The 2008 World Economic Crisis: Global Shifts and Faultlines

The last months of 2008 witnessed what is being called the worst financial crisis since the Great Depression of 1929-30. The first indications of a serious crisis appeared in January 2008. On 15 January, news of a sharp drop in the profits of the Citigroup banking led to a sharp fall on the New York Stock Exchange. On 21 January a spectacular fall in share prices occurred in all major world markets, followed by a series of collapses. A number of American and European banks declared massive losses in their 2007 end of the year results.

Later months of the year witnessed the bankruptcy of Lehman Brothers, a 158-year old investment bank, the takeover of the stock-broking firm and investment bank Merrill Lynch, and the move by Goldman Sacks and Morgan Stanley to seek banking status in order to receive protection from bankruptcy. During the same weeks, the remaining four investment banks on the Wall Street all went under in one way or another. To stop further collapse and to ward off total economic catastrophe, the US government made its most dramatic interventions in financial markets since the 1930s. Only the infusion of hundreds of billions of dollars into the US banking system, coinciding with equally colossal interventions in Europe, staved off an entire crash of the world’s financial markets.

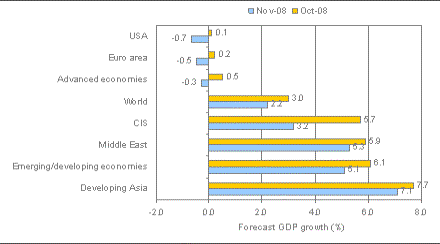

The collapse of financial markets is now being matched up by the decline of the real economy. The world appears headed for a period of inevitable economic stagnation/recession (a period of negative economic growth). After a year of financial shock and sharp economic loss, 2009 is likely to be extremely difficult for the global economy. Many observers commented that the turmoil in world financial markets has lead to a severe and still unfolding economic downturn in most of the Western economies, and as a result, the world has come on the brink of the ‘worst economic downturn’ since the Second World War. In November 2008 the IMF released an update to its October 2008 World Economic Outlook in which it highlighted the fast deteriorating economic environment and downgraded global real GDP growth forecasts for 2008-2009.(1) Many developed countries are now expected to face a deeper recession than had been anticipated. IMF downgraded its predictions for economic growth in 2008 and 2009, with world GDP growth expected to be 2.2% in 2009 instead of 3.0% predicted in October, and 3.7% in 2008 instead of 3.9% predicted in October. In the new forecast, the advanced economies are expected to contract by ¼ percent on an annual basis in 2009. This would mark the first annual contraction in the post-WW II period for these countries as a group. There are substantial downgrades for 2009 real GDP growth even for the emerging economies, which are expected to see overall growth of 5.1% in 2009, compared to 6.1% forecast in October 2008. The US economy is predicted to shrink by -0.7% in 2009 while the UK is set to be the worst affected of Western European countries with a contraction of -1.3% in 2008. Thus, it is expected that emerging economies will account for 100 percent of global growth next year. The IMF report indicates that the economic performance of the emerging economies will be critical in order to attain the hoped-for revival of global growth after 2010.(2)

October 2008 forecasts against November 2008 forecasts

Source: ‘World Economic Outlook Update. Rapidly Weakening Prospects Call for New Policy Stimulus, IMF, November 6, 2008, http://www.imf.org/external/pubs/ft/weo/2008/update/03/index.htm [retrieved on 13 January 2008.

Later on 28 January 2009, in an Update to its World Economic Outlook, the IMF revised again world growth down to lowest rate since World War II: World growth is projected to fall to just ½ percent in 2009, its lowest rate in 60 years. ‘We now expect the global economy to come to a virtual halt,’ said IMF Chief Economist Olivier Blanchard in prepared remarks for a press briefing. Advanced economies will experience their sharpest contraction in the post-war period, the report said. The IMF predicts real activity to contract by around 1½ percent in the United States, 2 percent in the euro area, and 2½ percent in Japan. Though more resilient than in previous global downturns, emerging and developing economies are also expected to suffer some setbacks. For instance, the growth is expected to slow to 6¾ percent in China and 5 percent in India.(3)

There is a possibility of growth forecasts being downgraded further. While the IMF expects a recovery in 2010, other forecasts believe that the recession will be more prolonged in certain countries, including the US and the UK. Many economists predict that the world’s largest economy, American economy, would contract 1.5 percent this year.(4) Developed economies will in general be the worst affected while developing regions are likely to avoid the worst effects of recession – even though the governments of some countries have already sought emergency funding.(5) In its ‘Global Economic Prospects’ report, released in December 2008, the World Bank also painted a grim picture of the global economy in 2009. ‘Developing countries’ economies would likely expand at an annual pace of 4.5 percent while wealthier, developed economies are expected to contract 0.1 percent’, the World Bank report said.(6)

It is not often that we are being faced with the financial and economic turmoil so severe that the IMF calls it ‘the largest financial crisis in the US since the Great Depression’.(7) Many observers portrayed the turmoil in financial markets in terms of a ‘domino effect’, claiming that ‘the risk of a domino effect … would be significant as many of the Emerging Europe region economies share the same vulnerabilities’.(8) Some others get metaphors drawn from ’chaos theory’ more suitable.(9)

What exactly happened?

There seems to be a consensus that the immediate cause of the crisis lay in the US sub-prime mortgage lending.(10) During the last decade, a large number of people, previously considered as bad credit risks, were offered mortgages. Because house prices were rising and it seemed like they would continually increase. It was anticipated that if people could not keep up with their mortgage payments their houses could be repossessed and sold at a generous profit. Indeed, it was such lending which pushed the very rises in the house prices it relied upon. The greater and easier availability of mortgage funding predictably led to greater demand for housing. Sharp and consistent rise in house prices served to reinforce speculation, and the rise in house prices made the owners feel rich. The result was a consumption boom that has sustained the economy in recent years.

The housing bubble had a double effect: it not only made American consumers feel confident that the value of their house was rising, enabling them to spend more; it was reinforced by a strong campaign from the banks, … urging them to take out second mortgages and use the new money for consumption spending.(11)

Those banks, mortgage lenders who lent the money did not usually do so out of their own pockets. They went to others to borrow, and those others in turn would borrow from somewhere else. All major banks in the US and in Europe were doing this, setting up special entities to borrow in order to lend. In this way, all kinds of different loans were packaged together into what came to be called ‘financial instruments’. ‘Financial instruments’ are simply defined as ‘any contract that gives rise to both a financial asset of one enterprise and a financial liability or equity instrument of another enterprise’. More simple and straightforward financial instruments can be receivables, payables, loans, etc. There emerged, however, much more complex and complicated ones during the last decade, such as financial instruments involving derivatives, forward contracts and hedging activities. Finance market is composed of endless strings of bilateral transactions involving an incredibly diverse array of high-risk financial instruments. And for a time all seemed to go well and provided enormous, almost effortless profits. There are limits, however, to how far economies can be sustained by debt that is not based on any real economic values created.

