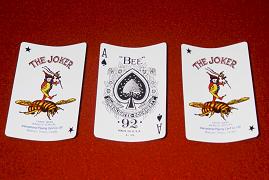

The Financial Crisis as a Game of 3 Card Monte

You always think you are going to win until you lose

We live in a three card monte world. Follow the money as it moves from one shell to another. Now guess where it is. Most of us don’t know the hand can be quicker than the eye. That’s why mostly everyone who has ever been suckered into playing ends up losing except those who are allowed to win to keep the hustle going. We miss the tricks of the trade even as we swear we know where the winning card or money or ball is.

Phase one: (http://www.goodtricks.net/three-card-monte.html)

Begin by showing the cards and explaining the game. Do a fair throw, mix the cards on the table slowly, and then turn over the winner. Do this a few times. Without any warning or any change in your pace or handling, do a fake throw and mix the cards slowly on the table. Point to the actual winner, and say something like “You saw it end up over here, right?” They will, of course, disagree with you. Turn it up.

On Tuesday night, Americans were watching the “super primary” in which campaigns in three states supposedly showed which was the 2010 election would go. In one a Tea Party backed candidate, Rand Paul, son of a well known Congressman prevailed, declaring “We will take our government back.”

Presumably he meant from the politicians, and from the major parties, but not from Wall Street which at the very hour of his great triumph in the latest Kentucky Derby was burning the midnight oil, trashing what’s left of financial reform especially the effort to regulate derivatives.

“It’s a bad sign,” bemoans the New York Times, “ that there are so many unresolved issues…virtually every effort to weaken the bill involves watering down or undoing these reforms either explicitly or by or by adding fiendishly convoluted language that obscures the bill’s purpose.”

When was the last time you saw the word “FIENDISHLY” in the New York Times

Speaking of fiends, The Financial Times reports: “Obviously, the idea is to kill it when no one is looking, which of course serves the industry. If you kill it now (and that is warranted, this is a poorly conceived measure), then the powers that be might have to come up with something sensible. But that might inconvenience the industry. This little finesse is perfect for them.”

Example: Writes Tiffiney Cheng of A New Way Forward, “The derivatives bill that Senator Dodd is trying to kill is the part that Joseph Stiglitz called the best part of the ENTIRE reform package– the last single strongest thing in the bill, the only thing that would really require a change in the way the biggest banks operate, and stops subsidies for toxic bets.”

Phase two: Immediately say something like “That’s okay! You see, most people, if they see the card go over here,” Pick up a loser and the winner in your right hand, and fake throw to the left as you say “here”. “figure that as long as they don’t bet on either of these cards,” pick up the other loser under the winner you are now holding in your right hand. Apparently the winner is to the left and you are holding the two losers. As you say “either of these cards” turn over your right hand to show the lower card (the loser), fake throw to the middle, and then turn your right hand over again to show the same loser again, and drop it to the right. You have, apparently, tossed the winner to the left, and then shown the two losers to be in the middle and to the right. “The thing is” pick up the middle card, the winner, with the right hand, and then the one to the left, which they think is the winner. “when they bet on this card, they lose.” Turn over the right hand to show the loser. Fake throw to the left. “It’s only when you bet on this card” flip the card in your right hand face up “or this one” use the card you’re holding to flip over the loser on the table to the right “that this one’s ever going to be the winner.” Drop the card you’re holding face up, and then turn over the winner.”

And as for action against financial fraud and crime, that’s virtually non-existent even on the day that the newspaper of record ran another story on its front page about how Goldman Sachs defrauded its customers and clients.

Phase three: Pick up the winner in your right hand. Use it to point to the two losers which are face up on the table, saying something like “You don’t want either of these two cards, you want this one.” As you point to the losers, press the corner of the winner down against them, bending it.

William Black, the former bank regulator who has exposed control frauds, and says they are at the center of the crisis, also says he is being ignored by most major US media outlets. After a story about him appeared in FAZ, a mainstream German publication, he wrote: “It’s interesting that while the video of my House testimony about Lehman, the Fed, FRBNY, and the SEC went viral on the web, led to Bill Moyers scrambling to interview me, and led to this FAZ interview it has not led to any story in the major U.S. press other than Bill Moyers Journal.”

I have had a similar experience promoting my film Plunder The Crime of Our Time.

“As you say “this,” hold the winner up so that the spectators see the bend edge on. Make sure they see it! Drop the winner face down, turn down the losers, and do the bend corner switch described above. After doing this, you have a loser to your left with a bent corner, which they think is the winner, the winner in the middle, and another loser to the right. Now, pick up the loser on the right with your right hand, and the one with the bent corner on the left with your left hand. Hold your right hand still as you sweep your left hand over and drop the card with the bent corner to the right. As you make this sweep, glance up at your audience and you should see everyone’s head move as they follow the card they think is the money card.”

Germany is outlawing naked short selling. China is warning of a global crisis that is “more serious that we thought.” A Federal Reserve official says our economy will suffer for years.

“A top Federal Reserve official, Federal Reserve Bank of Cleveland President and CEO Sandra Pianalto, warned Tuesday that one consequence of the Great Recession will be a “new normal” in which Americans have lower expectations…”

May 19 (Bloomberg) — The U.S. may fall victim to bond “vigilantes” targeting indebted nations from the U.K. to Japan in a potential second stage of the financial crisis, New York University professor Nouriel Roubini said….”

“History would suggest that maybe this crisis is not really over. We just finished the first stage and there’s a risk of ending up in the second stage of this financial crisis.”

“Address this audience member and ask them which card appears to be the winner. When they point to the one with the bent corner, say “That’s absolutely correct, and that’s the one most people would bet on.” Turn it over”.

Guess what? We all Lose!

News Dissector Danny Schechter directs the film Plunder The Crime of Our Time that treats the financial crisis as a crime story,

(Plunderthecrimeofourtime.com) Comments to [email protected]