The Fed Refuses Any Blame Including Its No Stress, Stress Test

The Fed's excuses for regulatory blunders are simply unbelievable.

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Click the share button above to email/forward this article to your friends and colleagues. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

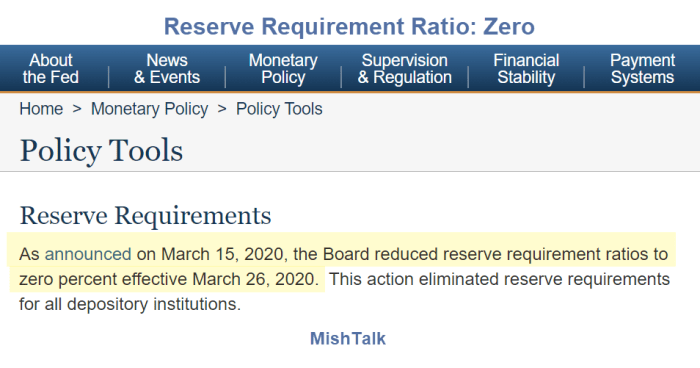

The above image from Fed Policy Tools.

“This action eliminated reserve requirements for all depository institutions.”

The Fed Passes the Buck on Bank Failures

On March 28, Michael Barr, Federal Reserve Board Vice Chair for Supervision, testified at a Senate Banking, Housing and Urban Affairs Committee hearing regarding three bank failures.

The Fed refused to accept any blame for the recent events.

The Wall Street Journal accurately comments The Fed Passes the Buck on Bank Failures:

One certainty in politics is that the Federal Reserve will never accept responsibility for any financial problem. Fed Vice Chair for Supervision Michael Barr played that self-exoneration game on Tuesday before the Senate as he blamed bankers and Congress for Silicon Valley Bank’s failure. This act is simply unbelievable.

No one disputes that bankers failed to hedge the risk posed by rising interest rates to asset prices and deposits. What Mr. Barr didn’t say is that the Fed’s historic monetary mistake created the incentives for the bank blunders.

Federal Deposit Insurance Corp. Chairman Martin Gruenberg noted in his testimony Tuesday that SVB’s balance sheet more than tripled in size between the end of 2019 and 2022, “coinciding with rapid growth in the innovation economy and a significant increase in the valuation placed on public and private companies.” That’s a cagey way of saying the Fed inflated tech valuations.

When near-zero interest rates persist for nearly 13 years with hardly a blip upward, some bankers will bet this will last forever as they hunt for yield. The Fed had also assured the world until very late in 2021 that it had no plans to change its policies because inflation was transitory.

Mr. Barr also passes the buck on the failures of bank supervision. He claims Fed supervisors flagged deficiencies in SVB’s liquidity risk management, stress testing and contingency funding in late 2021 and with its board oversight, risk management and internal audits in May 2022. In October 2022, he says, supervisors raised concerns with senior management over its interest rate risk profile.

He blames bank managers for failing to heed those warnings. But are these supervisors helpless bystanders?

In any case, the Fed’s “severely adverse scenario” stress test in February 2022 forecast a hypothetical world in which the three-month Treasury rate stayed near zero while the 10-year Treasury yield declined to 0.75%. This suggests the Fed staff in Washington were oblivious to risks from rising interest rates.

Stress Free Stress Test

Elizabeth Warren blames removal of Dodd-Frank legislation.

But the Bank Policy Institute says Silicon Valley Bank had higher capital than some bigger banks and likely would have met Dodd-Frank’s liquidity coverage ratio requirement.

And the stress-free stress tests, even if applied would have shown the same thing.

In Fed Q&A Jerome Powell Wonders “How Did Bank Failures Happen?”

I noted 12 mistakes by the Fed in In Fed Q&A Jerome Powell Wonders “How Did Bank Failures Happen?”

How Did This Happen?

- The Fed held interest rates too low too long, once again.

- The Fed even wanted to make up for lack of prior inflation, initially welcoming the pickup of inflation.

- The Fed failed to understand how $9 trillion in QE would fan asset bubbles.

- The Fed failed to understand how three rounds of fiscal stimulus, the largest in history, would fan inflation.

- The Fed presidents believe in economic models such as inflation expectations that its own studies prove do not work.

- When inflation did pick up, the Fed kept inisting that inflation was transitory.

- Even when the Fed finally realized inflation was not transitory, it kept QE going until the bitter end, not wanting to disturb prior forward guidance.

- The San Francisco Fed, whose job it was to monitor Silicon Valley Bank (SVB) was asleep at the wheel.

- The Fed considers treasuries a risk-free asset, ignoring duration risk.

- The Fed ignored a record concentration of long-term treasury and mortgage assets at SVB despite understanding the interest rate risk of those assets.

- The Fed’s forward guidance has been a disaster. It openly encouraged speculation.

- The Fed reduced reserve requirements on deposits to ZERO.

Dear Jerome Powell

Dear chairman Powell, instead of wasting taxpayer money on a study that will undoubtedly attempt to whitewash the Fed’s responsibility, please address each of the above twelve points.

ZERO Reserve Banking

The Fed openly encouraged and sought both inflation and speculation. It got what it wanted and then some.

Now the Fed has no idea how to fix the mess it created.

I still have not seen anyone major media outlet comment on zero-reserve banking.

I sent an article to the Wall Street Journal, ignored in favor of fluff pieces by people who have more name recognition.

*

Note to readers: Please click the share button above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.