China’s Long Term Trade and Currency Goals: The Belt and Road Initiative

Introduction

The evolving US-China trade war, which reached a dangerous level of US tariffs being imposed on $200 billion worth of imports from China, has been holding center stage in international relations discussions in 2018. But Beijing’s tit-for-tat response to the US is far from the only strategic weapon it has been deploying. What is less discussed in the context of the US-China strategic conflict, and is arguably of greater significance, is Beijing’s Belt & Road Initiative (BRI), which encompasses projects involving over 70 countries and counting (in Eurasia, South Asia, Southeast Asia, Africa and now in Latin America), in infrastructure projects worth more than $1 trillion and counting. Strategically the BRI draws countries into China’s orbit, through the building of infrastructure financed through loans from Chinese and China-promoted banks.1 The initiative is now just on five years old and already encompasses countries that account for half the world’s economic activity. These countries now form the world’s largest trade and investment area. The BRI has come in for much criticism, with articles in both the Financial Times and the New York Times among others querying its long-term viability.2 By contrast, an evaluation published by The Economist provides a balanced account of the BRI and its prospects, while pointing to some clear sources of concern (that will be elaborated below).3

The US Congress recognized the significance of the BRI’s five-year milestone by staging Senate hearings on the initiative – the first by the US legislature on this significant foreign policy challenge to the US. Leading scholars advanced testimony at these hearings of the Congressional US-China Economic and Security Review Commission (staged on Jan 25 2018) providing a summary and analysis of the progress achieved in the first five years of the initiative.4 Most commentary on the Belt & Road Initiative recognizes the grandeur of the vision and the scale of its execution, but also the challenges it poses for other great powers, in particular the United States.5 But there is also much critical commentary, mainly focused on the issue as to whether countries engaging in BRI projects are entering “debt traps” or, even worse, whether they are setting themselves up to become constituent parts of an emerging Chinese empire.

One recent commentary from the Washington, DC-based Center for Global Development, identifies eight developing countries (all relatively weak or marginal players, apart from Pakistan) that are said to be in particular danger of falling into debt arrears – these countries being Djibouti, Kyrgistan, Laos, the Maldives, Mongolia, Montenegro, Tajikistan and Pakistan.6 The eight include small countries that have long wished for closer relations with China, like Tajikistan and others that are buttressed by very large and substantial commitments on the part of China, such as Pakistan. The issues raised are substantial and call for some engagement. The case of Sri Lanka raises particular concerns, with its transfer to China of ownership of the Hambantota port as Sri Lanka was unable to meet debt repayments on the project.7 This and other projects deserve scrutiny.

This article provides an assessment of the design and implementation of the BRI, recognizing it as an important extension abroad of China’s development model, and viewing it as an important element of China’s soft power complement to its growing hard power military development, before addressing the issue as to whether it represents a series of “debt traps” for the countries involved.8 I begin by seeking to understand the BRI from the perspective of Chinese planners– what is it aiming for, how is it going about achieving these aims, and what expertise and resources is it bringing to the task? How does the Belt and Road Initiative build on, and affect, China’s own development strategy, in particular the balance between debt-fuelled infrastructure development and strategic industry development? This provides the context for asking what are the risks being run by the countries that are signing up for involvement with the BRI – as well as the risks being run by China itself.

It is widely recognized that China has brought about a far-reaching urbanization and industrialization on its own soil, in the 40 years since Deng Xiaoping ushered in the “reform and opening” period after 1978. In decade after decade of unprecedented growth, averaging close to 10% per annum, China built cities and laid down infrastructure at a scale never before attempted, or accomplished, by any developing country. China’s strategy of state-led growth, with the Chinese Communist Party firmly in control, and state-owned enterprises leading the way, initially at home and then increasingly abroad, has established a new norm for development that is attracting great interest from other developing countries in South, Southeast and Central Asia, Africa, and Latin America, many of whom had been struggling under the weight of the nostrums of the World Bank and IMF and the “Washington Consensus”. Central to China’s performance has been its rapid build-up in export earnings and foreign exchange reserves, which have enabled its policy banks like the China Development Bank (CDB) and Export-Import Bank (China Exim Bank) to provide Chinese firms with long lines of credit as they venture abroad. This has reinforced their position in international competition and most recently has enabled Chinese firms to gain positions of leadership in emerging sectors such as electronics, renewable energy and electric vehicles, widely viewed as strategic industries for the future.

The BRI now proposes to achieve similarly impressive results outside China, exporting China’s model of infrastructure-led development and providing Chinese-led finance as the driver. Funds are being channelled by the 70-plus participating countries into such projects as building bridges, railways, pipelines, hydroelectric dams, highways, power grids, with Chinese banks as well as new multilateral development banks such as the China-sponsored Asian Infrastructure Investment Bank (AIIB) and the BRICS New Development Bank (NDB) providing the majority of funding.9 Here China is providing finance via lines of credit created by these financial institutions, in the same way that it has financed its own domestic development. The difference this time, of course, is that the Chinese State and Chinese Communist Party are not able to control the process directly, as was possible in the domestic setting.10 The New York Times characterized the BRI as a “modern-day version of the Marshall Plan, America’s reconstruction effort after World War II” – except that China’s strategy is “bolder, more expensive and far riskier”.11

In this article I seek to characterize the model of state-led development pursued by China as prelude to discussing its internationalization as the New Silk Roads strategy, or “Belt and Road Initiative”.12 How are we to characterize this expansion of China’s influence across its neighboring countries and now extending globally, e.g. to Latin America and Africa? China’s expansion poses unique issues since its rise is clearly backed by hegemonic ambitions, at least within its own region. In the case of China’s BRI there is the persuasive power of finance (provided by the Chinese policy banks like CDB and China Exim Bank and the new multilateral banks like AIIB or NDB) backed by non-financial elements of Chinese diplomacy – such as student scholarships offered abroad, or the efforts of the Confucius Institutes to promote Chinese culture.13

Finance of course can be very persuasive. Countries accepting Chinese largesse could be making well-informed decisions with a view to building their infrastructure as basis for growing their output and exports – or they could be lured into making short-sighted or ill-advised judgments that can end in some form of ‘debt bondage’ (or locked into projects that might have little relevance to the country concerned, and might be mere vanity projects for a country’s ruler). Countries with records of political unrest and terrorism might find China taking steps to secure its own companies’ operations and personnel, in ways that might seem to contradict China’s expressed principle of non-interference in others’ affairs. China’s interests are generally well protected since the loans advanced are frequently tied to contracting with Chinese firms for construction, and they frequently employ Chinese suppliers and labor. The BRI is a pragmatic initiative and must be viewed through the lens of China’s own developmental ambitions; it is far from being merely a charitable exercise.

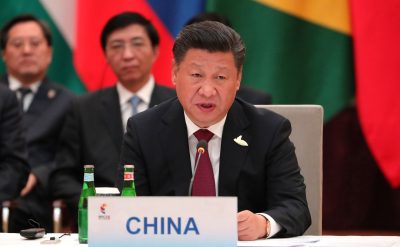

The name BRI

Like other commentators (e.g. Leverett and Wu 2016) I will refer to China’s grand strategy that is officially known as “Belt and Road Initiative” as its New Silk Roads strategy. Indeed, as announced by President Xi Jinping in 2013, the Initiative consists of two components, one the land-based Silk Road Economic Belt, and one the sea-based 21st Century Maritime Silk Road. These became integrated as the “One Belt One Road” strategy and now, officially, as the “Belt and Road Initiative”.14 It makes abundant sense to call this what it really is – namely a New Silk Roads strategy, or initiative – with the proviso that its geographic scope now extends far beyond what was historically called the “Silk Road”.

