Despite Stronger U.S. Growth

Anyone with a pulse knows that Europe is stuck in a downturn worse than the Great Depression.

Most think that the U.S. has fared better … but that is debatable.

Mega-bank Société Générale’s strategist Albert Edwards notes:

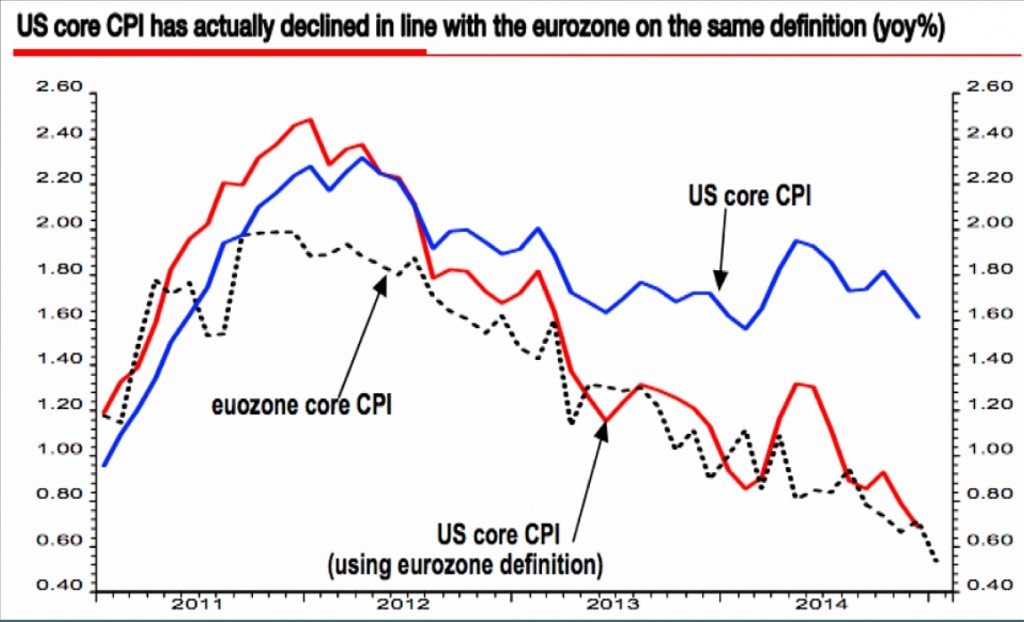

“Core Inflation in the US would be just as low as in the eurozone if measured on the same basis, despite the US having enjoyed much stronger growth!”

By way of background, the U.S. government has long ignored energy and food prices when reporting on inflation. As former Assistant Secretary of the Treasury and Assistant Editor for the Wall Street Journal, Paul Craig Roberts explains:

The inflation rate, especially “core inflation,” is another fiction. “Core inflation” does not include food and energy, two of Americans’ biggest budget items.

And – in contrast to the U.S. – the European method of calculation attempts to incorporate rural consumers into the sample (while the US maintains a survey strictly based on the urban population) and excludes owner-occupied housing from its scope (while the US calculates “rental-equivalent” costs for owner-occupied housing).

In any event, if calculated the same way, America’s crash in core inflation would be as obvious as Europe’s.

|