Failures of Central Banks, Interest Rates, Derivatives and Crisis in the Credit Market

The Biggest Black Swan of Them All ...False Beliefs!

Global markets are changing drastically and showing volatilities like we saw back in late 2008. I am not talking about stock markets, it is the debt and currency markets that are schizophrenic. Oddly, even after all of the various Western “QE’s”, liquidity suddenly looks like it is drying up. A great article as to why even the depth in the U.S. Treasury market has disappeared can be read here

http://www.zerohedge.com/

Various credit markets (important one’s!) have cracked over the last month and the myth of “zero percent interest” rates is in the process of being shattered. I want to visit several topics in this piece, each one with the ability to break the derivatives chain which is exactly what we are headed for!

First and foremost, I believe we are about to find out central banks are not the omnipotent powers we’ve been led to believe. You might as well say central banks have been perceived as all powerful, all knowing and the savior of any and all things “bad”. The confidence in central bank’s abilities to fix anything and everything has grown to epic proportions and is now ingrained everywhere. This thought process is so prevalent, we might as well say it is “imprinted” in the mass psyche from birth!

What we are seeing now are credit markets revolting against the risk of over levered sovereign treasuries and the fact of receiving zero compensation for the outsized risk. Investors were led and cajoled by central banks into this corner of uncompensated risk. It was easy. Central banks led by the Fed only needed to announce their “plans” and investors stormed the credit markets in front running fashion.

A natural problem or two is arising. Interest rates have been zeroed out for too long. As the three Fed stooges finally admitted last week, zero interest rates are only justified by crisis. Continued zero interest can mean only one of two things, we are still in a crisis behind the scenes or rising interest rates cannot be tolerated by markets with no margin left. Both of these are the reality! Before going any further, one thing needs to be made clear. Central banks do not, better said CANNOT set interest rates. Yes, they can push, pull, “suggest” and even buy sectors of the credit market to affect interest rates…

…BUT ONLY in the short run. My point is this, “the short run” is ending! The central banks are running up against the “confidence clock” if you will. The economic and financial lies told are now being revealed for what they are, WHOPPERS! Think about it, do any numbers make sense? Inflation? GDP? Employment? Spending? Housing? Nothing reported now makes any sense at all and the lies have by necessity gotten so big, even little children know them not to be true.

The truly HUGE problems lay in the derivatives markets. These are multiples of all markets …with very thin margins allowed for losses. The volatility seen in currencies and debt over the last month have surely bankrupted many. You see, it was the use of derivatives markets in the first place to “engineer” the bubbles …which are now bursting! It is quite simple, the leverage afforded by derivatives, funded by credit and freely printed currency blew the bubbles to begin with. Margin calls and forced closure of many of these derivatives will be the driving force of the coming collapse. A broken derivatives chain will break everything beneath them including the currencies themselves.

The following is how Jim Sinclair has described derivatives:

There is no such thing as a derivative that does not have an implied or defined interest rate characteristics. This is the chain that connects them all.

That makes this problems larger than one quadrillion dollars, the true level of the notional value derivatives outstanding before the BIS got into Whoopers, changed the computer program for measurement and reduced outstanding notional value of derivative outstanding to just $700 trillion in 2007. Here is the concept you must understand. Notional value of a derivative becomes real value of the derivative in the event of derivative bankruptcy. Derivative bankruptcy is defined as the breaking of the interlocking chain, interest rates. Now, you the reader, have a feel for how big this problem is. This unwelcome change in the interest rates market, the bond market, is truly the god of Death for the world’s financial system. When the smoke clears, gold will be the only true measure of value (a definition of money) with gold’s only mechanism for price discovery being the now growing and transparent physical market, the paper market will be in tatters as will be the paper exchanges and paper public companies that own these exchanges.

In a nutshell, derivatives NEVER DIE, THEY ONLY GROW LARGER!