This is the story that China is now telling the world to boost its soft power. It is carefully and astutely crafted to take advantage of moves by the US as the current hegemon. When the US announced its “pivot to Asia” under the Obama Administration, this spelt intensified US focus on the Pacific – and so China’s BRI has turned westward, to Central Asia (where the US is largely absent), the Middle East (West Asia) and Africa.15 China has found ready acceptance of its influence in the “-stan” countries, with its provision of financing and technical expertise to support construction of pipelines, roads, railways and high-speed rail (HSR), dry ports and airports, hydroelectric dams, which both improve communications between China and the region (and beyond, to Europe) and provide unparalleled opportunities for development for the countries concerned. This is emerging as one of the central features of US-China “great power rivalry”.16

The infrastructure proposals under BRI

The land-based corridors bundled together as the Silk Road Economic Belt cover a variety of routes. There is a “northern” route, going from western China via Xinjiang province through Kazakhstan and Russia to western Europe; and a “southern” route again leading from Xinjiang through the Central Asian countries Kyrgistan, Uzbekistan and Turkmenistan, via Iran and Turkey, into southern Europe. The complementary sea routes are called the 21st Century Maritime Silk Road, expanding sea-based commerce between China and Southeast Asia, South Asia (e.g. Sri Lanka and Pakistan) and Africa, in ways that diminish China’s reliance on the Malacca Strait between Singapore and Malaysia, and the more southerly Sunda Strait and Lombok Strait (Fig. 1). A “Polar Silk Road” traversing the Arctic, was added in 2018.17 But enumerating all the corridors is not all that significant since it is by now clear that the scope of the project is global, with new projects in South America and Africa being signed up in 2017/2018.18 So already the BRI has moved beyond a “westward” or “Go West” initiative to encompass global ambitions to assist countries in securing financial assistance from China in building local infrastructure (via trade and investment as well as traditional aid activities).

Figure 1. The Belt and Road Initiative – land corridors and sea lanes (Source: Wikimedia)

There are in fact six economic corridors making up the land-based Silk Road Economic Belt. The land corridors include the New Eurasian land Bridge, encompassing many new rail connections across Eurasia; the China-Mongolia-Russia corridor (a north-south connection); the China Central Asia-West Asia corridor; the China-Indochina Peninsula Corridor; the Bangladesh-China-Myanmar corridor; and the most ambitious of all, the China-Pakistan Economic Corridor. The largest and most ambitious of these is the CPEC, which promises to make Pakistan a long-term partner of China with clear benefits for Pakistan itself in terms of its own industrialization and development, and for China in the form of development that promises to stabilize the political situation in Pakistan and ease its fostering of radical Islamist terrorist initiatives. (Note how this counters the Soviet and later Russian tilt towards India.) The CPEC encompasses proposals that together amount to approximately $62 billion in transport, power and infrastructure projects. Notably the CPEC also counts a strategic port in the western tip of Pakistan, bordering on the Arabian Sea, at Gwadar.

Gwadar and Hambantota

Two port developments in Pakistan and Sri Lanka illustrate some of the positives and clear negatives in the BRI. Gwadar is a port at the western extremity of Pakistan, bordering on the Arabian Sea and linked to Kunming in southwest China by rail, road and pipeline projects that are viewed as part of the China Pakistan Economic Corridor. The contract to expand the port of Gwadar has been won by the China Overseas Port Holding Company (COPHC). The whole project involves not just the port but an associated Export Processing Zone as well as road and rail projects and an international airport. It is thus a project to which China attaches great significance, and which potentially holds great promise for Pakistan. So far it has evaded “debt trap” implications, but these remain at the forefront of international concern.

The Hambantota port has been open since 2010, but facing debt distress the Sri Lankan government made a debt-for equity swap, extending a 99-year lease to the Chinese state-owned company China Merchants Ports (CMP), for a price of $1.3 billion.19 After incurring heavy losses, a debt-for-equity swap was proposed in 2016, granting the China state-owned port operator CMP, an 80% stake in the company, in return for guarantees that it would make substantial investments to make the port profitable (totalling $1.12 billion in a public-private investment structure, and divesting 20% to a local Sri Lankan company within ten years. In July 2017 a settlement was reached leasing 70% of the port to CMP rather than the proposed 80% for a 99-year leasing period.20 So this is a case where a Sri Lankan government overstretched itself and ended in debt arrears to China – a situation that had to be remedied (in a fashion) by a subsequent Sri Lankan government through an arrangement with its Chinese counterpart.21 Of course India is disturbed by these developments because it is embroiled in security disputes with both Pakistan and Sri Lanka. Gwadar is probably more important from both China’s and India’s perspective because of the overland links it offers (rail, road, pipelines) between the port and western regions of China.

Fig. 2. Chinese port projects as part of the BRI (Source: C4ADS report22)

The Hambantota port in Sri Lanka and the Gwadar port in Pakistan, bordering on the Arabian Sea, are clearly two of the “string of pearls” that China has been sowing along the 21st Century Maritime Silk Road. (See Fig. 2, a chart taken from C4ADS report, May 2018.23) There are ample reasons for China to want to have a measure of control over these developments. In the case of Gwadar the new port and the associated communication routes from southwestern China open up possibilities for oil to be brought direct to China overland or via pipeline. In complementary fashion, exports from southwest China are to be shipped out via this Indian Ocean port rather than from the east coast of China and the extended sea lanes that go to Europe, South America and Africa.24 These are all attractive in geopolitical terms. In this way the BRI initiative involving Gwadar can be seen to encompass China’s geopolitical interests complementing the transport and economic interests served by the port. China has accepted proposals from the relevant governments but refused to make the conditions of the loans public or to make the tendering processes transparent – which leads to well justified suspicion that these processes have something to hide.25

The international political economy of China’s rise

What light does International Relations theory shed on the BRI and looming China-US power relations? The influential US international relations theorist John Mearsheimer deploys his framework of “offensive realism” to argue from the historical record that China is likely to be imitating in the 21st century what the US did in the 20th century. The US rose to become a regional hegemon in the western hemisphere in the 20th century and then forcibly kept other states from becoming hegemons themselves – first Imperial Germany, then Nazi Germany, then Imperial Japan and then the Soviet Union. Mearsheimer argues that this is what the US actually did – despite its liberal rhetoric. He argues that China has understandable aspirations to be a Great Power – and that this will lead it to seek to become a regional hegemon in Asia, which will be its base from which it will be able to roam the world, just as the US roams the world today because it is secure in the western hemisphere. Mearsheimer argues that China has been a smart player in seeking to reassure everyone – and in particular the US – that its rise is peaceful (while if its reassurances on this point have less credibility, even under Obama, and certainly under Trump).

Mearsheimer most recently argues (in conversation with Peter Navarro, a leading China hawk in the Trump administration26) that the Chinese understand full well what happened to Imperial Germany, then what happened to the Soviet Union – and they do not want to end up committing national suicide. So the Chinese are thinking how best to maximize their power in smart and sophisticated ways. Mearsheimer’s argument is that, given the “tragedy of Great Power politics”, the Chinese are likely to pursue regional hegemony but do so in a smart way, without disturbing or antagonizing their neighbors or the US. He sees China as being only moderately successful in this (a bit too trigger-happy over islands in the South China Sea, and perhaps provoking the US into a tariff/trade war).27

The BRI – or more generally, the New Silk Road (NSR) strategy – is a smart and sophisticated strategy of this kind. It enhances China’s economic power and brings a number of countries into China’s economic orbit, without deliberately antagonizing or threatening the US in doing so. The hegemonic ambitions of both the US and China (as recognized by realists like Mearsheimer) play out in a multi-faceted relationship, which gives rise to open conflict at times (such as in the current trade war) but has further implications such as in the negotiations over North Korea, a Korean War peace treaty, and nuclear weapons control, and much else besides. Without involving the cumbersome machinery of a treaty, or a new international organization, the NSR strategy aligns dozens of countries with China in a common quest for improved communications infrastructure development while seeking to leave US interests nominally intact.

