The U.S. Federal Reserve’s “Inflation Lies”. Ushering In A Global Economic Depression. Russia Sanctions and a New World Order

All Global Research articles can be read in 51 languages by activating the “Translate Website” drop down menu on the top banner of our home page (Desktop version).

To receive Global Research’s Daily Newsletter (selected articles), click here.

Visit and follow us on Instagram at @globalresearch_crg and Twitter at @crglobalization. Feel free to repost and share widely Global Research articles.

***

The Federal Reserve and most other world central banks are lying about how interest rates affect inflation. It’s no small matter, as it clearly is being used to usher in a global economic depression, this time far worse than in the 1930s, using Russia as the scapegoat to blame, as the powers that be prepare to push the world into what Joe Biden recently called “a New World Order.”

I have made the case many times that every major economic depression or recession of the past century or so, since creation of the US Federal Reserve, has been the deliberate political result of Fed actions. The present situation is clearly a repeat of that. Recent statements and actions of the Fed on combating inflation indicate that they plan to provoke a full blown global depression in the next several months. The conflict in Ukraine and the insane flood of NATO country sanctions on everything Russian will be used to accelerate the process of global inflation in food, energy and everything else, and allow blame to be put on Russia while the Fed gets away unscathed. Follow the money creators.

If we look at the recent statements of the Fed, far the most powerful central bank in the world regardless of predictions of the dollar’s imminent demise as the global reserve currency, it becomes clear they are openly lying. Keep in mind the same Fed deliberately kept interest rates at near zero for more than 14 years since the 2008 crisis to bail out Wall Street at the expense of the real economy. Now they claim they must reverse rates for the good of that economy. They are simply lying.

