On Global Capitalist Crises: Systemic Changes and Challenges

Interview with American Herald Tribune

The following is an excerpt from Dr. Rasmus’ May 2019 interview by American Herald Tribune reporter Mohsen Abdelmoumen

***

Mohsen Abdelmoumen: Why in your opinion can the capitalist system only generate crises?

Jack Rasmus: There are six major changes in the global capitalist economy since the 1970s that increase the potential fragility, instability, and the amplification and propagation rate of the fragility-instability events:

1. Greater Integration of the Former Colonial Elites into the Capitalist Global Economy as Partners

This began in the 1970s as global capitalism integrated the petro-economies, allowing them to nationalize oil and related resource production and share significantly in the revenues from that production—so long as it was understood those elites would recycle much of their income back to the capitalist core economies through direct purchases or the global banking system. In the 1980s, the US added Japan to this wealth recycling arrangement with the Plaza accords of 1986. Europe was to a lesser extent thus integrated as well via the Louvre agreements of that decade. In the 1990s it was Eastern Europe and to a lesser extent south Asia. In the 2000s it was China in part. The recycling benefited US capital greatly. US dominated institutions like the IMF and World Bank were put in service of helping facilitate the integration. The recycling was accompanied by a major acceleration of US foreign direct investment into the economies of the new partners. The dollars flowing back to the US in the form of US Treasury bonds and bills purchases allowed the US to run chronic massive budget deficits, caused by accelerating defense-war spending and simultaneous business-investor tax cutting in the amount of tens of trillions of dollars. The recycling allowed the US to build up its military into a global force on nearly all continents, with a budget of a $trillion a year, the most advanced technology, and more than 900 bases worldwide. Integration economically with the US enabled the US to more effectively wield a ‘carrot and stick’ policy within its global empire to ensure partners would adhere to its fundamental political interests in turn. But global financial and economic integration also means that crises that build and erupt in the US and/or within the key core partners of the US economic empire (aka Canada-Mexico, Japan, Europe), now more quickly spread across the integrated markets and economies. Integration increases the amplification magnitudes and propagation rates of crises.

2. Financial Restructuring of the Global Economy and the Relative Shift to Financial Asset Investing

I argued in some detail in ‘Systemic Fragility in the Global Economy’ that what has been underway since the early 1980s decade is a relative shift toward financial asset investing. This shift is structural and has not abated. In fact, technology is accelerating it. The opportunity for greater financial market profits is also a key driver. The financial asset investing shift, as I call it, has had the result of distorting real investment in plant, equipment, etc. The latter still goes on and may also grow during periods, but in relative terms it is slowing and even declining compared to financial asset investing. At the core of this is the explosion of free money provided by the central banks, made possible by the collapse of the Bretton Woods International monetary system in the 1970s.

Technology and new forms of what is money have also contributed, and increasingly so after 2000, to the explosion of credit enabled by money and near money forms. With excess credit comes excess debt—at all levels: government, banking, non-bank businesses, households, ‘external’, etc.

The magnitude of debt is not per se the problem. The failure to service that debt (i.e. pay interest and principal) is the problem, and that occurs when prices collapse (asset and goods and inputs prices). Price deflation occurs when financial asset bubbles implode. Assets are all substitutes for each other, and when one key asset collapses it has a contagion effect across others. So the price system is the transmission mechanism. This idea is quite counter to mainstream economics which purports the price system stabilizes the economy and markets via supply and demand. But that’s a myth. The price system is a destabilizer. And there isn’t just ‘one price system’, another mainstream error. There are three key price systems that are inter-related but behave differently. They are financial asset prices, goods & services prices, and in put prices (e.g. wages). The relative shift to financial asset investing tends to drive up financial asset prices into bubble range, that then bust and drag down goods and input prices in turn, causing the recession to deepen and recovery to occur slowly. But the financial asset shift and inflation has a further negative effect: it reduces productivity as real investment slows. That slows wages (price for labor) while causing greater unemployment or underemployment (especially the latter).