Joseph Nye also uses an alternative concept of “soft power” – which was developed to explain the capacity of the US to maintain its global dominance through aligning interests with allies and at the same time seeking to crush military rivals. Now Nye uses the same concept as a means of evaluating China’s strategy, and why it has been so far successful in moderating international reaction to its rise. Nye too argues that countries deploy both “hard” and “soft power” but that they increasingly do so in a smart way – what he calls “smart power”.28 In this context, China’s BRI is an interesting case of a country seeking to enhance its “smart power” – but meeting determined resistance from the incumbent – in this case the US with Trump’s trade war initiatives.29

The security dilemma – and how China is moderating it

The field of international relations certainly has its share of sweeping theories – like “offensive realism” and “soft power”. But a nuanced approach is also perfectly feasible to moderate the sweeping claims of structural realism – as in the case of the theory of the “security dilemma”. This theory holds that structural realism explains much of the endless search for security on the part of nation states – but it is focused on the case where “one state’s efforts to increase its own security reduces the security of others” (as elaborated in Foreign Affairs by Charles Glaser).30 If states in an anarchic international system face a strong security dilemma, then actions taken to enhance their own security could and probably will be viewed as hostile acts by other states.

But if the security dilemma can be moderated, then states face less chance of their security-enhancing actions being misinterpreted by other states. This is, I suggest, the case of China’s Silk Roads initiatives. This initiative is one of creating a community of states that have common interests in the building of infrastructure with China’s financial assistance – perhaps the central feature of the Belt and Road Initiative. Provided China does not mis-manage the consequences of states falling into debt arrears, the multiple projects promise benefits for China as well as decidedly for the countries concerned. If China were to demonstrate creditor restraint, and not threaten to acquire assets where repayments have fallen into arrears, there would be little provocation of other states or a fear of neo-imperial aggrandizement. But if on the other hand China views indebtedness as a “debt trap” leading at the first opportunity to a conversion of debt to equity, with assets passing into the hands of Chinese state-owned enterprises, then other states would be justifiably alarmed at China’s aggrandizing intentions, and the speed at which the transition is taking place. It remains to be seen how China will handle these issues.

The international relations and international political economy lens is focused on great power relations, but to really comprehend the magnitude of the New Silk Roads strategy we have to bring the funding mechanisms into clear focus, and in particular the role played by debt, or the credit supplied by China’s policy banks.31

Debt — and the New Silk Roads strategy

What are the credit arrangements provided by China to neighboring countries as part of the BRI, and what is the record so far with the debts created? There have been some high-profile cases of assets involving repayment arrears where debt has been converted to equity. The cases of Pakistan, with the Gwadar port, and Sri Lanka with the Hambantota port, are signal instances. This is the downside.

But there have also been cases where China has demonstrated restraint. According to a recent report from Nomura, China extended debt relief to 28 out of 31 of the most heavily indebted countries in the world – and totally cancelled the debts owing in the cases of Afghanistan, Guinea and Burundi.32 China continues to handle these incidents on a case-by-case basis – but the flexibility and tolerance shown in many cases is surely important. An historical example is relevant. China’s approach is conducted in more or less the same way that Rome used to handle cases over 2000 years ago, refusing to generalize solutions found in one case to others. Scholars have argued that this pragmatic approach was one of the factors involved in the seemingly unstoppable rise of Rome. This latitude of flexibility of course favors China with its large trade surplus – and China continues to go its own way in terms and conditions imposed as part of its lending activities. (Efforts to bring it into line with groups of creditor countries recognizing common rules and procedures, such as the Paris Club of creditor countries, have so far been unavailing.)33

Senior Chinese officials in finance have expressed concerns regarding this somewhat loose approach being taken by Chinese financial institutions (i.e. not being tough enough with creditors). The former governor of the People’s Bank of China (PBoC), the central bank, has framed the discussion in terms of the scale of the anticipated lending. He sees investment demand in the Asia Pacific region as totalling around US$500 billion each year – with government-backed funding being able to cover $200 billion, leaving $300 billion for the private sector to cover. In the case of the BRI the investment gap would be more like $600 billion per year. So far Chinese banks have invested $200 billion in loans to 2600 BRI projects.34 New institutions like the Asian Infrastructure Investment Bank (AIIB) and the BRICS bank, the New Development Bank, along with entities like the Silk Road Fund, are all pouring funds into BRI projects – with implications that remain to be analyzed.35

Prominent critiques like that mounted by the Center for Global Development (Hurley et al. 2017) turn on somewhat arbitrary criteria for defining a “debt trap”. The CGD report identifies 23 countries involved in BRI projects which appear to be at risk of debt distress; it then constructs a lending pipeline for each project; and on the basis of this chooses eight countries as being vulnerable to debt arrears problems. But the theory behind this methodology is based on analyses of countries that have gone into default, or IMF analyses of sovereign debt risk – not on analyses of China’s own development experience involving the power of debt. So it is only sensible to examine China’s experience of debt-fuelled infrastructure development as prelude to examining the methodology of the BRI.

Theory underpinning BRI: China’s evolving development strategy

Before discussing the significance of the debt provisions of the various projects bundled together as the Belt & Road Initiative, we must examine the state-led development model that China has pursued, and the role played by policy development banks in the process such as the China Development Bank (CDB). China has risen to prominence in the wake of the prior success of other East Asian countries, starting with Japan in the 1960s and 1970s, followed by that of South Korea, Taiwan, Hong Kong and Singapore in the 1970s and 1980s (the East Asian Tigers). Debate over the source of their success has been sharp, culminating in the contested conclusions of the World Bank study published in 1997 as “The East Asian Miracle”.36 Of course the key to these East Asian successes was the role played by the state – in this case, following the terminological innovation of Chalmers Johnson, the “developmental state”. But China is no mere extrapolation of the developmental states and their strategies pioneered by Japan, Korea, Hong Kong and Taiwan.37

For a start China is a very large country, and its central state has relations mainly with provincial governments and not directly with China’s businesses or citizens (while acknowledging that China’s state banks provide such a link and dominate lending to business). If anything, China may be conceptualized as having a coordinated portfolio of “developmental states” operating at the provincial level, many of which are comparable in size and scale to the national developmental states that emerged in East Asia (specifically, Korea, Taiwan, Singapore et al). Secondly China has a very large domestic market which it has been able to use to great effect in attracting foreign direct investment and in some cases imposing the requirement of technology transfer, particularly via joint ventures, in a way that was not feasible for the earlier and developmental states of East Asia.38 Thirdly China has not been content to pursue simply the goal of “catch-up” as was practised initially by the earlier East Asian developmental states, but it has explicitly stated its goal of leapfrogging to the technological lead, particularly in areas judged to be strategic industries of the future such as robotics, artificial intelligence and pharmaceuticals (known as Industry 4.0 after the nomenclature favoured by the World Economic Forum) and green industries such as renewable energy, batteries and electric vehicles.

Recent analysis of China’s evolution from “imitation” to “innovation” by China specialists indicates that China is moving towards higher productivity and higher levels of innovation – as measured for example by patent filings.39 There seems little likelihood that China will find itself thwarted by the so-called “Middle-Income Trap” where a rising country finds itself unable to break into higher levels of productivity and innovation. But the aspect of development that does not appear to be given sufficient emphasis in these analyses is the question of debt.

The role played by debt in China’s development strategy looms larger than in earlier East Asian developmental states. This is closely linked to the fact that China’s modernization and industrialization have been strongly associated with urbanization, to an extent that dwarfs the challenges faced by earlier industrializers. Debt-fuelled and state-driven urbanization has been the signature of China’s development – as now transferred across to an international and global setting in the form of the New Silk Roads strategy.40 Urbanization in China has involved a central focus on the building of infrastructure – at a scale and pace that makes China an outlier amongst developing countries, even granting that infrastructure building was an important component of development strategy in East Asian countries like Korea and Taiwan. China is now one of the world leaders in the building of new cities and the rail and road transportation projects that link them.