The Bogus Phillips Curve

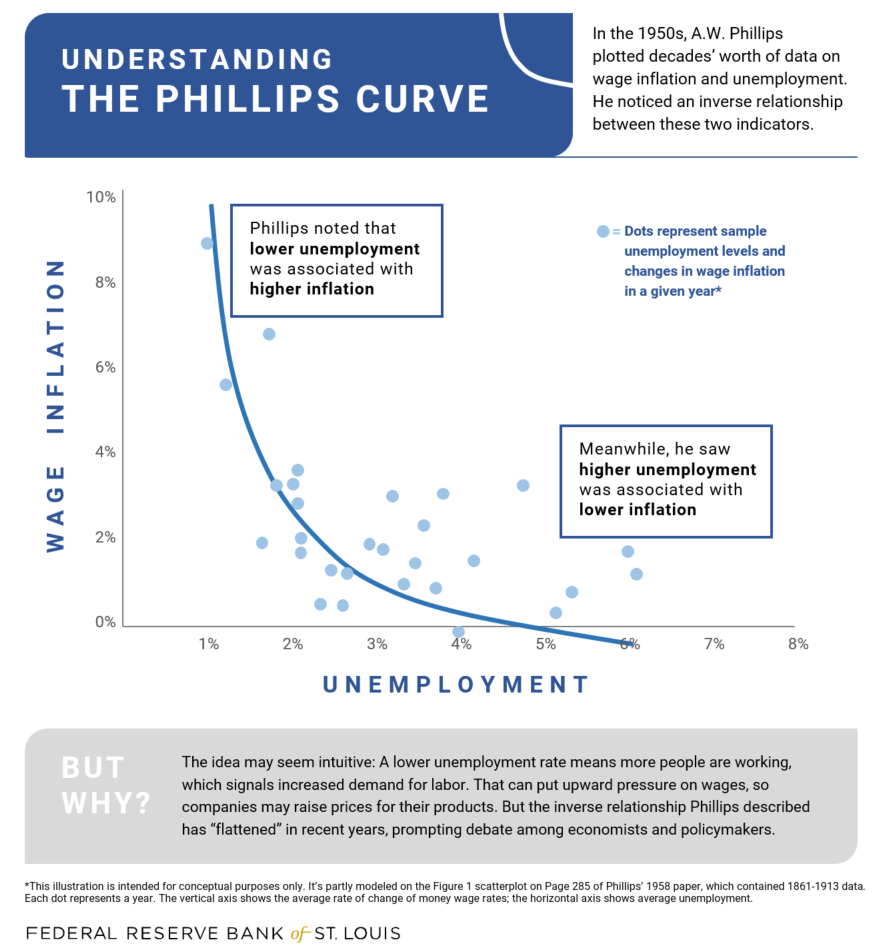

Over the past several years Turkish President Erdogan has been severely attacked for claiming that higher central bank interest rates are not effective in controlling Turkey’s high inflation. Ironically, he is right as far as he goes. He dared to attack today’s monetary orthodoxy, for which financial markets punished him by attacking the Lira. The basis of the theory on interest rates and inflation today goes back to an article in 1958 published by A.W. Phillips, then at the London School of Economics. Philips, reviewing UK economic data on wages and inflation over a century concluded there was an inverse relation between wages and inflation.

Basically Philips, who put his data into what is now known as the Philips Curve, concluded that inflation and unemployment have an inverse relationship. Higher inflation is associated with lower unemployment and vice versa. Yet correlation does not prove causality, and even the Fed’s own economists have published studies showing the Philips Curve invalid. In 2018 Princeton economist Alan Blinder, a former Vice‐Chairman of the Fed, noted that “the correlation between unemployment and changes in inflation is nearly zero… Inflation has barely moved as unemployment rose and fell.”

Despite that, the Federal Reserve, as well as most central banks worldwide since the 1970s, have used this Philips Curve notion to justify raising interest rates to “kill” inflation. The most infamous in this was Fed chairman Paul Volcker who in 1979 raised key US interest rates (at the same time as the Bank of England) by 300% to near 20% levels where he triggered the worst US recession since the 1930’s.

Volcker blamed the extremely high inflation of 1979-82 on worker wage demands. He conveniently ignored the true cause of global inflation then, soaring prices of oil and grains through to the 1980’s as a result of geopolitical actions of Volcker’s patron, David Rockefeller, in creating the oil shocks of the 1970’s. I write about this extensively in my book A Century of War: Anglo-American Oil Politics.

Since the brutal Volcker interest rate operation it has become orthodoxy for the Fed and other central banks to say rising inflation must be “tamed” by rising interest rates. In fact the ones to gain are the main banks of Wall Street who hold US Treasury debt.

Causes of Recent Inflation

The cause of the alarming inflation rises since the 2020 COVID lockdowns has little or nothing to do with rising wages or a booming economy. Raising rates to create a “soft landing” or so-called mild recession will have virtually no effect on real inflation.

Prices are soaring for the very necessities that families must spend on. According to a study by US economist Mike “Mish” Shedlock, more than 80% of the components of the US Consumer Price Index used to officially measure inflation is made up of so-called “inelastic components.” That includes above all cost of housing, gasoline fuel, transportation, food, medical insurance, education. Most families are not able to seriously reduce any of these necessary living costs regardless of higher interest rates.

Food cost is soaring as global shortages of grain, sunflower oil and fertilizers appear, owing to skyrocketing cost of natural gas to make nitrogen fertilizers.

This was well before the Ukraine conflict. Eliminating Russian and Ukrainian wheat exports because of sanctions and war can cut up to 30% of world grain supply. Drought in USA Midwest and South America, and heavy floods in China are adding to exploding food costs. Natural gas is rising because of the foolish EU and Biden Zero Carbon agenda to eliminate all hydrocarbon energy in the next years. Now because of the suicidal sanctions by the West against Russia, a major source of global diesel fuel, Russia, is being eliminated. Russia is the second largest crude oil exporter in the world after Saudi Arabia. It is the largest natural gas exporter in the world, most to the EU.

Sanctions, Urea and Microchips

An example of how interconnected the globalized world economy has become, in October, 2021 China imposed severe export controls on export of urea, a key component of not only fertilizer but also of a diesel engine additive, DEF or AdBlue, which most modern diesel engines need to control Nitrogen Oxide emissions.

