New Economic Alliances. Does China have an Option? The Role of Gold

As an addendum to yesterday’s writing, today we should tie together the new alliances and what appears to be Western defections toward the East. Just overnight, Australia also applied for membership to the AIIB, a U.S. rebuke is sure to follow, who is next? With this in mind, it is my belief the Chinese will be the key player in the gold market and the “pricing” of gold in the future. In turn they will gain even more financial strength because of the massive amounts they have already accumulated. As a side note, do you believe it is by mistake China is now the largest gold producer in the world? I think not. I will give you my theory first, then work my way toward supporting it.

Very simply, I believe China will fare poorly when the paper and derivatives markets around the world collapse. They have a very over levered real estate market to which many of their banks and “shadow banks” have lent to and have exposure. Their real economy and manufacturing will suffer as global demand drops further because of economic depression. It won’t be “pretty” but they will survive and eventually thrive. Why? Because undoubtedly, China is working toward the yuan becoming “a” reserve currency and given time, “the” reserve currency. My theory is this, China, even though they are probably willing and plan to eventually re mark gold much higher than where it trades today, will be FORCED to mark gold higher to re liquefy or re capitalize their banking system. This is not groundbreaking thought as gold has been marked higher in past monetary episodes in order to re capitalize treasuries and banking systems. It also had the side effects of generating some inflation and kick starting the economy. It is in a parallel fashion to this which I believe China will ultimately be forced into.

As you know, Britain (and Australia) has applied to become a charter member of the AIIB. No matter what is given as reason, this is simply their recognition of where the future is headed and the Brits wanting to be allied with the winner in a “if you can’t beat ’em, join ’em” type of move. Britain must first clear the hurdle of being accepted. China has introduced them but they must be ratified by the various founding countries. I find this intriguing because of the potential motivations for either a yes or a no vote. Does Britain bring much to the table other than reputation or the fact they are the number one U.S. ally changing their allegiance? If Britain is accepted, they will merely be a “feather” in the East’s cap. A no vote would be quite embarrassing because Britain has now shown their hand and intent, …only deemed to be “not good enough”? A very bad place to be if you asked me.

Why am I even bringing Britain’s application up? Because I believe it is a timing thing. The East, obviously led by China is beginning a new “fix” to challenge London’s and they are also beginning a new cash and carry metals exchange which will challenge COMEX and LBMA. Maybe “challenge” is the wrong the word. Better said would be to make these two exchanges “obsolete”. What will happen if (when) China’s physical exchange prices metal higher than the paper exchanges? “Arbitrage” will happen and the Western vaults will be cleaned out, that’s what! I hate to state the obvious but how do you have a “business”, in this case an exchange, if you have no product? For Britain to make application now and against direct “orders” from the U.S., at this point in time, tells me something is changing and it may now be coming to a head.

Whether or not the timing of the East beginning new exchanges and pricing, along with their own alternate clearing system and global bank is “cause” can be debated. Have they timed it with the demise of the overleveraged system of the West? Or will the alternative systems themselves pull the rug out from under the dollar and all that goes with it? It really does not matter. As I wrote above, China will not go unscathed and will be defaulted on in many instances and will also watch as much of their internal leverage defaults.

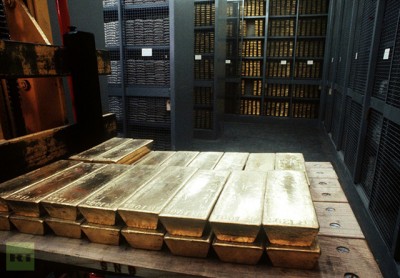

It is the nature of defaults that leads me to my theory of China revaluing gold higher whether they want to or not. It will be their natural, if not ONLY choice. I don’t believe they will have any other choice even though they have been preparing for many years, simply because they have played and are playing in the paper game. They have built a manufacturing base the Rockefellers, Vanderbilts and Fords would marvel at in both size and technology. They have built new infrastructure and even new cities preparing for “something”. During this “build out”, China has also amassed more gold than the U.S. even claims to have. It is my contention China has done all of this because they understand the end game. They understand the dollar game fully. They have known ever since and even before 1971 the rules were “never pay” or settle as the key component.

Think this through, clearly default of nearly everything paper is coming. If you don’t agree with this or cannot see it then my theory is useless to you. If you can see this, and the Chinese surely do based on their actions, what is the plan? Just as has always been done in the past many times, their “treasury” will require a MUCH higher gold price to rebuild their base from. With much of everything paper defaulted on (and including “to” the Chinese), there will by necessity need to be a restart button pushed. China’s gold will serve this function. As with Exter’s pyramid I recently showed you, a new pyramid will begin to build …using China’s gold as a foundation.

Revaluing their gold hoard has many advantages and zero disadvantages as I see it. Their treasury coffers will swell, their currency will begin to enjoy the fruits of reserve status and along with this, they will enjoy new found power. We will witness not only the greatest transfer of wealth in all of history, along with this will come a transfer of power, financial power. When China revalues gold higher, this will serve several functions beyond the obvious of devaluing their currency against it. For those countries not holding gold, a very long and arduous financial time will follow. By marking the price up, they will be making any accumulation or “catch up” plans very difficult. Another aspect is from the very micro standpoint of gold being priced too high for the average citizen to buy much if any. For China to do this makes perfect sense. They take the lead and the power while making it difficult for anyone to catch up to them for possibly several hundred years …which is exactly how they think. The West has clearly forgotten the old saying about gold and those making the rules, I believe China will be forced to invoke it!