China’s debt-driven infrastructure development of recent decades finds its theoretical counterpart in the theory of growth in urban land values that can be captured by public authorities for investment in infrastructure. This process, driven by state-owned development banks like the China Development Bank, seems to be one important engine of China’s debt-driven domestic infrastructure development. The scholarly consensus in China’s case is that this pattern of development has been pursued as a high priority, with emphasis on the role played by local and provincial governments in driving their own local growth metrics. The scholarly literature has focused on the impact of local debt build-up and its potential long-term consequences.41

While China has fashioned this combination in its own domestic setting, the BRI represents a colossal project to apply the same theory in an international setting, where it is not the Chinese state driving the process in its own domestic setting but China financing a process that spans multiple national jurisdictions. Never has an international project been attempted before at such scale. The risks are enormous – as are the potential rewards both for China’s status as an international leader and the development fillip the projects promise to give the participating industrializing countries.

In China urban developments have been based on the creation of local government financing vehicles (LGFVs) which capture improved values in land acquired at agricultural rates. Development banks like the China Development Bank have led this process, setting up the LGFVs which acquire land at agricultural prices in their local government area and then sell it to developers, utilizing the profits to finance infrastructure building.42 This is basically how China has been able to urbanize and industrialize at such a rapid rate over the past several decades. It was the CDB under its governor Chen Yuan that developed the theory and practice underpinning this process – with its dual emphasis on privatization of public assets and debt-driven development.43

A central theoretical strand that underpins the BRI is this idea of debt-driven development – a process of universal significance and recognition in both public and private sectors. It is widely recognized in business that an underperforming asset can be transformed into a high-performing asset and source of profit by making a capital investment that improves the asset, financed by debt. From the perspective of the lender, the collateral for the loan is the future profits to be achieved by the activities that make use of the improved asset. From the perspective of the borrower, the asset is turned into a source of profit by the investment that is financed by the debt. The debt fuels growth, which generates profits. This is how smart businesses view the process of growth and investment, and why smart businesses always carry some debt on their balance sheets.

In the case of the CDB and Chinese industrial development, it has been the CDB and its capacity to provide long credit lines that has helped to turn Chinese firms like Huawei and ZTE into international champions – complementing their clear strategies of shifting rapidly to innovation and capability enhancement. Huawei was able to move into international competition in the 21st century backed by a line of credit from the CDB of $30 billion, while ZTE was likewise backed by a line of credit of $15 billion. The CDB was able to create these impressive lines of credit by issuing bonds on the China and international markets, backed by its state-owned status that meant that the bonds carried low risk because of their quasi sovereign security status.44

Development banks are policy banks, usually state-owned, that direct their activities towards achieving policy goals of growth and development. There are national DBs, some of which grow to be very large like the China Development Bank (CDB) and the Brazilian Development Bank (BNDeS); and there are multilateral development banks, led by institutions like the World Bank, the European Investment Bank (EIB), the Asian Development Bank (ADB) and the new banks created by China and others to accompany and complement the Belt and Road Initiative, namely the BRICS-based New Development Bank (NDB) and the Asian Infrastructure Investment Bank (AIIB). All these institutions are able to mobilize finance for infrastructure development.45

So, China and its leading policy banks like the CDB and China Exim Bank have long experience of utilizing debt as the fuel that drives growth and future profits. It would be perverse to view a smart company formulating a business strategy to invade a new business segment, where the invasion is to be financed by debt, with the intent of repaying the loan in terms of capital and interest through the profits thereby earned, as entering a “debt trap”. Such “debt traps” abound in capitalism for the very good reason that this is how entrepreneurial firms can challenge incumbent firms to create new surges of business development. Schumpeter explained how such debt places these entrepreneurial firms on a ”level playing field” with large, established firms, allowing the smaller firms to creatively destroy the older, established firms and make way for the new.46

Now in the case of the BRI, all this experience by China and the CDB in a domestic setting, or in the international setting where the CDB is promoting and assisting Chinese firms in ‘going out’ into international competition, is being put to use in a completely new foreign setting. In place of the Chinese state managing the process in its own domestic arena, it is China and its lending institutions seeking to influence the behavior of 60-plus foreign governments and guiding the process of development through arms-length financing, again either through the CDB or through new multilateral development banks like the AIIB or the new BRICs development bank, the New Development Bank (NDB), launched in July 2014 with initial capital of $100 billion.47

In the case of the BRI China is entrusting investment funds to projects that are under the ultimate control of national governments that have their own agendas as well as seeking to work on positive terms with China. Chinese financing executed through the CDB and China Exim Bank will of course carry provisos like the requirement that Chinese firms be involved in carrying out a certain proportion of contractual works, such as engineering for high-speed rail projects or the building of bridges, or pipelines or hydroelectric dams. In his new study High-Speed Empire, journalist Will Doig provides on the ground reportage from Southeast Asia on how this process of mutual advantage unfolds, in the context of the long-discussed Pan-Asia Railway – where decisions do not always go China’s way, as in the recent roll-back of Chinese loans taken by the new Malaysian government and the more cautious approach being taken to Chinese loans by the Myanmar government.48

The link with industrial strategy: The BRI as an outlet for China’s excess capacity

There are many strategic goals that can be viewed as being fulfilled by the BRI. One aspect of the BRI that has attracted international comment is the potential for China to extend and elaborate on strategic industrial goals by linking them to the BRI. Take the case where overseas projects may be viewed as providing an outlet for excess capacity being experienced in China’s domestic market. During China’s own industrialization (from the period of US-China opening in the 1970s), it was the beneficiary of export of industrial capacity from advanced countries like Germany or Japan, which saw it in their interest to offload factories and manufacturing equipment that had become surplus to requirements. Now the Chinese can see the potential for behaving in the same way where the recipients of its excess manufacturing capacity could be in Southeast Asia or Central Asia, via projects brought under the umbrella of the BRI (and involving the export not just, e.g. of steel, but of steel mills).49

China’s State Council, for example, has identified the BRI as a means through which the domestic steel industry may “export” excess capacity, while enhancing its international competitiveness. One means through which this economic strategic goal may be accomplished is through the supply of steel for new railroads to be constructed under the BRI.50 In line with the State Council’s directive, the Ministry of Industry and Information Technology has identified 20,000 km of new railroads to be constructed under the BRI, potentially creating export demand for 85 million tons of Chinese produced steel. At the same time, the MIIT views BRI as a means of diversifying exports to countries like Vietnam, Turkey, Iran and Saudi Arabia. China’s Premier Li Keqiang is on the record as stating that a main objective of the government is to reduce industrial over-capacity through promotion of the BRI.51

The export of surplus capacity is one aspect of China’s industrial strategy where the BRI can be viewed as providing complementary projects at an international level, consistent with the goal to globalize China’s industries. More ambitiously, BRI projects can be viewed as providing opportunities for the export of Chinese technology, know-how, and standards. High-speed rail projects are the exemplary cases of such a strategy, where China has poured huge efforts into securing technology from the EU and Japan and is now bidding hard, via the BRI, for HSR projects such as the Djakarta to Bandung railway in Indonesia. China fought hard against Japan to win this contract from the Indonesian government, and while it is likely to lose money on the deal, it is viewed in Beijing as an opportunity to extend Chinese technology and standards into the international domain and win good will, via the BRI. It is not without merit to describe China’s BRI strategy as one involving the quest to capture not just overseas markets, but overseas supply chains themselves.52

Monetary dimensions of BRI: One Belt, One Road, One Trade Area, One Currency

An important Chinese aim for the BRI as well as the associated financial institutions, the BRICS New Development Bank (NDB) and the Asia Infrastructure Investment Bank (AIIB), is to promote the use of the Chinese currency (yuan, or RMB) as a vehicle of trade. It has long been a strategic goal of China to internationalize the yuan, but the trading volumes have worked against this in the past, as well as the limited convertibility of the RMB. Now with the BRI the conditions for internationalization are more favorable. The countries aligned with China through the BRI form a significant monetary bloc, and many already accept the yuan as payment for commodities supplied to China, and as means of payment for goods supplied from China.52 In Pakistan with its large China Pakistan Economic Corridor the yuan is already the dominant currency held by the central bank in its reserves. At the end of June 2018, the cumulative total of China’s commodity trade with countries aligned with the BRI reached the equivalent of US$5 trillion – with the yuan being the primary vehicle for this enormous trade volume.54 According to the HSBC, the BRI is likely to add an extra $2.5 trillion in new trade internationally each year.55

