Our Two Most Onerous Taxes: College Tuition and Healthcare Insurance

It is not coincidence that these two unofficial taxes–healthcare and college tuition–are soaring in cost, outpacing all other household expenses.

I have long argued that to make an apples-to-apples comparison of real tax rates in the U.S. and other equivalently developed advanced democracies, we have to include two enormous expenses that are funded by the central state in countries such as Denmark and France: healthcare and college tuition/fees.

In The Real-World Middle Class Tax Rate: 75% (July 5, 2012), I estimated that healthcare insurance (if paid out of gross income, as we self-employed workers do) in the U.S. is roughly equivalent to a 15% tax.

Now that the Orwellian-named Affordable Care Act (ACA) is raising costs and deductibles, the true cost of healthcare (a.k.a. sickcare, because being chronically sick is so darned profitable for the cartels) is more like 20% in America.

Correspondent Tim L. (whose daughter is attending a prestigious STEM–science, technology, engineering, math–university) recently called $40-$50,000 per year college tuition what it really is: a tax:

College tuition is just another tax. If you can afford to pay it, you have to. If you cannot, you do not. Anytime you have to pay more for something because you can, you are paying a tax. Between traditional taxes, the college tuition tax, and the health insurance tax (also paid only by those who can afford to), I figure this year and the next three I’m in a 100+% tax bracket.

Middle-class Scandinavians famously pay around 65% to 75% of their gross incomes in taxes, but these taxes fund national healthcare for all and nearly free college tuition and fees. Add $200,000 (four years of tuition/fees at $50,000/year) in tax to the already-high U.S. real tax rate, and the real tax rate for middle-class households exceeds 100% of gross income.

Since only those with significant savings can possibly afford to pay a $200,000 tuition tax, the average-income household is left with one choice: the debt-serfdom of student loans. This is the acme of a morally bankrupt system of higher education: you need a college degree to have any hope of succeeding in America, but the only way to get that degree is to enter debt servitude, with no guarantees of future income needed to pay off the debt.

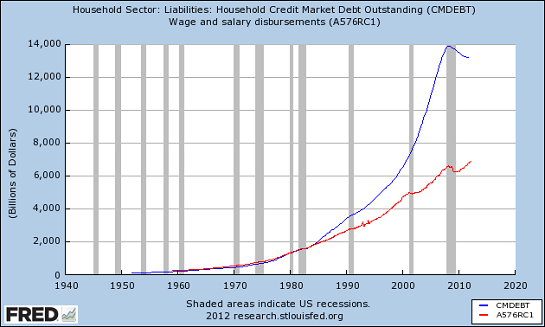

It is not coincidence that these two unofficial taxes–healthcare and college tuition–are soaring in cost, outpacing all other household expenses. The only other household item that is skyrocketing is debt:

The two unofficial taxes–paid by debt, either student loans, or Federal deficits– have no restraints: if you can’t pay, then the upper-middle class taxpayers who are paying most of the Federal tax will, one way or another:

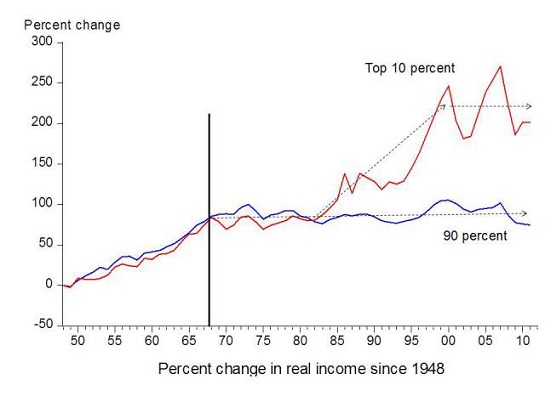

Meanwhile, guess what’s been flat to down for the past 40 years–yup, the earned income of the bottom 90%:

With an unofficial tax rate for healthcare and college tuition that makes Scandinavian countries look like low-tax havens, no wonder the middle class in America is vanishing like mist in Death Valley. The political class is now bleating about the erosion of the middle class and rising wealth inequality. There are two primary sources of rising inequality in America: the Federal Reserve and the higher-education and healthcare cartels that so generously fund the campaigns of the bleating politicos.