The Coming Economic Crisis and “Opportunity”

The economic alarm bells are ringing nationally and globally if anyone’s listening. While the political struggles surrounding the Trump administration remain our focus, economic distress will come calling.

A soaring stock market and shrinking corporate profits combined with an M&A (merger and acquisition) frenzy to purchase profits, rising interest rates, an end to qualitative easing are all signs of forthcoming stock market correction, or, more ominously, a collapse. Stock price to earning ratio has soared to 26.38 as stock prices rise much faster than profits. Global M&A has exceeded $700 billion a year for the first time since pre-collapse 2007.

It’s not just that the stock market is overvalued. The global context is of a housing bubble in the EU, China, Australia, and of underwater or zombie banks whose bad debts, ‘non-performing loans”, as bankers delicately call them, far exceed their book value and their loss reserves. This is the so-called Texas Ratio of bad divided by good. For 114 of 500 Italian banks, the ratio of bad over good is well over 100 percent, meaning banks without massive bailouts have little or no chance to survive a sharp economic downturn. Monte dei Paschi di Siena, with €169 billion in assets has a Texas ratio of 269%.

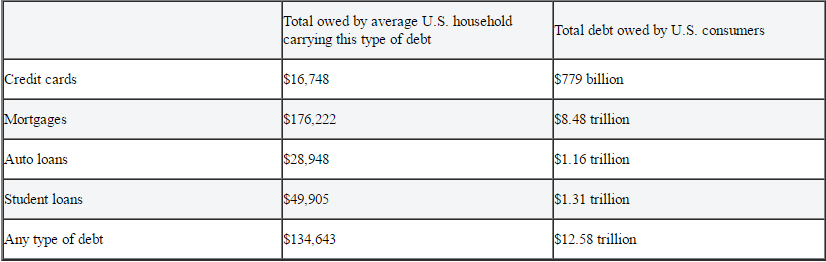

In China, the state controlled banking system is similarly ensnared in real estate. There’s $12.58 trillion in U.S. consumer debt. The sub-prime auto loan has replaced the sub-prime mortgage with banks like Santander N.A. in trouble. Add crushing student loans, credit card debt, and zombie state governments staggering under debt, A stumble in one area can be the trigger for rapidly spreading financial collapse a la 2007-8. My guess is that Italian banks may be the trigger with European bankers keeping things afloat until after the French elections in April or the German elections in Sept.

But this time there won’t be the U.S. Fed providing trillions of dollars to make banks and speculators whole once again as in 2008. To take advantage of the collapse, and not get fooled once again, a few basic principles are in order to save the people, the economy, the planet, and not bankers and speculators.

First, write all bad debt, including home mortgages, down to market. This is usual practice for commercial real estate. Terms are renegotiated to reflect market reality or a bankruptcy judge will do this. The law must be changed to allow bankruptcy judges to mandate market terms and allow people to stay in their homes with manageable debt.

Second, the holders of unsecured financial instruments are wiped out as are stockholders of the insolvent banks. Bank executives lose their jobs, and go to jail if they have committed fraud. FDIC saves the depositors. The banks are recapitalized by Federal funds to make real business loans and run by competent trustees appointed by the Treasury with an elected community board to guide sustainable investment policies with full transparency.

Third, a new Glass-Steagall Act must separate commercial banking from investment banking, and the size and geographic scope of commercial banks limited.

Fourth, economic recovery can be driven by profitable sustainable infrastructure investments to create jobs and stable communities by building the efficient renewable energy infrastructure including solar and wind farms, energy storage, the electric vehicle charging infrastructure, high speed rail networks, high speed broad band networks, and zero-pollution and zero- waste factories.

We can create jobs, slash carbon dioxide pollution, and build a sustainable 21st century economy in the aftermath of the coming crisis. A world run by and for billionaires is nearing its expiration date.

The financial storm is coming, be prepared.

***

FACT CHECK

Stock price to earning ratio by year

http://www.multpl.com/table

Corporate Profits

http://wolfstreet.com/2017/03/30/corporate-earnings-stagnate-stocks-soar-crash/

…corporate profits have been in a volatile five-year stagnation. However, during that time – since Q1 2012 – the S&P 500 index has soared 70%.

Merger and Acquisitions

http://wolfstreet.com/2017/03/29/stock-market-exuberance-drives-merger-valuations-to-highest-level-on-record/

“Announced” global volume of Mergers & Acquisitions – “announced” in quotes for a reason, more in a moment – has breached the $700 billion year-to-date for the first time since the crazy pre-collapse year 2007. This includes 125 deals of over $1 billion, totaling $455 billion. Three industries are at it with the most vigor: oil & gas, healthcare, and technology.

This surge in M&A “has been driven by cross-border acquisitions, which have doubled in the last 5 years to $288 billion in 2017 YTD,” according to Dealog

Italian Banks

https://www.bloomberg.com/news/articles/2016-07-06/italian-banks-rank-among-worst-in-europe-by-texas-ratio-chart

According to new research by Italian investment bank Mediobanca, 114 of the close to 500 banks in Italy have “Texas Ratios” of over 100%.

