Mainstream Economists Finally Admit that Runaway Inequality Is Hurting the Economy

But Bad Government Policies Are Making Inequality Worse By the Day

AP reported Tuesday:

The growing gap between the richest Americans and everyone else isn’t bad just for individuals.

It’s hurting the U.S. economy.

***

“What you want is a broader spending base,” says Scott Brown, chief economist at Raymond James, a financial advisory firm. “You want more people spending money.”

***

“The broader the improvement, the more likely it will be sustained,” said Michael Niemira, chief economist at the International Council of Shopping Centers.

***

Economists appear to be increasingly concerned about the effects of inequality on growth. Brown, the Raymond James economist, says that marks a shift from a few years ago, when many analysts were divided over whether pay inequality was worsening.

Now, he says, “there’s not much denial of that … and you’re starting to see some research saying, yes, it does slow the economy.”

As one example, Paul Krugman used to doubt that inequality harmed the economy. As the Washington Post’s Ezra Klein wrote in 2010:

Krugman says that he used to dismiss talk that inequality contributed to crises, but then we reached Great Depression-era levels of inequality in 2007 and promptly had a crisis, so now he takes it a bit more seriously.

Krugman writes this week in the New York Times:

The discussion has shifted enough to produce a backlash from pundits arguing that inequality isn’t that big a deal.

They’re wrong.

The best argument for putting inequality on the back burner is the depressed state of the economy. Isn’t it more important to restore economic growth than to worry about how the gains from growth are distributed?

Well, no. First of all, even if you look only at the direct impact of rising inequality on middle-class Americans, it is indeed a very big deal. Beyond that, inequality probably played an important role in creating our economic mess, and has played a crucial role in our failure to clean it up.

Start with the numbers. On average, Americans remain a lot poorer today than they were before the economic crisis. For the bottom 90 percent of families, this impoverishment reflects both a shrinking economic pie and a declining share of that pie. Which mattered more? The answer, amazingly, is that they’re more or less comparable — that is, inequality is rising so fast that over the past six years it has been as big a drag on ordinary American incomes as poor economic performance, even though those years include the worst economic slump since the 1930s.

And if you take a longer perspective, rising inequality becomes by far the most important single factor behind lagging middle-class incomes.

Beyond that, when you try to understand both the Great Recession and the not-so-great recovery that followed, the economic and above all political impacts of inequality loom large.

***

Inequality is linked to both the economic crisis and the weakness of the recovery that followed.

Indeed – as we noted in September – a who’s-who of prominent economists in government and academia have now said that runaway inequality harms economic growth, including:

- Fed chairman Ben Bernanke (video continues here)

- Federal Reserve Governor Sarah Bloom Raskin (more)

- Former FDIC Chair Sheila Bair

- Nobel prize winning economist Joseph Stiglitz

- One of America’s leading economists, Robert Shiller

- Former chief IMF economist Raghuram Rajan

- Former U.S. Secretary of Labor and UC Berkeley professor Robert Reich

- Stanford University professor John Taylor

- Northeastern University professor Robert Gordon (more)

- University of Oregon professor Mark Thoma

- University of California professor Emmanuel Saez

- Paris School of Economics professor Thomas Piketty

- Famed economist John Kenneth Galbraith

- Harvard Business School professor David Moss

- Paris School of Economics professor Romain Rancière

- London School of Economics professor Robert Wade

- University of Notre Dame professor David Ruccio

- Harvard professor Lawrence Katz

- Arkansas State University professor Christopher Brown

- Global economy and development division director at Brookings and former economy minister for Turkey, Kemal Dervi

- Societe Generale investment strategist and former economist for the Bank of England, Albert Edwards

- World Bank economist Branko Milanovic

- Deputy Division Chief of the Modeling Unit in the Research Department of the IMF, Michael Kumhof

- Former executive director of the Joint Economic Committee of Congress, senior policy analyst in the White House Office of Policy Development, and deputy assistant secretary for economic policy at the Treasury Department, Bruce Bartlett

- IMF economist Andrew Berg (IMF economist)

- IMF economist Jonathan Ostry

- Federal Reserve chairman from 1934 to 1948, Marriner S. Eccles

- And many others

Even the father of free market economics – Adam Smith – didn’t believe that inequality should be a taboo subject.

Numerous investors and entrepreneurs agree that runaway inequality hurts the economy, including:

- More than half of all international investors polled by Bloomberg

- Billionaire and legendary investment adviser Jeremy Grantham

- Billionaire and hedge fund manager Stanley Druckenmiller

- Billionaire Bill Gates

- Billionaire Warren Buffet

- Billionaire Nick Hanauer

Indeed, extreme inequality helped cause the Great Depression, the current financial crisis … and the fall of the Roman Empire . And inequality in America today is twice as bad as in ancient Rome, worse than it was in Tsarist Russia, Gilded Age America, modern Egypt, Tunisia or Yemen, many banana republics in Latin America, and worse than experienced by slaves in 1774 colonial America. (More stunning facts.)

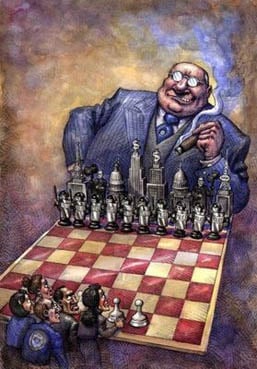

Bad government policy – which favors the fatcats at the expense of the average American – is largely responsible for our runaway inequality.

And yet the powers-that-be in Washington and Wall Street are accelerating the redistribution of wealthfrom the lower, middle and more modest members of the upper classes to the super-elite.