The first signs that all was not well were about 18 months ago. Economic growth slowed in America that ignited a sharp increase in the number of mortgage holders who could not afford the interest rates, and in the end there was a growing number of repossessions. Meanwhile, investors who bought these mortgages through a range of schemes, known as mortgage-backed securities, found out that the value of what they own is sharply dropping.(12) As a result, house prices fell sharply, and mortgage lenders discovered that they could not make enough from selling off roughly one million repossessed homes to pay back what they themselves had borrowed.(13) So, the investment banks which had been so willing to lend money to mortgage lenders just as suddenly found out that they were facing losses of tens of billions of dollars. For some, the losses represented by various toxic securities simply diminished their reserves and brought them down.(14) At that stage no one knew precisely how deep any particular bank’s problems because the ‘financial instruments’ were so complicated.(15)

As a result of all these, financial institutions right across the global economic system became afraid to lend each other in case they discovered they could not get their money back. Many banks have basically stopped lending to one another, and lending practically stopped everywhere. This situation was the ‘credit crunch’. A credit crunch is, in simple terms, a crisis caused by a [sudden] reduction in the availability of liquidity in the financial markets. In the case of a credit crunch, banks hugely reduce their lending to each other because they are uncertain about how much money they had. All this led to a fundamental reassessment of the value of virtually every asset in the world.(16)

Financial markets and credit institutions play a very fundamental role in a modern economy, coordinating the production circuits and networks, by directing capital to where it can make the maximum level of profit. They produce credit money and credit systems to smooth the payments of debts. Every modern economic activity depends for their day-to-day activities on continuous borrowing and lending. It would be quite appropriate, therefore, to compare a credit crunch to a heart attack. If it is not dealt with properly, the whole system immobilizes. That is why all those governments rushed to interfere, pouring billions of dollars into private banks, hoping the recipients will use the cash to start lending and borrowing again. The danger is that once governments step in and nationalise banks and take on their entire debt, eventually this debt may be going to be bigger than the whole GDP of the country. This is what happened in Iceland, and a number of other ‘problem countries’ came closer to that point and asked the IMF urgent help.

Many commentators in the media saw the story as ending there, and the only lesson they drew was the urgent need for more financial regulations. Most of the debate was centred on how much and what kind of regulation. Even a more critical and nuanced commentator, British anti-debt campaigner Ann Pettifor, was explaining the crisis by ‘the stupidity, poor economic analysis and sheer ignorance of those central bankers, politicians, auditors …’ in openDemocracy. Such an explanation, focusing on the blatant deceit and corruption of financial players, runs the risk of downplaying the structural features of global economy in the 21st century, which indeed breeds such financial meltdowns.(17)

Some commentators looked a little deeper. For example, Martin Wolf, chief economic commentator of the Financial Times, was saying that ‘I now fear that the combination of the fragility of the financial system with the huge rewards it generates for insiders will destroy something even more important – the political legitimacy of the market economy itself – across the globe.’ The same point was expressed by Angel Gurria, Secretary-General of the OECD: ‘the market system is in crisis’.(18) ‘What we are seeing right now looks like a very slow train wreck,’ says James Boughton, the historian of the International Monetary Fund and Assistant Director in the Policy Development and Review Department of the IMF.(19) Alan Greenspan, the former boss of the Federal Reserve, calls it the crisis that happens once in a century.(20) Other commentators pointed out that the main reason of the current crisis was related to the fact that economic growth in the US since the last recession seven years ago has been to a large extent boosted by growing debt, both of consumers and of the US government.(21)

For a healthy economy to function smoothly the wealth being produced throughout the system must be sold. If investment falls below savings, a gap opens up between what has been produced and what is being sold. Some producers cannot sell what they produced, and they have to scale down or even close, as a result of which their workers lose their jobs. This reduces still further what can be sold in the system. This did not happen until the recent crisis in the US, because easy lending to US consumers had provided a domestic market and absorbed the surplus production.

The credit crunch is now putting a stop to this, because banks and mortgage lenders, fearing that they will be unable to meet their own financial obligations, are not lending money to one another and to customers. Even if credit institutions recover confidence in lending each other, it is not likely that they are going to start lending to people again soon with the same relaxed attitude. Credit will not start flowing just because banks can get hold of more liquidity. They will instead, most likely, use the funds to shore up their own finances, fix up bad debts and build up their capital base in an attempt to get solvent.

Systemic crisis

The story told so far is not complete. We have not been told, for instance, why the rest of the world is so dependent on the US economy. Due to highly complex, geographically extensive, and transnational nature of production and trading networks, a crisis in one part of the system inevitably and directly affects the other parts. Furthermore, the size and strength of the US economy have made it the main determinant of the pace of expansion of the world economy as a whole. From the US the crisis has now spread to the rest of the world which is witnessing the first synchronised world recession since 1974. There are lots of proximate causes – the US housing bubble and the huge size of the American economy, persistent unresolved global imbalances, a lack of government regulation of the financial sector, lax regulation and insufficient regulation that lead to widespread underestimation of risk.(22) But all these are still symptoms. In order to make clear sense of this crisis, I would like to develop a broad picture here regarding the configuration of the world economy. My focus here is less on intentions than on structures, less on ‘goodness’ and ‘badness’ than on historically configured relations of power. My purpose here is, above all, to make connections between different layers of global system to explore the long-term origins of the current global systemic crisis.

The recent crisis is an expression of the structural changes and deep-rooted contradictions which have occurred within the global system in the last 30 years. As a result, today’s global economic system is marked by three profound vulnerabilities: 1) the explosive growth of the financial system relative to manufacturing and the economy as a whole, and the proliferation of speculative and destabilising financial instruments of wealth accumulation; 2) the loss of relative power by the US, and the rise of other centres of accumulation; 3) resource depletion and ecological crisis. I am hoping that by examining each of these three areas where contradictions and vulnerabilities have been structurally emerging by the very logic of the global economic system and the process of capital accumulation, I can offer a more comprehensive understanding of the deeper roots of the current financial crisis and serious deep and synchronised economic downturn.

1) The explosive growth of the financial system during the last three decades relative to manufacturing and the economy as a whole, and the proliferation of speculative and destabilising financial institutional arrangements and instruments of wealth accumulation:

Current economic system rests upon the search for profit and accumulation of capital. What stimulates investment is, however, not just the absolute level of profits, but the ‘rate of profit’, which is the ratio of profits to investment. Therefore the rate of profit is an essential indicator that determines as well as exposes conditions of accumulation, in other words, the health of a particular economic body. In the world economy, the rate of profit stayed more or less steady all through the late 1940s, the 1950s and the 1960s. As a result, these years witnessed a steadily rising levels of investment, and a continual boom. This era, from the end of the Second World War to the late 1960s, is generally referred as ‘the golden age of capitalism’. But from the late 1960s until 1982, profit rates fell continuously, and global economy witnessed real decline in the rate of global GDP increase. As a result, the mid-1970s and the early 1980s witnessed a number of deep economic recessions. Growth slowed, profits dropped, and serious levels of unemployment became a central feature of the system.

The response of governments to the economic recessions was to introduce a series of measures which later came to be known as neoliberalism. Neoliberal response(s) to the recession took the form of Reaganism in the US and Thatcherism in Britain, and similar measures in most of the developed economies of the West. Under the pressure of the leading capitalist states (primarily the United States) and international monetary institutions (IMF and the World Bank), the developing economies have adopted structural adjustment programmes along the same lines. As a result, global growth averaged 1.4 % in the 1980s and 1.1 % in the 1990s. (It was 3.5 % in the 1960s and 2.4 % in the 1970s)(23)

One thing, which was essential in this partial recovery of the rate of profit in the 1980s and 1990s, was the increase of the share of total profits in total national incomes at the expense of wages. This meant everywhere, increased pressure for people to work harder and all kinds of attacks / cuts on welfare services. It meant a fall in the real wages and a massive increase in working hours. Almost everywhere in the world, the proportion of the wealth produced which comes back to the workers has decreased since the 1970s.(24)

