Hillary Clinton Calls For ‘Toppling’ the 1%…While Being Bankrolled by the 1%

This really happened. As crazy as it sounds, Hillary Clinton is trying to repackage her war-torn reputation into a populist spitting image of progressive icon Elizabeth Warren. The New York Times reports that“Mrs. Clinton pointed at the top category and said the economy required a ‘toppling’ of the wealthiest 1 percent, according to several people who were briefed on Mrs. Clinton’s policy discussions.”

The New York Times and Huffington Post didn’t bother asking the questions that should have been asked, with their reporting easily summed up by the opening line in the HuffPo peice: “Hillary Clinton believes that strengthening the middle class and alleviating income inequality will require ‘toppling’ the wealthiest 1 percent of Americans, according to a New York Times profile published on Tuesday.” That statement, so far, has gone relatively unquestioned by the corporate media.

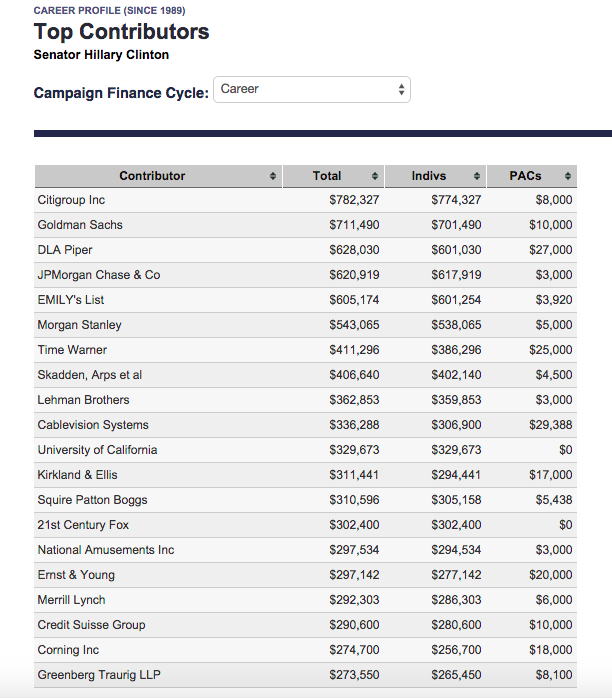

But, as we all know, politicians tend to say things when they’re campaigning that differ greatly from what they actually do in real life. Firstly, Hillary Clinton’s stance that the 1% needs to be toppled goes directly against the interests of her biggest financiers. Behold her greatest campaign contributors since 1989 below:

A few familiar faces — Citigroup, Goldman Sachs, JP Morgan, Time Warner, 21st Century Fox (?) — which all happen to fall under the 1% category that Hillary is now claiming to despise. But Wall Street knows the name of the game, it is their game now after all, isn’t it? Politico asked them what they thought about Hillary’s pseudo-populist agenda a few days ago:

Back in Manhattan, the hedge fund managers who’ve long been part of her political and fundraising networks aren’t sweating the putdown and aren’t worrying about their take-home pay just yet.

It’s ‘just politics,’ said one major Democratic donor on Wall Street, explaining that some of Clinton’s Wall Street supporters doubt she would push hard for closing the carried-interest loophole as president, a policy she promoted when she last ran in 2008.

William Cohan at Politico added,

Down on Wall Street they don’t believe it for a minute. While the finance industry does genuinely hate Warren, the big bankers love Clinton, and by and large they badly want her to be president. Many of the rich and powerful in the financial industry—among them, Goldman Sachs CEO Lloyd Blankfein, Morgan Stanley CEO James Gorman, Tom Nides, a powerful vice chairman at Morgan Stanley, and the heads of JPMorganChase and Bank of America—consider Clinton a pragmatic problem-solver not prone to populist rhetoric. To them, she’s someone who gets the idea that we all benefit if Wall Street and American business thrive. What about her forays into fiery rhetoric? They dismiss it quickly as political maneuvers. None of them think she really means her populism.

This must be some kind of inside joke.

Wall Street knows it’s all politics. They continue funneling money into her campaign knowing that once she gets into office everything will be just fine for the 1%. These superficial, pseudo-populist calls for empowerment of the common working American will fall to the wayside once she’s elected. Hillary Clinton’s campaign is expected to raise $2 billion dollars during her 2016 presidential run. A large portion of that money is expected to come from two of her closest support groups in the private sector: Wall Street and the military-industrial-complex. Not exactly surprising considering her cozy ties to the banking industry and her track record of supporting pretty much every warAmerica has been in since she became a politician.