|

Precisely ten years ago (to the day), in its second bulletin of February 2006[1], warning about the imminent explosion of a «global systemic crisis”, the GEAB based its opinion on the identification of two strong signs: the end of the publication of the M3 money supply indicator[2] (suggesting a start to unusual degrees of the famous “money printing” which everyone has spoken about ever since); and the Iranian oil bourse launch – a country not yet constrained by international sanctions at the time – but a stock market based on the Euro[3]. These two strong signs enabled the GEAB team of that time to say that something big was about to happen, something which was going to bring into question the foundations of the system in which the economic-financial world was living at the time: the petrodollar and money-debt system.

Regarding the money supply, things have revolved around this subject for ten years. The initiation of this “money printing” operation, which the Americans had hoped to be discreet by ceasing the M3, had soon to be formalized via the Fed’s massive Quantitative Easing[4], and then even stopped, first relayed by the allied QE operations (about to slow down quite quickly, as well – an anticipation made by our team for six months now). End of the attempt to artificially maintain the dollar’s supremacy via the global dollar flood, and end of the system of indebtedness as a growth engine.

Regarding the sale of the Iranian oil in Euros, a major attack by a “non-aligned country” on the petrodollar system, it is particularly interesting to look at the following sequence: the announcement made by Iran regarding the launch of this oil bourse in petro-Euro early 2006, the start of the international sanctions against this country in July 2006 causing the partial abortion of the project, then the huge attacks against the Euro through Greece from 2009 on[5], which allowed the dollar to come back to light after its tarnishing of 2008. It is even more interesting that the Greek debt crisis (although still unresolved) is finally being put aside by the media, that immediately after being freed from the sanctions Iran announced the sale of its oil in Euros … and that the next day Deutsche Bank is attacked from all sides.

One of the early assumptions we made, you may remember, is that the real “game-changer” for world supremacy of the dollar is actually the Euro. For the Euro was obviously the first currency to compete directly with the only international reserve currency status of the dollar. And when we look back for once at the sequence of the events mentioned above, one can not help thinking that the real war that took place over the past decade has been a war between the United States and Europe. A war during which the yuan, the BRICS, the New Development Bank and any alternative system to the Western system, have been quietly advancing, while the West was silently being torn a part[6].

Apparently all resistance to change is futile. Is that so…

If we were to compare what happened in 2007-8 when the crisis officially began, and this new episode which is worrying the financial world so much, a picture of the crisis of ten years is imposed upon us: the values fall experienced at the beginning of the crisis were huge, and the system was completely close to collapse. In a way, the collapse process seems as if it had been stopped just before touching the ground. Thus, it did not really break: an aborted crash somehow.

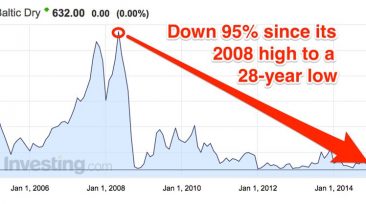

Baltic Dry Index 2006 – 2014 – Source: Business Insider[7]

And the fact is that at the time, nobody was interested in having the system broken, simply because nothing was close at hand to replace it. So: image freeze… for ten years.

Ten years during which everyone has been working hard… for better and for worse: the Chinese have refocused their economy and prepared for the inevitable transition from their world fabric status to the full-fledged economic power; the BRICS got organized and created new tools for funding mechanisms and international governance; Obama’s US helped unlock big locks planted by George W. Bush’s US (starting with the sanctions against Iran); the Russians have positioned themselves as a geopolitical counter-power; the United States of the Pentagon withdrew from many places in the world but progressed on European territory, considered as another “backyard”; the financial powers have blocked most regulatory projects that were likely to affect them… but not all of them (actually, they still lost a lot of their superb status). As for Europeans, the Euro resisted and the EU-US decoupling has still been increasing, even if a real governance of the area is still pending (… on the British referendum, as discussed further on), as well as the European common defence.

In short, eight years ago the system could not break without dragging the entire planet into a gigantic catastrophe, but today we can consider that many things are ready to “receive” the global economy as soon as the old system covers the last centimetres that separate it from the ground and the crash.

Apparently this final crash is currently underway.

The inevitable Western banking crisis, due to the shock of collapse of the oil price in dollars, is shaking the financial world. It started in China, but, as we extensively explained in our previous edition, what was shaking in China was not at all specifically Chinese: it was the Chinese part of the famous Western-centred financial system… and actually it’s already escalating to Europe.

That said, our team believes that the psychological shock (risk of government and social panic) is the most dangerous component in this banking crisis. Basically, the delusional and totally artificial valuations of the markets and banks, key players in the past financial system, one day must deflate in order to finally restructure the corresponding huge debt and have the economy restart. Besides, the giant financial power must be weakened so that governors can finally take full control of things – hoping they will continue to rule in democracy. Otherwise, this takeover by politics could end up in the pockets of the military…

Our team wishes now to further decode the forces of the global systemic crisis which gives an interesting vision from the anticipatory perspective.

