|

As we approach 2019 the global economy teeters on the brink of yet another recession which will plunge geo-political relations into a period of great upheaval and rapid change. In 2019 global stock markets will continue to face unprecedented volatility and gigantic losses as the Ponzi scheme pumped up by the cartel of central banks comes crashing down.

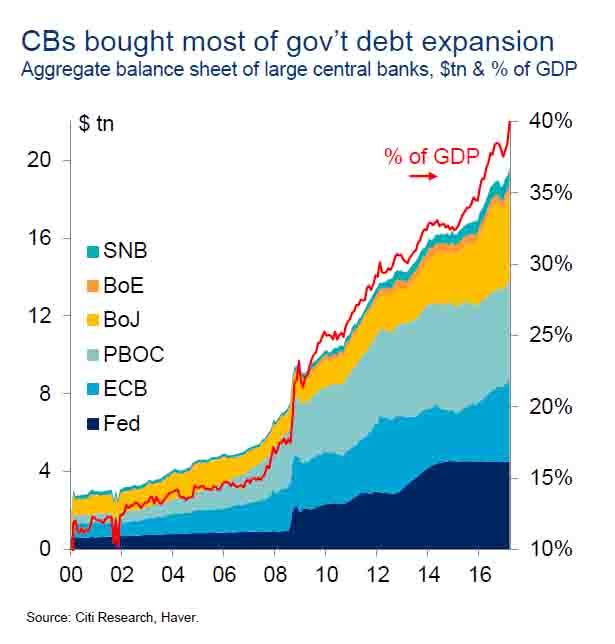

The central bank cartel of the U.S. Federal Reserve, European Central Bank, Bank of Japan, and Bank of England together with the Bank of China have flooded their national economies with astronomical sums of money since 2008 in an attempt to stave off collapse of the global financial system.

Their money printing experiment has driven global debt from $177 trillion to over $277 trillion today while interest rates have been artificially suppressed enabling a wealth transfer to the 1% of historic proportions. This massive expansion of central bank balance sheets is illustrated below.

During this period global stock markets surged to new historic heights pumped up as they were by the financial heroin provided by the central bank cartel. The chart below clearly illustrates the correlation between the tremendous growth of the S&P 500 and the money printing by the central bank cartel.

.

Now the chickens are coming home to roost as the global economy slows down and the central bank cartel tries to end their money printing colloquially known as Quantitative Tightening.

The withdrawal of this financial heroin is behind the collapse of global stock markets during 2018 that has wiped trillions off the values of a range of inflated assets.

There is a very clear correlation between the shrinking balance sheets of global central banks and the continuing crash of stock markets. The collapse of the stock values of globally systemic banks poses great dangers to the global economy.

The central bank cartel policies of quantitative tightening, as they attempt to wean financial markets off their monetary heroin, are taking us towards a period of stagflation, reminiscent of the 1970s, which will usher in a period of depressed economic growth and rising inflation. Geo-political relations, as in the 1970s period of stagflation, will become even more unstable and volatile intensifying many current conflicts and threatening new wars between nations and military blocs.

The next world recession will pose severe challenges for the great powers as they jostle to maintain control over strategic raw materials, trade relationships and economic resources. Meanwhile,

The great powers will struggle to cope with the devastating consequences of the collapse of inflated assets from bank failures to the return of mass unemployment. They will all face unprecedented social and political upheaval from their own citizens suffering from the effects of economic collapse.

One thing we can be sure of is that 2019 will be very different to 2018 and the years that have gone before as nations struggle to redefine their political and economic relations with one another.

|