A significant boost to the internationalization of the yuan has been its use in trade in oil, with countries like Russia, Iran (China’s two most important oil suppliers) and Venezuela already accepting the yuan in payment for oil deliveries, and China making the yuan more attractive by ensuring that it is fully convertible into gold on the Shanghai and Hong Kong markets. There is wide speculation that Saudi Arabia will be induced to follow suit, ensuring that a significant proportion of global trade in oil is conducted not in the US dollar but in Chinese yuan. These moves are complemented by China’s issuing a futures contract for oil on the Shanghai International Energy Exchange, which has been trading in significant volumes since its launch on March 26, 2018. In their first four months of trading these futures contracts (by the end of July) had reached a cumulative total of 3.67 trillion yuan (equivalent of US$538 billion) in transaction value. It is widely anticipated that this futures contract will provide a yuan-denominated crude oil benchmark that rivals the Brent and West Texas Intermediate (WTI) current benchmarks that are traded principally in London and New York.56

BRI trade and investment conducted in yuan promises to promote Chinese soft power while serving as a means for countries to evade US sanctions. Both Russia and Iran are selling oil to China and accepting payment in yuan, as a response to sanctions imposed on these countries by the US. China also views the emergence of yuan-denominated oil contracts as a means for Chinese companies to buy oil and gas in their own currency, thereby avoiding exposure to foreign currency fluctuations. Given that China is now the world’s largest oil importer, these initiatives frame the emergence of a multipolar world with a significant role played by a yuan currency area.

More generally, China is looking to utilize the BRI as a means of promoting trade between itself and countries that sign up for BRI projects – thus enhancing trade within a newly emerged yuan currency area. The World Bank has been monitoring these trade-related aspects of the BRI, and reports that trade linkages between BRI countries have proliferated, while production networks centered on China have also intensified since the BRI was initiated.57 These are benign influences – and they carry implications for wider industrial development and for the internationalization of China’s currency, the yuan. Perhaps it is overstating the case to assert that the BRI, in creating a dominant trade area, is likely to set the future rules of international trade and competition – as done recently by the CEO of Siemens, Joe Kaeser – but one can see the point that the BRI is so much more than just a series of infrastructure projects.58

Is the BRI promoting green or black development?

While the BRI is couched in general trade and investment terms, in practice much rests on whether its investments promote green or black (fossil fuelled) industrial development on a global scale. The World Resources Institute looked at this issue in a recent report, finding that the Chinese government “has taken initial steps to incorporate environmentally sustainable, or green, strategies and objectives into BRI – but in very high-level and conceptual terms.”59 Against this, the WRI report cites results from the Global Development Policy Center that claim that most Chinese deals in energy and transportation over the period 2014 to 2017 were tied to carbon-intensive sectors.60 These findings can be traced to the research efforts of the China’s Global Energy Finance (CGEF) database housed at Boston University (see website) which is based on analysis of lending abroad in BRI countries by the China Development Bank (CDB) and China Export/Import Bank (China Exim Bank). The negative conclusions reported by the WRI/GDPC researchers are at variance with the analysis provided by myself and Carol Xin Huang, using the same database, as reported in this journal. Our conclusion: “There is no doubt about the reality of China’s green shift in electric power generation in the domestic arena. What we are demonstrating in this article, using data from the BU CGEF, is that a comparable green shift is occurring in China’s energy investments globally, if not to the same degree as is found in China itself.”61

So the jury is out as to whether China’s loans through CDB and China Exim Bank around the world, and specifically to BRI countries, are promoting green over black investments. Resolution awaits further data being provided by China’s institutions and BRI recipient countries. In the meantime, much can be gleaned by examining the policy statements of lending institutions such as the Asian Infrastructure Investment Bank (AIIB), the BRICS New Development Bank (NDB) and the Silk Road Fund – all of which have strong commitments to funding green infrastructure around the world. And there are policy prescriptions like the Green Investment Principles, or guidelines on making Belt and Road construction greener, issued by Beijing and London in December 2018.62 Meanwhile China is now second only to the US in issuing green bonds, as vehicles for attracting investment in green projects around the world; China’s issuances in the first half of 2018 topped $10 billion, while those from US institutions came to $18 bn. China’s green bond issuances, which cumulatively reached $60 billion by 2018, provide finance for green investments around the world, including in BRI projects, involving Chinese companies.63 While there are still some discrepancies between the standards governing Chinese green bond issuances and those from European, American or Japanese sources, there is convergence in projects considered to fall within green bond financing guidelines.64 These then are the financial drivers of a greening of the Belt and Road Initiative.

Risks and downside factors in the BRI

Given its scale and its involvement of multiple sovereign state players, the BRI is clearly hostage to international developments that could be quite beyond China’s control. But there are factors that multiply the risks that China is running and which could be addressed in a timely fashion – if the Chinese leadership chose to do so. The obvious points of weakness concern the lack of transparency or general rules in the granting of credit and the terms on which countries are allowed to borrow from Chinese or Chinese-influenced banks and multilateral institutions. To date the lending criteria seem to be governed more by willingness to borrow than by informed analysis of ability to repay from the profits generated by the project being financed – as would be the case with World Bank loans, for example. The multilateral banks like the AIIB are taking steps to raise their transparency and the publicizing of terms on which loans are granted.

The same cannot be said for the practices of the CDB or China Exim Bank, which are under direct Chinese state control. One can understand that China is seeking to promote the BRI as a major foreign policy initiative, and in doing so is liable to grant loans to countries or governments on sometimes flimsy evidence of credit-worthiness. This generates opportunities for secrecy and corruption that are clearly evident in cases like Sri Lanka and Malaysia (where the borrowing activities of the previous government have been reversed by the incoming Mahathir-led government), or where there is mounting evidence that poorly conceived programs are leading to financial problems in host countries – as in cases like Kenya, Pakistan and Sri Lanka. Such negative outcomes may reflect the willingness of the Chinese to accommodate the preferences of host country governments. If the hosts focus on projects and programs that promote their countries’ national interests, the Chinese will cooperate, to the mutual benefit of both parties. But if the hosts’ main interests are to secure personal benefits for a few leaders – as apparently in the cases of Sri Lanka and Malaysia – then the Chinese are also happy to oblige. So the results are a mixed set of outcomes – from projects that are of clear benefit to the host country to vanity projects that are of benefit only to a particular leader and his/her family.65 The indirect critiques of bodies like the IMF concerning the BRI are clearly directed at seeking to bring the various projects under some common set of transparency guidelines and lending rules that would minimize the prospects for negative outcomes – even if there is as yet little evidence of moves in this direction.

Meanwhile China is discovering the security implications of many of its BRI-related investments, as unrest is provoked or exacerbated in areas of geopolitical tension. China’s BRI-related investments in Pakistan have involved opening up mineral deposits in Baluchistan, provoking several terrorist attacks claimed by the Baluchi Liberation Army. This has prompted China to form a Marine Corps, modelled on the US Marines, as a first line of defence to protect BRI projects.66 The possibilities for such security concerns to spill over into militarization of the BRI region are clear and ominous.

Concluding remarks

It is difficult not to be impressed by the sheer scale and bravado of China’s New Silk Roads strategy. At a time when the US is looking inwards, and adopting profoundly protectionist stances, China is looking outwards and globally, offering a strong defence of economic openness and assisting developing countries with financial support for their own infrastructure building projects. For seven decades since its victory in World War II the international initiative lay overwhelmingly with the US, and to some extent the EU, in terms of the governance of the world economy. Suddenly China is there and precisely at a moment when the US is looking inward and emphasizing short-term goals. The Belt & Road Initiative can be justified for China as part of an immense “soft power” push, but no less significantly as a means of extending China’s power and reach internationally, to protect the sea lanes carrying its commercial produce, both imports (particularly oil) and exports of its manufactured goods. At the same time the new strategy represents an enormous development boost for dozens of countries that have been held back previously by the heavy demands of the IMF and World Bank.