Still, as seen in the figures above, the profit rates never recovered more than about half their previous decline, and even the small booms of neoliberal era ran into serious trouble with a number of serious crises, most significantly, the stock exchange crash of October 1987, and the East Asian financial crisis of 1997 (and its contagious effects on the rest of the world economy). Both the US Federal Reserve and the Bank of England reacted, on both occasions, by cutting interest rates and encouraging lending. All this was made possible by an active process of ‘deregulation’, in other words, the elimination of proper oversight on financial institutions and efforts. Such measures were able to encourage spending to some extent and thus to extend the booms, but in retrospect one can now conclude that they simply delayed the recessions for a few years. After the recession of 2001-02, the US government cut taxes again, and the Federal Reserve slashed interest rates even further. All these encouraged even greater levels of and more risky borrowing than before, which pushed the housing bubble. Demand for assets such as homes increased, without a corresponding increase in new value being produced in the system. This caused the prices of these assets to rise even further. On paper, people’s and businesses’ wealth increased, so it seemed they now had the means to borrow more, and they became ‘irrationally exuberant’. All of this lead to a further increase in demand, and so forth and so on. In other words, many people were provided mortgages (by relaxing income documentation requirements) to buy overpriced properties that they could not, in reality, afford. ‘The housing bubble, associated with rising house prices and the attendant increases in home refinancing and spending, which has been developing for decades, was a major factor in allowing the economy to recover from the 2000 stock market meltdown and the recession in the following year.’(25) Under the euphemistic heading of ‘financial innovation’, a number of changes in institutional arrangements enabled banks and mortgage lenders to escape regulatory restrictions and expand their activities even further.(26)

It seemed, for the time, the economy was dragged out of recession, yet one can claim in retrospect that the same measures (this ‘cheap money, easy credit’ strategy) laid the ground for much more serious problems the system faces right now. Greater levels of risky borrowing lead to speculative bubbles that lead to the temporary prosperity but which ultimately ended up in corporate collapse and in recession in the real economy.(27)

The rise in profit rates had not been enough to raise investment to its previous levels, but also raising profits at the expense of salaries had indeed cut the capacity of workers to buy consumer goods.(28) Because the drain on wages was not/ and could not used to invest more, extra profits were accumulated in the financial sector. As a result, a large amount of increased business profits was invested in various financial schemes. As a result, the value of financial wealth has grown considerably, and the relations between productive capital and financial capital were profoundly modified subordinating all other economic activities. The road to wealth accumulation has no longer been manufacturing industry or the provision of financial services associated with manufacturing, but the buying and selling of assets using borrowed funds for profit. Until the recent crisis, there has been a constant search for even further investment opportunities for this financial wealth. All this vast financial sector expansion, overaccumulated financial capital, in other words ‘the new centrality of the financial sector’ greatly advanced speculation. This process, widely referred to as financialization, is defined as ‘the increasing role of financial motives, financial markets, financial actors and financial institutions in the operations of the domestic and international economies’.(29) As a result of this complex structure exceptionally high profits were achieved in the financial sector, but the whole system remained extremely vulnerable.(30)

The share of financial services in the GDP of the US surpassed that of industry in the mid-1990s. From 1973 to 2008 the portion of manufacturing in GDP fell from 25 % to 12 %. The share represented by financial services rose from 12 % to 21 %. In parallel to this, borrowing at all levels was encouraged by the new financial structures which were re-shaped/ and relaxed to allow high levels of risky borrowing.(31) In the words of Peter Gowan, the last twenty years witnessed a ‘structural transformation of the American financial system’ as a result of which ‘a New Wall Street System has emerged …, producing new actors, new practices and new dynamics’.(32) The computerization of finance in the 1990s has dramatically improved the system’s ability to innovate, and a number of long-standing barriers to the reach and range of permissible activities were gradually undermined by various changes in the American financial-services industry. Particularly, the Financial Services Modernization Act of 1999, known as the Gramm-Leach-Bliley Act, repealed the banking-activity restrictions of the Depression era Glass-Steagall Act that separated commercial and investment banking to control speculation and protect bank deposits, as a result of which the financial system has become increasingly volatile and unpredictable.(33) By the end of the century, the level of personal borrowing in America rose to the record level, 9 % of Gross Domestic Product. Especially mortgage re-financings and home-equity loans allowed U.S. households to cash in capital gains from rising housing prices without having to sell off their homes. There was no other way, all the goods and services produced within the system could be sold.(34)

The gap between stagnant or even declining wages and fast increasing consumer expenditure was closed by the accumulation of consumer debt. Consumer debt allowed many working families to maintain their standard of living to some extent. Today, US households spend more of their disposable income to pay off debts (14 %) than to buy foods (13%). In the US, household indebtedness rose from 50 % of GDP in 1980 to 71 % in 2000 to 100 % in 2007. Financial sectors indebtedness was 21 % of the GDP in 1980, 83 % in 2000, and 116 % by 2007.(35)

In Britain borrowing levels were even greater proportionately. Until the current crisis, the house boom had been even crazier, with average house prices quadrupling in 12 years. The reason Britain is in so much trouble is that both its corporate debts and household debts are huge. It is the combination that makes British economy such a credit liability. Michael Saunders from CitiGroup has calculated British‘external debt’, which is what the country owes the rest of the world. It is 400% of GDP, the highest in the G7 by some margin. The next down, France, is 176%. America is just 100%. Japan is about half America.(36)

Between mid-2000 and 2004, American households took on three trillion dollars in mortgages.(37) Where did this money come from? During the same period, the US government, as well as the private sector, borrowed from the rest of the world three trillion dollars. Between a third and a half of mortgages were financed with foreign money. The total American debt, which is the debt of individual households, private business, and government, has doubled as a proportion of GDP since 1980, and was 350 % of GDP even before the recent dramatic takeovers of new debt by the government. This is the result of ‘financialisation’ — the enormous increase in debt of all kinds.(38)

So, the current crisis –both financial and ‘real’ economy crisis– was not simply bankers’ mistakes or greed, or lack of government regulation of a hyperactive sector, or not even bad financial technology which produced the current crisis, but indeed those policies of the last three decades to use debt to overcome the stagnationist tendency of the economy. This is a structural issue. It is about an economy which can not grow without resorting to a huge build up of debt and speculative financial asset investment. This crisis, now engulfing the US economy and most of the Western world, has not come out of the blue. It is the outcome of processes stretching back more than three decades. What made it worse is ‘the interplay between persistent external and internal imbalances in the US and the rest of the world. The US and a number of other chronic deficit countries have, at present, structurally deficient capacity to produce tradable goods and services.’(39) ‘One of the most striking trends, since at least the 1960s but, especially since the 1970s, has been the disappearance of manufacturing jobs,…’(40) Indeed, the subprime crisis is actually a correction to years of debt-driven consumption in the US, revealing the end of unstable economic growth based on ‘spending tomorrow’s income today’. Therefore, the turmoil in global financial markets is the manifestation of not simply a conjunctural downturn, but rather a profound systemic disorder. It is the inevitable outcome of the progressive deregulation of financial markets, and colossal growth of the process of shifting investment from manufacturing to ever more exotic forms of financial speculation, the rise of the shadow banking system, initiated by Wall Street and its ‘backyard’, the City of London.(41) The current crisis points unambiguously to the conclusion that it is not possible to revive the level of consumption and investment by artificially boosting demand to fill the ‘output gap’.

2) The rise of new centres and the loss of relative weight of the US as a global hegemonic power(42)

Throughout the twentieth century, the U.S. patiently built its world system of control, first in Latin America and the Philippines, and then in Europe, Japan, Korea and the Middle East. Its superior army, weapons systems and intelligence networks have been essential to this project. But equally important, if not more so, has been the economic control of the world economy, mainly through the role of the dollar as the world’s reserve currency.

