On Global Capitalist Crises: Failure of Economic Theory and Capitalist Restructurings

Part VI

Read part I, II, III IV and V from the links below.

Part I – On Global Capitalist Crises: Systemic Changes and Challenges

Part II – On Global Capitalist Crises. Debt Defaults, Bankruptcies and Real Economy Decline

Part III – On Global Capitalist Crises: US Neocons and Trump’s Economic and Social Agenda

Part IV – On Global Capitalist Crises: The Destruction and Cooptation of the Trade Union Movement

Part V – On Global Capitalist Crises: Resisting US Financial Imperialism in Venezuela

***

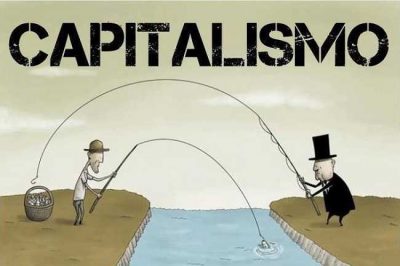

Mohsen Abdelmoumen: Why in your opinion does capitalism generate crises?

Jack Rasmus: Part of the reason is the failure of economic theory today to understand how global capitalism has been restructuring itself in recent decades. This restructuring has rendered much of traditional economic theory irrelevant, in so far as understanding and predicting the current trajectory of the global capitalist economy.

My view is not the typical mainstream (e.g. bourgeois) economics analysis of what causes (i.e. ‘cause’ here means distinguishing between what enables, or precipitates, or fundamentally drives) a crisis. There are different ‘forms’ of causation which mainstream economists do not distinguish between, but which I think are necessary. I would not characterize my view as a Keynesian, Schumpeter, Fisher, or even an Austrian (Von Mises-Hayek) economist view.None of these mainstream approaches to economic crisis analysis understand finance capital or how it determines, and is determined by, real (non-financial) capital. They don’t understand how financial and labor markets have both changed fundamentally since the 1980s.Their conceptual framework is deficient for explaining 21st century capitalism and its crises.Nor is my view what might be called a traditional Marxist approach. It too does not understand finance capital.It too tries to employ an even older conceptual framework, from the 19th century classical economics, to explain 21st century capital and crises.

Mainstream economics focuses only on short term business cycles and fiscal-monetary policy measures as solutions. But short term business cycle fluctuations aren’t really ‘crises’. A crisis suggests a fundamental crux or crossroad has been reached requiring basic changes in the system. Mainstream economics doesn’t even raise this as a subject of inquiry. Reality is just a sequence of short term events patched together. Or it attempts to apply business cycle analysis, and associated fiscal-monetary policy solutions, to what is a more fundamental, longer term, chronic instability condition. Consequently it fails both at predicting crises turning points and/or posing effective solutions to them. The two main trends in mainstream economics—what I call Hybrid Keynesians (which is not really Keynes) and Monetarists along with their numerous theoretical offshoots in recent decades—are both incapable of explaining longer term crises endemic in capitalism that have required the periodic restructuring of the capitalist system itself over the last century. That is, in 1908-17, 1944-53, and 1979-88.

Marxist economists have fared little better understanding or predicting 21st century capitalism. This is especially true of anglo-american Marxist economists, although the European and others outside Europe have been more open-minded. Marxist economists do consider the problem of longer term crises trends but attempt to explain it based on the conceptual economics framework of 18th-19th century classical economics, which is insufficient for analysis of 21st century capital. They assume industrial capital is dominant over finance capital, that only workers who produce real goods explains exploitation, and that finance capital and financial asset markets are ‘fictitious’. Hobson-Lenin-Hilferding and others attempted to better understand and integrate the relationship between industrial and finance capital at the turn of the 20th century. This led to an analysis of what’s sometimes called ‘Monopoly Capital’, a school of which still exists today. But subsequent capitalist restructurings of 1944-53 and 1979-1988 in particular have rendered such a view and analysis inaccurate.A century later, today in the early 21st, the relationships between finance capital and industrial capital have significantly changed from how Marx saw them in the 19th century, as well as how Hobson-Hilferding-Lenin envisioned them in the early 20th. In other words, contemporary Marxist economists don’t understand modern finance capital any better than do contemporary mainstream economists. Moreover, they still insist on employing classical economics concepts like the falling rate of profit, productive v. unproductive labor, and try to explain 21st century money and banking based on 19th century financial structures.Nor do they pay much attention to the new forms of labor exploitation today or explain why the unions and social democratic political parties have declined so dramatically in the 21st century.