From the perspective of China, the BRI strategy involves the use of debt as the fuel of industrialization and development, via infrastructure development, with a powerful role to be played by state-owned development banks like the CDB and Exim Bank and new multilateral banks like the AIIB and NDB – albeit in ways where transparency and general rules could be greatly strengthened. China itself has utilized this strategy of debt-fuelled development (without ever defaulting) and urbanization, with a prominent role played by the CDB – and is now extending this experience beyond its borders to the Eurasian continent and beyond to Africa and Latin America. The goals of the BRI need to be evaluated from such a perspective, as extending China’s own development strategies to a swathe of countries being brought within China’s influence by becoming involved in the infrastructure projects created by the BRI. As The Economist puts it, this is nothing less than “a vastly ambitious plan to connect the world.”67 Likewise it is hard to disagree with the New York Times’ assessment that the BRI constitutes a modern-day version of the Marshall Plan which refloated Europe in the aftermath of World War II.68

In such a vast and ambitious project there are bound to be mis-steps and falters along the way – not least the environmental costs of such mega-projects. Some countries will doubtless get themselves into too much debt and will be appealing to China to bail them out. China has so far displayed a willingness to do so, but on strict terms and without a sense of sending countries to “debtors’ prison”. On the other hand, countries would be well advised to view China’s generosity as something not to be taken advantage of, for enforced debt-for-equity swaps can and will lead to cases of transfer of sovereignty over key assets – as experienced by Sri Lanka with the port of Hambantota. But to see China’s strategy as simply seeking to ensnare countries in “debt traps” is to misread its ambitions, to misdiagnose its methods, and to ignore the outcome in the vast majority of cases.

So far the US has attempted to curb China’s strategic ambitions with a clumsy trade war involving escalating tariffs imposed on Chinese imports – while leaving itself vulnerable to counter-tariffs imposed by China on US agricultural exports, and (no doubt soon enough) on high tech exports from Silicon Valley. Meanwhile China’s global ambitions for its New Silk Roads strategy, involving debt-fuelled infrastructure investment around the globe, drawing countries firmly into its sphere of influence, goes largely unanswered. Until the US and allies in Japan and the EU can find a way to respond to China’s BRI, to provide alternative funding for alternative infrastructure projects at the scale envisaged by China, the game will be lost.69 The New Silk Roads strategy is China’s ‘grand strategy’ for the 21st century, and it is not to be under-estimated.

*

Note to readers: please click the share buttons above. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

John A. Mathews is Emeritus Professor of Management at MQ University Sydney, in the Faculty of Business and Economics. and formerly Eni Chair of Competitive Dynamics and Global Strategy at LUISS Guido Carli University in Rome.

Sources

Amsden, A. 1998. Why isn’t the whole world experimenting with the East Asian model to develop? Review of the East Asian Miracle, World Development, 22 (4): 627-633.

Ansar, A., Flyvbjerg, B., Budzier, A. and Lunn, D. 2016 Does infrastructure investment lead to economic growth or economic fragility? Evidence from China, Oxford Review of Economic Policy, 32 (3): 360-390.

Boffa, M. 2018. Trade linkages between the Belt and Road economies. Policy Research Working Paper 8423.World Bank Group

Brandt, L., Ma, D. and Rawski, T.G. 2014. From divergence to convergence: Reevaluating the history behind China’s economic boom, Journal of Economic Literature, 52 (1): 45-123.

Cai, P. 2017. Understanding China’s Belt and Road Initiative. Sydney: The Lowy Institute.

Chan, L.-H. 2017. Soft balancing against the US ‘pivot to Asia’: China’s geostrategic rationale for establishing the Asian Infrastructure Investment Bank, Australian Journal of International Affairs, 71 (6): 568-590.

Chu, W.-W. 2011. How the Chinese government promoted a global automobile industry, Industrial and Corporate Change, 20 (5): 1235-1276.

Doig, W. 2018. High-Speed Empire: Chinese Expansion and the Future of Southeast Asia. New York: Columbia Global Reports.

Duchâtel, M. and Duplaix, A.S. 2018. Blue China: Navigating the Maritime Silk Road to Europe, Policy Brief(23 April 2018). European Council on Foreign Relations.

Eisenman, J. and Stewart, D.T. 2017. China’s new Silk Road is getting muddy, Foreign Policy

Glaser, C.L. 1997. The security dilemma revisited, World Politics, 50 (Oct 1997): 171-201.

Glaser, C.L. 2011. Will China’s rise lead to war? Why realism does not mean pessimism, Foreign Affairs, 90 (2): 80-91.

Heath, T.R. 2016. China’s evolving approach to economic diplomacy, Asia Policy, 22: 157-191.

Hillman, J.E. 2018a. The hazards of China’s global ambitions, New Perspectives Quarterly, 35 (2): 17-20.

Hillman, J.E. 2018b. China’s Belt and Road is full of holes, Report, Center for Strategic and International Studies (CSIS)

Holslag, J. 2017. How China’s New Silk Road threatens European trade, The International Spectator, 52 (1): 46-60.

Hurley, J., Morris, S. and Portelance, G. 2018. Examining the debt implications of the Belt and Road Initiative from a policy perspective. CGD Policy Paper 121. Washington, DC: Center for Global Development

Leverett, F. and Wu, B. 2016. The New Silk Road and China’s evolving grand strategy, The China Journal, 77: 110-132.

Mathews, J. and Huang, C. X. 2018. China’s Belt and Road as a conduit for clean power projects around the world, The Asia-Pacific Journal: Japan Focus, 16 (18), No. 3 (15 September 2018)

Mathews, J. and Selden, M. 2018. China: The emergence of the Petroyuan and the challenge to US dollar hegemony, The Asia Pacific Journal: Japan Focus, 16 (22), No. 3 (15 November 2018)

Mathews, J. and Tan, H. 2017. China’s New Silk Road: Will it contribute to export of the black fossil-fuelled economy? The Asia Pacific Journal: Japan Focus, 15 (8), No. 1 (15 April 2017)

Mearsheimer, J. 2014. Can China rise peacefully? The National Interest. New concluding chapter to the book The Tragedy of Great Power Politics, University of Chicago Press

Munir, W. and Gallagher, K.P. 2018. Scaling up lending at the Multi-Lateral Development Banks: Benefits and costs of expanding and optimizing MDB balance sheets. GEGI WP 013-4/2018. Global Economic Governance Initiative, Boston University/Global Development Policy Center.

Nye, J. 2004. Soft Power: The Means to Power in World Politics. New York: Public Affairs.

Nye, J. 2009. Get smart: Combining hard and soft power, Foreign Affairs, 88 (4): 160-163.

Nye, J. 2017. Soft power: The origins and political progress of a concept, Nature

Pan, F., Zhang, F., Zhu, S. and Wojcik, D. 2017. Developing by borrowing? Inter-jurisdictional competition, land finance and local debt accumulation in China, Urban Studies, 54 (4): 897-916.

Rolland, N. 2017a. China’s “Belt and Road Initiative”: Underwhelming or game-changer? The Washington Quarterly, 40 (1): 127-142.

Rolland, N. 2017b. China’s Eurasian Century? Political and Strategic Implications of the Belt and Road Initiative. Washington, DC: National Bureau of Asian Research.

Ru, H. 2018. Government credit, a double-edged sword: Evidence from the China Development Bank, The Journal of Finance, 73 (1): 275-316.

Sanderson, H. and Forsyth, M. 2013. China’s Superbank: Debt, Oil and Influence – How China Development Bank is Rewriting the Rules of Finance. Singapore: John Wiley/Bloomberg Press.

Schumpeter, J.A. 1942. Capitalism, Socialism and Democracy. New York: Harper & Bros.

Spence, J., Wolf, M., Tellis, A., Kharas, H., Pei, M., Brzezinski, Z. and Mearsheimer, J. 2005. Panel discussion: China Rising – How the Asian Colossus is changing the world, Foreign Policy, (Jan/Feb 2005): 43-58.

Tsui, K.Y. 2011. China’s infrastructure investment boom and local debt crisis, Eurasian Geography and Economics, 52 (5): 686-711.

