Inflation, Deflation and the Gold Market

“Gold is the constant”

On occasion of the publication of his 8th annual “In Gold We Trust“ report, renowned gold market analyst Ronald Stoeferle points out in this interview some aspects of his latest report and the larger picture, inter alia: the interplay between inflation and deflation; the factors for the weak trend of the gold price during the last 24 months; and the importance of the permanently high stock-to-flow ratio of gold.

The new “In Gold We Trust” report can be downloaded as a PDF file here.

Lars Schall: You believe that “the many monetary experiments currently underway will have numerous unintended consequences.” Which do you consider the most serious ones?

Ronald Stoeferle: A major difference between the views of the Austrian School of Economics and mainstream economic theories is that the Austrian School recognizes the importance of price distortions in the price of money, i.e. interest rates. Keynesians and Monetarists broadly agree that price fixing of goods and services is not a good idea. However, when it comes to money, they are inconsistent, believing that it is imperative to fix the price of money. Distorting interest rates to an absolutely unnatural rate of zero (or even below) will obviously have numerous consequences.

Probably the most serious consequence of structurally too low interest rate levels is the “culture of instant gratification” that is fostered. Instant gratification is characterized by consumption that is not financed with savings, but rather by taking on debt. This debt-based life goes hand in hand with rising time preferences and undermines the sustainability of responsible economic activity. Declining interest rate levels renders a gradual increase in public indebtedness possible, while the interest burden (as a share of government spending) does not grow immediately.

Michael von Prollius said that the key to avoid booms and busts was “to let interest rates tell the truth about time”. However, currently, this truth is veiled and distorted. Governments, financial institutions, entrepreneurs and consumers that are acting in an uneconomic manner are thus being kept artificially afloat. As a result, instead of them being punished for their errors, these errors are perpetuated. Protraction of this process of selection leads to a structural weakening of the economy, and a concomitant increase in the system’s fragility.

LS: Please tell us about a phrase you guys coined, “Monetary Tectonics“ – what’s that?

RS: The big question “inflation or deflation?” has been a key bone of contention for economists in recent years. We tried to analyse the problem from the point of view of the Austrian School of Economics. The interplay between inflation and deflation can be compared to the permanent reciprocal pressure of two tectonic plates. A number of phenomena, such as volcanic eruptions and earthquakes, which are visible on the surface, are the result of processes taking place below the earth´s surface.

The natural market adjustment process of the current crisis would be deeply deflationary. The reason for this lies in our current fractional reserve banking system. A large portion of the money in circulation is created by credit within the commercial banking sector. The much smaller portion is, however, created by central banks. As the financial sector in most parts of the world reversed their credit expansion policies, the overall credit supply was reduced significantly.

This (credit) deflation, or deleveraging, is currently being offset by very expansionary central bank policies. In our opinion, this is an extremely delicate balancing act.

LS: Why would you say so many people in the Austrian camp have been wrong with their hyperinflation predictions?

RS: Everyone who predicted rapid, severe consumer price inflation as a direct consequence of QE programs etc. has so far been proven wrong. However, one could argue that the prices of some asset classes exhibit features of hyperinflation.

LS: In a way, yes.

RS: The pre-2008 boom was induced by an unprecedented credit expansion. So-called financial innovations have contributed to a massive increase of overall liquidity, which has outgrown the broad money aggregates. After the bust, the deflationary forces were enormous and often underestimated. Look at Japan for instance. The credit-induced boom of the 1980s was huge, and the bust has been drawn out affair lasting more than two decades. So far, the so-called reflation policies have been “more successful” in the West since 2008, but we obviously have yet to reach the last chapter of this experiment.

LS: What reasons do you see for the recent correction in the gold price?

RS: In the report we outline the following factors as decisive for the weak trend during the last 24 months: a strong disinflationary tendency together with rising real interest rates; partly declining money supply (esp. ECB), resp. slowing momentum of money supply growth (due to the tapering by the Federal Reserve); and rising opportunity costs due to the rally in stock markets.

