China Aims to Diminish US Influence in Latin America by Boosting Trade Relations

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

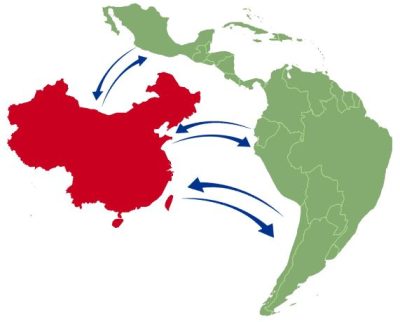

China reactivated its investments and trade with Latin America, something which could be key in the trade dispute with the US as the Asian Giant anticipates trade volumes to massively increase in the coming years. It is not lost that Cuban president Miguel Díaz-Canel was the first foreign leader to visit China following the National Congress of the Chinese Communist Party in October; Beijing is negotiating a Free Trade Agreement (FTA) with El Salvador and Uruguay; and, Argentina has expressed its interest in becoming a BRICS member. This is all with the aim of diminishing US influence in Latin America.

The Latin American region is having increased geopolitical importance for China. Beijing is particularly focussing on lines of investment and trade, especially on agreements already made but were diminished by the pandemic and China’s own economic problems. None-the-less, Latin America is the second largest destination for foreign investment from China, with more than 2,700 Chinese-funded companies operating in the region.

What makes China’s drive into Latin America all the more audacious is that it is traditionally considered the “Backyard of the United States.” By China making inroads in a US-dominated region, it signals a change in the international order – one towards multilateralism.

Despite this demonstration of multipolarity in action, Latin America still has not moved on from its logic of only being an exporter of raw materials which imports industrialised goods from China. China has focused on acquiring raw materials and investing in infrastructure to get products out of the region at the lowest possible cost.

There is also a hope in China to lessen its trade relations with the US by engaging more deeply with Latin America.

In November 2022, China removed the last phytosanitary barriers with Brazil so that it can import Brazilian corn. The removal of the barriers will result in greater flows of Brazilian corn and lessen China’s dependency on corn from the US, the Asian Giant’s top supplier.

In another example, China lessened its reliance on American soybeans after buying 3.6 to 4.2 million tons of Argentinian soybeans since the new soybean dollar agreement was announced, a special exchange rate provided by the Argentine Central Bank for soybean exporters.

None-the-less, China’s geopolitical value on Latin America is almost exclusively in raw materials, as is now seen in the market for lithium, a metal fundamental in the development of many technologies. Of the nine mining projects in Argentina that are financed by China, six are lithium. In 2021, 98.2% of total mining exports of lithium carbonate was to the East Asian country.

Contrary to the strengthening of trade relations, trade with China and the rest of Asia is unlikely to have a positive effect for domestic consumers in Latin American countries, especially those suffering from rising inflation. Although agricultural and energy production records are being broken every year across Latin America, the alleviation of poverty and hunger has not advanced. Without a proposal that allows directing the benefits and income of the energy and agriculture sectors towards a productive transformation that generates employment, it is difficult to foresee changes in the local economies to benefit the majority and not just local elites and China.

However, it is not only China that is increasingly playing a central role in the economic development of Latin America and consolidating itself as a strategic destination for its exports. Trade relations between Asia and Latin America will continue growing due to, among other factors, the prospects for economic and demographic growth of the other giant in the region: India. India for now does not compete with China in Latin America but has found some niches, such as agricultural manufacturing, but this will likely change as the South Asian country continues to develop.

South Korea, for their part, has been negotiating an FTA with Mercosur – a trade bloc that includes Argentina, Brazil, Paraguay and Uruguay – since 2018. In recent years it has had permanent contacts with the governments of those countries to try to speed up the process. Japan also seeks to be influential in Latin America and maintain strong ties, especially with Chile and Brazil. However, just like South Korea, they continue to have heavy tariffs on agricultural imports, something that diminishes the full potential of relations.

None-the-less, with China’s influence growing in Latin America, and with India, Japan and South Korea wanting to expand trade relations and influence, the region is no longer the “US’ backyard”, as it was perceived to be since the 1823 Monroe Doctrine.

*

Note to readers: Please click the share buttons above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Ahmed Adel is a Cairo-based geopolitics and political economy researcher.

Featured image is from InfoBrics