Financialization is measured not by the share of profits or jobs going to the banking sector. It is defined by the explosion of financial asset securities (especially derivatives), the new highly liquid markets worldwide created in which to trade those securities, and the new financial institutions that dominate that trade—i.e. what are called the shadow banking system. Around this securities, markets, and institutional new framework (that functions globally due to technology) a new global finance capital elite has emerged as the human ‘agents’ of this new global financial structure that I define as ‘financialization’. That global finance capital elite now manages more investible assets than do the traditional commercial banking system (which by the way is increasingly integrated with the shadow banking system). But the shadow banks are virtually unregulated and thus prone to engage in excess risky financial investing, which is behind the chronic shift to financial investing and the financial instability globally it is creating.

3. Global Restructuring of Labor Markets & Collapse of Unionized Labor

Not all of contemporary capitalism is of course financialized. There is still much non-financial production going on and, in the (non-financial) services sectors, actually growing. It’s just that it isn’t as profitable as financial investing and thus is getting relatively less money capital than it otherwise would for purposes of expansion. Financialization is diverting more money capital to itself relative to non-financial investing—i.e. a shift that is slowing productivity gains in the latter and, as a consequence, wages and raising underemployment as businesses cut costs in order to offset the slowing productivity and higher costs of investing in real assets.

We thus now see major transformations in labor markets worldwide that is resulting in lower wage income gains. The ‘global integration’ process in item #1 above is accompanied by the ‘offshoring’ of higher wage manufacturing and other sector jobs to the emerging markets, following the capital outflow from the capitalist core (US, Europe, Japan) to the periphery of EMEs (note: Emerging market economies). Simultaneously, businesses still producing in the core intensify their cost cutting to compete with producers in the EMEs. That means the rise of contingent labor (part time, temp, gig, etc.) which is paid less and paid fewer benefits. The rise of contingency and offshoring reduces union membership and in turn bargaining power. Whereas in the past unions recovered some of income lost during the recession and downturns during the business cycle upswing, this is no longer occurring as unionization has collapsed. The offshoring of jobs also increases worker insecurity and means less likely worker resistance to wage compression by strikes and collective bargaining. As unions decline their political influence also wanes, and with it the ability to achieve wage and benefit improvements via political action. Minimum wage legislation in particular suffers.

Labor market restructuring thus becomes a popular project of business elites and their politicians. It takes the form of job offshoring as the State increasingly subsidizes foreign direct investment. It takes the form of job creation that is now almost totally contingent in character in the advanced capitalist core of US-Japan-Europe (60%-80% of jobs created in Europe in recent decades have been contingent—part time, temp, etc.). As unions weaken economically, it means the restricting and limiting of what union labor may legally negotiate over. As unions weaken politically, it means slower legislated wage adjustments (min. wages) and cut backs in ‘social wages’ like pensions, national health insurance, etc. As union effectiveness weakens, they are attacked and removed by business action or abandoned by workers who see them ineffective in defending their interests. Business led political parties then propose national legislation to, in part, codify the changes and in part to drive them deeper.

Just as the financial restructuring of the capitalist economy leads to accelerating income and wealth accumulation by the financial elite and business class, the restructuring of labor markets had the effect of compressing and stagnation (or for some sectors of the working class even reducing) wage incomes. The former financial restructuring causes income and wealth inequality to accelerate even faster than the labor market restructuring causes wage, working class, incomes to stagnate and decline. Both restructurings result in accelerating income inequality that we see today. And with income inequality, wealth (i.e. assets) grows in turn. Conversely, more asset accumulation produces even more non-asset income inequality. So the two, income and wealth, inequality in favor of financial and business classes feed off each other to expand even further. Meanwhile wage income stagnates.

Thus de-unionization, wage compression, social benefits cut backs, job offshoring, decline of collective bargaining and strike activity, labor market ‘reform’ legislation, etc. are all the consequence (and objectives) of labor market restructuring. Labor market restructuring is largely for the benefit of those sectors of capital still mostly doing business in the domestic economy.

Financialization, subsidization by the State of foreign direct investment, and free trade agreements are largely for the benefit of the multinational corporate sector. Free trade agreements subsidize multinational corporations in two major ways: They are primarily about legalizing terms and conditions for US multinational corporate and banking penetration of other economies on favorable terms. Free trade deals also serve as a multinational corporation cost cutting aid, as corporations are able to bring back their goods and services and not pay the tariff (tax) to re-import back to the US. For example, 49% of the US’s more than $500 billion a year in goods trade deficit with China involves goods made by US corporations in China.