Dollar hegemony has always been critical to the future of American global dominance, even more so than its overwhelming military power. In turn, the U.S. economy is intimately tied to the dollar’s status as a reserve currency. Thus, the continuing dominance of the U.S. dollar is not a matter of simple economics, but is also ‘deeply rooted in the geopolitical role of the United States.’(43)

The central place that the U.S. now occupies in the global system rests on a particular convergence of structure and history. The crucial phase in this process occurred during and after World War Two. Only after the twin disasters of the Depression and the Second World War did capitalist globalization obtain a new life under the hegemonic control of the U.S. power. This reorganization of capitalism could not have been accomplished without the uneven development of certain structural characteristics that also shaped the post-war leadership of the U.S. imperial state. The post war state of physical and economic ruin in much of Europe, Asia and parts of Africa challenged the remaining industrial states to reestablish order in the world system. The economic and financial system in France was shattered, the whole of the German state was collapsed, Britain was on the brink of bankruptcy, and Japan was prostrate and disorganized after the collapse of its imperial state. With the unraveling of international competitive capital, only the U.S. remained as a stable capitalist state capable of determining the terms of a new world economic order.

The first task in rescuing the global capitalist order was to recompose the nations of Western Europe and Asia as member states, and then place the U.S. at the centre of the system. Economically, this required that the U.S. ruling elite create a new international monetary system that could provide the capital necessary for this reconstruction, and the construction of a system of world trade that could solve the residual effects of the Depression and the War. The post-war restructuring was begun at the Bretton Woods Conference in 1944, which adopted a gold standard for world currency, and encouraged the rapid expansion direct foreign investment and world trade.(44) The currency standard left the pre-war gold-exchange system in place, except that it substituted the dollar for the British pound as the key reserve currency. This required that all government that wanted to be part of this system would be required to hold dollars as their basic reserve currency and link their own currency to its value. The dollar, however, enjoyed immunity from any currency instability, because it was pegged to the value of gold, which was fixed at $35.00 an ounce. The Bretton Woods system was a natural expression of the global economic supremacy of the U.S. By the end of the war, the bulk of the world’s gold supply was held by the U.S. in Fort Knox, Kentucky, and the massive supremacy of U.S. industrial production guaranteed that it would enjoy huge surpluses in its balance of trade.(45)

This dominant role for the U.S. dollar in currency created at Bretton Woods was given particular power in association with a greatly expanded emphasis on direct foreign investment as the main form of capital export and international economic integration.(46) American corporations had evolved into hubs of increasingly dense host-country and cross-border networks among suppliers, financiers, and final markets. This worked to secure an even tighter international network of production and, arguably, promoted the internationalization of the American state. Thereafter, U.S. national interests increasingly were defined in terms of acting not only on behalf of the U.S., but also on behalf of the extension and reproduction of the global capitalist order.

As the 1950s and 1960s passed, the U.S. became more and more inflationist with regard to the value of the dollar, particularly with respect to Japan and Western Europe. Gold flowed steadily out of the U.S. during this period: U.S. gold stock declined from over $20 billion in the early 1950s, to less than $9 billion by 1970. Concern about this gold drain was expressed in first years of the Kennedy administration, but it didn’t become a crisis until the late 1960s and early 1970s when the U.S. balance of trade became negative.(47)

Conterminously with the decline in gold stocks and competitive trade, U.S. corporate profits also begin to decline in the face of competition from Germany and Japan. Collectively, these trends marked the beginning of a long decline in the relative superiority of the U.S. economy. The late 1960s and early 1970s were particularly harsh times for U.S. international economics. French President de Gaulle, witnessing the sharp decline of confidence in the U.S. economy happily sold U.S. dollars, eventually accumulating more gold than Fort Knox. (48) The Bank of England joined the French in demanding gold for dollars, which accelerated a run on the dollar, provoking a currency crisis that lasted until the middle of 1971. At that point, bowing to a tripling of the U.S. balance of trade deficit and an increasing outflow of capital, President Nixon announced a serious of drastic changes in the world’s currency arrangements. In a dramatic televised address to the nation on 15 August 1971, Nixon announced that the U.S. would no longer honor the dollars for gold valued at a fixed rate, but would only agree to a system of floating exchange rates, where each currency would be valued according to world demand. In one stroke, the American President invalidated twenty-five years of currency agreements, and introduced a prolonged period of currency instability and inflation.(49)

The U.S. administration’s dramatic end to the convertibility of the dollar restored the economic autonomy of the American state. The dollar, no longer convertible into gold at a fixed price, entered into a process of prolonged decline. The devaluation led almost immediately to an explosion of global price inflation and a collapse of share values on equity markets, which in turn restored the U.S. balance of trade. With this radical shift, the dollar became an irredeemable currency, no longer defined or measured in terms of gold, and no longer restrained in its printing. But with its role as the world’s dominant reserve currency, the dollar became even more dominant in determining trade relations. Since the 1971 devaluation, the petrodollar has been at the heart of U.S. dollar hegemony.

With almost two-thirds of the world’s currency reserves in dollars, and oil priced, imported and exported in dollars, it means that everyone needs dollars to do business in the world’s petroleum markets. The terms of this dollar dominated petroleum market were set in June 1974, when U.S. Secretary of State Henry Kissinger met with OPEC’s biggest oil producer and organized the US-Saudi Arabian Joint Commission on Economic Cooperation,

officially agreeing to sell its oil only for dollars. Soon after the agreement with Saudi government, an OPEC agreement accepted this, and since then all oil has been traded in US dollars.(50) In effect, oil dollars provide the U.S. with an interest-free loan, as petro-dollars are repatriated back into the U.S. economy as investments in U.S. treasury notes, stocks mutual funds and bonds.(51)

This has been the situation and the essential basis for the US economic hegemony since the 1970s. Needless to say, this system enables the US administration to effectively control the world oil market.

So long as OPEC oil was priced in U.S. dollars, and so long as OPEC invested the dollars in U.S. government instruments, the U.S. government enjoyed a double loan. The first part of the loan was for oil. The government could print dollars to pay for oil, and the American economy did not have to produce goods and services in exchange for the oil until OPEC used the dollars for goods and services.

Obviously, the strategy could not work if dollars were not a means of exchange for oil. The second part of the loan was from all other economies that had to pay dollars for oil but could not print currency. Those economies had to trade their goods and services for dollars in order to pay OPEC.(52)

While this has produced undeniable benefits for the US political and economic elites, it has left the US economy intimately tied to the dollar’s role as global reserve currency. In this situation, dollars rapidly accumulated in foreign banks, particularly those serving petroleum-exporting countries. These petrodollars created an additional financial issue, because unlike Western Europe and Japan most of the oil-exporting countries had limited possibilities for domestic development and consumption. The Nixon administration responded by coaxing these countries into buying up US Treasury bills and bonds, which has since that time been the primary strategy for dealing with the US international deficits. Because of its large current-account deficit America has been heavily reliant on foreign funding. The current crisis poses serious challenges to the US dollar as the dominant global reserve currency.(53)

By the 1970s, West European and Japanese capital had already recovered from the devastation of the Second World War and begun out competing US corporations, and US economic hegemony, both in America and abroad. By the 1980s, it was the turn of southeast Asian capital to out compete both the US and West European capital through the formation of a new kind of transnational business structure – a structure that was deeply rooted in the region’s history and geography, and that combined the advantages of massive, young, dynamic population with the flexible business networks. This is a very significant development in the context that all major indications point out that the economic power of the United States was in stagnation since the 1970s and is in decline since the end of the Cold War. Particularly its share of world trade and manufacturing is substantially less than it was just prior to the end of the Cold War, and its relative economic strength measured against the EU and the East Asian economic group of Japan, China and other Southeast Asian countries is similarly in retreat. A closer look at the extraordinary economic expansion of the Southeast Asian region for the last 20 years can give some insights into the remarkably new kind of global economic order that may be emerging at the edges of the current systemic crisis.