Before moving on, HUGE NEWS has broken today, the two CEO’s of Deutsche-Bank have stepped down! http://www.usatoday.com/story/

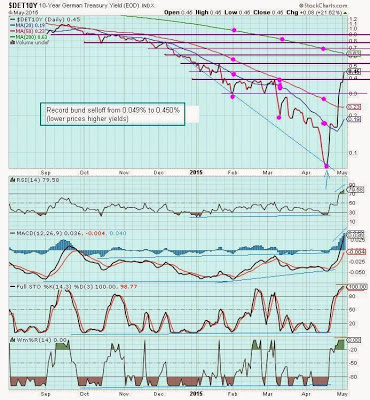

Deutsche-Bank is the largest holder of derivatives in the world, equaled ONLY by JP Morgan holding a “cool” $75 TRILLION!!! Please view the following chart of the 10yr Bund, rates have exploded higher in a very short time span. Huge losses have been incurred as ALL derivatives have interest rates assumptions within, no doubt your reason for the sudden resignations!

Something has clearly BROKEN!

The next false belief is about debt itself. I had the privilege the other day to personally listen to Greg Hunter go on a tirade about this. He said “the biggest lie in the world is that debt is an asset and debt is money”. He went on to say “NO IT’S NOT! Debt is ALWAYS A LIABILITY!” This is absolutely true, simple to understand, and 180 degrees counter to what the world believes …for now. Let me explain this a little because it is “core to everything” (pun intended as you will see).

Debt is the foundation to everything. “Currency” itself is created ONLY by the creation of debt. Better said, currency is created by the increase in the amount of debt outstanding. Debt stands as the foundation to all bank portfolios, all pension plans, the “value” of and “liquidity” of all real estate and equity markets. “Debt” is THE foundation to what 99% of the world calls their “net worth”.

Before tying this part up for you, one other item needs mentioning. This past week, Christine Lagarde of the IMF was out publicly “stating” (could be called demanding, asking or even PLEADING) the Fed should not raise interest rates until sometime next year. (As a side note, can you remember when “raising rates” was first mentioned? 2010! It has always been “next year” since then!). The interesting thing is Janet Yellen was talking about raising rates at the same time Ms. Lagarde was speaking.

“Houston, we have a problem”! Do you see the problem? Switzerland broke the peg with the euro back in January …and forgot to give the IMF a heads up ahead of time! This affected MANY banks including central banks themselves. Did they give a heads up to the BIS? Probably. If so, was this the first sign of the “Western” IMF being isolated and in the dark? I believe it was and I also believe Ms. Lagarde is terrified the Fed may actually try to raise rates one token time for whatever reason, to save face, for legacy or whatever. (I am on the record many times before, I do not believe the markets will even function within 48 hours of an actual Fed rate hike). One other question, can the Fed or other central banks really sit idly by as market rates run interest rates away from them to the upside? A true dilemma!!!

Do you now see where I am going with this? Market rates are now clearly going higher whether central banks like it or not …with or without them! This part is important because it speaks to “confidence” or the lack of, it is however not the MOST important. What is most important of all is this, EVERYTHING financial in the world is “discounted” against current, prevailing and EXPECTED interest rates. The higher the rate and the higher the expectation of rates …the lower someone is willing to pay for a current asset! Can you say “everyone out of the water”!

There is also another aspect. Since “debt” underlies everything, as interest rates do rise, bond “prices” (values) drop. What do you think lower debt values will do to bank portfolios, pension plans, insurance programs etc.? You got it! More and more “assets” become “unfunded”! Obviously, starkly higher interest rates in a very short time also blow up ALL derivative’s interest rate assumptions. We are talking about TRILLION’s being turned on their head!

To wrap this up, the world CANNOT in any way have higher interest rates but this is exactly what is happening. Interest rates were forced to zero because that was the only rate where debt services could be made and asset prices “supported”. Rates are reversing, many debts will not be paid nor able to be rolled over (at higher rather than lower rates), asset values of all sorts will plummet, financial structures and promises will be hollowed out …and even the currencies themselves will be questioned.

Once the belief that “debt is an asset …or even money” is broken, just as a spooked herd of cattle runs wild, so will investors. They will seek the safety of “no one’s liability” because no one will be trusted. This includes the central banks and sovereign treasuries themselves. Gold, (no one’s liability) will not pay you interest and will not make promises that cannot be kept, it will simply “remain”. Gold will remain as the world’s purest asset and purest money. In a world where most all “assets” are finally understood to really be someone else’s liability, there is no telling what value might be placed on the purest form of asset/money? Gold will be seen as the “anti liability of last resort”. I guess better said, gold is the ultimate central bank for the asset side of the balance sheet!