A Large Financial Sector Hurts the “Real Economy”

Contrary To Widespread Assumption, A Large Financial Sector Is Bad for the Economy

One of our favorite economists – Steve Keen – showed in 2010 that a large financial sector hurts the economy.

Specifically, Keen showed that bank profits above 1% of GDP are unsustainable, and lead to a Ponzi economy and – eventually – a depression.

A large financial sector also increases inequality, which in turn drags on the economy:

We noted in 2010 that extreme inequality helped cause the Great Depression … and the 2008 financial crisis. We noted in 2011 that inequality helped cause the fall of the Roman Empire.

In a few short years, mainstream economists have gone from assuming that inequality doesn’t matter, to realizing that runaway inequality cripples the economy.

Pikettey correctly notes that inequality is now the worst in world history … and will only get worse.

***

[Economics professor] Jamie Galbraith argues that countries with larger financial sectors have greater inequality, and the link is not an accident.

And see this.

Today, Yves Smith reports that the world’s most prestigious financial agency – BIS, known as the “central banks’ central bank” – agrees:

The BIS has released an important paper, embedded at the end of this post, which has created quite a stir, even leading the orthodoxy-touting Economist to take note. Titled, Why does financial sector growth crowd out real economic growth?, its analysis of why too much finance is a bad thing is robust and compelling. This article is a follow up to a 2012 paper by the same authors, Stephen Cecchetti and Enisse Kharroubi, which found that when finance sectors exceeded a certain size, specifically when private sector debt topped 100% of GDP or when financial services industry professions were more than 3.9% of the work force, it became a drag on growth. Notice that this finding alone is damning as far as policy in the US is concerned, where cheaper debt, deregulation, more access to financial markets, and “financial deepening” are all seen as virtuous.

***

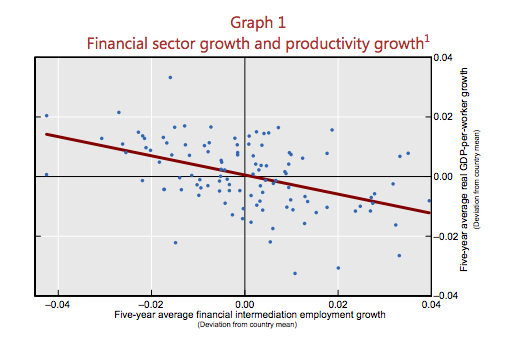

The paper starts by looking empirically at the fact that larger financial sectors are correlated with lower growth rates:

Smith notes another new study showing the detrimental effect of a large finance sector:

Brad DeLong, earlier this week, flagged another important article on why finance has become a productivity drain by [NYU Finance Professor] Thomas Philippon, titled Finance vs. Wal-Mart: Why are Financial Services so Expensive?

Despite the financial services industry having so much bigger and supposedly more efficient firms, the cost of financial intermediation is higher than in 1910. How is that possible? Is it all the new and improved looting? It’s even simpler. It’s Keynes’ capital markets as a casino problem:

… Historically, the unit cost of intermediation has been somewhere between 1.3% and 2.3% of assets. However, this unit cost has been trending upward since 1970 and is now significantly higher than in the past. In other words,the finance industry of 1900 was just as able as the finance industry of 2010 to produce loans, bonds and stocks, and it was certainly doing it more cheaply. This is counter-intuitive, to say the least. How is it possible for today’s finance industry not to be significantly more efficient than the finance industry of John Pierpont Morgan?… Technological improvements in finance have mostly been used to increase secondary market activities, i.e., trading. Trading activities are many times larger than at any time in previous history. Trading costs have decreased, but I find no evidence that increased liquidity has led to better (i.e., more informative) prices or to more insurance

This is another damning finding from a policy perspective, in that the bias of regulations has been strongly toward promoting more market liquidity. Readers may recall that we’ve been skeptical of that premise for years, noting that in the stone ages of our youth, investors were not terribly bothered by limited liquidity in large and important markets like corporate bonds. Yet the SEC and the Fed have been all in with the “more liquidity is better” program, with the SEC pushing for lower and lower transaction charges (which has the perverse effect of leading financial services firms as trading counterparties to be fleeced rather than good customers to be nutured) and promoting high frequency trading, and the Fed allowing derivatives to grow like kudzu, out of the belief (among other things) that they would facilitate price discovery in cash markets.

And of course, an overly costly financial services sector on a raw transaction level again drains resources from other sectors.

As the Tax Justice Network noted,

…an oversized large financial sector is not the Golden Goose providing benefits for all, but a cuckoo in the nest, crowding out and harming other sectors and society. Winston Churchill summarised:

“I would rather see finance less proud and industry more content.”

Moreover, a large finance sector warps the political process, and turns representative governments into oligarchies. This – in turn – destroys economies.

Postscript: Oligarchies also like to wage war … and war is horrible for the economy.