Wang, H. 2017. New Multilateral Development Banks: Opportunities and challenges for global governance, Global Policy, 8 (1): 113-118.

Wang, Jisi 2015. China in the middle The American Interest

Wang, Jisi 2011. China’s search for a grand strategy: A rising great power finds its way, Foreign Affairs, 90 (2): 68-79.

Wei, Shang-Jin, Xie, Zhuan and Zhang, Xiaobo 2017. “Made in China” to “Innovated in China”: Necessity, prospect, and challenges, The Journal of Economic Perspectives, 31 (1): 49-70.

Wen, L., Butsic, V., Stapp, J.R., and Zhang, A. 2017. Can China’s land coupon program activate rural assets? An empirical investigation of program characteristics and results of Chongqing, Habitat International, 59: 80-89.

Wuthnow, J. 2017. Chinese perspectives on the Belt and Road Initiative: Strategic rationales, risks, and implication, China Strategic Perspectives No. 12. Center for Study of Chinese Military Affairs, Institute for National Strategic Studies, Washington, DC.

Yağcı, Mustafa, 2018. Rethinking soft power in light of China’s Belt and Road Initiative, Uluslararası İlişkiler, 15 (57): 67-78.

Zhao, M. 2015. “March westwards” and a new look at China’s grand strategy, Mediterranean Quarterly, 26 (1): 97-116.

Notes

1 Many organizations now monitor the evolving Belt and Road Initiative. The World Bank for example maintains a website here.

The Mercator Institute for China Studies (MERICS) webpage provides a “BRI Tracker”. Business Insider puts the number of countries involved as of 2018 at 71, accounting for 33% of world GDP (and hence for approx. $26.7 trillion in economic activity). A full list of the countries involved can be found at the website of the Hong Kong Trade Development Council.

2 See ‘China taps the brakes on its global push for influence’ by Keith Bradsher, New York Times, June 29, 2018; and ‘China’s Belt and Road difficulties are proliferating across the world’ by James Kynge, Financial Times, July 11, 2018, The latter article drew a sharp response from China’s Ministry of Foreign Affairs – see ‘Belt and Road financing criticism draws strong Chinese response’, GBTimes, July 18, 2018

3 See “Gateway to the globe: China has a vastly ambitious plan to connect the world. Briefing on China’s Belt and Road Initiative”, The Economist, July 28 2018, pp. 13-16

4 See hearings transcript and video

5 See the written contributions from scholars testifying at the US Congressional hearings, in particular Nadege Rolland, Joel Wuthnow, Joshua Eisenman and Jonathan Hillman. For their scholarly contributions, see Rolland (2017a; 2017b), Wuthnow (2017), Eisenman and Stewart (2017), Hillman (2018a).

6 See the report from the Center for Global Development by Hurley, Morris and Portelance (2018).

7 See recent commentary on Sri Lanka, e.g. in South China Morning Post and in Bloomberg.

8 In this article I treat the BRI as a series of financial and investment initiatives, separate from and perhaps complementing strategic security and military initiatives like the creation of a Chinese military base in Djibouti and the series of aggressive initiatives in the South China Sea. These all feature as aspects of China’s emerging bid for hegemonic status, which have intensified in the recent period of Xi Jinping’s presidency – but the financial and investment aspects as captured in the BRI deserve analysis in their own right.

9 Some of the countries involved include the ‘stans of Central Asia, Russia, Afghanistan, South Asia – Sri Lanka, Pakistan and Bangladesh (but not India), Southeast Asia (including Singapore, Malaysia, Thailand, Cambodia, Myanmar et al) and now countries in Africa as well as Latin America.

10 China has been careful to promote these new multilateral banks as complementary to existing west-backed institutions like the World Bank and the Japan-based Asian Investment Bank, rather than as direct competitors.

11 See ‘The world, built by China’, by Derek Watkins, K.K. Rebecca Lai and Keith Bradsher, New York Times, Nov 18 2018.

12 The Hong Kong Trade Development Council (HKTDC) maintains a web-based scrutiny of developments with the Belt & Road Initiative. For profiles of BRI projects, see HKTDC. For informed commentary, see expositions from such research bodies as the Lowy Institute, e.g. Cai (2017), and the Center for Strategic and International Studies (CSIS), e.g. Hillman (2018b).

13 As noted above, this article focuses on the financial and investment initiatives being taken by China as captured in the BRI, without examining the initiatives being taken in the military and security spheres. The sheer scale of the BRI calls for analysis of its initiatives in their own right.

14 The name “Belt and Road Initiative” has itself followed an interesting evolution. Five years ago, at the launch by President Xi Jinping, the terms used were “Silk Road Economic Belt” (encompassing six “corridors” such as the China-Pakistan Economic Corridor CPEC) and the “21st Century Maritime Silk Road” – both conjuring up major infrastructure projects linking Eurasian cities by road, rail, air and sea and involving new ports, airports, pipelines, high-speed rail, new freight services, electric power grid interconnections and so on. It then came to be known as “One Belt One Road” (OBOR) and finally, in an official publication of the National Development and Reform Commission (ND&RC) issued in March 2015, as the “Belt and Road Initiative” (BRI) – with the ND&RC specifying that English translations of the Chinese term “Yidai Yilu” (with its melodic tones) should not include “strategy” or “vision’ but insists that it should be viewed as a “process” or an “Initiative” (See the Chinese website)

15 It is probably worth noting that while the US “pivot to Asia” was never really followed through with investment and financial commitments, the Chinese initiatives certainly did.

16 The US-China rivalry, as evidenced in many of the projects associated with the belt and Road Initiative, is covered by recent articles in the New York Times, such as James Millward, ‘Is China a colonial power?’, New York Times, May 4 2018; or David Barboza, Marc Santora and Alexandra Stevenson, ‘China seeks influence in Europe, one business deal at a time’, New York Times, August 12 2918.

17 The “Polar Silk Road” encompassing Arctic sea routes past the melting Arctic ice cap, was announced at the 2018 meeting of the World Economic Forum, at Davos. See ‘At Davos, the real star may have been China, not Trump’ by Keith Bradsher, New York Times, Jan 28 2018.

18 China issued an invitation to Latin American countries to join the BRI, in January 2018 – via a speech from Foreign Minister Wang Yi in Santiago, Chile. See ‘China invites Latin America to join One belt, One Road’, Reuters, Jan 23 2018.

19 See report in South China Morning Post.

20 A useful summary is provided by Wikipedia.

21 It is worth noting that China is the largest trade partner of both Pakistan and Sri Lanka.

22 Note that this map from C4ADS omits the Chinese territorial claims in the South China Sea, which are a source of so much geopolitical conflict in the current period.

23 See the report by Devin Thorne and Ben Spivack, Harbored Ambitions: How China’s Port Investments are Reshaping the Indo-Pacific, 17 April 2018, C4ADS.

24 This aspect of the BRI can be linked to the Go West strategy … diversifying industry including electronics from the East coast (Guangdong, Shanghai) to western regions such as Sichuan, or Chongqing.

25 Of course the Gwadar port proposals have received a setback with Pakistan having to seek a bailout from the IMF in talks that have been underway since October 2018, and likely to continue into 2019. Pakistan has been looking to both China and Saudi Arabia as alternative sources of bailout, but it seems that the IMF is going to have to provide funding after all. See ‘IMF warns Pakistan of risks of working with China’, by Xie Yu, South China Morning Post, 9 Oct 2018.

26 See the interview with John Mearsheimer by Peter Navarro.

27 See Mearsheimer (2014). The current US-China trade war is a vindication of his position. For the celebrated debate between Mearsheimer and Brzezinski on offensive realism, see Spence et al (2005).

28 See Nye 2004 and then 2009; 2017

29 See Yağcı 2018 for discussion on this point. It is worth noting that while the US was fighting multiple wars, China for the most part remained at peace, though it provided military support in Korea, Vietnam, and went to war with Vietnam and others. Now, however, it is exercising greater geopolitical leverage of which the disputed claims (and China’s arrogance) in the South China Sea are most notable.