4. Destruction of Former Social Democratic Parties and Movements

Everywhere globally we see the collapse of social democratic parties that once dominated government. This has been true even in the ‘heartland’ of social democracy, in Europe, but also in USA, in South America, Israel, and select economies in Asia where ‘weak forms’ of social democracy previously participated. The rise of right wing ‘populism’ should be viewed as a direct result of the political vacuum created by the demise of social democracy. It is the consequence. So why have they declined? And how has this decline fueled the global integration, financial restructuring, restructuring of labor markets, the financial investing shift, and the accelerating income and wealth inequality? Those are key questions that remain largely unanswered still today among the so-called ‘left’ or ‘progressive’ movements everywhere. Some likely causes of the collapse of social democracy at the political level parallels include the destruction of their political base, the unions, and their significant loss of political influence. To some extent it has been the result of strategic errors by these parties, allowing themselves to become too closely associated with the neoliberal offensive that began circa 1980. But whatever the cause, their decline has opened the floodgates to legislative and other capitalist initiatives to restructure the capitalist financial system and capitalist labor markets globally along lines noted above. Capital has never been more powerful relative to labor than it is today. That’s why, in desperation, working classes vote in mere protest of conditions without being able to propose and promote solutions in their interest. Thus we get Brexits. Support for far right parties that promise to change the system and argue falsely the change will better the conditions of workers. That’s why we get Donald Trump. Bolsonaros and Macris in South America. Salvinis and Orbans in Europe. Dutertes in Asia. Etc. Working classes worldwide have been ‘de-organized’ both economically and politically. Into the vacuum step the far right movements, ideologues, and their parties, who take power often by default. The working classes are left with mere periodic protest votes and they vote for parties and movements that say they are going to ‘stick it to’ the capitalists that have created their declining working conditions and standard of living—even if they know little will come of that pledge.

5. Transformation of Mainstream Capitalist Political Parties

Political change has taken the form not only of the demise or rise of certain political movements and parties, but also the change in formerly ruling parties.In the US the Republican party has assumed the mantle of the far right populism. Its former challenger of the past decade, the Teaparty, has been integrated and transformed that party fundamentally.Its ideology, policy mix, and willingness to undermine democratic norms and even institutions has signified a basic change in the composition and strategy (and tactics) of the Republican party. A similar transformation to the ‘left of center’ is in the early stages with the US Democratic party.Not just in the US is this process occurring. In the UK the formerly dominant parties are in crisis and losing popular support.A ‘Brexit’ right wing populist party is emerging within the Conservative party, while the Labor party continues to lose support to nationalists and environmentalists in its ranks as well.At earlier stages a similar development is occurring in France and even Germany, where both the national front and AfD are growing support. And of course, Italy is well ahead in the rightward shift. The parties of the ‘center’ are collapsing in various stages everywhere.

These political party changes are the consequence of the intensifying income and wealth inequality, and the forces driving it associated with global capitalist economic integration, financial restructuring, and labor market restructuring.On the periphery of the political system are the demise of social democracy and rise of the populist right parties;but ‘in the middle’ as well the traditional capitalist parties are becoming fluid and experiencing internal instability.

6. Increasing Subsidization of Capital Incomes by Capitalist States

Capitalists have totally captured the direction of fiscal and monetary policy and have turned it to the benefit of their direct interests.In past periods, the primary mission of fiscal-monetary policy was to stabilize capitalist economies when recessions or goods inflation occurred. Fiscal-monetary policy was also employed in a manner that shared the benefits of such policy with working classes and other sectors. But 21st century capitalist fiscal-monetary policy (taxation, government spending, budget-national debt management, interest rates, inflation targeting, employment, etc.) has been transformed. Today the primary mission of such policy is to directly subsidize capital incomes, both in periods of economic contraction and in subsequent periods of recovery.Keeping interest rates low chronically allows constant cheap credit and the issuance of multi-trillions of dollars of corporate and household debt.Providing excess liquidity fuels financial asset market (stocks, bond, derivatives, etc.) bubbles that boom capital incomes from financial investing. Equally massive, multi-trillion dollar tax cuts for businesses, corporations and investors, bankers and shadow bankers, results in the US alone more than a $1 trillion a year annually in redistribution to shareholders from stock buybacks and dividend payouts (in 2018 rising to $1.4 trillion in US alone). Ever more funding is simultaneously provided for defense and war production.

