The Case for Deflation

As Absolute Return Partners wrote in its July newsletter:

The most important investment decision you will have to make this year and possibly for years to come is whether to structure your portfolio for deflation or inflation.

So which is it, inflation or deflation?

I’ve analyzed this issue in numerous posts, but every day there are new arguments one way or the other from some very smart people.

The biggest deflation bears are rather pessimistic:

- David Rosenberg says that deflationary periods can last years before inflation kicks in

- Renowned economist Dr. Lacy Hunt says that we may have 15-20 years of deflation

The Best Recent Arguments for Deflation

Following are some of the best arguments for deflation.

Wall Street Journal’s Scott Patterson writes that we won’t get inflation until unemployment is down below 5%:

A rule of thumb is that inflation doesn’t become sticky until the unemployment rate dips below 5%…

“I see very little prospect of accelerating inflation” partly because of the employment outlook, said Mark Zandi, chief economist of Moody’s Economy.com. “I don’t think the risk shifts toward inflation until 2011, or even 2012.”

It could take a lot longer for unemployment to go back down to 5%.

Pension expert Leo Kolivakis writes:

The global pension crisis is highly deflationary and yet very few commentators are discussing this!!!

Hoisington’s Second Quarter 2009 Outlook states:

One of the more common beliefs about the operation of the U.S. economy is that a massive increase in the Fed’s balance sheet will automatically lead to a quick and substantial rise in inflation. [However] An inflationary surge of this type must work either through the banking system or through non-bank institutions that act like banks which are often called “shadow banks”.

The process toward inflation in both cases is a necessary increasing cycle of borrowing and lending. As of today, that private market mechanism has been acting as a brake on the normal functioning of the monetary engine.

For example, total commercial bank loans have declined over the past 1, 3, 6, and 9 month intervals. Also, recent readings on bank credit plus commercial paper have registered record rates of decline. The FDIC has closed a record 52 banks thus far this year, and numerous other banks are on life support. The “shadow banks” are in even worse shape. Over 300 mortgage entities have failed, and Fannie Mae and Freddie Mac are in federal receivership. Foreclosures and delinquencies on mortgages are continuing to rise, indicating that the banks and their non-bank competitors face additional pressures to re-trench, not expand. Thus far in this unusual business cycle, excessive debt and falling asset prices have conspired to render the best efforts of the Fed impotent.

Ellen Brown argues that the break down in the securitized loan markets (especially CDOs) within the shadow banking system dwarfed other types of lending, and argues that the collapse of the securitized loan market means that deflation will – with certainty – continue to trump inflation unless conditions radically change.

Mish writes:

Conventional wisdom regarding money supply suggests there is massive pent up inflation in the works as a result of the buildup of those reserves. The rationale is that 10 times those excess reserves (via fractional reserve lending) will soon be working its way into the economy causing huge price spikes, a collapse in the US dollar, and possibly even hyperinflation.

However, conventional wisdom regarding the money multiplier is wrong. Australian economist Steve Keen notes that in a debt based society, expansion of credit comes first and reserves come later.

Indeed, this is easy to conceptualize: Banks lent more than they should have, and those loans are going bad at a phenomenal rate. In response, the Fed has engaged in a huge swap-o-rama party with various banks (swapping treasuries for collateral of dubious value) in addition to turning on the printing presses.

This was done so that banks would remain “well capitalized”. The reality is those excess reserves are a mirage. Banks need those reserves for credit losses coming down the pike, as unemployment rises, foreclosures mount, and credit card defaults soar.

Banks are not well capitalized, they are insolvent, unwilling and unable to lend…

Total U.S. debt as a percent of GDP surged to 375% in the first quarter, a new post 1870 record, and well above the 360% average for 2008. Therefore, the economy became more leveraged even as the recession progressed.

An over-leveraged economy is one prone to deflation and stagnant growth. This is evident in the path the Japanese took after their stock and real estate bubbles began to implode in 1989.

Leverage is increasing again, according to an article in Bloomberg:

Banks are increasing lending to buyers of high-yield company loans and mortgage bonds at what may be the fastest pace since the credit-market debacle began in 2007…

“I am surprised by how quickly the market has become receptive to leverage again,” said Bob Franz, the co-head of syndicated loans in New York at Credit Suisse…

Indeed, as I have repeatedly pointed out, Bernanke, Geithner, Summers and the chorus of mainstream economists have all acted as enablers for increasing leverage.

Mish continues:

Creative destruction in conjunction with global wage arbitrage, changing demographics, downsizing boomers fearing retirement, changing social attitudes towards debt in every economic age group, and massive debt leverage is an extremely powerful set of forces.

Bear in mind, that set of forces will not play out over days, weeks, or months. A Schumpeterian Depression will take years, perhaps even decades to play out.

Thus, deflation is an ongoing process, not a point in time event that can be staved off by massive interventions and Orwellian Proclamations “We Saved The World”.

Bernanke and the Fed do not understand these concepts, nor does anyone else chanting that pending hyperinflation or massive inflation is coming right around the corner, nor do those who think new stock market is off to new highs. In other words, almost everyone is oblivious to the true state of affairs.

And Naufal Sanaullah writes:

So if all of this printed money is being used by the Fed to purchase toxic assets, where is it going?

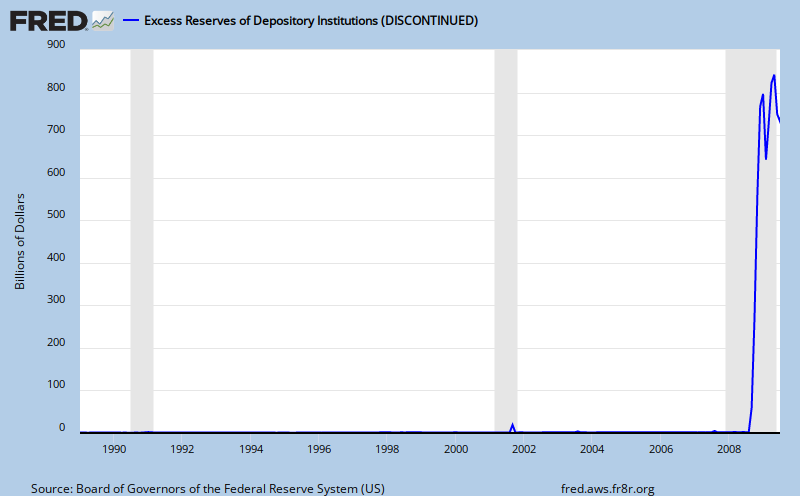

Excess reserves, of course. Counting for $833 billion of the Fed’s liabilities, the reserve balance with the fed has skyrocketed almost 9000% YoY. Excess reserves, balances not used to satisfy reserve requirements, total $733 billion, up over 38,000%!

The Fed pays interest on these reserves, and with an interest rate (return on capital) comes opportunity cost. Banks hoard the capital in their reserves, collecting a risk-free rate of return, instead of lending it out into the economy. But what happens as more loan losses occur and consumer spending grinds to a halt? The Fed will lower (or get rid of) this interest on reserves.

And that is when the excess liquidity synthesized by the Fed, the printed money, comes rushing in and inflates goods prices.

Of course, most people who are arguing we will have deflation for a while believe that we might eventually get inflation at some point in the future.