My critique of all these mainstream (bourgeois) and Marxist economic ‘schools of analysis’, and their numerous spinoffs and offshoots, is contained in Part 3 of my 2016 ‘Systemic Fragility in the Global Economy’ book. That book also advances the analysis I originally began to develop in the 2010 book, ‘Epic Recession: Prelude to Global Depression’. My books published thereafter, 2017-2019, subsequent to ‘Systemic Fragility’, expand upon the key themes introduced in ‘Systemic Fragility’. Looting Greece: A New Financial Imperialism Emerges, August 2016, expands upon analysis in chapters 11, 12 in ‘Systemic Fragility’, addressing financial restructuring of late 20th century capitalism. Central Bankers at the End of Their Ropes (August 2017)expands on ‘Systemic Fragility’, chapter 14, on monetary contributions and solutions to crises.So does ‘Alexander Hamilton and the Origins of the Fed’ (March 2019), which is a prequel to ‘Central Bankers’ as a 18th-19th century historical analysis of US banking.And my forthcoming, September 2019, The Scourge of Neoliberalism book,will expand on Chapter 15 in ‘Systemic Fragility’ addressing fiscal policy, deficits and debt.

So all my work is an attempt at a more integrated analysis of 21st century capitalist economy, its contradictions, its increasing financial—and thus general economic—instability, the profound changing relations between finance and industrial capital, its fundamental changes in production processes and both product and labor markets, the increasing failure of traditional fiscal-monetary policies to stabilize the system, and the growing likelihood of a crisis coming within the next five years, or even earlier, that could prove far more intractable and deeper than even that of the 1920s-1930s.

The Three Restructurings of US & Global Capitalism, 1909-2019

Thus far, American capital, the dominant and hegemonic form of global capital over the last century, has restructured itself successful on three occasions: the first in the period just prior to world war I (1909 -1918) and during that war, as US capital ascended in the 1920s as a global player more or less equal to British capital. British capital in this period was eclipsed as hegemonic and had to share hegemony with American capital. In the wake of the second world war British capital was displaced by American as hegemonic, starting 1944 with the Bretton Woods international monetary system created by US capitalists, for US capital, in the interests of US capital.That second restructuring (1944-1953) began to break down in the early 1970s as global capitalist stagnation set in once again. That 1970s decade witnessed a general crisis of global capitalism, especially in the US and throughout the British empire (or what was left of it). But elsewhere among advanced capitalist economies in Europe and Japan as well.

A third restructuring was launched in the late 1970s by Thatcher and Reagan.Thisis sometimes called ‘Neoliberalism’ (a term I don’t like but use since it is generally accepted but is somewhat ideological). The third, Neoliberal restructuring re-stabilize US and global capital and expanded US capital, from roughly 1979 to 2008. It underwent a crisis with the Great Financial-Economic crash of 2008-09 in the US, and subsequent European and Japan multiple recessions and general stagnation that followed 2010 in the ‘advanced capitalist economic periphery’ of Europe-Japan which is now the weak link of global capitalism. Trump’s regime should be understood as an attempt to restore and resurrect neoliberalism—as both a restructuring and a new policy mix—albeit in a more violent, aggressive and nasty form of neoliberalism (2.0? perhaps).

I do not believe Trump will be successful in the longer term with this restoration. He’s had definite success with tax restructuring favoring capital, but is still contending with restoring monetary system to neoliberal principles (i.e. free money/low rates/low dollar value),and is in the midst of a major conflict and resistance to restore US hegemony in international trade and money affairs, in particular from China. Should Trump fail in restoring a harsher, more aggressive Neoliberalism 2.0, it will almost certainly mean a ‘fourth’ major capitalist restructuring will follow in the 2020s. That fourth restructuring will be even more exploitive and oppressive than Neoliberalism, especially for working classes as well as for US capitalist competitors in the advanced capitalist economic periphery and emerging market economies.

My Basic Thesis On Capitalist Crises

Is that capitalism experiences periodic crises every few decades (not ‘business cycles’ that may occur in between the crises but are not crises per se) and it must, and does, restructure itself periodically in order to survive.It creates multiple imbalances within itself whenever its shorter term fiscal-monetary policy solutions no longer are able to re-stabilize a system that grows increasingly unstable over time—i.e. a system which inherently and endogenously tends toward crisis periodically. Each restructuring, however, proves to have limits. Its effect at resurrecting capitalism inevitably dissipates over time, typically 2-3 decades.As a consequence of periodic restructurings, stability and growth is restored for a couple decades, but the fundamental contradictions that lead to renewed crisis arise and intensify once again during the periods of apparent growth and stability. Thus even basic economic restructurings as solution are temporary. Think of fiscal-monetary policy as solutions for only the very short term in the case of business cycles that are due to policy errors or other non-financial forces that cause ‘normal’ recessions. Think of periodic restructurings as producing solutions for the medium term (2-3 decades). But the capitalist system’s longer term crisis is that even periodic restructurings don’t prevent the inevitable crises from reappearing.

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

This article was originally published on the author’s blog site: Jack Rasmus.