More than 8 % average annual economic growth set by a number of East Asian economies for the last 20 years is outstanding in the 140 years of recorded economic history. This is all the more outstanding in having been recorded at a time of total stagnation or near stagnation in most of the developed economies of the West. ‘The rise of China represents one of the most fundamental shifts in world politics over the past few decades.’(54)

The opening up of China’s economy to global forces was part of US Cold War policy, with the intention of reaching a rapprochement with Mao Zedong in the 1970s against the Soviet bloc. The economic modernisation programme activated by Deng Xiaoping in 1978 accomplished consistent growth rates of 9 to 10 % throughout the 1980s and 1990s. Under Deng Xiaoping, whole approach to economic growth took a new direction: ‘the main task of socialism is to develop the productive forces, steadily improve the life of the people, and keep increasing the material wealth of society. … So to keep rich is no sin.’(55) For more than two decades, China has marched to the banner of ‘reform and opening to the outside world’.(56) Deng Xiaoping’s economic programme was regarded by many observers as one of those historical turning points of the 20th century. How ironic is that now, three decades later, the US increasingly regards a fast expanding market economy in China as a serious threat to US global hegemony.

The 2008 report of the US National Intelligence Council – which supports the Director of National Intelligence and is the centre for long-range analysis in the US intelligence community – published in November 2008, presents a detailed and comprehensive report on global trends to 2025. Most press coverage focused on the report’s key message of the ’sun setting on US power’ (almost identical headlines in the Guardian and the Times). It is explicitly mentioned in the report that by 2025, the US will be less dominant, and ‘China will have the world’s second largest economy and will be a leading military power.’ Furthermore, the report identified China and India, together with the US, as the ‘three of the largest’ economies.(57) It seems that the unprecedented transfer of wealth roughly from West to East now under way will continue for the foreseeable future. This unprecedented economic growth, coupled with 1.5 billion more people, will undoubtedly put pressure on world’s key resources—particularly energy, food, and water—raising the specter of scarcities emerging as demand outstrips supply.(58)

One flash point with the US is China’s fast growing demands for oil. China has become the world’s second largest consumer of petroleum products in 2004, having surpassed Japan for the first time in 2003, with total demand of 6.5 million barrels per day (bbl/d). China’s oil demand is projected by EIA to reach 14.2 million bbl/d by 2025, with net imports of 10.9 million bbl/d.(59)

All the existing evidence point out that even without a total collapse of the US global hegemony, there seems to be satisfactory evidence for a great and rapid shift of wealth and power to China and India, and other emerging economies. The transfer of power from the West to the East is gathering pace since the late 1990s, and Washington think-tanks have been publishing thick white papers charting Asia’s, and China’s in particular, rapid progress in microelectronics, nanotech, and aerospace, and printing gloomy scenarios about what it means for America’s global leadership. China, India and other emerging economies have so far boasted growth rates that could outstrip those of major Western countries for decades to come. China is currently the world’s sixth largest economy with an annual economic growth of more than nine percent. India’s annual growth rate is eight percent. China’s economy is expected to overtake France and Britain this year, be double the size of Germany’s by 2010, and to overtake Japan’s, currently the world’s second largest, by 2020. Due to its one-child policy, China’s working-age population will peak at 1 billion in 2015 and then shrink steadily. India has nearly 500 million people under age 19 and higher fertility rates. By mid-century, India is expected to have 1.6 billion people – and 220 million more workers than China. Of course, this could be a source for instability. But a great advantage for growth if the government can provide education and opportunity for India’s masses.(60)

China has become the engine driving the recovery of other Asian economies from the recessions of the 1990s. Japan, for example, has become the largest beneficiary of China’s economic growth, and its leading economic indicators have improved as a result. Thanks to increased exports to China, Japan has finally emerged from a decade-long economic crisis.

After China, India is emerging as an economic superpower. With economic growth topping 9 percent in 2007, an acknowledged nuclear capability, and a growing role in international relations, it has attained the status of a leading ‘emerging power’. India is today playing an invaluable role in the global innovation chain. Motorola, Hewlett-Packard, Cisco Systems, and many other high-tech giants now rely on their teams in India to devise software platforms and dazzling multimedia features for next-generation devices. Intel has 2000 electrical engineers with PhDs in Bangalore designing absolutely the latest ships. Indian engineering houses use 3-D computer simulations to produce sophisticated designs of everything from car engines and forklifts to aircraft wings for clients like General Motors and Boeing Corp.(61)

The post-war era witnessed economic miracles in Japan and South Korea. But neither was big enough to power worldwide growth, or change the direction of global economy in a complete spectrum of industries. China and India, by contrast, possess the weight and dynamism to transform the 21st century global economy. The closest parallel to their emergence is the saga of the 19th century America: a huge continental economy with a young driven force that grabbed the lead in agriculture, apparel, and the high technologies of the era, such as steam engines, the telegraph, and electric lights. But in a way, even America’s rise falls short in comparison to what has been happening in China and India for the last two decades. Never has the world seen the simultaneous and sustained takeoffs of two countries that together account for one-third of the world’s population.

What makes the two Asian giants especially powerful is that they complement each other’s strengths. All indications point out that China will stay dominant in mass manufacturing, and is one of the few countries building multibillion-dollar electronics and heavy industrial plants. The Chinese producers not only make textiles and cheap toys. They also make semiconductors and very advanced technology. Indeed, the world semiconductor fabrication capacity is dominated by Asia-Pacific region.(62) India is a rising power in software, design, services, and precision industry. If Chinese and Indian industries truly collaborate, they would take over the world high-tech industry. These immense workforces are already converging. Because the global deployment of high-speed internet communication renders geography almost irrelevant, now multinationals are able to have their goods built in China with software and circuitry designed in India. Together they are combining Indian software technology with Chinese hardware technology to achieve world leadership in the global information technology industry. In 2005, India and China formed a ‘strategic partnership’. More recently, they agreed to hold their first-ever joint military exercise October 2008.(63)

One obvious reason to this shift in the balance of power in many technologies is that China and India graduate a combined more than half a million engineers and scientists a year. The total number of graduates in America is only 60.000. In three years’ time, the total number of young researchers will rise to 1.6 million in India and China together. Because these two countries can throw more brains at technical problems, their contribution to research and innovation is increasing fast.(64)

Western business is not just shifting research work to Asia, because Indian and Chinese brains are young, cheap and plentiful. Thanks to comprehensive and intense technological education available in China and India, in many cases, the Asian engineers are better educated and they combine complex skills: mastery of latest software tools, a knack for complex mathematical algorithms, and fluency in new multimedia technologies. That is true that many Western companies came to India and China for the low cost. But they are staying for the quality, and they are investing for the innovation. China and India are rapidly moving from providing low-cost manufacturing and services to being innovation powerhouses. Now it is becoming more and more clear that China, and India (and some other emerging economies) are taking center stage in the global competition for innovation and talent. China and India now boast some of the world’s top science and research universities, including the seven-campus Indian Institutes of Technology as well as Beijing’s Tsinghua University.(65) ‘One of the most striking features of the Chinese labor market is its growing level of education and skilling’.(66)