30 See Glaser (2011) for an application of “security dilemma” reasoning to the case of China; for an extended discussion in the abstract, prior to the clear rise of China, see Glaser (1997).

31 Some scholars and analysts refer to this aspect of China’s strategy as “economic diplomacy” in the sense that it represents an economic aspect of diplomatic activity and a framing of diplomatic initiatives around economic goals. For such a discussion relevant to the Belt and Road Initiative, see Heath (2016).

32 See the Nomura report ‘The Belt and Road Initiative: Globalization, Chinese style’, April 2018.

33 The Paris Club of creditor countries goes back to the debt crisis engulfing developing countries in the 1980s; it turned on efforts by creditor countries like the US and EU members to provide debt relief without undermining the IMF and its conditionality requirements. An analysis at the time is provided by Riefel in 1985 in the Princeton Essays in International Finance.

34 See ‘Debt bumps on China’s Belt and Road’, by Michael Smith, Australian Financial Review, 27 April 2018.

35 In the first five months of 2018, Chinese companies signed contracts worth $36.2 billion across all economic sectors – according to the New York Times (‘China taps brakes on its global push for influence’, by Keith Bradsher, New York Times, June 28 2018)

36 See World Bank 1997 report, The East Asian Miracle. For outstanding reviews and debate, see Alice Amsden, ‘Why isn’t the whole world experimenting with the East Asian model to develop?’ (Amsden 1998), or Dani Rodrik, ‘King Kong meets Godzilla: The World Bank and the East Asian Miracle’.

37 For analyses of China’s development model, from an historical perspective, see for example Brandt, Ma and Rawski (2014). Wan-wen Chu at Academia Sinica in Taiwan provides a penetrating analysis of China’s industrial strategy at provincial levels (Chu 2011).

38 Much of the early investment in the 1980s and 1990s did not so much target the Chinese domestic market as its cheap, disciplined labor to produce for export; this was also the Chinese government idea underpinning the Free Trade Zones. Later, industries such as electronics and auto would tap China’s vast internal market.

39 See for example the recent study by Wei, Xie and Zhang (2017), which takes the story to the year 2014, and demonstrates striking gains in both productivity and innovation in China as measured by patent filings from 1995 to 2014. A study from the World Intellectual Property Office (WIPO) issued in 2018 argued that China is now driving international patent applications to record heights – see the summary.

40 Of course China’s strategies of infrastructure-driven growth and development have not gone unchallenged. In Oxford Review of Economic Policy, Ansar et al (2016) challenge the premises of Chinese success.

41 For critical discussions in this vein, see Tsui (2011) and more recently Pan, Zhang, Zhu and Wojcik (2017).

42 There has been criticism of China’s approach to urban redevelopment based on CDB practices of debt management, with cases of underpayment to agricultural land holders who are subject to compulsory acquisition orders. No doubt there have been cases of such underpayment, but the overall strategy does not depend on this aspect. There seem to be fewer cases as market reforms are introduced at local level (Wen et al 2017).

43 For an insightful book-length account of the workings of the CDB, see Sanderson and Forsyth (2013). Ru (2018) provides a scholarly analysis of the workings of the CDB as development institution, arguing on the basis of data provided by the CDB that the bank “crowds-in” private investment, thus acting as a catalyst for further development.

44 Of course the current US-launched trade war complicates these considerations of prospects for firms like ZTE and Huawei.

45 On the positive role played by Multilateral Development Banks (like the ADB and AIIB) see Munir and Gallagher 2018.

46 See Schumpeter (1942) for the original exposition of creative destruction as a key mechanism of capitalist innovation.

47 Financing by China so far is impressive, with the Silk Road Fund announcing a goal of $40 billion in equity investments (with funds of $680 million being allocated by August 2017); the AIIB with BRI investments of $3.7 billion by 2017; and the CDB with huge loans of $110 billion to BRI projects by January 2018. On top of these lending arrangements, the CDB and China Exim Bank have announced separate BRI funds amounting to $36.2 billion and $18.8 billion, respectively, at the 2017 Belt and Road Summit staged in Beijing. For details on these financial commitments, see the report from ING, ‘China’s Belt and Road: Bigger than the Marshall Plan?’, 6 June 2018.

48 See Doig (2018) as well as recent reportage on the Malaysian and Myanmar cases, e.g. ‘The many bumps in paving China’s new silk road’, by M. Sharma, Gulf News, July 16 2018.

49 Another dimension is that climate crisis and environmental pollution requires that China cut back on e.g. steel production and it has closed some major mines while seeking also to create new green industries such as renewables and new energy vehicles.

50 Note that China is now the world’s leading steel producer. Indeed a recent article by David Scutt, at Business Insider, claims that ‘China is now producing more steel than the rest of the world combined’, May 28 2018.

51 See Holslag (2017), p. 49, for discussion on this point.

52 See the article in Forbes, “Belt and Road: China’s strategy to capture supply chains from Guangzhou to Greece”, by Dane Chamorro, Forbes, Dec 21, 2017.

53 See the website maintained by HSBC.

54 See ‘Why international use of RMB is about to be propelled’, by legal commentators David Olsson and Andrew Fai, at King & Wood Mallesons, 5 April 2018.

55 See HSBC.

56 See the article on China’s petroyuan, ‘China: The emergence of the Petroyuan and the challenge to US dollar hegemony’ by Mark Selden and myself at The Asia Pacific Journal.

57 See the World Bank report by Boffa (2018).

58 Joe Kaeser, CEO of Siemens, is quoted in the NYT as saying: “The China One Belt, One Road is going to be the new WTO – like it or not”. See ‘At Davos, the real star may have been China, not Trump’, by Keith Bradsher, New York Times, Jan 28 2018.

59 See Lihuan Zhou et al, ‘Moving the Green Belt and Road Initiative: From words to actions’, Oct 2018, World Resources Institute and Global Development Policy center.

60 The data reported are that greenfield investments in coal, oil and gas-fired power plants globally by Chinese sources, 2014 to 2017, amounted to over $30 billion (mostly provided by state-owned enterprises), while investments in solar PV and wind, respectively, amounted to just over $5 bn and just under $5 bn (overwhelmingly provided by privately owned firms) See Fig 15 in Zhou et al 2018, p. 19.

61 See the critique published by myself and Carol X. Huang, ‘China’s Belt and Road as a conduit for clean power projects around the world’, The Asia-Pacific Journal, Sep 15 2018.

62 The Green Investment Principles were formulated and published by the Green Finance Committee (GFC) of the China Society for Finance and Banking (chaired by Dr Ma Jun, a member of the People’s Bank of China Monetary Policy Committee) and the Green Finance Initiative (GFI) of the City of London, chaired by Sir Roger Gifford. See ‘China, UK publish guidelines to make Belt & Road construction greener’, Xinhua, 1 Dec 2018.

63 On green bond issuances in 1H 2018, and cumulatively, see Climate Bond Initiative, ‘Green bonds market summary, 1H 2018’, July 2018.

64 For example, there is convergence in projects emanating from China that involve renewable energies and energy storage. But there are discrepancies, as noted by Climate Bonds Initiative, in projects that involve retrofitting on coal power plants, or projects involving “clean coal”. See the Climate Bonds Initiative China Annual Report 2017.

65 I would like to thank a reviewer, Professor Thomas Rawski, for this insight.

66 See the Lowy Institute paper by David Brewster, ‘China: The forces needed to protect the Belt and Road’, 28 November 2018.

67 See The Economist Briefing on the BRI, July 25 2018, as mentioned above.

68 As cited above, see ‘The world, built by China’, New York Times, Nov 18 2018.

69 A small step in such a direction is evidenced by the trilateral announcement from the US, Japan and Australia of the possibility of finance for infrastructure development being provided from joint initiatives from the three countries, according to a statement from Australia’s then Foreign Minister Ms Julie Bishop, at the end of July. See report in The Australian, July 31 2018, “Australia, US, Japan to offer infrastructure lending in Asia-Pacific region”.