|

All Global Research articles can be read in 51 languages by activating the “Translate Website” drop down menu on the top banner of our home page (Desktop version).

To receive Global Research’s Daily Newsletter (selected articles), click here.

Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

Corporate CEOs’ “greedflation” in pay and perks, especially bonuses and stock options, highlights the latest AFL-CIO Executive Paywatch study, says federation Secretary-Treasurer Fred Redmond.

And—no great surprise—the new CEO of Amazon, Andy Jassy, leads the way, at least in the ratio of his compensation to workers’ pay.

Jassy, successor to Amazon founder and still controlling owner Jeff Bezos, received $212.7 million last year, according to federal filings the AFL-CIO uses for Paywatch. That’s 6,424 times the $32,855 median pay of Amazon workers. The median is the point where half the workers are above and half below.

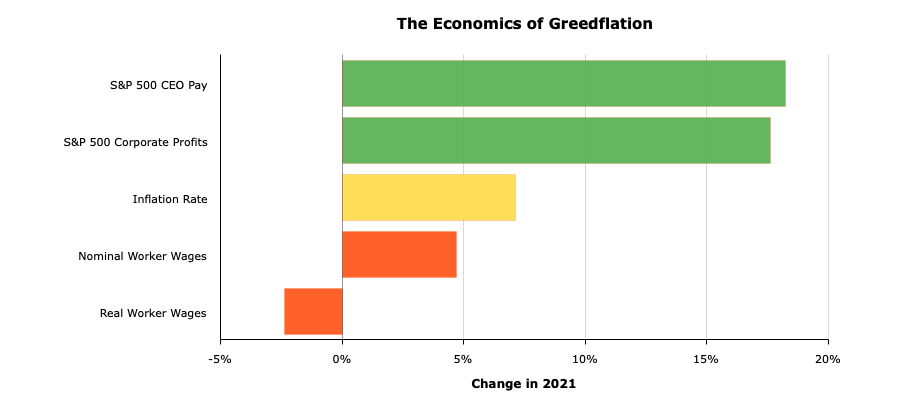

What makes it even worse, Redmond said, is that overall compensation of CEOs in the Standard & Poor’s 500 big companies listed increased by 18.2% in 2021, the last year for which full figures are available. That was more than double inflation, 7.1%.

And the median CEO saw $2.8 million more in pay and perks in 2021, Paywatch says.

“Wall Street elites have been quick to blame workers’ wages and low unemployment for causing inflation. But in reality, U.S. workers’ earnings actually fell behind inflation, rising just 4.7% in 2021. In real terms, average hourly earnings fell 2.4% last year,” the fed said.

Or as Redmond put it: “It’s another version of more for them and less for us.”

Overall, the report says the median CEO-to-worker ratio in 2021 was 324 to 1, another record since the federation started such Paywatch reports. In other words, the median pay for a CEO is higher in a day than it is for a worker in a year, once you remove weekends.

“During the pandemic, the ratio between CEO and worker pay jumped 23%,” said Redmond during a press conference.

“Instead of investing in their workforces by raising wages and keeping the prices of their goods and services in check, their solution is to reap record profits from rising prices and cause a recession that will put working people out of our jobs.”

No wonder the number of union organizing drives is up 69% compared to this time last year, Redmond said.

Though Amazon’s Jassy had the largest pay inequity ratio with Amazon workers, he didn’t draw the largest combo of pay, perks, and bonuses. That “honor” went to Peter Kern of Expedia, the discount travel aggregator, at $296.25 million. Kern got 2,897 times the median pay of his workers, the second-largest ratio, behind Amazon’s Jassy.

Instead of paying his workers a decent wage, Amazon’s Jassy is waging a multimillion-dollar campaign

against union efforts to organize them, especially at his warehouses in Staten Island, Bessemer, Ala., and Chicago, complete with hiring high-priced “union avoidance” law firms, a.k.a. union-busters, to harangue them and lie.

One question always up for discussion is if the corporate class really earns, much less deserves, its high compensation. Asked several years ago whether bosses should get multimillion-dollar checks, the late AFL-CIO President Richard Trumka bluntly said “no.”

Proof of his point: Though the report doesn’t say so, Investor’s Business Daily reports dozens of firms in the S&P 500, part of Paywatch, lost money in 2021. Notable among them: ExxonMobil and American Airlines. Both got hit hard by the coronavirus-caused depression.

Yet the CEOs of both took home millions in compensation.

ExxonMobil CEO Darren Woods received $23.57 million total, with $4.7 million in pay and bonuses, 60% of overall the value of stock awards, and the rest in a pension hike. The ratio between his compensation and a median ExxonMobil worker’s pay: 125-1.