What is driving innovation in Asia, however, is not only the Western demand, but increasingly more so, fast rising home-grown consumer class. China is currently the world’s third largest travel market, with 120 million air passengers in 2004. China is currently the world’s second largest market for automobiles, after the US. For instance, Volkswagen is producing more cars in China than in Germany.(67) China has the world’s biggest base of mobile-phone subscribers – 350 million — and that is expected to rise 600 million by 2009. The fastest growth in demand for semiconductors is overwhelmingly concentrated in China. Much of this growth is in the expansion of the mobile phone market. With over 100 million Internet users this year, China is a dominant presence in the Internet world. In two years, China should overtake the US in homes connected to broadband. The rapid growth of Chinese Internet market has turned the country into a promised land for many Internet giants, like Yahoo, Google, MSN and eBay.(68) Recent studies show that the attitudes and aspirations of today’s Chinese and Indians resemble those of Americans a few decades ago. Surveys of thousands of young adults in both countries found that they are overwhelmingly optimistic about the future and believe success is in their hands.(69)

In terms of size, speed, and directional flow, the global shift in relative wealth and economic power now under way—roughly from West to East—is without precedent in modern history.(70) The last 10 to 15 years have witnessed 3 billion people entering into the global economy. In many past examples, newcomers were generally those who were doing unskilled, labour-intensive tasks. What is interesting about today’s Chinese and Indian population is that, while, on average, they are poor and while most of them are unskilled, there are such a large number of them, and a small percentage of 3 billion is still a lot of people. A small percentage of these 3 billion, 300 million of them are highly skilled and very well educated and ready to produce everything with the latest scientific methods. These 300 million, still a large number, as large as the US, larger than Japan, and any European country, make a big impact on the global economy. Both India and China would become major power centres by 2015 even while remaining middle-income countries on account of their having the highest population in the world. Their fast integration into the world economy during the last 20 years has already dramatically changed the pattern of world economy, which is considered as ‘the most significant global shift in the geography of the world economy during the past 40 years’.(71) As the global crisis churns, China and India are emerging as more vital players in limiting the economic damage from the worst global financial crisis in almost 80 years. Together, India and China, two of the largest economies in the world, clearly have the wherewithal to take a leading role and reshape the world order.(72)

In the coming decades, how these Asian giants integrate with the rest of the world will largely shape the 21st century global order. All these powerful trends may soon be followed by increasing geopolitical strength in Asia as well. To explain the current financial crisis and economic downturn within the context of an epochal shift in the world-system away from North American/ West European dominance and towards Asia would provide us a longer term and deeper understanding of the global economy in the current century. The 21st century looks set to be fashioned by the rise of China and India at the state level; and the formidable rise of Pacific-Asia-India as the foremost economic zones at the regional level.

All this should not really be surprising. Asia, and especially East Asia, was already dominant for most of human history and remained so until very recently, that is less than two centuries ago. China and the area that is now India then accounted for about 75 percent of global GDP. Even in 1820, China and India together were worth more than 50 per cent of world trade. Europe’s share was relatively insignificant, and America had been discovered but was still not important enough beyond the Atlantic. Only then, for a number of reasons, Asian economies lost their position to the West, but it seems only temporarily.(73) Leadership of the world system has been temporarily centred in the West, Europe and America, while Asia had slipped into increasing economic insignificance. That shift happened in the 19th century, and another shift appears to be happening again at the beginning of the 21st, as the centre of the world economy seems to be shifting back to the East. Measured by purchasing power, China had 13 per cent of the world’s gross domestic product in 2007. By 2050 it is expected to reach 20 per cent. India will grow from 6 per cent to 12 per cent, the US will slip from 21 per cent to 14 per cent and Europe from 21 per cent to 10 per cent.(74) Peter Dicken describes this ongoing process as ‘the changing global economic map’, arguing that ‘old geographies of production, distribution and consumption are continuously being disrupted and that new geographies are continuously being created. In that sense, the global economic map is always in a state of becoming …’.(75)

Modern world system has gone through several rounds of hegemonic shifts and several cycles from unicentric to multicentric organisations for centuries. In the 17th century, the Dutch were hegemonic in the European world-economy. Then the British rose to hegemony in the 19th. The shift from British to American hegemony in the early 20th century was spectacular and significant, but it was a routine change. In the Rise and Fall of the Great Powers, Paul Kennedy shows how economic data indicated clear signals about which powers were rising and which ones were falling back between 1500 and 1980s. In his survey, Kennedy detects a pattern repeated over and over: ‘Wealth is usually needed to underpin military power, and military power is usually needed to acquire and protect wealth’. Kennedy argues that the strength of a Great Power can only be properly measured relative to other powers and he argues that Great Power ascendency (over the long-term or in specific conflicts) correlates strongly to available resources and economic durability; military ‘over-stretch’ and a concomitant relative decline is the consistent threat facing powers whose ambitions and security requirements are greater than their resource base can provide for. He argues that military superiority by itself is often deceiving, since it may be weakening a state’s ability to compete economically and fund future conflicts. Kennedy demonstrates that while it is true that in the year 1900 Britain stood as the world’s greatest power, the writing was already on the wall. The figures for ship building, military spending, amount of coal produced, GDP, and other relevant categories clearly showed that Britain was being overtaken by Germany and the US.(76)

If one looks at China’s economic figures for the last 20 years, one realises a truly global power rising at a stunning rate. If one considers that ultimately geopolitical power is built on economic power, then there exist every reason to anticipate that China will soon become one of the two or three superplayers on the global arena. Former deputy treasury secretary Roger Altman has written in Foreign Affairs: ‘the financial and economic crash of 2008, the worst in 75 years, is a major geopolitical setback for the United States and Europe… No country will benefit economically from the financial crisis over the coming year, but a few states most notably China will achieve a stronger relative global position… Beijing will be in a position to assist other nations financially and make key investments in, for example, natural resources at a time when the West cannot.’(77)

China and India are not the only new global players in the world. In 2006, for the first time, new (emerging) markets accounted for over 50 % of global output. If this development continues at the current rate, all forecasts project a very different world by mid-century. A 2006 research by the accountancy firm Price Waterhouse projected that in 2050 the Chinese economy would be as large as that of the US in dollar terms, and that India would be the third largest in the world. Another projection, last year, by Goldman Sachs predicted that China would indeed surpass the US much before the mid-century, by 2027, and India’s economic power would become greater than the US before 2050.

Price Waterhouse research also predicts that soon the collective size of E-7 (emerging 7 economies: Brazil, China, India, Indonesia, Mexico, Russia and Turkey) would be about 25 % larger than the collective size of the current G-7 rich economies. According to the same research, the banking sector is growing faster and stronger in the emerging economies comparing with the G-7 economies. ‘By 2020, China, India, Brazil, Indonesia and Russia will between them account for 30% of global GDP. The change will bring an important shift in the global balance of economic power.’(78) Observers now talk of the emergence of a new ‘Seven Sisters’ (a term used to describe the seven major Anglo-American companies that controlled the world oil after the Second World War). Today it is not ExxonMobil, Royal Dutch Shell, and the other western companies, but Russia’s Gazprom, CNPC of China, Venezuela’s PDVSA, Brazil’s Petrobras, Saudi Aramco, and Malasia’s Petronas that are seven giant producers.(79)

Whatever one may think of the details and differences of such projections, there is no doubt that momentous changes are happening in the global economy. With the rapid rise of alternative economic power centres, the relative weight of America in the global economy is plainly declining. The balance of economic and political power is shifting to China and India and other emerging economies, placing the Asian region, under Chinese leadership, in a much more competitive position vis-à-vis the US. The increase in output in the emerging economies means the departure of numerous industries from the old industrialised countries, as a result of which real wages in the US and Western Europe are steadily declining, strengthening the trend to chronic employment (which is also one of the main reasons behind the current financial crisis). As a result of this still continuing trend, the buying power of the populations in the advanced economies will diminish even further. The unconstrained development of global economy in new regions brings devaluation to previously leading centres through intensified international competition. In general money and influence go hand in hand, and the wealth accumulation in China, India and other emerging economies will eventually change the geopolitical landscape. The central question arises as ‘what are the implications of China’s (and India’s) rapid rise for the political-economic trajectory of a global system in which the United States finds it increasingly difficult to act effectively as the hegemonic power?’(80)