When the masters of the twentieth century grounded on the shore of the 21st century, they quickly understood the new horizons opened by the emerging powers. The former “third world” – then became “developing world”, now called “emerging world” when it is actually already well “emerged” – was unfolding before their dazzled eyes. Particularly the United States, but also Europe, as a dominant club until then, rubbed their hands at the idea of a prodigious market opening at their feet.

At that point, the entire Western economy got involved body and soul into a general project of wondrous investment in order to prepare for a huge overwhelming demand. To do so, companies have come up with enthusiastic and very convincing result forecasts to obtain bank funds necessary for their new scaling. The loans were approved, convinced of a forthcoming return. Billions and billions of dollars have been printed by private banks, creating an exorbitant digital wealth based on anticipated valorisation, which nobody doubted would become real.

Let us dwell for awhile on the fundamental monetary crisis induced by that very behaviour. Everyone knows that the dollar as a currency of the second half of the twentieth century turned from a gold-supported currency to an oil-supported currency. Furthermore, the “financialisation” actually pushed it to a new stage: “the anticipated value-currency”. Indeed, when a private bank creates money to finance a project, it anticipates that this advance will create the forecasted wealth. Thus the currency remains connected to the economic reality. And the fact is that within a regularly growing economy, money actually remains money.

But, if at any time in history, delusional optimism seizes an economic system further to a false anticipation of global-scale, money becomes debt, “real debt” this time.

Well this is what has happened in 2005, and this brings into question the monetary system as it existed, as long as debt-money mingles with real money.

Indeed, the problem of the West was its failure to understand that new markets would also correspond to new competition, and that not only its own companies would benefit from the windfall, perhaps even the opposite would happen. This masterful anticipation error initially came out in 2007, and the subprime crisis was the small end of the chain of the financial system: the individuals who had been granted very easy personal loans in the wild enthusiasm based on the general economic outlook. Eight years later, it’s the other side of the chain which is catching fire: all the economy generated from this indebtedness collapses and banks, through which the crime appeared, are finally forced to admit the unreality of their value. The crisis of the CDS and of all those products that have facilitated the excessive lending process since the end of the last century, appears now to be in smoke: evaporation of ghost assets, as anticipated by the GEAB a long time ago … ten years to get there, ten years to finalise a crisis.

This description may seem frightening. Nevertheless our team continues to think the following: the “hard-landing” is primarily a beneficial “landing” even if some categories of players will leave their skin there; the world has had ten years to prepare for this outcome, which is also a solution; the banks will probably not be in default or very few will be, because the states or supra-state entities are in position now to regain control of things, contrary to ten years ago; many indicators will turn red but new indicators, already in the green, are starting to emerge; new economic dynamics (especially the whole internet-enabled collaborative economy) are already there and political systems, in command again, will not be long to find, mentor, recognize, tax them and recreate collective wealth, etc.

There will be collateral damage: by simplifying, our team is tempted to think that the “very big ones” will particularly suffer, because everything which is very big is also extremely indebted.

The oil/shale gas industry is a typical case of this debt madness: the peak oil theory in the early twenty-first century has dangled the idea of an oil price explosion which, mathematically, seemed inevitable, justifying the staggering investments based on assumptions of miraculous results. We have already seen that the ‘invented’ oil reserves are being gradually removed, since they will never be pumped; yet, they have been reported in corporate balance sheets (as a loan) and in those of the banks – evaporation of ghost assets.

Last month we anticipated serious difficulties in powerful sectors like arms, for precisely the same reasons: sin of pride, “we will cover the planet with our arms”; we will see in this issue that all the freight transport industry is in danger; we will see in the next issue that the construction sector currently valuing profits of billions in the emerging countries are making false anticipations[8]. We have also been convinced for some time now that Monsanto and other small agro-business chemists will be in big trouble… under the blow of the COP21’s effects, and by the new political control of the world.

As we have said before, our real concern is and remains the question of the democracy in this taking over by the politics. Whom will the politics serve? Order or well-being?

Notes:

[1] Source: LEAP (old website), 15/02/2006.

[2] Source: Federal Reserve Bank of Saint Louis, 13/03/2006.

[3] Source: The Trumpet, 12/2005.

[4] Source: The Market Mogul.

[5] Source: Wikipedia.

[6] Obviously the « NATO-ization » of Europe started in 2014 should be viewed with the same glasses.

[7] We will speak of this later on, but this index is about to fall below 300, a 50% fall compared to the last currencies … which is nothing compared to its fall from 11,000 to 600 in 2008… but they are the last centimetres before the bankruptcy wave.

[8] Source : Les Echos, 03/07/2015

|