Inflation Is the Legacy of the Federal Reserve

Federal Reserve Policy Has Levied a Hidden Tax On All Americans

Bloomberg asks whether inflation is the legacy of the Fed:

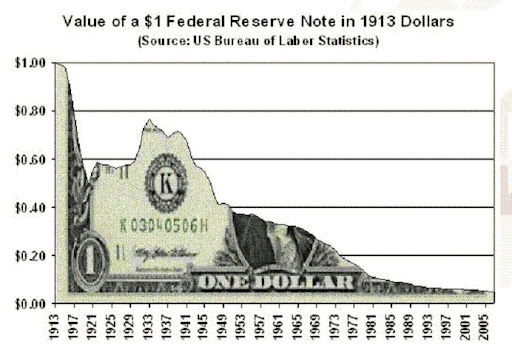

The dollar’s purchasing power has plummeted from 1913 – the year the Fed was created – to 2005:

(Image courtesy of Charles Goyette.)

A devalued dollar equals inflation. Specifically, when the dollar is worth less, more dollars are required to by the same item.

In testimony this week, Bernanke said that he has done a great job of keeping inflation under check. But there is a tremendous amount of hidden inflation caused by Mr. Bernanke’s policies:

(Image courtesy of Charles Goyette.)

We noted in 2011:

Inflation Is A Tax

The father of the theory that government stimulus is the way to fight severe downturns – John Maynard Keynes – famously said about inflation:

By this means government may secretly and unobserved, confiscate the wealth of the people, and not one man in a million will detect the theft.

Fed chairman Ben Bernanke also admits that inflation is a tax on the American people:

Money printing creates inflation. [Including inflation in food prices … which food producers are trying to hide through fraud] Société Générale strategist Dylan Grice writes:

By issuing bonds to itself the government seems to have miraculously raised revenue without burdening anyone else. This is probably why the mechanism is universally adopted throughout the world’s financial system. Yet free money does not, and cannot, exist. Since there can be no such thing as a government, or anyone else for that matter, raising revenue “at no cost” simple logic tells us that someone, somewhere has to pay.

But who? This is where the subtle dishonesty resides, because the answer is that no-one knows. If the money printing creates inflation in the product market, the consumers in that product market will pay. If the money printing creates inflation in asset markets, the purchaser of the more elevated asset price pays. Of course, if the printed money ends up in asset markets even less is known about who ultimately pays for the government’s ‘free lunch’, because in this case the money printing sets off its own dynamic via the perpetual Ponzi machine that is the global financial system. The ‘free lunch’ providers will be the late entrants into whatever asset-bubble or investment fad the money printing inflates.

The point is we can’t know who will pay, only that someone will pay. Thus the government has raised revenues without even knowing upon whom the burden falls, let alone telling them. Compare this to raising explicit ‘honest’ taxes, which are at least transparent. We know who levied the sales tax or the income tax, when it was levied, when it is payable, and how much has to be paid. The burden of this money printing, in contrast, seeps silently into the economy, falling indiscriminately but indubitably on unseen, unknowing victims.

The economic hardships this clandestine tax operation imposes are real and keenly felt. But because no one knows from where it comes the enemy is unseen. Thus, during great inflations, societies turn on themselves with each faction blaming another for its malaise: the third century inflation crisis in ancient Rome coincided with Diocletian’s infamous persecution of the Christians; the medieval European debasements coincided with surging witchcraft trials; the extreme Central European hyperinflations following WW1 saw whole societies blaming their Jewish communities. More recently, the aftermath of the historically modest asset inflations in the tech market and the US real estate market have seen society turn on “fat-cat CEOs” and “greedy bankers” respectively.

By now, some of you might feel this all to be irrelevant. Surely, you might be thinking, the plain fact is that there is no inflation. I disagree. To see why, think about what inflation is in the light of the above thinking. I know economists define it as changes in the price of a basket of consumer goods, the CPI. But why should that be the definitive measure, given that it’s only one of the many possible destinations in money’s Brownian journey from the printing presses? Why ignore other destinations, such as asset markets? Isn’t asset price inflation (or bubbles as they are more commonly known) more distortionary and economically inefficient than product price inflation?

I believe economists focus so firmly on product prices in their analysis of inflation not because of any judgment over the relative importance of one type of inflation over the other, but simply because CPI-type measures of inflation are easier to see. In doing so, they resemble the fabled driver who lost his keys one evening and was found looking for them under a streetlamp. When asked by his wife why he was looking there when he’d probably lost them further back, he replied “Because here it’s easier to see.”

We know that revenue cannot be raised for one person without costing someone else. We know that money printing generates revenue for the public sector. So we also know that money printing must be a tax. We know that the magnitude of that tax – the inflation rate – can be reliably measured by the increase in the rate of base money growth. Since we don’t know which markets new money will end up in or even when, we know we can’t reliably count on measures of inflation in those markets to tell us what the ‚inflation rate? is. Thus, the only reliable measure of inflation is the expansion of the monetary base. So to those who say there is no inflation, I give you the following chart.

By now, the more polite economists among those still reading may be thinking something like: “What utter drivel you are full of Grice! When there is a recession/depression on and the pressure faced by an economy is deflation, which can become self-fulfilling, the only correct thing to do is to create inflation to protect jobs.”

To this I would reply that every right thinking person wants to see job creation. Those advocating the creation of inflation, or fiscal stimulus are doing so because that’s what the system of logic known as ‘theoretical macroeconomics’ teaches. Yet this system of logic with its deeply flawed epistemological foundations is what brought us here in the first place! The macroeconomic body of knowledge represents no such thing – a cacophony of faiths would be more accurate. The instruments and gauges it recommends policy makers rely on – CPI, trend growth, output gaps, NAIRUs, budget deficits, debt/GDP – are subject to such wide conceptual ambiguity, not to mention estimation error, as to render them utterly meaningless. The fact is the captains of our ship have no reliable gauges. They have no understanding of what a yank of this lever, or a push on that button will ultimately achieve. They just think they do. Intoxicated by trumped up notions of what they know and understand, the drunk driving of macroeconomists is what led us to where we are today.

Perhaps even more importantly, the way that the Fed has kept inflation from going even higher – despite its massive money printing – is to intentionally discourage banks from making loans to Main Street. In other words, by killing the real economy …

Of course, the Fed also caused the Great Depression and the current economic crisis, and most Americans – and many economists – want to end or severely downsize the Fed.