The direct subsidization fuels the financial asset investing shift and in turn the financial asset bubbles, corporate and household excess debt, and generates the financial fragility and instability in the form of the next crisis. It also results in escalating government sector debt and rising debt servicing costs.

Thus all three major sectors of capitalist economy—business, households, government—keep loading up on debt and leverage. In the US, government debt (national and local, central bank and government agency) is well over $30 trillion. Another $20 trillion could easily be added by 2030. Corporate and business bond and loan debt may be as high as $20 trillion today.And household debt nearly $14 trillion and rising rapidly. The problem of debt is multiplied many fold across the global capitalist economy, with areas of high concentration of either corporate and/or government debt.The amount is easily more than $75 trillion. It is worth repeating, however, that the sheer magnitude of debt is not by itself the problem.The problem is when the incomes for servicing the debt cannot keep up.And that gap widens rapidly when financial asset prices, and other prices, rapidly collapse and contagion spread just as rapidly from the financial to the real economy. Price collapse, beginning with financial markets, is the critical chemical additive that makes the debt problem explode. And when that explosion takes place, the massive debt accumulation at government levels prevents traditional fiscal-monetary policy from playing an economic stabilization role. All it is then used for is to subsidize the losses incurred by owners of capital incomes.

On Reforms and Four Fundamental Challenges to Capitalism Today

Mohsen Abdelmoumen: You are a brilliant economist and a prolific author. Unlike most economists linked to the establishment who see nothing, you keep warning with very solid arguments and careful work that we are heading for another cycle of crises more serious than the previous ones. Is the capitalist system reformable or should we not seek an alternative as soon as possible?

Jack Rasmus: It depends what you mean by ‘reforms’. There are obviously minor reforms that, while important for protecting average folks income, their standard of living, protecting their basic rights and civil liberties, etc., don’t challenge or stop the fundamental drift of US and global capitalism, including its growing tendency toward crises that I noted above. These should be distinguished from structural ‘reforms’ that do attempt to fundamentally change the direction of 21st century global capitalism. These fundamental reforms are, of course, strongly resisted by capitalists and their political representatives. What then are these transformable ‘reforms’?

They would be changes that halt and roll back the financialization and the multiple forces now accelerating income and wealth economy, with emphasis on ‘roll back’ here.They would reverse the changes in the labor markets of recent decades, by prohibiting for example the excess hiring of part time, temp and otherwise ‘contingent’ labor. They would restore an even field for the recovery of unions and collective bargaining.

They would democratize the central banks and give them a new mission to serve not only the banks but the rest of society; central banks would become part of a broader public banking system and their decisions made by elected representatives accountable to all of society (my recent book provides proposals of legislation that would do this). The tax shift of recent decades that gave ever more income to businesses, investors and wealthy 1% would be reversed, perhaps via a financial transaction tax system and would make tax fraud and offshore tax sheltering a criminal offense with guaranteed jail time. And of course the massive $ trillion a year war budget would be significantly reduced by fundamental reforms. All these fundamental reforms challenge the trajectory and dynamics of 21st century capitalism. Capitalists and politicians would vigorously resist them. In that sense the system is not ‘reformable’. Minor reforms are sometimes allowed, and concessions granted especially in times of system crisis. But both kinds of reforms should be aggressively pursued.

There are four great challenges confronting 21st century US dominated global capitalism.It is questionable whether the system can overcome them. If it can’t it will be perceived by the general, non-capitalist populace that it is failing and no long can deliver on improving standards of living or even maintaining past levels of living standards. If that occurs, it’s a game changer. Here are the four great challenges it faces:

1. Will Capitalism be able to resolve the crisis of climate change in the next two decades.

If it can’t do that, the economic negative impacts of climate change by 2040 will have reached such a level that they will become economically unresolvable.Thesystem will be appropriately blamed for not resolving the problem. It remains to be seen if the private profit and capital expansion system of capitalism can co-exist with the climate crisis. Can profits be maintained and the climate crisis simultaneously resolved? We shall see, but I’m not optimistic the two can coexist.