All indications point out that the current financial crisis, and economic downturn, is going to confirm, and possibly accelerate the shift in economic power to Asia, in particular to China. IMF predicts that ‘despite the emerging economies’ cooling momentum, they are still expected to provide a source of resilience, benefiting from strong productivity growth and improved policy frameworks.’(81) In its November 2008 report, Global Trends 2025: A Transformed World, the US National Intelligence Council alerted that ’The international system as constructed following the Second World War will be almost unrecognisable by 2025 owing to the rise of emerging powers, a globalizing economy, and historic transfer of relative wealth and economic power from West to East, and the growing influence of nonstate actors.’(82)

Thanks to its capital controls, its huge saving surplus and its publicly owned and state-controlled banking system, China seems to be well shielded from the Western financial crisis. China has already become a major actor in world currency and financial markets. The country holds $1.8 trillion in foreign exchange reserves. In particular, China’s dollar holdings are a source of considerable financial leverage in the global financial markets. China has an especially effective financial system, which seems to be well positioned to finance the next phase in its economic expansion. Many observers also agree that the Chinese economy has a much bigger margin of maneuver, because its exposure to those speculative toxic assets, which lay at the root of the recent financial crisis, is much lower than the exposure of the American and West European economies. In a way, China faces the global crisis from a position of strength.(83)

In financial terms, China is little affected by the crisis in the West. Its entire financial system plays a relatively small role in its economy, and it apparently has no exposure to the toxic assets that have brought the U.S. and European banking systems to their knees. China also runs a budget surplus and a very large current account surplus, and it carries little government debt.(84)

3) Resource depletion and ecological crisis(85)

The final and perhaps greatest vulnerability of the world system is that of availability and distribution of critical resources as oil, food, and water. The very logic of accumulation under the current economic system necessitates that the material elements (resources) of nature are transformed into commodities in an ever-expanding rate. In this long history of human excessiveness in production and consumption, the stability of the economic order, as an unrestrained structure, is dependent, more than ever, on the continued accumulation in a cycle of never-ending expansion. This means that more and more materials from the nature must be consumed in the process of production. So far, the world’s most valuable energy supplies and minerals are being extracted and consumed at a bread neck pace.

In the contemporary world, hardly any issue causes more stress, either directly or indirectly, than the exploration, production and consumption of the world’s energy resources, in particular oil. From the war in Iraq to rising food and fuel prices, energy consumption has been a crucial topic. A direct consequence of the consumption of oil is air-pollution in the form of sulphur dioxide, nitrous oxides, and carbon dioxide, which are a burden on society due both to current health issues, and future costs related to global warming.

Oil is the most strategic raw material. It can hardly be overstated how crucial petroleum is to our modern industrial society. Virtually every aspect of modern industrial life requires oil, gas and electricity (largely created from these fossil fuels). The modern life depends on petroleum as the main energy source for its very existence. Every day we rely on fossil fuels in one way or another – to transport us to work, to cook our food, to light, heat, and cool our homes, and even to grow our food. Our lives are so dependent on petroleum that it is impossible to imagine of a world without it. There is very little we consume or use in our lives that does not use petroleum in its manufacture.

Oil fuels the economy. It is the largest single traded product in the world. It provides about 95 % of all transportation fuels and 40 % of the global energy. Oil is also determinant of national security. Today’s modern armies are entirely dependent on oil-powered ships, planes, helicopters and armoured vehicles. Oil also supplies feedstock for thousands of manufactured products and is vital for food manufacturing: 17 % of our energy is used for producing food. Modern agriculture makes heavy use of oil in a variety of ways. We use oil for fertilisers, pesticides, and for the packaging and distribution of food.(86)

Since the beginning of the 20th century, global trade and a global economy have developed, and our population has grown in size from 1,000m to 6,000 m by drawing down a massive natural gift of energy in the form of cheap crude oil. Up until early modern times, miners, scientists, natural philosophers, and other ‘experts’ believed that gold, silver and other minerals were vegetable-like in that, when mined, they would literally grow back like mown grass. This belief was not wrong in principle in the case of coal and its hydrocarbon cousins in gaseous and liquid form, because they are the remains of ancient organisms. As a practical maxim, however, it was completely mistaken, because the time it would take normal geological processes to transform organic matter into coal, natural gas and petroleum is of the order of millions of years. Therefore, for all practical purposes, these fuels are finite, non-renewable energy sources, i.e. in any given region there is a fixed amount of oil at the beginning of the exploration, and after every drop of oil taken out there will be that amount of less oil left under the ground.

Like any fixed non-renewable resource, oil is limited, and its consumption will rise, peak (the point beyond which oil production will irreversibly start declining), and decline. Oil production follows a bell curve, and after the production reaches its peak (meaning when half the oil is taken out), oil production will inevitably fall. On the upslope of the curve, there is the first oil, the oil closer to the surface, which is also called ‘cheap oil’ or ‘easy oil’, because it is easier and cheaper to take that oil out and also it is better quality (‘light’, low-sulphur oil, therefore cheaper to refine). On the upslope of the curve, oil production costs are lower than on the down slope, when extra effort (and cost) is needed to extract the remaining poorer quality oil from deeper in the reservoirs, and extra cost needed to refine this ‘heavy oil’ (which is high-sulphur, very viscous and does not flow easily). Thus, once oil production reaches its peak, global demand for oil is most likely to exceed the capacity to produce it, prices will rise, oil-dependent economies will face serious problems.(87) ‘An increasing body of evidence suggests that the era of “easy oil” is over and that we have entered a new period of “tough oil”’.(88)

Today, oil and gas experts around the world are growingly alarmed at current and future scarcity of the ‘black gold’. As demand for energy explodes worldwide, there is less of it available and, it seems, less exploration for it. Crude oil prices have doubled since 2001. There may still be times when oil prices temporarily fall due to sharp decline in demand, mainly during the times of serious economic crisis like the current financial crisis in the Western economies, but the general long term trend is unquestionably upward in the price of crude oil. US refineries are working close to capacity, yet no new refinery has been constructed since 1976. And oil tankers are fully booked, but outdated ships are being decommissioned faster than new ones are being built.

According to many estimates, the world is depleting oil reserves at an annual rate of 6 %. At the same time, growth in demand is rising at an annual rate of 2.2 %. All this means that the world’s oil industry would have to find the equivalent of more than 8 % a year in newly discovered oil reserves to maintain an orderly oil market. Unfortunately, discoveries are lagging behind, primarily because new large oil deposits are not being found, but also because even if they were, there is a considerable time lag between a discovery and turning the oil into a useable energy product. Many observers have drawn attention to the extraordinary technological accomplishments of the industry over the past few decades. Of course, advanced technologies will buy a bit more time before production commences to fall, but it is also important to appreciate that spending more money on oil exploration will not really change this situation. There is only so much crude oil in the world, and the industry has found about 90 % of it.(89)

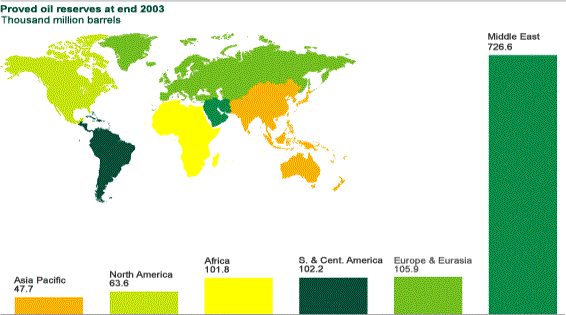

Figure: World Oil Resources (BP Statistical Review of World Energy 2003)(90)

There are some indications that, in the years to come, the search for new sources of oil maybe transformed into a quest for entirely new sources of energy. The replacement of fossil fuels by alternatives such as solar, wind, geothermal, biomass, hydrogen and nuclear fission does not yet seem to be a viable alternative. So far, the available energy alternatives, mostly solar and wind power, offer only diluted energy substitutes, i.e. not as powerful a fuel source as oil. For solar and wind energy to come close to providing the same amount of energy as oil does, would require a truly massive scale up in production and deployment of such technologies and still they would come nowhere near to match the convenience and density of oil. Therefore, while conservation and renewable energy are much in the news, the reality is that neither of these factors is likely to have any significant impact on the steadily growing demand for oil products.