China Banks

www.businessinsider.com/china-banks-shadow-credit-lehman-risk-wmps-2016-11

“China’s financial system could be vulnerable to a Lehman Brothers-style collapse,” the FT says. The FT’s article is based on this report from the IMF, published in August.”

Credit Card and Other Household Debt

https://www.nerdwallet.com/blog/average-credit-card-debt-household/

“The average household has $134,643 in debt. For households that carry credit card debt, it costs them about $1,300 a year in interest.”

Sub -prime auto- loans

http://www.zerohedge.com/news/2016-09-07/one-trillion-dollar-consumer-auto-loan-bubble-beginning-burst

Sep 7, 2016 – “Well, this time around we are facing a subprime auto loan meltdown. … The total balance of all outstanding auto loans reached $1.027 trillion”

Santander N.A. and sub-prime auto loans

http://www.autonews.com/article/20170329/FINANCE_AND_INSURANCE/170329814/santander-pays-25-9-million-to-settle-subprime-auto-loan-probes

UPDATED: 3/29/17 3:41 pm ET – adds details

BOSTON — Santander Consumer USA, the lender behind Chrysler Capital, has agreed to pay $25.9 million to resolve investigations by the attorneys general in Massachusetts and Delaware into its financing and securitization of subprime auto loans.

Zombie State Governments

http://www.statedatalab.org/chart_of_the_day/fcdetail/are-some-states-taking-higher-risks

“Edward Kane coined the term ‘zombie’ in a financial context back in the savings and loan crisis of the late 1980s. ‘Zombie’ banks were effectively insolvent but allowed to continue operating…”

Today, many state governments find themselves cornered by long-unrecognized, massive off-balance sheet obligations… In turn, some of them may… also end up increasing eventual costs to taxpayers to resolve the situation, much like the endgame of the S&L crisis.

International Housing Bubble

http://www.mymetrotex.com/news/international-housing-bubble-forming-imf-warns

“ Chinese real estate mogul Pan Shiyi, CEO of Soho China, likened the local Chinese housing market to ‘the Titanic’ on its way to its rendezvous with an iceberg…the bigger risk will be in the financial sector,” he told an investment meeting in Shanghai.

Paul Krugman …says Sweden is having a full on housing bubble, and even in Canada some believe a crash is looming like the sword of Damocles.”

Student loan debt

http://www.npr.org/sections/ed/2017/04/04/522456671/a-new-look-at-the-lasting-consequences-of-student-debt

‘”All that borrowing adds up to a total of $1.3 trillion, nearly triple what it was a decade ago.”

Texas Ratio

The Texas ratio was developed by RBC Capital Markets’ banking analyst Gerard Cassidy as a way to predict bank failures during the state’s 1980s recession. The ratio is still widely-used throughout the banking industry.

HOW IT WORKS (EXAMPLE):

Cassidy’s original Texas ratio formula is:

Texas Ratio = (Non-Performing Loans + Real Estate Owned) / (Tangible Common Equity + Loan Loss Reserves)

The Texas ratio is determined by dividing the bank’s nonperforming assets (nonperforming loans and the real estate now owned by the bank because it foreclosed on the property) by its tangible common equity and loan loss reserves. Tangible common equity is equity capital less goodwill and intangibles. As the ratio approaches 1.0, the bank’s risk of failure rises. And relatively speaking, the higher the ratio, the more precarious the bank’s financial situation.

Some analysts consider it appropriate to use a modified version of Cassidy’s formula in order to account for any government-secured loans that a bank may hold. For example, if a bank owns a nonperforming loan that is guaranteed by a federal loan program (VA, FHA, etc), the bank is not exposed to losses on that loan because the federal government will compensate them for any losses. Therefore, in most cases, it is appropriate to adjust the Texas ratio by subtracting the dollar amount of government-sponsored loans from the numerator:

Modified Texas Ratio = (Non-Performing Loans – Government-Sponsored Non-Performing Loans + Real Estate Owned) / (Tangible Common Equity + Loan Loss Reserves)

All of the inputs needed for the Texas ratio are reported to the Federal Deposit Insurance Corporation (FDIC) by member banks on a quarterly basis. Every quarter, the FDIC discloses the number of banks on its “problem banks list.” The FDIC doesn’t release the names on its list, it only says how many banks are on it. But it’s widely believed that some version of the Texas ratio forms the basis for the FDIC’s list.

Click here to see InvestingAnswers’ list of The 359 Safest Banks in America.

Or to learn how to use the Texas ratio to see if your bank is in trouble.

WHY IT MATTERS:

The Texas ratio takes into account two important factors in a bank’s health: the number of bad loans it’s made and the cushion the bank’s owners have provided to cover those bad loans (i.e. common equity).

If too many of the bank’s loans are nonperforming (as described by the Texas ratio’s numerator), the bad loans will erode the bank’s equity cushion, which could cause the bank to fail.

Likewise, if there is not enough equity in a bank (as described by the Texas ratio’s denominator), the bank will not be able to absorb very many bad loans and the bank will fail.

Roy Morrison’s latest book Sustainability Sutra has just been published by SelectBooks.