there was never any formal lawsuit filed. So why does The Federal Reserve get to assess penalties?

And, where does the money go? That’s the billion $$$$ question that has no simple answer.

We do know that rarely does it go to pay restitution to the victims. Victims are required to file a civil lawsuit. So according to the Sarbanes-Oxley Act of 2002, the money is supposed to go into a “Fair Fund”. Some of the fines go back to the regulatory agencies for other investigations or to the Consumer Financial Protection Bureau, or to the Civil Penalty Fund, or to the Treasury Department. In this case, given the enormity of transactions in currency, which is said to be a $5 trillion per day market, I doubt that there are individuals that can be identified as having been victimized. Which means the money, if actually collected, will be spent however the Treasury wants…

But that still begs my curiosity as to why a private banking system would be a party to the receipt of hefty penalties? If the job of the Federal Reserve Bank is to safeguard all banks, and they failed at their job, shouldn’t they be sued as a party WITH UBS, Citigroup, etc…? According to their job description, it is their role to act as the Central Bank for all others. On the other hand, if the Federal Reserve is acting on behalf of the US government, then why would the US government be entitled to a penalty? Shouldn’t it simply pass to one entity? It would seem that the Federal Reserve is actually benefiting by claiming they are 1) private and entitled to their own penalty, and at the same time, 2) an agent for the government acting on their behalf.

You can’t be both. At least not in the real world.

The operations of the Federal Reserve include: formulating and conducting monetary policy, executing spot and foreign foreign exchange transactions in foreign currencies, warehousing foreign currencies, maintaining liquidity swap lines, and monitoring the collaboration of all central banks. Any ‘excess earnings’ are required to be transferred to the US Treasury. In addition, under Section 29 of the Federal Reserve Act, collected fines and penalties are remitted to the US Treasury. So they receive ‘additional’ fines and penalties and turn around and remit them back to the same agency – the US Treasury that initiated the lawsuit. In the world of private business this would be considered a conflict of interest, the circular passing of revenue. The penalties recovered by the Federal Reserve are defined as ‘civil penalties’ but are then remitted to a government authority. A bit odd.

A search in the US Treasury notes that in 2104 the government collected total penalties of $1,209,298,807. Of 23 assessments, the largest penalty was assessed against BNP Paribas SA in the aggregate amount of $19,272,380,006. They settled for $963,619,900 for violations of Sudanese Sanctions, Iran Sanctions, Burmese Sanctions and Cuban Asset Control Regulations. In 2015, PayPal was convicted of compliance issues with regard to transactions totaling about $43,000. They were fined $7,658,300 by the US Treasury Department. Don’t mess with Uncle Sam! YIKES!

But the fines and penalties collected by the government are not just from banking, they are widespread. In 2012, big pharma companies paid over $5.2 billion in penalties. Most of the charges involved kickbacks for promotion and prescription of various drugs. Interestingly, it would appear that the penalties do not deter the crime given the same crime accounts for nearly all the penalties spread over a hand full of pharma’s. Not all the penalties remit to the government, but a sizable portion do. Penalties are the new big business. In 2013, the Justice Department announced it collected over $8 billion in civil and criminal penalties. Do they use it to pay down the deficit? Nah.

While the case against the banks has been finalized regarding currency manipulation there is still the outstanding charge of violating sanctions which has yet to be settled. More money for the Treasury! None for the people.

Notes:

http://www.cnbc.com/id/102377305

http://www.latimes.com/business/la-fi-banks-criminal-fines-20150521-story.html

http://www.treasury.gov/resource-center/sanctions/CivPen/Pages/civpen-index2.aspx

http://en.wikipedia.org/wiki/List_of_largest_pharmaceutical_settlements

http://www.justice.gov/opa/pr/justice-department-collects-more-8-billion-civil-and-criminal-cases-fiscal-year-2013

Helena Glass is a blogger and sculptor, who formerly worked as Finance Director for a Financial Planning and Wealth Management company. Growing up in Germany, Helena had the opportunity to see much of Europe before her father was stationed back to the Pentagon in Virginia. Her father’s daughter, she does extensive research to unravel truth from the false reality that has infested our media.

www.helenaglass.net

www.helenaglass.com

Email: [email protected]

|