Figure: PRODUCTION OF OIL, both conventional and unconventional. This model, based in part on multiple Hubbert curves, is prepared by Colin J. Campbell and Jean H. Laherrère, March 1998 (91)

Many analysts, looking at the current discovery and production levels of oil fields around the world suggest that within the next decade, the supply of conventional oil will be unable to keep up with demand. We are also witnessing the impact in the increasing scarcity and cost of food and other critical resources that rely on oil. There are some reports that there has been a surge of motorists running out of fuel because they could not afford to fill their tanks. Airlines are cutting back on flights, and some even are beginning to charge extra for checked baggage. During the last couple of years, in some parts of the world, rising fuel prices led to massive protests and strikes. Many leading economists and oil experts claim that the price of oil generally reflects the fast rising demand from China and India, and stagnant production as reserves of accessible oil become less plentiful. According to some experts, even a shortfall between demand and supply as little as 10 or 15 percent is enough to wholly shatter an oil-dependent economy. There were serious oil-related crises in the 1970s, but these ‘oil shocks’ were due to political effects rather than the decreasing amount of oil. Unlike the oil shocks of the 1970s, this time there seems to be a permanent decline. It is becoming clear that cheap fuel is no longer something that we can take for granted. The economy is already suffering for it. The end of cheap oil indicates a potentially spectacular reshaping of the globalized trade flows that have emerged in the last two decades.(92)

Without volume energy we have no sustainable water, we have no sustainable food, we now have no sustainable healthcare. And since five-sixths of the world still barely uses any energy it really is an important issue. And since five-sixths of the world is still growing fast or too fast it’s even a more important issue.

What peaking does mean, in energy terms, is that once you’ve peaked, further growth in supply, is over. Peaking is generally, also, a relatively quick transition to a relatively serious decline at least on a basin-by-basin basis. And the issue then, is the world’s biggest serious question.(93)

Recently energy (and food prices) have sharply declined but only because of the severity of the recession. Despite the current fall in prices, the latest report by the International Energy Agency (IEA), 2008 World Energy Outlook (WEO), paints a depressing picture of an oil industry having to run faster and faster, like a hamster trapped on a wheel, just to keep pace with burgeoning oil demand over the next 20 years.(94) The first paragraph of the IEA report reads as ‘the world’s energy system is at a crossroads. Current global trends in energy supply and consumption are patently unsustainable – environmentally, economically, socially’. The report, released in November 2008, estimates that the industry will need to find 64 million barrels per day (bpd) of new oil production capacity to meet the expected growth in demand by 21 million bpd by 2030 and offset 43 million bpd of expected declines from existing fields. The total cost is put at around $5 trillion at today’s prices. The study, based on detailed data for the world’s 580 largest oilfields and an extrapolation to the remaining 70,000 smaller fields, estimates output from existing and future fields will decline by 6.7-8.6 percent a year.(95)

In the report “Global Trends 2025: A Transformed World”, the National Intelligence Council speculates that ‘Countries capable of significantly expanding production will dwindle; oil and gas production will be concentrated in unstable areas. … As a result of this and other factors, the world will be in the midst of a fundamental energy transition away from oil toward natural gas and coal and other alternatives’.(96)

The world economy was able to enjoy impressive growth in the 20th century, largely because it benefited from cheap and abundant oil, and could afford ignoring environmental costs. The severe effects of global environmental damage have now risen to the point that the very survival of the humanity is at stake. By far the most controversial feature of environmental damage relates to potential atmospheric damage, that is, damage to the gaseous membrane that maintains all life on earth. Especially the combustion products of fossil fuels are the major source of danger to earth’s atmosphere. The problems arise because some of the key gaseous components of the atmosphere are becoming excessively concentrated, and many experts believe that this situation is dangerously upsetting the delicate balance between various gaseous in earth’s atmosphere.(97) This human-induced global warming is only one among many serious environmental consequences caused by the never-ending drive of accumulation under the existing system. A quarter of all deaths in the world today have some links to environmental factors.

…the environmental crisis we now confront is quantitatively and qualitatively different from anything before, simply because so many people have been inflicting damage on the world’s ecosystem during the present century [20th] that the system as a whole – not simply its various parts – may be in danger.(98)

The environmental problems associated with all aspects of production, distribution and consumption trigger crucial questions about the future sustainability of economy and society in the present way of organisation. The world population is expected to grow by 1.2 billion over the next 20 years, and all of these people will want food, shelter and energy, further straining the planet’s already strained resources. This is the secret ticking time bomb under the global economic system in the 21st century. The only long-term solution is to reduce significantly our energy usage. This does not just mean using energy efficient light bulbs, taking the bus to work, or to cycle. In order to reduce our energy consumption, it follows that we consume less products. The only rational response to the impending end of the cheap oil age is to redesign all aspects of our lives.

Conclusions

The current financial crisis (and economic downturn) has not come out of blue. It is the outcome of deep-seated contradictions within the structure of global economic system. It is not a ‘failure’ of the system, but it is central to the mode of functioning of the system itself. It is not the result of some ‘mistakes’ or ‘deviations’, but rather it is inherent to the logic of the system. When I speak of crisis I am not pointing to a single event, but rather a historical process. To use an analogy to the complex motions of large plates of the Earth’s outer shell, lithosphere, this is a discussion of shifting tectonic plates in the world economy, longer term movements together with some more sudden and unexpected eruptions. At this moment of acute systemic crisis, great shifts are taking place in the balance of economic strength among the global powers. New faultlines can be discerned in the global system. Just like the movements of the tectonic plates being originated in Earth’s radioactive, solid iron inner core, the vast shifts in the structures of global system are the outcome of changes that have been taking place beneath the surface of economic life over years, if not decades.

What this crisis means for the global economic system? – is this the end of capitalism?

A downturn, or a crisis, does not mean that the current system comes to a halt. There is nothing to suggest that the present crisis is paving the way for the collapse of the capitalist system. It signifies the opening of a new epoch in history, in which some of the old structures give way and new forms may develop to radically affect the global structures of power and hegemony. However, if the current pattern of global imbalances and vulnerabilities persists, so will recurrent financial and economic crises of the kind we have seen recently.

In conclusion, I would like to offer an overview of the current crisis to re-emphasise some of the key points discussed above:

1. While it is difficult to predict events with any certainty, there is no reason to expect that the current crisis will pass quickly, and there is no quick way out of this crisis. It is difficult to predict the true extent of economic decline. We are at the beginning phase of the crisis, indeed as crisis progressed through its phases, the situation automatically gets worse.

2. The historic meltdown of the global capital markets, and sharp economic downturn, is systemic in nature, and is conditioned by the contradictions, and vulnerabilities, of the current level of economic organisation, with the world economy unable to develop further in the old manner.