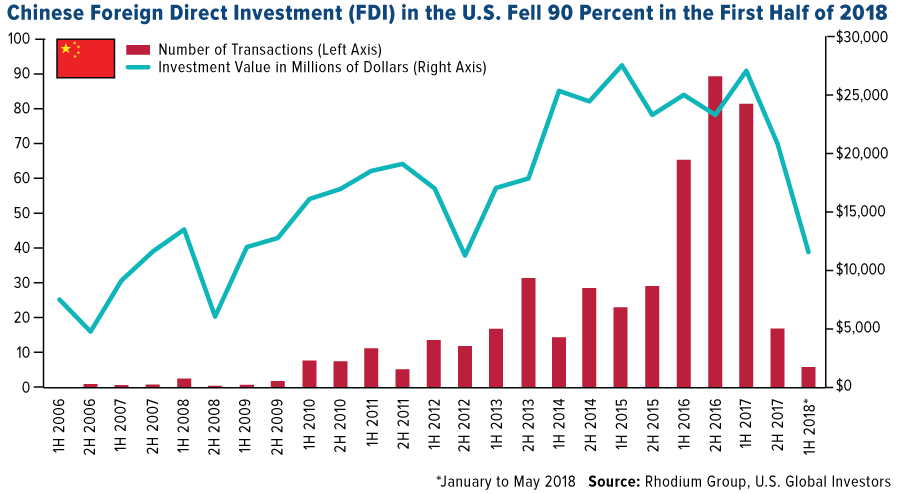

Chinese Investments in US Grind to Halt, Trade War Blamed

Chinese foreign direct investments in the US, including new factories, has collapsed: down to just $5 billion last year, from $29 billion in 2017 and $46 billion the prior year, according to the Rhodium Group, a New York-based economic research firm with a focus on China.

.

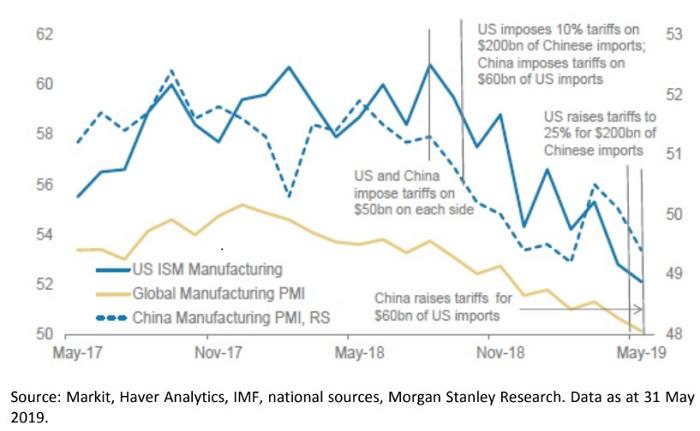

The US and China trade war has been well underway for one year with both sides imposing punitive tariffs on each other’s goods. President Trump has already imposed a 25% tax on $250 billion worth of imports from China. In a tit-for-tat effort, Beijing imposed 25% tariffs on $110 billion worth of US goods.

The escalation of the trade war has since triggered a significant increase in investments in South and Southeast Asia, but very little in the US, contrary to President Trump’s claims that a trade war would bring companies back to US.

There is some hope that a recent trade war truce between President Trump and President Xi could spark more direct investments into the US from China. But in our opinion, that won’t happen in the near term because a global synchronized slowdown that started before the trade war (1Q18) is being amplified by trade uncertainties, spooking corporate investment and confidence in US markets.

Take, for example, Jushi USA, a supplier of fiberglass reinforcements and fabrics to the bolster the plastics industry in the US, recently opened up a new factory in a deindustrialized part of Columbia, South Carolina, had plans for the second phase of its $400-million project, but had to put it on hold due to the trade war.

About 80 miles to the north, another Chinese businessperson, Zhu Shanqing, invested $200 million into constructing two yarn-spinning plants in a deindustrialize area near Rock Hill.

Shanqing said his new South Carolina mills, part of the Keer Group based in Zhejiang province, along the Chinese coast south of Shanghai, would have employed 650 workers today, not 400, were it not for the trade war driving uncertainties to extremes.

“In the current climate,” he said, “we had to put it on hold.”

The plunge in Chinese investment across the US has been felt the hardest in South Carolina, which has attracted the most investments from China than any other state in recent years.

Over the last decade, Chinese investors plowed $10 billion into greenfield projects in the US, and South Carolina captured 10%, much more than any other state.

South Carolina marketed itself as a state with cheaper operating costs and nonunion labor. To handle increased trade volumes, the port of Charleston made investments and offered incentives to attract global manufacturers, including BMW, Samsung, and Michelin.

This has made South Carolina very dependent on international trade and sensitive to trade disputes.

Joyce Dickerson, chair of the Richland county council, blamed Congress for allowing President Trump to intensify the trade war. She said,“It’s like a domino effect. With a trade war going on, people cannot have stability.”

Dickerson said: “He can’t negotiate with people’s lives like this. His approach is not making America great.”

Trade uncertainty is a lingering unknown and dangerous for corporate sentiment. It has already amplified the cycling down of the US economy and could produce a shock so significant that a recession could form.

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

All images in this article are from Zero Hedge