American CEO W. Parker took no pay or bonuses but got $7.2 million in stock awards. Parker’s workers got median paychecks of $62,765. The ratio was 115-1.

Below is the Paywatch Report.

***

Greedflation

by Paywatch

Working People’s Real Wages Fall While CEO Pay Soars

In 2021, corporate CEOs were quick to blame worker wages for causing inflation. But workers’ real wages actually fell 2.4% in 2021 after adjusting for inflation.

Working people experienced a pay cut with every price increase while U.S. companies enjoyed record profits and CEO pay increased at an even faster rate.

In 2021, CEOs of S&P 500 companies received, on average, $18.3 million in total compensation. CEO pay rose 18.2%, faster than the U.S. inflation rate of 7.1%.

In contrast, U.S. workers’ wages fell behind inflation, with worker wages rising only 4.7% in 2021. The average S&P 500 company’s CEO-to-worker pay ratio was 324-to-1.

Runaway CEO pay is a symptom of greedflation — when companies increase prices to boost corporate profits and create windfall payouts for corporate CEOs.

Amazon Delivers the Highest CEO-to-Worker Pay Ratio in the S&P 500

In 2021, Amazon’s new CEO Andy Jassy received $212.7 million in total compensation, giving Amazon the highest CEO-to-worker pay ratio out of all S&P 500 Index companies.

- Amazon’s CEO Total Compensation: $212,701,169

- Amazon’s Median Worker Pay: $32,855

- Amazon’s CEO-to-Worker Pay Ratio: 6,474-to-1

The ratio of CEO-to-worker pay is important. A higher pay ratio could be a sign that companies suffer from a winner-take-all philosophy, where executives reap the lion’s share of compensation. A lower pay ratio could indicate the companies that are dedicated to creating high-wage jobs and investing in their employees for the company’s long-term health.

2021 Average CEO Pay at S&P 500 Index Companies

Too many working people across the country are struggling to afford the basics, much less save for college or retirement. Some states serve as stark examples of the incredible gap between CEOs and the hardworking people who make their companies profitable.

This map shows how the CEO pay at companies headquartered in each state compares to the pay of the average employee in the state.

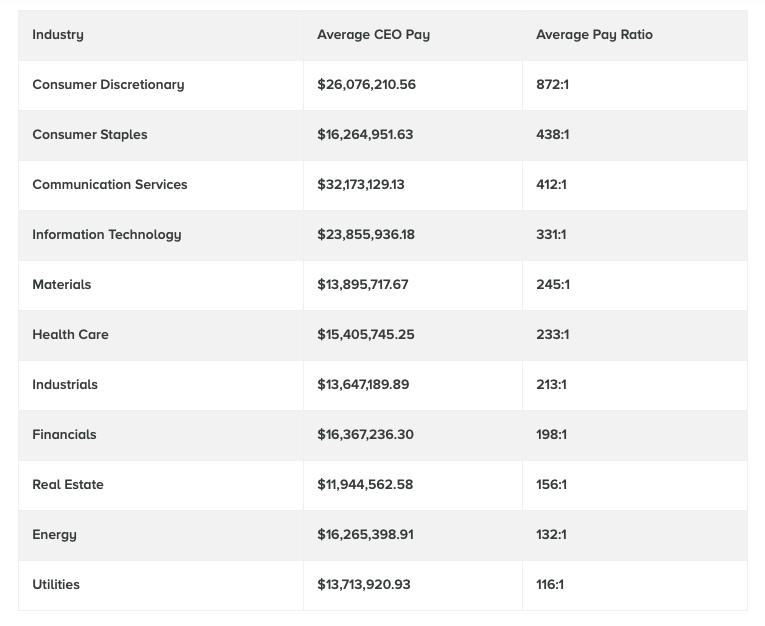

CEO Pay by Industry at S&P 500 Index Companies

CEO pay rose fastest in the consumer discretionary sector in 2021, up 79% compared to the previous year. The ratio of CEO-to-worker pay is also the highest in the consumer discretionary sector that includes retail companies like Amazon, where the median worker made only $32,855 in 2021.

*

Note to readers: Please click the share buttons above or below. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Award winning journalist Mark Gruenberg is head of the Washington, D.C., bureau of People’s World. He is also the editor of the union news service Press Associates Inc. (PAI). El galardonado periodista Mark Gruenberg es el director de la oficina de People’s World en Washington, D.C. Known for his reporting skills, sharp wit, and voluminous knowledge of history, Mark is a compassionate interviewer but a holy terror when going after big corporations and their billionaire owners.

Featured image is from AFL-CIO

|