|

All Global Research articles can be read in 51 languages by activating the “Translate Website” drop down menu on the top banner of our home page (Desktop version).

Visit and follow us on Instagram at @crg_globalresearch.

***

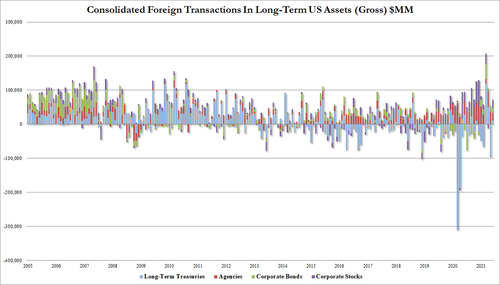

Overall, June was a ‘buy all the US things’ month for foreign investors

- Long-Term Treasurys +$10.9BN

- Agencies +22.7BN

- Corporate Bonds $13.8BN

- Corporate Stocks +$25.2BN

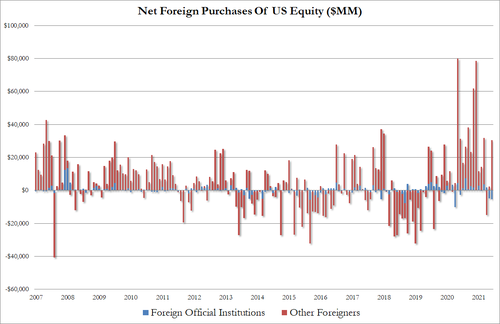

That is the biggest stock buying binge since March, led by non-official source buying (Foreign Official institutions -5.4BN, Other foreign entities: +30.6BN)…

For the 4th straight month, China dumped US Treasuries in June (the latest TIC data). In fact, over the last two months, China sold over $34 billion in Treasuries – the biggest dump since 2016…

Source: Bloomberg

Belgium also saw significant selling (often considered a proxy for China selling via Everclear), now with the lowest holdings since Sept 2020…

Source: Bloomberg

Japan bought Treasuries in June (after selling in May)…

Source: Bloomberg

And finally, hedge funds appear to have been big buyers of bonds in June as Catman Islands added almost $16bn (up for the 3rd month in a row)…

Source: Bloomberg

As a reminder, the benchmark 10-year Treasury yield decreased about 13 basis points in June to 1.47%.

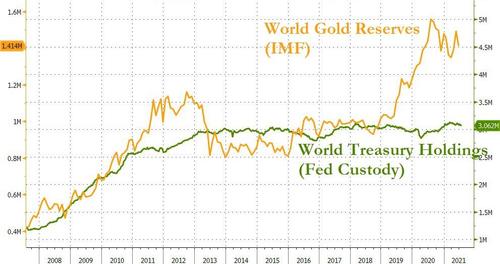

Finally, we note that the shift from Treasuries to Gold among global reserves remains in tact…

Source: Bloomberg

*

Note to readers: Please click the share buttons above or below. Follow us on Instagram, @crg_globalresearch. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

|