2. Can the system control the coming huge negative impacts of technological change?

We’ve seen how technology has transformed financial and labor markets, to the great detriment of 80%-90% of the working classes. It has spawned new business models like Amazon, Uber, and others that have devastated jobs and wage incomes.In the US more than 50 million are already ‘contingent’ labor of some kind (in Europe and Japan even more) and it’s just the beginning. The real crisis will begin when next decade the technological effects of Artificial Intelligence and machine learning software have an even greater impact. A recent Mckinsey Consultant study predicts a minimum of 30% of all occupations and jobs will be replaced or reduced. How are these people going to earn a decent living, start families, afford housing, etc.? Some say a Guaranteed Basic Income will have to be the answer. I don’t see capitalists going along with that.It’s a ‘structural reform’ they’ll resist tooth and nail. What are the economic and political consequences of AI (note: Artificial Intelligence) if they allow it to happen and drive down living standards for hundreds of millions of workers worldwide? Here again I don’t see the capitalist system, as it pursues profits via AI, being able or willing to soften its massive negative effects on jobs, income and living standards.

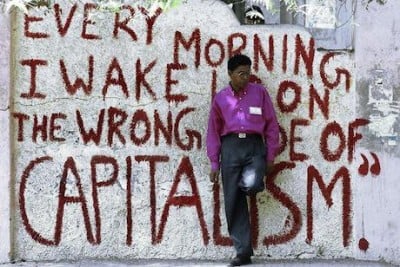

3. Will They do anything about accelerating Income Inequality?

Capitalists and politicians talk about this but so far put forward no solutions to it.And the realization of ‘them vs. us’ is beginning to deepen in the consciousness of more workers. That resentment is fueling the right wing populism globally. It is also making the young workers, the millennials and next ‘generation Z’ coming, to turn against the system in droves. Polls in the US show a majority of under 30 year olds now reject the capitalist system as it is and prefer some kind of ‘socialism’. We shouldn’t make too much of this yet, but ‘socialism’ means to them ‘none of the above’ currently.

4. Can capitalists ‘manage’ the radical right populist surge underway?

They think they can but are losing in that effort thus far. They thought they could control Trump, but he is transforming the Republican party by driving out traditional capitalist representative from it and from their initial placement in his administration.He is terrorizing the opposition from within. It’s not unlike what’s going on elsewhere in Europe and South Asia countries where authoritarian right ideologues like Trump and his neocons are slowing changing the political rules of the game in their favor, at the expense of the traditionalists, sometimes called ‘globalists’. But it’s really about an internal internecine intra-capitalist class fight going on the US and elsewhere.A more aggressive and violent wing views the crisis of living standards as an opportunity to assert itself, take control of the institutions of government, transform the State apparatus and bureaucracy to serve it and not the traditionalists, and govern in a more direct way, even approaching a kind of dictatorship of its wing over the formal institutions of government and state. In short, I don’t see that the capitalists have had much success so far in containing this development, this shift toward a more radical right. There are of course some historical parallels here. It’s what Hitler was able to do in the early 1930s. There are numerous disturbing historical parallels between Trump and his movement and Hitler’s early strategies. Of course, the process was accelerating in Germany as the economic and social crisis was more intense and concentrated in a shorter time frame in the 1920s there. The crisis is not as intense yet in the US and the process of Trump’s take over of the political system is more drawn out and protracted. But there are similarities to the process nonetheless. The traditionalist capitalist wing and globalists are clearly ‘losing’ in the US. And if Trump should win another term in 2020, which he might if there’s no recession in the US in the interim, then this transformation of American democracy and American political institutions and culture will then become quite obvious. Meanwhile, we see a similar rightward drift and transformation of the capitalist political systems occurring in the UK, in central Europe, maybe even France soon, in the Philippines, in India, in Brazil-Argentina, in places in Africa and elsewhere. I think the traditionalists have no idea or strategy of how to stop it.

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.