LS: You state in your report: “We like the fact that consensus considers the gold bull market over. Gold is now a contrarian investment.” Please elaborate.

RS: The consensus definitely sees the gold bull market as over! There is major scepticism towards gold as far as the eye can see. Yesterday, Bloomberg ran a major story entitled “Gold Euphoria Won’t Last With Yellen’s Rally Fading”. Investors who hold gold as an alternative to stocks or bonds are having great problems justifying these positions towards their investors. Today, most of the people left with gold in their portfolios will not sell now or should it fall a further USD 200. Gold is now in firm hands, the weak hands have been shaken out.

LS: Why do you think, as you’re stating in your report, “that the gold price is near the end of its long consolidation period“?

RS: Correct, in the report we wrote that from a technical perspective, our assumption is that the gold price is near the end of its long consolidation period.

When the gold price reached its intra-day all time high of USD 1,920, the price was three standard deviations above the 40-day moving average. It was therefore extremely overbought. The support zone between USD 1,250 and USD 1,270 has by now been successfully tested several times. We believe, based on futures market positioning data, negative sentiment and gradually improving seasonal tendencies, that the opportunities plainly outweigh the risks. In the short-term, the significant relative strength in silver and mining stocks clearly gives us cause for optimism as well. As a result, we expect higher prices in coming months. The USD 1,530 level should represent a massive resistance level on the upside, based on the principle that “support becomes resistance, resistance becomes support”.

LS: How does Asia change the overall picture in gold?

RS: Gold moves from those countries in which capital is consumed to those in which it is accumulated. The Romans already noticed this 2000 years ago, when Chinese and Indians would only accept gold in exchange for spices and silk instead of Roman goods. We believe it is quite likely that gold is increasingly being hoarded and its circulation is declining, as it is increasingly held in “strong hands.”

LS: Once again you’re explaining the stock-to-flow ratio of gold. Why is it so important?

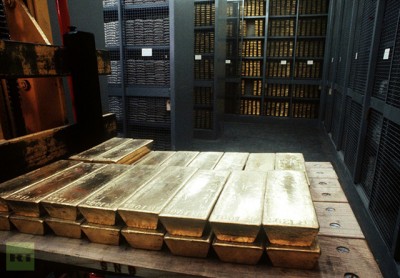

RS: Simply put, Lars, the stock to flow ratio means that in the case of gold and silver – as opposed to other commodities – there is a major discrepancy between annual production and the total available supply. We believe that the permanently high stock-to-flow ratio represents one of gold’s most important characteristics. The total amount of gold amounts to approximately 177,000 tons. This is the stock. Annual mine production amounted to roughly 3,000 tons in 2013 – this is the flow. If one divides the total gold mined by annual production, one arrives at a stock-to-flow ratio of approximately 59. The ratio expresses the number of years it would take to double the total stock of gold at the current rate of production. Gold is by no means the scarcest commodity, but rather the commodity with most constant above ground stock available. This highly constant level of outstanding stock is what enables gold to be a monetary metal.

LS: Is being patient the name of the game when investing in gold?

RS: Gold to me is not an investment in the narrow sense, it is an alternative to cash. If you compare gold to paper money, paper money has always devalued versus gold in the long run. Gold is in fact the constant.

Ronald Stoeferle, managing director of Incrementum AG in Liechtenstein, is a Chartered Market Technician and a Certified Financial Technician. He was born October 27, 1980 in Vienna, Austria. During his studies in business administration and finance at the Vienna University of Economics and the University of Illinois at Urbana-Champaign in the U.S., he worked for Raiffeisen Zentralbank (RZB) in the field of Fixed Income / Credit Investments. After graduating, Stoeferle joined Vienna based Erste Group Bank, covering International Equities, especially Asia. In 2006 he began writing reports on gold. His benchmark reports drew international coverage on CNBC, Bloomberg, the Wall Street Journal and the Financial Times. Since 2009 he also writes reports on crude oil. In 2013, Stoeferle and his partners incorporated Incrementum AG in Liechtenstein. Furthermore, he is now senior advisor to Erste Group Bank