Without AdBlue the engines don’t run. That threatens trucks, farm tractors, harvesters, construction equipment. U.S. military uses diesel fuel in tanks and trucks. Now with the sanctions on Russia, the world’s second largest exporter of refined diesel fuel is being forced out. The EU imports half of its diesel from Russia. Shell and BP have warned German buyers of potential supply problems and prices are soaring. The diesel loss comes as diesel fuel stocks in Europe are at their lowest since 2008. In the US according to OilPrice.com, the situation is graver still. There, diesel fuel inventories are 21 percent lower than the pre-pandemic five-year seasonal average.

Neon gas is a byproduct from steel production. Some 50% of world semiconductor high-purity neon gas critical for the lasers needed for lithography to make chips comes from two Ukrainian companies, Ingas and Cryoin. Both got their neon from Russian steel plants. One is based in Odessa and the other in Mariupol. Since the fighting there began a month ago, both plants have shut down. Moreover, according to the California-based firm TECHCET, “Russia is a crucial source of C4F6 which several US suppliers buy and purify for use in advanced node logic device etching and advanced lithography processes for chip production.” As well Russia produces about a third of all world palladium used in car catalytic converters and in sensors and emerging memory (MRAM).

Oleg Izumrovov, a Russian computer data expert points out further that Russia today “accounts for 80 percent of the market of sapphire substrates – thin plates made of artificial stone, which are used in opto- and microelectronics to build up layers of various materials, for example, silicon. They are used in every processor in the world – AMD and Intel are no exception.” He adds, “Our position is even stronger in the special chemistry of etching chips using ultra-pure components. Russia accounts for 100 percent of the world’s supply of various rare earths used for these purposes.”

Not to mention Russia is the world’s second largest producer of Nickel and of aluminum.

As Washington continuously escalates sanctions against Russia it is only a matter of weeks before these supply chain links impact global and USA inflation to a degree not seen in recent memory. At the March 24 Brussels NATO meeting Joe Biden tried (unsuccessfully for now) to push the EU member states to sanction Russian oil and gas. Energy prices are already soaring globally and Biden admitted to a reporter that prices are going to go much higher for food and energy, blaming it on the Ukraine conflict.

None of these effects, most of which are only beginning to impact the cost and even availability of food and other essentials, can be altered by raising Federal Reserve Fed Funds rates. And the Fed knows that. They are literally throwing kerosene onto a burning economic fire with their actions. They will point to alarming rises in inflation by May and double-down on their false “cure”, namely higher interest rates that risk plunging the US and world into a global depression that will make the 1930s seem mild. We can expect much talk about introducing a digital central bank currency to replace the dollar at that point. Welcome to the Davos Great Reset.

*

Note to readers: Please click the share buttons above or below. Follow us on Instagram, @globalresearch_crg and Twitter at @crglobalization. Feel free to repost and share widely Global Research articles.

F. William Engdahl is strategic risk consultant and lecturer, he holds a degree in politics from Princeton University and is a best-selling author on oil and geopolitics. He is a Research Associate of the Centre for Research on Globalization (CRG).

Seeds of Destruction: Hidden Agenda of Genetic Manipulation

Seeds of Destruction: Hidden Agenda of Genetic Manipulation

- Author Name: F. William Engdahl

- ISBN Number: 978-0-9879389-2-3

- Year: 2007

- Product Type: PDF File

Price: $9.50

This skilfully researched book focuses on how a small socio-political American elite seeks to establish control over the very basis of human survival: the provision of our daily bread. “Control the food and you control the people.”

This is no ordinary book about the perils of GMO. Engdahl takes the reader inside the corridors of power, into the backrooms of the science labs, behind closed doors in the corporate boardrooms.

The author cogently reveals a diabolical world of profit-driven political intrigue, government corruption and coercion, where genetic manipulation and the patenting of life forms are used to gain worldwide control over food production. If the book often reads as a crime story, that should come as no surprise. For that is what it is.