Global Economy Heads for Major Recession as Central Banks Increase Emergency Measures to Prevent Collapse of the Financial System

“Those whom the gods wish to destroy they first make mad.’’

You can taste the fear as global central banks panic and introduce emergency measures to prevent a systemic collapse of the global financial system. On Sunday the U.S. Federal Reserve launched another financial bazooka at stock and bond markets when it announced the start of QE 4. This will involve the purchase of $700 billion of government bonds/mortgage backed securities and a 1% interest rate cut taking them to zero.

Today the ECB has announced another $112 billion to be made available to banks while the Bank of Japan has declared that it will spend trillions more on purchasing bonds and exchange-traded funds.

This gigantic package of stimulus measures comes on top of the panic measures introduced last week as the meltdown in stock and bond markets began to get out of control. Last Thursday, as the bond market melted down and lines of credit were under threat the Fed announced an intervention in the short term debt markets (repo) that will run into April and amounts to over $4.5 trillion.

Last Thursday’s panic measure backfired as the Dow Jones plunged over 2000 points.

Financial analyst Wolf Richter, who has recently shorted the markets with some success, commented:

“This is the Fed’s latest effort to bail out Wall Street, the cherished asset holders that are so essential to the Fed’s “wealth effect,” all repo market participants, the banks, and the Treasury market that suddenly has gone haywire. Lots of things have gone haywire as the Everything Bubble unwinds messily. ‘’

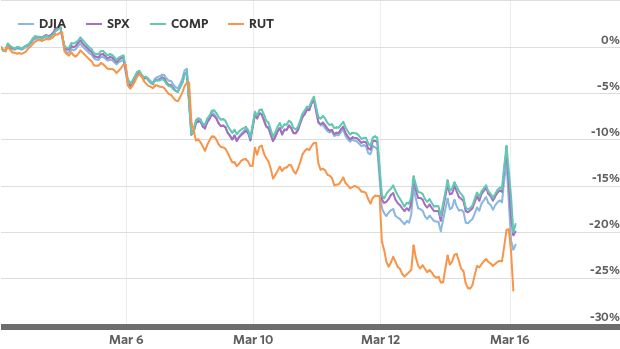

Flash forward to today and markets are reacting badly to the latest panic measure. At the opening of trading today stocks immediately crashed triggering circuit breakers that halted trading. The S&P 500 -9.8% 220 points or 8.1% down while the Dow Jones -10.5% plummeted 2, 250 points or 9.7% down. Meanwhile, the Nasdaq -9.83 dropped 482 points or 6.1% down.

The epic collapse of U.S. stock markets in shown in the chart below from Marketwatch:

This meltdown has been repeated on stock markets around the world. As if this wasn’t bad enough oil prices have fallen below $30 dollars a barrel while the scramble for cash has led haven assets such as gold to tumble in price today.

Sven Heinrich of Northman Trader has called this market to perfection and explained how global central banks are responsible for the current financial crisis through their reckless money printing measures since the 2008 economic crisis.. On twitter today he warned:

“If they can’t control markets today they should just shut it down until things can get sorted. They’re risking major fund blow ups and irreparable damage with consequences felt for a long time even if coronavirus gets sorted.’’

The Federal Reserves announcement of QE4 on Sunday illustrates how frightened the central banks are of the major economic recession ahead. Highly respected economist Mohammed El-Arian, Allianz Chief Economic Advisor, has explained the Fed’s decision to launch massive monetary stimulus in simple terms:

“The fundamentals went from flashing red to constant red over the weekend.”

Market trader Mike O’Rourke, chief market strategist at financial brokerage Jones Trading, rather aptly describes the current market mayhem as “Bearmaggedon’’. This refers to a situation when the economy collapses at a time of easy monetary policy with historically low interest rates and paper assets like stocks and bonds are still expensive and over valued. In a note to clients he said ominously, “That combination of events becomes toxic because investors begin to express concern that the [Federal Reserves] monetary policy has become impotent.”

O’Rourke puts the failure of central bank intervention into its historical context:

“We thought the panic peaked on Thursday, when most of the country started to shut down, but that was eclipsed tonight by the Federal Reserve. All of us have just witnessed a central bank expend all of its conventional and unconventional tools to support an equity market that is less than a month from all time highs.”

Howard Gold of Marketwatch sums up why markets across the world continue to collapse:

“Bottom line: Investors don’t think the Fed’s moves are enough.’’

The political and economic elites of the American empire have boxed themselves into a corner and created an economic hurricane that threatens an economic depression similar to the 1930s.

Since 2008 the Federal Reserve has presided over a gigantic wealth transfer as its massive money printing led to massive price inflation in paper assets across the board from stocks to bonds. The 1% have raked in massive profits while income levels for the majority have stood still or declined.

It has kept interest rates at historically low levels enabling banks, hedge funds and corporations to gorge themselves on cheap debt and engage in a frenzy of stock buybacks to the tune of several trillion dollars. These stock buybacks have artificially inflated the price of stock market shares while insiders sell at high prices.

Despite the current turmoil in financial markets the largesse of the Fed knows no bounds as it bails out its corporate masters.

The U.S. government which acts on behalf of corporate America, just like the Fed, is bankrupt and has a $23 trillion deficit that is growing exponentially. Trump’s $1 trillion tax giveaway in 2017 that largely benefited the super rich and corporate America has left the U.S. government with annual trillion dollar deficits. Many economists argue that Washington has little room for the massive stimulus needed to combat the impacts of the current pandemic.

Howard Gold of Marketwatch sums up the predicament of the American empire in rather sombre terms:

“As investors clamor for some kind of certainty — or at least leadership —the Fed is out of ammo, the federal government is fiscally tapped out, and the factionalism Washington and Madison warned about is tearing the country apart. Yes, indeed, the chickens are coming home to roost, but this time they’re infected by a deadly virus.’’

Buckle up, for we have entered an unprecedented period of turmoil and volatility which will shake the global economy to its foundations.

The current panic rates cuts and massive money printing by global central banks and the stimulus measures of governments everywhere are just the beginning of this crisis. Expect bail outs galore as industry after industry screams for government/central bank assistance.

It would appear that the solution to $250 trillion of unpayable global debt is to hit the printing presses hard and create a whole load more cash out of thin air.

As businesses of all size go bankrupt while job losses and pay cuts rise over the next period I wonder if central banks generosity will extend to ordinary citizens?

As the global economy shuts down we will rapidly slide towards a major recession that will shake up geo-politics and lead us into even more uncertain times. The 2020s threaten to be a repeat of the 1930s when international relations broke down and the economic crisis was of such severity it left the major powers with no other recourse but war to try and solve their intractable problems.

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.